halbergman/iStock via Getty Images

They Sold It For How Much?

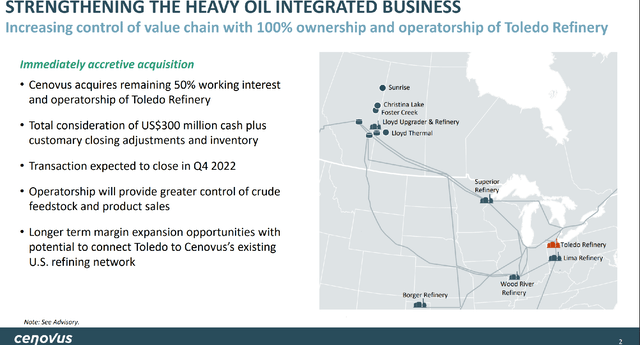

BP (NYSE:BP) and Cenovus (NYSE:CVE) recently announced that Cenovus will acquire BP’s 50% stake in Toledo refinery, with the deal to close by the end of the year. BP owned 100% of this refinery until 2008 when it contributed a 50% share to Husky Energy in exchange for a 50% share in Husky’s upstream Sunrise oil sands project. (Cenovus and Husky merged in 2021.)

BP and Cenovus already unwound the upstream part of the deal in June 2022. Cenovus acquired BP’s 50% share of Sunrise in exchange for $600 million Canadian up front, a variable performance-based payout of up to another $600 million, and all of Cenovus’s 35% stake in the Bay du Nord project in offshore Newfoundland and Labrador.

With the upstream leg of the deal ending, it was not surprising that BP would look to get out of the downstream side as well. What is surprising (and disappointing) is the low price agreed on the refinery sale. At only $300 million US, the price values the refinery at only about 0.6 times its current EBITDA earning power. Using BP’s long-term $60 crude planning price set, it is still only 4 times EBITDA. Such a low price is hard to justify based on the high demand for US refining capacity and instead seems like a move to improve its ESG profile given the reputation of oil sands crude with the green crowd.

At 1% of BP’s current EBITDA, the refinery income is barely material but still serves as a warning that BP management is at risk of doing deals for uneconomic reasons. The company is still cheap, but the risk of uneconomic deals may cause the market to continue valuing it much lower than US peers. For Cenovus, the deal is more material, improving EBITDA by around 5%.

A Great Asset At A Low Price

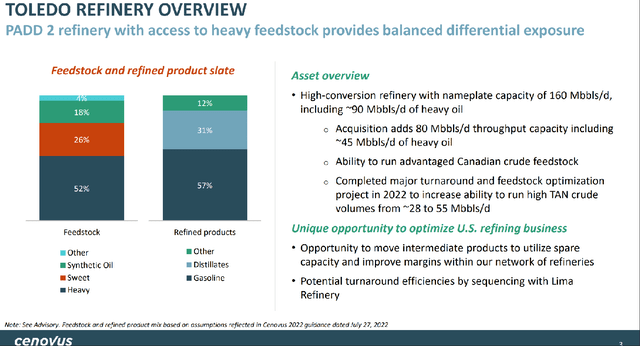

Toledo Refinery has been around over 100 years, originally built by Standard Oil of Ohio in 1919. BP acquired Sohio in 1987. The refinery was first upgraded to process heavy Canadian crude around 1999 and recently completed a maintenance turnaround this year to allow it to process the high-acid crude from the Sunrise field. While the nameplate capacity is 160,000 bpd, typical rates are average around 140,000 bpd outside of turnarounds.

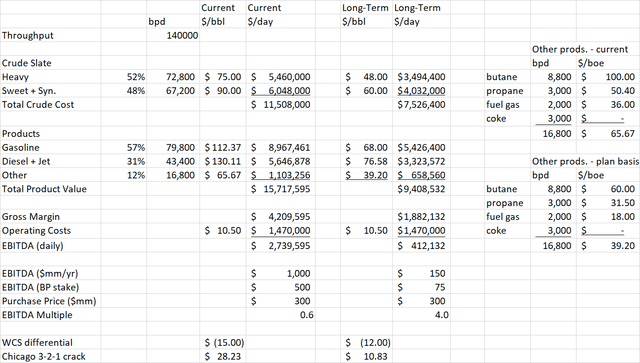

Given these crude and product slates, the refinery is capable of generating about $1 billion per year in EBITDA at current prices. Using BP’s long-term planning price set of $60 Brent crude and $11 Refining Marker Margin, the refinery can still generate about $150 million of EBITDA. (These values are on a 100% basis and apply to non-turnaround periods.)

My earnings model uses the crude and product ratios in the above slide and assumes 140,000 bpd throughput. Current sweet crude price assumes $90 WTI with heavy Canadian WCS crude $15 lower. Product prices are based on CME gasoline and diesel futures, adjusted for a Chicago basis of -$8.38/bbl for gasoline and -$3.12/bbl for diesel. Pricing for other products in $/boe is shown in the table below. For operating costs, I am using $10.50/bbl based on Cenovus’s 1Q 2022 US Manufacturing operating expenses (translated to US dollars) divided by total US refining throughput. I chose 1Q because it had relatively low turnaround activity, although Lima refinery was in turnaround for part of that period. This data can be found in Cenovus’s earnings release and supplement.

At current prices, the refinery is capable of earning $1 billion per year of EBITDA. Therefore, the $300 million paid for BP’s 50% stake is an extremely low EBITDA multiple of 0.6 times. If we instead use BP’s long-term planning price set which assumes $60/bbl crude and $11/bbl refining marker margin, the refinery earns $150 million per year of EBITDA. In that case, the $300 million purchase price for the 50% stake values the refinery at 4 times EBITDA, still a great deal for Cenovus.

Upside Potential

The operating costs are a much larger fraction of the gross margin at lower product prices but also provide the greatest opportunity for savings. Lima and Toledo refineries were managed as a system by BP before BP sold Lima in the mid-1990’s. There is opportunity to eliminate some administrative functions and perhaps manage turnarounds jointly. On the gross margin side, the refineries are well-connected by pipelines. This allows intermediate feedstocks to be shipped back and forth as needed and also streamlines product demand balancing with the two largest Ohio refineries again under one operator.

A Retreat By BP, A Win For Cenovus

Under just about any likely price set, BP is almost giving away its half of Toledo refinery at only $300 million. It is however a small part of BP’s earning power. The foregone $500 million per year of EBITDA at current prices is less than 1% of BP’s total expected EBITDA of $60 billion if we annualize 1H actuals. Using prices from the long-term planning basis, BP is expected to earn around $42 billion per year of EBITDA, so the foregone $75 million is an even smaller part of the total. While the impact is small, it is still disappointing to see BP selling assets at such a low price because it seems in a hurry to deliver its green strategy. In BP’s favor, they do get up to $925 million US plus a stake in an offshore Atlantic Canada project in return for the upstream stake in Sunrise. Considering the two parts of the Cenovus JV together, the deal may not be as bad.

For Cenovus, they can expect to earn another $650 million Canadian ($500 million US) from the added 50% stake in Toledo at current prices. Compared to Cenovus’s trailing 12-month EBITDA of $12.242 billion Canadian, Cenovus is getting a 5.3% bump in income. Additionally, Cenovus is exiting their small stake in offshore Canada for a bigger position in the oil sands. They are also gaining a dominant position in the Ohio refining market, bringing Lima and Toledo under one owner again after 25 years.

Conclusion

BP is selling its remaining 50% stake in Toledo refinery at an extremely low price in a strong refining market. The impact of the deal is nearly immaterial to BP while working toward BP’s long-term strategy. Still, investors should be wary of BP management judgment in leaving so much value on the table. The deal is a clear win for Cenovus which now has a 100% stake in the Sunrise oil field and 100% of a downstream refinery capable of processing it. Cenovus also gains a dominant position and potential operating synergies in the Ohio refining market.

This deal does not change the fact that BP is cheap relative to earnings, but the suboptimal deal making by management leads me to rate the stock a hold. Cenovus looks cheap compared to Canadian peers based on earnings but is less competitive based on profitability metrics and dividend yield. The Toledo deal will add 5% to Cenovus’s earnings power, bringing its debt/EBITDA ratio down faster and enabling a dividend raise or a special dividend. That makes Cenovus a buy.

Be the first to comment