Daniel Wright/iStock Editorial via Getty Images

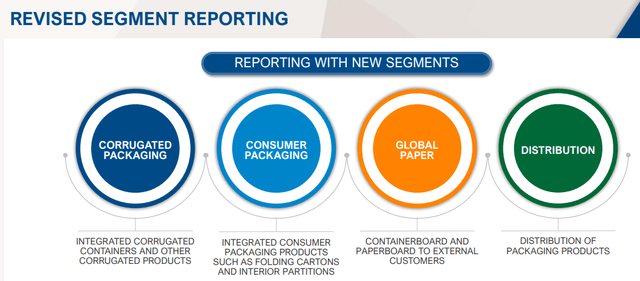

We know our paper mills pretty well at Mare. We recently published a follow-up article on International Paper (NYSE:IP) looking at their Russian exposure and we also have good coverage of Mondi (OTCPK:MONDF) (OTCPK:MONDY). Today, our focus is on WestRock (NYSE:WRK). WestRock Company, together with its subsidiaries, is one of North America’s leading producers of fibre-based paper and packaging solutions. With its new reporting system, the company operates in four main segments: corrugated packaging, consumer packaging, Global paper and distribution. As mentioned by management, the new segment split will further provide “greater transparency around its margin structure both for the time being and for the future“.

New reporting segments

Source: WestRock FY results

Looking at Seeking Alpha’s previous publication we see that WestRock is a well-covered stock. As we already know, WestRock has bought its way up through inorganic growth over the past several years. The company in its current form was created in 2015 through a merger between what used to be MeadWestvaco and Rock-Tenn. The company is pretty focused on the food and beverage sector, but it is highly diversified in terms of end market exposure and it serves a broad clientele base. Over the years, WestRock has carefully launched and developed a new list of products that serve a variety of customers and environments, meaning that it is no more subject to industry cyclicality.

It went wrong, now it’s getting better

Here are the challenges the Group faced in 2021…

- During Q2, a cyber-attack occurred causing high financial costs and most importantly reduced production capability;

- Labour shortages decreased WestRock’s ability to fully utilise its asset base to meet ongoing and strong customer demand;

- It was a record year in maintenance outages that continued to pose an operational challenge on Company volumes.

Now we see an opportunity to step in. Our internal team believes that:

- WestRock is solving its bottleneck issues;

- Volumes are going up and order books are at a record highs;

- Labour shortages and absenteeism are improving;

- The company is better positioned to announce a price increase;

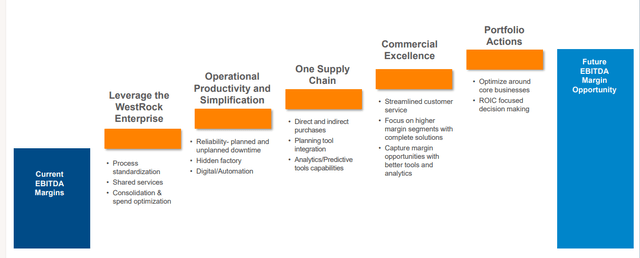

- We believe in management’s ability for a structural margin expansion.

Future EBITDA Evolution

Source: WestRock FY results

The next catalyst is going to be the investor day scheduled in May.

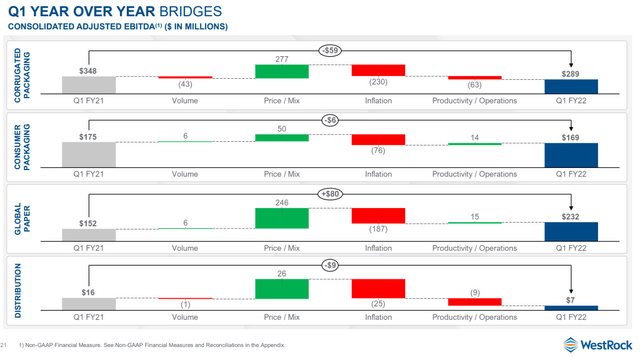

Looking and commenting on its Q1 results, we can clearly note that WestRock was able to pass through cost increases thanks to its pricing power in almost every division apart from consumer packaging.

WestRock Price over Costs

Source: WestRock FY results

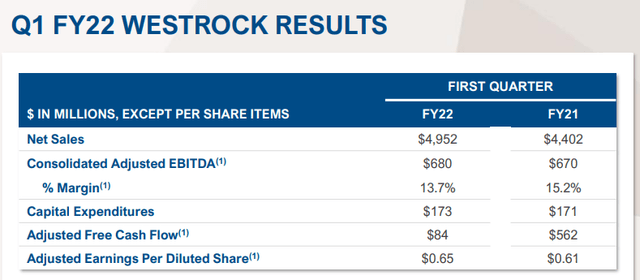

David B. Sewell WestRock CEO stated that he is “pleased with our strong performance during the first quarter of fiscal 2022, in which our teams delivered record first quarter sales and double-digit EPS growth while navigating the continued and unpredictable macroeconomic landscape. We also delivered solid margin performance in the face of continued supply chain disruption, higher inflation and increased absenteeism associated with COVID-19“.

This quarter was a record in terms of top-line sales, going down to the P&L, WestRock adj. EBITDA stood at $680 million with an increase of 1.6% compared to the previous year-end. Looking at the marginality, we see a negative performance due to energy prices and ongoing cost inflation.

WestRock Q1 Results

Source: WestRock FY results

Conclusion

As for International Paper, our internal price target stands at $70 per share and it is derived on the average between:

- A 7.0x EV/EBITDA on our 12-month forward estimates,

- A DCF analysis in which we assume a 10% cost of equity and a terminal growth rate of 2%.

Compared to IP, WestRock has no exposure in Russia. There is short-term turbulence ahead due to ongoing cost inflation but we believe the new management will exceed expectations. As we already wrote for IP, our long term investment thesis is based on:

- Sustainable trends on paper, we consider IP well positioned to be a “doing good while doing well” ESG company.

- Ban of single use plastics in many countries is contributing to create a favourable environment for alternative products based on paper, while other alternatives are still not cost-effective.

- Global trends in e-commerce

Risks are equally important, we note that our target price might be affected by slow demand, new capacity that will exceed supply in the US, and most importantly, an increase in input costs.

If you are interested in our previous paper mills coverage, please have a look at our recent publications:

- International Paper: Looking At The Russian Exposure

- Mondi Has Ecommerce And Infrastructure Winds In Its Sails

- International Paper: Long Term Thesis Intact But Not Without Short Term Turbulence

Be the first to comment