RoschetzkyIstockPhoto/iStock Editorial via Getty Images

ChargePoint (NYSE:CHPT) is building out charging infrastructure for the growing global number of EVs and is the largest publicly listed company in the fast-growing EV charging space. Hence, it forms an immediate pick-and-shovel play on the expected growth of new EVs in the coming years.

Whilst EV purchases will continue to be driven by strong state and federal government incentives, upcoming EVs are set to be cheaper than their predecessors with a longer range and faster battery charging. This combined with what is expected to be elevated gas prices will likely accelerate the adoption of EVs beyond currently expected growth rates. Expensive gas prices bolster ChargePoint’s bull case. Indeed, a recent UK survey established that nearly half of current ICE owners are worried about prices at the pump and would consider making a switch to an EV alternative in the future.

This shift is happening against the backdrop of the global race towards net-zero with nations across the world pursuing ambitious strategies to decarbonise transport. For example, the European Union recently announced a phase-out of fossil fuel vehicles by 2035, following the footsteps of California, the United Kingdom, and South Korea. A number of incumbent automakers are planning to switch to all-electric lineups ahead of these dates.

ChargePoint is thus at a critical juncture in its journey. The SPAC market that brought the company public early last year has entirely collapsed and the company is still in the cash-burning phase of its growth. This means currently deteriorated capital market conditions could somewhat derail its growth plans.

Cash Burn A Cause For Concern As Revenue Ramps Up

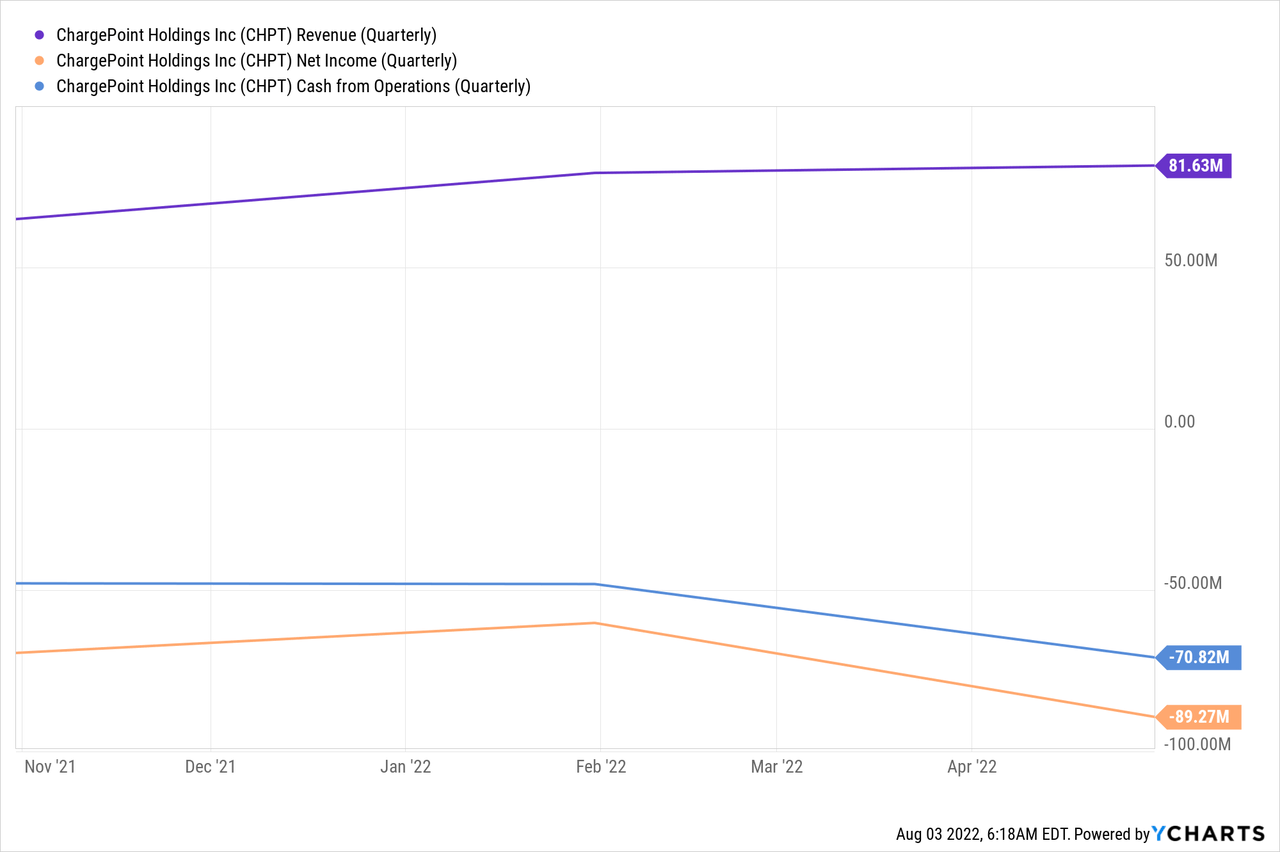

ChargePoint has a different fiscal calendar from most of its peers and is set to report earnings for its fiscal 2023 second quarter next month. The company’s last reported earnings for its fiscal 2023 first quarter saw revenue come in at $81.63 million. This was a material 101.5% increase from the year-ago quarter with activated ports under management growing to just over 188,000 with 30% of this located in Europe.

Whilst revenue growth was strong, net income worsened both year-over-year and quarter-over-quarter to reach $89.3 million. This meant cash burn from operations was negative at $70.82 million, up from a negative $37.5 million in the year-ago quarter. After raising $300 million from a convertible note offering, the company ended the quarter with cash and equivalents of $540.6 million. This places ChargePoint in a good position with the market crash and terrible economic landscape already increasing the concerns for companies within the broader EV economy sector.

The company’s management confirmed full-year 2023 revenue guidance of $450 million to $500 million, placing its enterprise value to forward sales multiple at 10.56x. Whilst this is significantly higher than the sector average, it could be justified by the triple-digit rate of revenue growth and the expected acceleration of EV uptake in the years ahead. With intense competition in the sector likely to lead to a level of consolidation, the company’s market dominance opens up further opportunities that help to also justify the premium.

The Global Race To Net Zero Speeds Up

ChargePoint is a fast-growing and well-capitalized company operating in a valuable space. The company has 7x more market share in networked level 2 charging than its closest North American competitor, around 5,000 commercial and fleet customers worldwide, and 188,000 places to charge in North America and Europe.

This position of leadership places ChargePoint in a good position as the EV charging space heats up and companies in the space are likely to come under pressure with access to the capital markets not as buoyant as it was a few years ago. Further, it would also potentially place ChargePoint at the top of the list of any oil major looking to expand their investments in the ESG space. A prospect bolstered by the record profits they all have recently reported.

The global shift towards net-zero forms a macro trend that will see tens of billions invested yearly over the next decade to decarbonise the economies of the world’s most developed economies. Transport, as well as energy generation, forms the most immediate avenues for this ambitious effort which was initially driven by altruism but is now commercially viable. Fundamentally, this means trying to restrict the rise in mean global temperature to well below 3.6°F above pre-industrial levels and stopping a future where we are all besieged by the effects of climate change.

Against this backdrop, ChargePoint is likely to continue to realize strong levels of revenue growth albeit with a significant degree of cash burn. I would rate shares only as a buy when future earnings show improved profitability as the pullback from its highs has helped derisk the investment proposition.

Be the first to comment