wildpixel/iStock via Getty Images

Shares of medical device player and venous disease specialist Inari Medical (NASDAQ:NARI) got off to a promising start in its May 2020 IPO, more than doubling from an initial price point of $19 at the day’s close. From there to present, shares have further risen by 57%. On the other hand, the stock has hit a bit of a rough patch in 2022 and is down 25% YTD.

I’ve been wanting to revisit this one for quite some time, as in ROTY’s Core Biotech portfolio (emphasis on commercial stage drug developers) we also make space for the occasional medical device player should a story look particularly compelling. Our current winner, organ transplant enabler TransMedics (TMDX) sports a 118% gain since we accumulated a full-size position in late Q1 to early Q2 this year as sales growth accelerated and full year guidance was raised.

Moreover, I’ve learned the hard way to simply hold compelling stories patiently instead of taking profits early, as was the case with ShockWave Medical (SWAV) where I am kicking myself (recommended in 2019 at $33 and sold later that same year, now the stock is up over 9x).

Returning to the story here at Inari Medical, my objective is to determine whether the current dip in share price is offering long-term investors a buying opportunity or if this negative movement portends more headwinds to come.

Chart

Figure 1: NARI weekly chart (Source: Finviz)

When looking at charts, clarity often comes from taking a look at distinct time frames in order to determine important technical levels and get a feel for what’s going on. In the weekly chart above we can see share price perform very well since initial IPO in 2020, rising multi-fold and then topping out at the $120 level. From there, over the past couple years shares have bounced around in the $70 to $100 range. While I’m tempted to say the stock has bottomed at $60, it’s clear on the chart that it’s failed to get traction and has fallen below major moving averages once again. Thus, I’m not comfortable suggesting an initial accumulation strategy for readers until we dig deeper.

Overview

Founded in 2011 with headquarters in California (800 employees), Inari Medical currently sports an enterprise value of ~$3.2 billion and Q2 cash position of $330M providing them operational runway for multiple years to come considering quarterly net loss has narrowed to ~$10M.

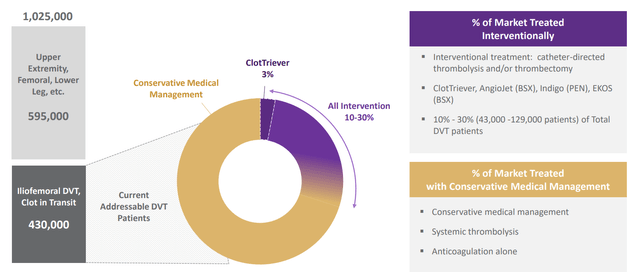

While a bit dated, the management team’s presentation at the BofA Healthcare Conference from back in May provides an excellent overview of the business. CEO Bill Hoffman (being succeeded by COO Drew Hykes effective January 2023) starts by noting that in Q1 the company showed 14% growth sequentially in procedures compared to Q4 (off a 15% procedure growth in Q4 compared to Q3). The most exciting development is the hospital operating environment being more constructive than at any point the company went public (post pandemic environment). When looking at treating PE (pulmonary embolism) and DVT (deep vein thrombosis), the company is only 5% penetrated in a very large market (the size of the market is determined by claims data presented in the hospital). 60%+ of patients never even get a consult with VTE (venous thromboembolism) experts and as the environment improves, the company hopes to do even better at getting its story out.

Figure 2: Large addressable market in VTE (Source: corporate presentation)

Management states that Covid causes a hypercoagulability state in some patients and thus causes VTE in some cases. The link has broken down now because so many people have had Covid (ask the physician if a patient had Covid and 60% to 80% of the time the answer is yes and thus it may be incidental instead of causative). There have been 4+ waves over the past 2 years and the company has grown consistently regardless. Their procedure consumes a limited number of resources (one doctor, one physician, one tech) and the financial package for the hospital is favorable so staffing issues were not much of a concern in their case. A combination of high acuity disease space (patients cannot wait, not like a hip or knee replacement or cosmetic procedure) and efficiency (can be done in less than an hour safely and quickly with limited number of staff) and economics are favorable for hospitals (why the company has not suffered same issues of medical device peers).

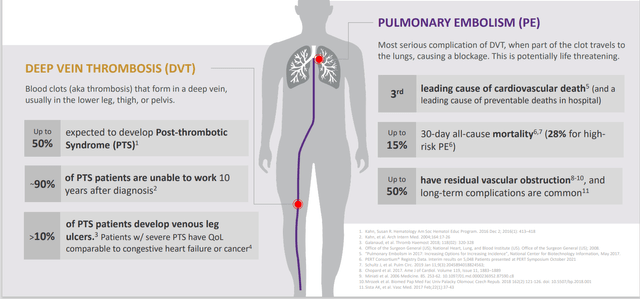

Figure 3: Treatment of DVT and PE are clearly not elective procedures, with time being of the essence (Source: corporate presentation)

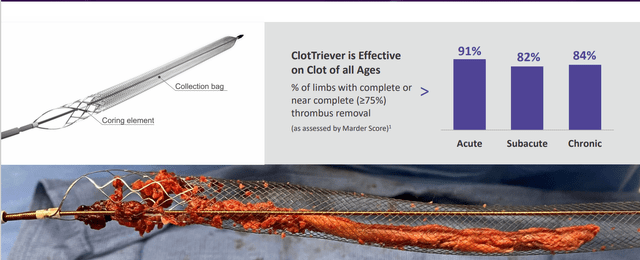

As can be seen above, conditions the company treats are truly urgent which is why procedures don’t get postponed. Before I understood this space, I thought that venous clots were simply treated by thrombolytic drugs (drugs used to dissolve clots). However, the company notes that these can be ineffective when the underlying clot has grown significantly and hardened. Likewise, as symptoms often appear gradually, thrombolytic treatment is rendered ineffective as fewer “targets” remain. These drugs can be expensive and again the risk/benefit profile is not always favorable (they carry significant rates of bleeding complications and are often contraindicated for up to 50% of VTE patients). Contrast this to the company’s procedure with devices such as FlowTriever and ClotTriever systems which capture and remove large clots mechanically, eliminating the need for thrombolytic drugs and accomplishing removal with minimal blood loss in a short, single session with no capital equipment required.

Figure 4: ClotTriever works on all clot ages (Source: corporate presentation)

As an aside, for readers who are visual learners like myself, this video case study was both very fascinating and quite helpful for getting a look at what the procedure really looks like.

Management is guiding for a flat Q2 (why the stock has suffered) followed by acceleration in the second half of the year. Programs will yield results (more patients into queue) and a number of new products are coming on down the line with pace accelerating (5 introduced prior, 2 more coming this year). These include improvements on existing devices and new products in DVT and PE space as well as new TAMs (total addressable market) in markets they have not accessed yet. Sales professionals as hired become more productive over time and again there are a number of drivers to accelerate growth. Timing for new products with new TAMs sounds like these will come to market next year (one might be ready in late 2022).

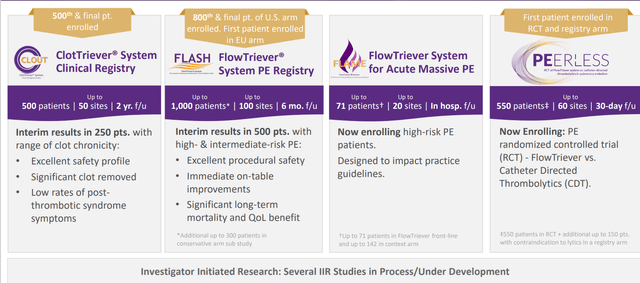

An example is given of 1 million patients with DVT last year, the year before, and 20 years before that and suffer from post-thrombotic system (have venous leg ulcers secondary to untreated mistreated or unaggressively treated DVT). These patients are told there is nothing that can be done for them and this is not true, as publications coming out shortly showing patients whose ulcers have healed based on ClotTriever and ability to decrease venous hypertension simply by increasing the lumen (take out a bit of the tissue and fundamentally change the disease state). This is complex, no one is working on it and clearly represents unique opportunities the company’s expertise can be applied to (other indications not being disclosed at this time for competitive reasons). The first bucket is more incremental improvements to existing products FlowTriever and ClotTriever in DVT and PE. The second bucket is new products in venous (new products, not just improvements to existing products). Analyst Day is coming up this month and management likely believes that Wall Street does not appreciate the depth and scope of the company’s ongoing clinical trials (500+ patient registries, hopefully late-breaker coming out later this year). 800 patients PE in FLASH study and FLAME trial in worst of the worst PEs has guideline changing potential. PEERLESS is their first randomized, controlled study and additional studies could be run simultaneously. As for competition, they believe data from such studies does have that kind of impact in creating a moat for the company’s products.

Figure 5: Broad evidence generation driving adoption including investment in randomized controlled studies (Source: corporate presentation)

The company has the ability to be profitable, meter spend in SG&A and R&D and recent fundraise provided for long term investment opportunities in the business. International expansion into western EU, Canada, Central & South America, Asia, etc is an example of investments that take several years to start seeing a return (no immediate payoff). The story for them is about growth (treat as many patients as possible with best possible outcomes) but they are sitting on best-in-class margins (almost “pharma-like”) and SG&A as percentage of revenue consumed is much lower than other companies growing this fast (operated 5 of 8 quarters as public company in the black). They’ve doubled spend in R&D, add sales representatives at rapid clip that don’t consume cash as most do because they become productive very quickly. “You can have a solid business with 88% margin” is quite the statement of confidence.

As for the possibility of inorganic growth, they are so busy and early in the penetration of DVT and other markets they will announce later this year, that acquiring other companies or technologies is probably not even on their radar and does not make sense at this time (could be closely related to things they are doing today and incremental in nature). They are not planning to “do anything stupid” and wish to simply stay focused on creating value for shareholders and patients, in my opinion.

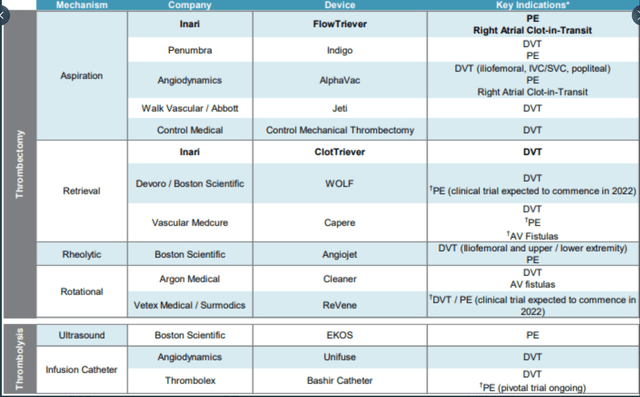

As for the competitive environment, there are quite a few competitors out there in the DVT space. They have not seen any pricing pressure (fundamental difference in their mechanism of action and amount of clot they take out). Some competitors are talking about straight line flows and arterial concept, but management contends that’s not the way it works in venous (clot is the single most important variable that determines how these patients do over time and you have to get it all out). Safety and simplicity of procedure has differentiated Inari versus peers (aspiration won’t work in DVT). PE requires a minimum 2 year clinical trial before getting FDA-cleared (more likely 3 years). Everyone coming to this market is highly valuable (overall market is less than 20% penetrated and the company has penetrated just 5%). High quality peers help to expand the market and get the value proposition across (acceleration of awareness and penetration).

Long term, Inari is not exclusively a venous company and instead seeks to address unmet needs or things that are addressed very poorly. They are building purpose-built ideas to have a spectacular impact on human life (beyond simply doing business).

Select Recent Developments

On August 3rd, the company announced that Chief Operating Officer Drew Hykes will succeed Bill Hoffman as CEO effective January 1st 2023. Hykes has been at Inari since 2020 and served prior as VP of Commercial Operations at Sequent Medical where he led the commercialization strategy for the WEB Aneurysm Embolization system from early prototype to broad adoption in the European market. Sequent was then acquired by Terumo Corporation in July 2016 for $380M. Prior to that he spent 11 years at Medtronic, including as VP of Marketing for the AF Solutions business.

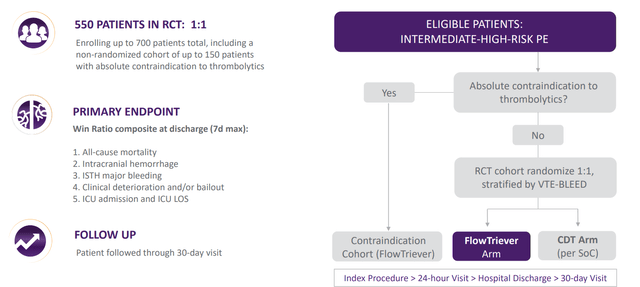

On August 30th, the company announced planned enrollment of the DEFIANCE randomized, controlled study comparing clinical outcomes of patients with iliofemoral deep vein thrombosis (“DVT”) treated with the ClotTriever System versus anticoagulation only. The trial will enroll 300 patients at up to 60 centers worldwide. DEFIANCE is Inari’s second RCT and it will run in parallel to the PEERLESS trial. PEERLESS began earlier this year and compares FlowTriever to catheter-directed thrombolytics in pulmonary embolism. Dr. Steven Abramowitz, Co-Principal Investigator and Chair of Vascular Surgery at MedStar Heath, notes that anticoagulation is still the predominant therapy in the management of DVT and has been associated with post-thrombotic syndrome (PTS) in up to 50% of patients. PTS is a very debilitating condition with symptoms including swelling, difficulty walking, skin changes and poorly healing open wounds. Research has shown PTS quality of life scores can be as low as those of patients suffering from heart failure or cancer. The value add of mechanical thrombectomy procedures like ClotTriever is the ability to rapidly remove large volumes of DVT and thus reduce risk of PTS developing in the first place. Management believes such high-quality studies will establish a new standard of care for patients and further build the competitive moat.

Figure 6: Study design for PEERLESS (Source: corporate presentation)

Along the same vein, the company announced 3 new data sets to be presented during Late-Breaking Clinical Trial sessions at the 2022 TCT (Transcatheter Cardiovascular Therapeutics) and the 2022 VEINS (Venous Endovascular Interventional Strategies) conferences. These include in-hospital and 30-day results from fully enrolled 800-patient US cohort of FLASH registry (largest device study ever conducted in PE field, evaluating short and long-term clinical outcomes of patients treated with FlowTriever system. Also, it includes in-hospital and 30-day outcomes from fully enrolled 500-patient CLOUT registry (largest prospective mechanical thrombectomy study ever conducted in the field of DVT). Lastly, they will also present a propensity-matched comparison of patients treated in the CLOUT registry versus patients treated with pharmacomechanical thrombolysis from ATTRACT, an NIH-sponsored randomized controlled trial (RCT).

Finally, the company announced it will host an R&D and Investor Day on September 15th (first ever).

Other Information

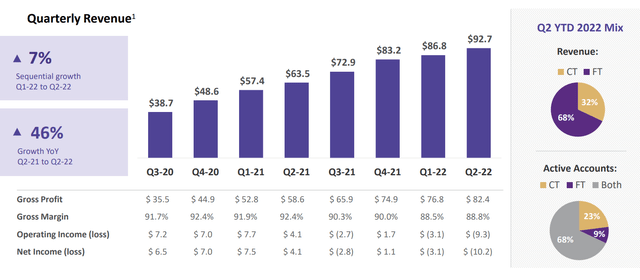

For the second quarter of 2022, the company reported cash and equivalents of $330M as compared to a net loss of just $10.2M. Operating expenses rose substantially to $91.7M, while gross profit increased to $82.4M. Revenue rose slightly to $92.7M (up 7% sequentially from the first quarter, and 46% over the same quarter last year) with management providing full year 2022 revenue guidance of $360M to $370M.

Figure 7: Financial performance (Source: corporate presentation)

As for the conference call, management notes the following case study which I believe is reflective of the value-add to patients here:

Couple of months ago, a 14-year-old boy, a competitive athlete in excellent physical condition collapsed while playing basketball with friends. He was rushed by ambulance to a nearby hospital with multiple generations of family arriving shortly thereafter. Imaging showed large blood clots in both his left and right lungs. His physicians used FlowTriever along the FlowSaver towards 12 times until all of the clot was removed from his lungs. Procedure was completed in 52 minutes, his pulmonary artery pressures, heart rate and breathing returned to near normal levels immediately and he was discharged from the hospital within 24 hours.

As for prior financings, the company raised $186M in March at a price point of $81/share (about 15% higher than present levels).

Moving on to competition, this is the area that gives me pause as peers include medical device giants like Boston Scientific (BSX) and Abbott Laboratories (ABT). See below graph courtesy of Andrew Ryan on Twitter.

Figure 8: Competitive Landscape (Source: corporate presentation)

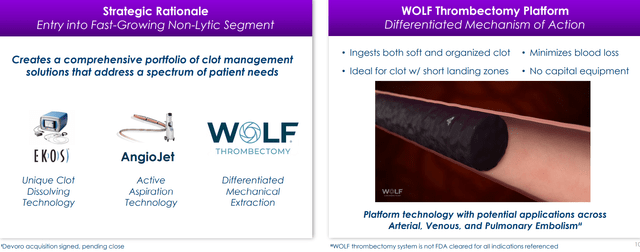

In September of last year Boston Scientific acquired Devoro Medical for its innovative non-console and lytic-free WOLF technology targets and rapidly captures blood clots using finger-like prongs that retrieve and remove thrombi in the arterial and venous systems. This complements the company’s existing offerings including the EkoSonic Endovascular System (EKOS) and the AngioJet Thrombectomy System. In its Investor Day Presentation, Boston Scientific notes that the venous therapies market is experiencing rapid growth and the PE market is vastly underpenetrated. Boston is the category leader across venous disease states with new entries to come and notes that reimbursement trends offer a favorable tailwind as well.

Figure 9: Boston’s differentiated technology in the clot management space (Source: corporate presentation)

As for institutional investors of note and insiders, it’s interesting that Donald Milder owns an 8.2% stake (recently sold nearly a quarter of his shares). Current CEO Bill Hoffman owns over 500,000 shares. A steady stream of insider selling over the past couple years does not inspire confidence.

As for relevant leadership experience, the CEO Hoffman served prior as CEO at Visualase (a private company focusing on MRI-guided lasers) until its acquisition by Medtronic (MDT). COO Drew Hykes served prior as VP of Commercial Operations at Sequent Medical where he led the commercialization strategy for the WEB Aneurysm Embolization system from early prototype to broad adoption in the European market. Sequent was acquired by Terumo Corporation in July 2016 for $380M. Prior to that he spent 11 years at Medtronic as VP of Marketing for the AF Solutions business. VP of Clinical Affairs and Market Development Tara Dunn served prior as Venous Business Segment Leader at Volcano Corporation (acquired by Philips in 2015). VP of Medical Affairs Justin Crockett served prior as Vice President of U.S. Healthcare Solutions leading commercial solutions across the Cardiac Rhythm Management Division and the Interventional Cardiology Group at Boston Scientific.

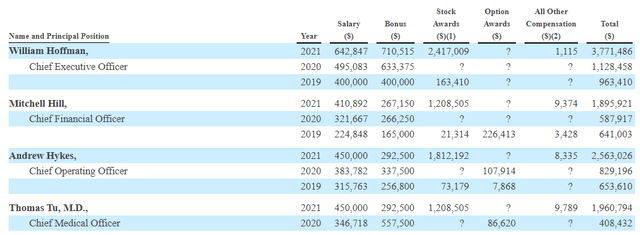

Moving on to executive compensation, the cash portion of salary and bonus is on the high side (especially for the CEO totaling nearly $1.4M). To be fair, he (and other executives) have likely earned it in my opinion (to an extent) given the strong balance sheet and very low burn rate. On the other hand, the levels of stock and option awards are more than reasonable.

Figure 10: Executive Compensation Table (Source: proxy filing)

The important thing is to avoid companies where the management team is clearly in it for self-enrichment instead of creating value for shareholders, and looking at compensation is one of several indicators in that regard.

As for IP, the company has 32 US patents expiring between 2025 and 2037, 21 pending US patent applications, six issued foreign patents and 22 pending foreign patent applications and 8 pending Patent Cooperation Treaty applications. They also licensed two U.S. patents and sublicensed one U.S. patent related to braiding elements of their product designs, such as the tubular braiding of the clot collection bag (expires in October 2037).

As for other useful nuggets from the 10-K filing (you should always scan these in your due diligence as many companies like to sweep undesirable elements under the rug), the company highlights the highly competitive nature of markets they are competing in. Primary medical device competitors are divisions of Boston Scientific Corporation, Penumbra, Abbott, Philips, AngioDynamics, and Teleflex, and multiple smaller companies that have single products. There is growing interest in the treatment of VTE disease with catheter-based solutions, and thus a number of approved thrombectomy devices will be available or entering the market in the near term.

Final Thoughts

To conclude, Inari Medical presents us with an appealing medical device play in a rapidly growing space benefitting from multiple tailwinds (including mechanical thrombectomy eventually replacing anti-embolic drugs as standard of care in some cases). Management is doing an admirable job of keeping cash burn minimal and growing the competitive moat via ambitious clinical studies meant to yield data sets showcasing value-add to patients’ lives versus available alternatives. The company lived much of its public life during the pandemic and emerging from this situation is resulting in a more favorable hospital environment that should also aid growth going forward. The leadership bench is full of members with relevant experience in this space, and the value-add of ClotTriever and FlowTriever is readily apparent to my eyes in terms of clinical outcomes. On the other hand, I have a hard time determining differentiation versus newer entrants (and those upcoming) in this space including from medical device giants like Boston Scientific.

For readers who are interested in the story and have done their due diligence, NARI is a Buy and I suggest accumulating dips during the near term ahead of expected reacceleration of growth in 2H 22 and beyond.

From a Core Biotech perspective (emphasis on next 3 to 5 years), I’m not sure I can get behind this one yet as I need to better understand the competitive landscape over this longer period.

Key risks include the growing competition in the VTE space, especially from newer products entering or set to enter the market. Disappointing clinical data for ongoing studies would negatively impact the company’s ability to build out its moat. Likewise, overspending on any potential acquisitions or in-licensing of new products would weigh on valuation and investor sentiment as well.

Author’s Note: I greatly appreciate you taking the time to read my work and hope you found it useful. I look forward to your thoughts in the Comments section below.

Be the first to comment