sturti

Investment summary

We advocate that TransMedics Group, Inc. (NASDAQ:TMDX) is a buy following its latest earnings. Long-term investors might consider adding to their position at current market prices whilst first time investors look to be paying fair value to enter a position. With a robust period of growth in FY22, the company is well positioned to continue unlocking long-term value.

Here we took a hard data approach versus an intense focus on the company’s segment offerings to examine market and fundamental factors post earnings. We illustrate the market is rewarding TMDX’s idiosyncratic risk premia and looks set to continue doing so for FY22 full. We rate TMDX a buy.

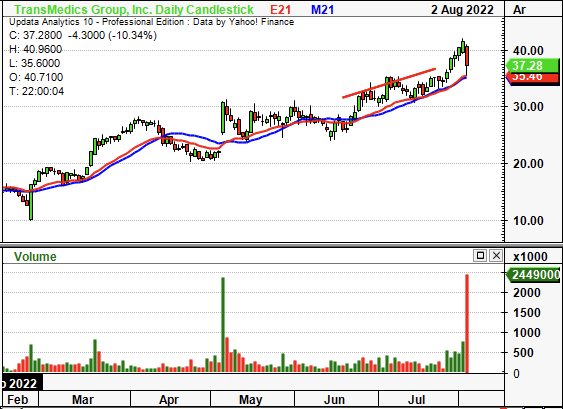

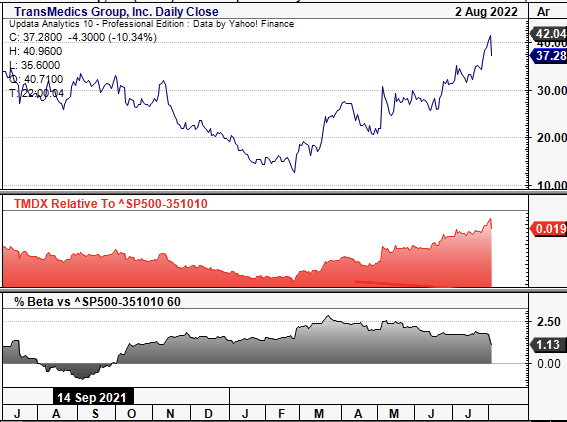

Exhibit 1. TMDX 6-month price action

Data: Updata

Q2 earnings illustrate fundamental momentum

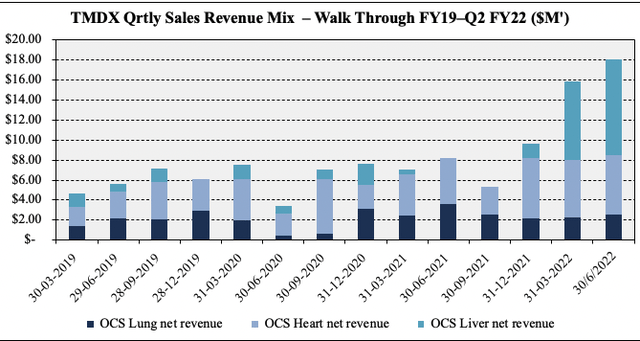

Second quarter sales came in strong with upsides at the top and a miss below the bottom line. If printed a 151% YoY gain in turnover to $20.5 million, also a ~30% sequential increase. The bolus of sales were recognized in the US with ~88% of contribution, also a 215% gain from the same time last year. Management noted on the call that OCS adoption across all organs was a key driver to revenue upside last quarter. The National OCS Program (“NOP”) in particular is touted as the “critical commercial vehicle” to drive utilizations across the US. Segmentally, OCS Liver printed $9.6 million in revenue, OCS heart $5.9 million and OCS lung revenues were $2.6 million. As seen in Exhibit 3, the result is well above quarterly top-line growth trends across all product segments providing solid bedrock to work from in FY23.

Exhibit 2. Quarterly segment revenue ratcheting up substantially in FY22

Data: HB Insights; TMDX SEC Filings

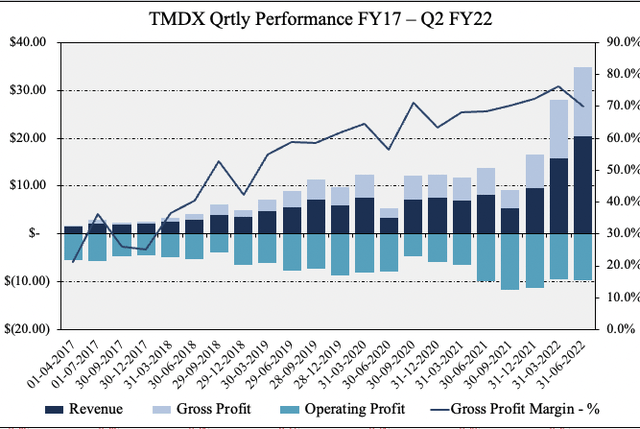

Gross margins also came in with ~200bps of liftoff to 70%, underscored by higher revenue volumes across the 12 months. Sequentially, however, it realized a tightening of gross margin given the distribution of revenue to the lower margin NOP segment. This is a key upside factor that investors should consider in the debate here. As the company hits scale and operating efficiency in NOP, margins are also likely to follow suit as a measure of this. This supports the case for overall gross margin to decompress further into the coming periods, feeding more income down to the bottom line.

Moving down the P&L, OPEX came in at ~$24 million and were up ~56% YoY. The change was underpinned by the company’s marketing and commercial efforts to drive NOP adoption in the US. Whilst R&D spend came in higher YoY it was also down on a QoQ basis due to the wind-back in investment to the next generation of development activity. As such, TMDX printed an operating loss of $9.7 million, in line with Q2 FY21. This carried through to a net loss of $11.5 million versus $10.7 million loss in Q2 FY22 and a net loss on EPS of $0.41.

As seen in Exhibit 3, Q2 FY22 earnings were well ahead of long-term averages. In particular, gross margin continues to exhibit ongoing decompression and this serves as adequate fundamental heading into the possible distributions of outcomes for the global economy. In other words, strengthening margins into a weakening economic outlook is an insulating factor in TMDX’s investment debate.

Exhibit 3. Q2 FY22 earnings exhibit fundamental momentum on display

The fact gross margins continue to strengthen into a weakening economic outlook looks to be an insulating factor

Data: HB Insights, TMDX SEC Filings

The company left the quarter well capitalized with ~$58 million in cash on the balance sheet having burnt ~$14 million in cash net-net last quarter. It also secured additional liquidity by refinancing its existing liability structure with a $60 million facility with CIBC Innovation Bank. With this amount it was able to retire its liability to OrbiMed whilst retaining an additional ~$23 million in liquidity on the balance sheet. With the upside in revenue versus consensus, management also updated FY22 guidance, forecasting substantial top-line growth of 121-148%, calling for $67-$75 million in revenue.

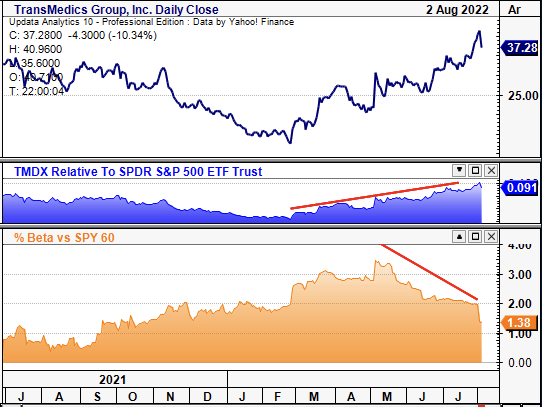

Market factors supportive of further upside

Investors are paying a premium for idiosyncratic risk factors in FY22, despite a recent resurgence of tech and other long duration segments. As such, investors can no longer rely on simply gaining exposure to sector or market beta as a form of carry to see outsized returns in the new investment landscape. Instead, investors should be looking to reduce correlation to the broad market and seek out those businesses displaying idiosyncratic (company-specific) equity premia instead. We measure this as an uptick in relative strength relative to benchmarks with accompanying reduction in equity beta.

As seen in Exhibit 4, TMDX has gained in strength relative to the benchmark since February this year, when the stock first caught a bid. At the same time, its covariance structure has shifted downward, albeit on a slight delay. Since this setup formed, the TMDX has correspondingly recognized buyers all the way up until its current levels. Outpacing the benchmark whilst reducing equity beta are indicators the market has identified idiosyncratic risk premia in this name.

Exhibit 4. Relative strength stretching up vs. benchmark whilst covariance structure shifting down illustrates market has identified idiosyncratic risk premia in TMDX

Data: Updata

Further evidence of the same is seen on the chart below. As noted, TMDX has also gained against the medical devices and health care supplies sector. This is important, because the sector has also caught a bid in mid-FY22, therefore TMDX is outperforming into a strengthening market. With TMDX and the sector both stretching up at the same time, the assumption immediately then turns to: “well, that’s just sector beta” for TMDX. However, it is pushing higher than the sector and has also seen a downtick in covariance to its returns, as seen below. This adds further evidence to suggest that, no, returns aren’t just a function of beta to the sector and look to be idiosyncratic in nature instead.

Exhibit 5. Also outpacing medtech whilst reducing correlations to the sector further evidence of pure alpha ready to harvest

Data: Updata

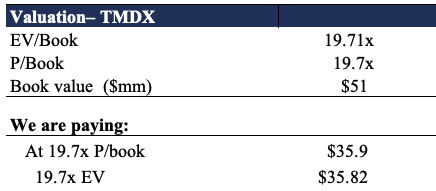

Valuation

Shares are richly priced considering the company’s stage in its lifecycle. We are paying ~70x Q2 FY22 gross profit, [~18x gross profit annualized] for cash flows priced out into the future, a more than 51% negative trailing ROE and a series of quarterly operating losses to date. However, We estimate TMDX is at an inflection point based on Q2 earnings. Sales are forecast to expand in triple-digits in YoY in FY22, and this is key fundamental momentum that is yet to be fully priced into stock, by estimate. Moreover, TMDX’s niche offering must also be considered into the debate.

With respect to absolute value, shares are trading at ~19.7x book value from Q2 FY22 earnings. It is roughly the same on EV/Book value. If we were to pay this premium, then we’d be paying ~$36, suggesting the stock could be fairly priced at this level. Given this, any pullback of ~10-20% in the short-term will provide an excellent mispricing opportunity to capture any mean reversion back towards a fair value of $36-$37. As such, we are theoretically paying a fair price for the stock and access to the growth opportunity at hand.

Exhibit 6.

Data: HB Insights Estimates

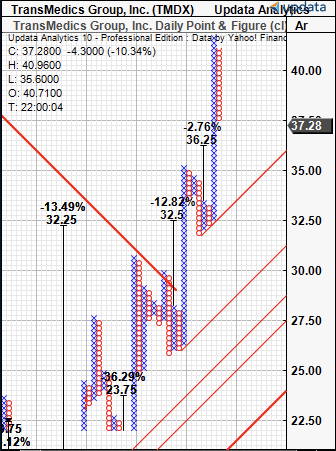

Further upside potential is observed below with point and figure charting suggesting there is buying support up to the current valuation. As seen on the chat below, there are price objectives at $36-$37, in line with the fundamentally derived valuation. This gives us further confidence around the estimation of a fair price of entry for the stock. The below price indicates price action is also bullish, by estimate.

Exhibit 7.

Data: Updata

In short

With another period of YoY growth at the top, TMDX’s niche offering continues to unlock value for shareholders. Management have also taken steps to free up liquidity and strengthen the balance sheet, whereas the market continues to adopt its proprietary offerings. As such, investors look to have rewarded this idiosyncratic equity premia in FY22 and should continue looking ahead.

Whilst we took a hard data approach in this analysis, the qualitative strengths of the company shouldn’t be discounted and are best understood at their core level. We forecast a period of ongoing growth for the company and estimate we are paying fair value at $36-$37 for entry into the name. We rate shares a buy on these grounds.

Be the first to comment