Melpomenem

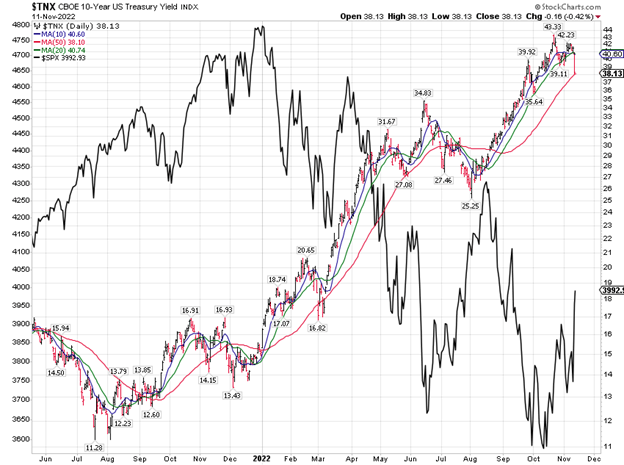

The 3-month/10-year Treasury curve inverted last Thursday on better-than-expected inflation (CPI) news. The 3-month Treasury rate closed at 4.20%, while the 10-year closed at 3.83%. Fed Chair Jerome Powell had been saying that until that curve inverted, the yield curve is not really inverted. Well, now it is.

If the 10-year note can stay below 4% until the end of 2022, we could see the stock market rally extend into Christmas, but here are some reasons why the 10-year note may rise above 4% again.

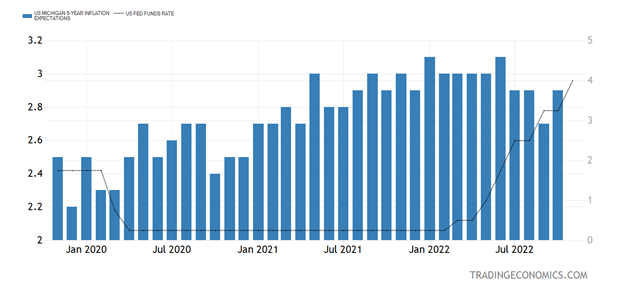

It is peculiar that the 5-year inflation expectations rose again last Friday, coming in at 3%. When that indicator shot up to 3.1% in June, it caused the Fed to bump its expected 50-basis point rate hike up to 75 bps later that month and caused all subsequent rate hikes to stay at 75 bps. I think the Fed is using the rear-view mirror to decide the size of its rate hikes, but with these kinds of inflation reports (and more are coming), the pivot that the stock market was celebrating last week may turn out to be a mirage.

US Michigan 5-Year Inflation, US Fed Funds Rate Expectations (Author)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Personally, I would prefer that the stock market rally till the end of the year and worry about Powell next year, but what I prefer does not count. It’s what the probabilities are, given the inflation outlook. If I ask myself where the 10-year yield will be in December if the Fed funds rate stands at 4.50% (and later is at 5%): Is it higher or lower than where it closed last week, the answer I come up with is “higher.” In other words, the next 50 bps in the 10-year yield away from its 50-day moving average (red line below) is up.

CBOE 10-Year US Treasury Yield (StockCharts.com)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

Powell can make all this craziness go away by announcing a pause in rate hikes at the December meeting and the stock market would surge. The question is: How likely is that to happen? The answer I come up with is “not likely,” based on his statements and actions so far in 2022.

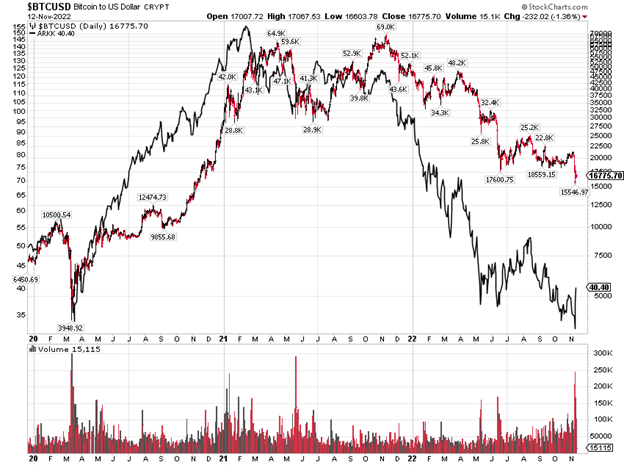

When Bitcoin Started Hitting the Tape, FTX Collapsed

FTX International (FTT-USD) has now filed for Chapter 11, which is a major milestone in the spectacular failure of one of the largest bitcoin exchanges. Some credible news organizations have estimated the hole on FTX’s balance sheet to be as much as $8 billion, but we will not know for sure until all investigations are done, most importantly the one from the U.S. Department of Justice. There will be many twists and turns in this saga in 2023, but one thing is for sure: As an exchange, FTX is finished.

Bitcoin to US dollar (StockCharts.com)

Graphs are for illustrative and discussion purposes only. Please read important disclosures at the end of this commentary.

The price of bitcoin has now taken out all major support levels. As a speculative digital asset generating no cash flow, bitcoin may fully unwind its entire rally since the March 2020 bottom, putting it at $3,949, similar to the way a major ETF of speculative securities, ARK Innovation Fund (ARKK), recently did.

All content above represents the opinion of Ivan Martchev of Navellier & Associates, Inc.

Disclosure: *Navellier may hold securities in one or more investment strategies offered to its clients.

Disclaimer: Please click here for important disclosures located in the “About” section of the Navellier & Associates profile that accompany this article.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment