TU IS

Arlo Technologies (NYSE:ARLO), a company that provides cloud-based security and security-related products, continues to struggle even after its recent earnings beat, as declining consumer demand based as a result of economic concerns has become a significant challenge for the company, as are finding ways to cut costs and improve the bottom line.

After recently dropping to a 52-week low of $2.93 after its earnings report, it has since rebounded to $3.90 at the end of trading on November 14, 2022. That’s significantly down from its 52-week high of $11.79.

To mitigate some of its risk, the company has been working on diversifying its channels and product line, which over the long-term should accelerate revenue growth, and if it can scale across most of its products and services, it should eventually lead it to sustainable growth and profitability.

In this article we’ll look at some of the short- and long-term drivers, its recent earnings report, and how the long-term prospects of the company look.

Latest earnings

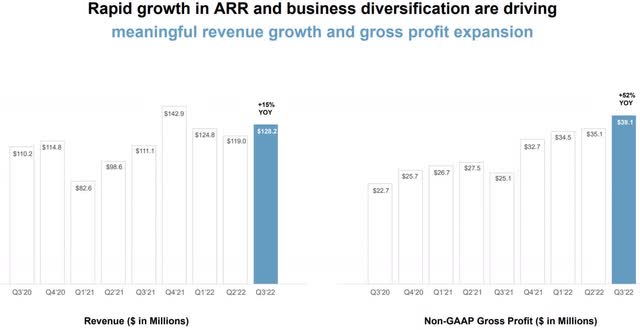

Revenue in the third quarter was $128.2 million, up 15 percent year-over-year, and 8 percent sequentially. Management noted that consumer demand in the second half of the quarter slowed down from inflation and macro-economic concerns. That is probably going to continue on in the fourth quarter, and probably the first two quarters of calendar 2023, depending on the depth and length of the recession.

Non-GAAP gross profit in the third quarter was $38 million, up $13 million, or 52 percent from the third quarter of 2021. Gross profit improvement was driven by growth in its ARR and monetizing its installed base of paid subscribers and lowering costs. Of the $13 million increase, services accounted for $8 million of that, with product accounting for the other $5 million.

Non-GAAP gross margin in the reporting period was 29.7 percent, slightly up from the 23.5 percent in the prior quarter, and a strong improvement over its 22.6 percent last year in the same quarter.

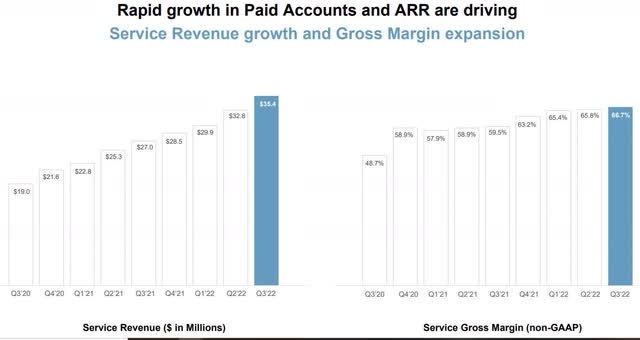

ARLO’s focus on growing its service segment is important because its gross margin, at 66.7 percent in the quarter, is much higher than its product gross margin of 15.6 percent. Successful execution on that strategy will likely result in sustainable profitability over the long haul, as while increasing its revenue.

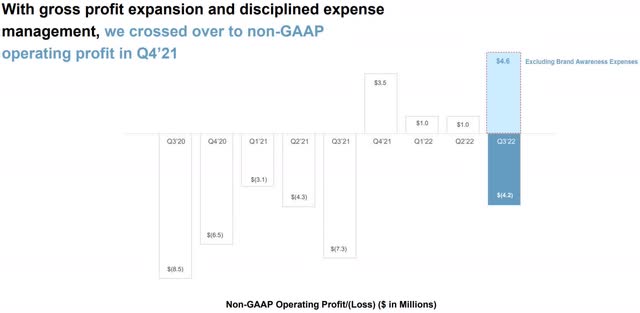

Non-GAAP operating expenses in the quarter were $42.3 million, up $8 million, or 24 percent from the prior quarter, and up $10 million, or 30 percent year-over-year. The increase came from investing in its brand awareness campaign, which it has now paused because of the current economic environment.

Without the spend on the campaign, the company would have generated net income of $4.6 million, instead it incurred a non-GAAP loss of $4.2 million, or $0.05 per share.

In anticipation of an ongoing weak economic environment causing some erosion of demand, the company is reducing expenses outside services, office leases and headcount. While it’s obvious how that will reduce costs, whether or not it’ll have an impact on revenue and customer satisfaction from a smaller workforce has yet to be determined.

Concerning its balance sheet, at the end of the third quarter the company had $125.3 million in cash, cash equivalents and short-term investments, down $10 million from the previous quarter. The decline in cash was attributed primarily to bumping up its investment in inventory.

Its inventory balance at the end of the quarter was $73.2 million, up $34 million sequentially. The two reasons given for that were stocking up for holiday demand and the decision to have higher inventory levels in order to meet customer demand. Some of that is in response to supply chain constraints that limited inventory levels in the recent past.

Guidance for the fourth quarter was for revenue to come in at $105 to $115 million. GAAP net loss per diluted share to be in the range of $0.23 to $0.30 per share, and non-GAAP net loss per diluted share to be from $0.06 to $0.13. I think those losses will continue in the near term, by which I mean through the first half of calendar 2023.

Company’s strategy

There are several things the company is doing to boost revenue, widen margins, and move toward sustainable profitability. They include focusing on and increasing its service business and diversifying channels and introducing new products. products.

Services

In regard to services, while only accounting for 28 percent of its revenue in the third quarter, it represented 62 percent of its overall gross profit. If it can successfully execute the strategy, it would accelerate its path to profitability, although it needs to be taken into account that it will probably continue to grow its product segment as well, which would offset some of that service growth.

Its SaaS business remains a key driver of the company’s performance, with paid accounts up 91 percent year-over-year, with ARLO adding 195,000 paid accounts in the third quarter. Service revenue was $35.4 million in the quarter, up 31 percent from the same quarter of 2021. It now has an installed base of 1.7 million subscribers.

Channel diversification

Understanding the weak economic environment presented risk if it didn’t diversify its channels, ARLO has worked on expanding its routes across more channels in order to reach a larger number of households.

That has paid off strongly for the company, as over the last year Verisure has installed ARLO services in over 320,000 households via its direct channel.

It has also partnered with Bell Canada, Celcom, T-Mobile, U.S. Cellular and Verizon, providing even more routes for its services. By continuing to pursue its diversification of channels the company believes it’ll be able to generate more “predictable revenue streams.”

New products

Knowing it must introduce new products and services to ensure a long-term growth trajectory, ARLO launched Arlo Safe, a mobile application and service which provides safety and security for customers wherever they are. The significance of this new service is it opens up the door to another market, moving from a single, physical location, to whatever location the customer happens to be in at the time.

Among the features are a direct dispatch to first responders and a check-in mode for members of the family. It is offered at this time for download through Google and Apple app stores, and at Best Buy.

Individual subscriptions are $4.99 on a monthly basis, or $9.99 per month for the entire family. As an upsell, ARLO is offering new service with its home security for $19.99 per month.

Another new product it is introducing is its Innovative Security System, which appears very compelling with an impressive full range of features included with the system. Here’s how the company described it:

The modular hub includes battery backup, cellular backup, direct dispatch buttons, an integrated motion sensor, a microphone for smoke and carbon monoxide alarm listening and an NFC reader, and our incredible multi-sensor combines a door sensor, window sensor, tilt sensor, motion sensor, water leak sensor, ambient light sensor, temperature sensor, tamper sensor and a smoke and carbon monoxide listeners into one small form factor.

That does look to be an incredible all-in-one security system across many of the daily risks people face.

The other new product to be released is its Arlo Pro 5S smart security camera, the Pro 5S; it is made to integrate with the new security system.

Among the features are an extended battery life and non-stop operation even if there are Internet or power outages. It can do that “by leveraging the battery and cellular backup functionality of our security hub.”

Conclusion

ARLO offers some compelling products and services in a growing sector, but the existing economic environment is forcing consumers to prioritize their spending, and that has resulted in demand starting to slow down in the second half of the third quarter of 2022, and that’s probably going to continue at least through the first half of 2023, possibly longer if the recession remains deeper for longer.

I like its dual focus on increasing its services business while engaging in cost-cutting measures. That and its channel and product and services diversification strategy should, over time, pay off for the company as far as reaching sustainable profitability.

The major thing to watch to me will be how successful the company is with its service business. If it’s able to grow that segment successfully, it should accelerate its path to profitability, which would be a strong tailwind for the company.

In the near term I see ongoing headwinds, but once the economy turns around, it has the potential to perform nicely over the long haul.

Even with the recent bounce in its share price, I’m not convinced it will be able to maintain that because of slowing consumer demand. It may do okay in the fourth quarter, but based upon slowing momentum, it may disappoint with holiday sales.

I would be surprised if the company will be able to find support in the near term, but again, if services are able to take up and become a bigger percentage of its revenue mix in the near term, it will likely surprise to the upside.

On the other hand, if growth remains modest, investors and shareholders will have to be patient until market conditions improve.

I think its current share price isn’t a bad entry point, but it could get better over the next several months.

For investors interested in ARLO, and an industry that has a lot of growth left in it over the long term, using a dollar-cost averaging strategy is most likely the best way to trade the stock in a volatile and uncertain market.

Be the first to comment