William_Potter

Introduction

When last discussing BP (NYSE:BP), the focus was on the impacts of exiting Rosneft and as my previous article highlighted, their outlook still saw faster dividend growth likely coming, despite this war-related setback. Thankfully, this proved timely with their recent second quarter of 2022 results once again seeing a dividend review, which saw management boost their dividends by 10%, which was far more than the mere 4% one year prior seen during 2021. Not only does this see them back on track two years after their dividends were reduced during the Covid-19 pandemic but more excitingly, I expect more big dividend increases coming that make their moderate yield of 4.86% even more desirable.

Executive Summary & Ratings

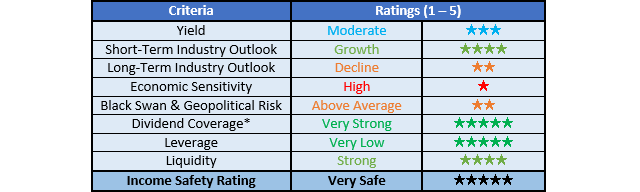

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

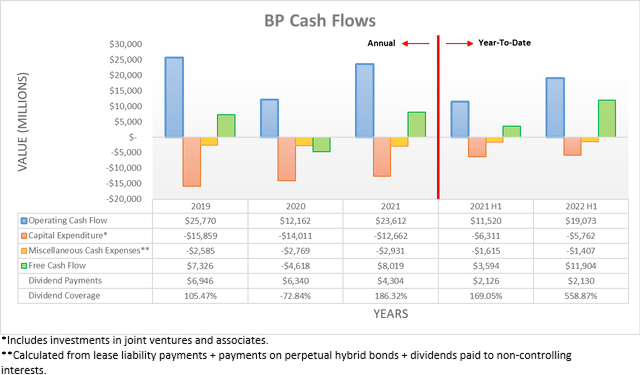

After seeing a very impressive increase during the first quarter of 2022, it was little surprise to see the booming oil and gas prices of the second quarter translate into another very impressive set of results for their cash flow performance. This saw their operating cash flow expand to $19.073b during the first half, which marks an increase of $10.863b during the second quarter alone, given their result of $8.21b during the first quarter. Obviously, this marks an improvement of nearly two-thirds versus the first half of 2021, which saw a result of $11.52b.

Whilst this was already a massive improvement in its own right, their results during the second quarter of 2022 were actually once again weighed down by a working capital build of $2.946b, similar to the first quarter and thus now sees a total build of $7.033b for the first half. Considering full-year 2021 saw a build of $5.305b, in theory, it seems reasonable to expect these to reverse in the future and thus provide a very large cash infusion.

Even if we ignore the impacts of their very large working capital build for a moment, they still saw free cash flow of $11.904b during the first half of 2022, up from $4.578b during the first quarter. Whilst this already surpasses anything seen during recent years, it nevertheless would have actually been far higher at an extremely impressive $18.9b if not for their working capital build, which provides them with never-before-seen scope to reward their shareholders.

Following their quarterly dividends being boosted by 10% to $0.3604 per ADR, these should still only cost $1.15b per quarter or $4.6b per annum given their latest ADR equivalent outstanding share count of 3,189,233, before considering the effects of their share buybacks. Apart from a meaningful dividend boost, they also announced $3.5b of share buybacks to be conducted during the third quarter of 2022 alone, which stands to repurchase around 3.70% of their shares given their current market capitalization of approximately $95b. Along with their dividends, this sees circa $4.6b of shareholder returns during the third quarter with ample scope to see more coming.

Considering they generated near $19b of free cash flow during the first half if not for their working capital build, thereby equating to circa $9.5b per quarter, they should have zero issues funding these shareholder returns with this sitting slightly over twice as high. Admittedly, oil and gas prices are inherently volatile and given the risks of a recession weighing down prices at the moment, their results may soften versus the first half, but given the size of this gap, it should ensure that they generate at least a few billion dollars of retained free cash flow. It also indicates that even if oil and gas prices soften, they should still have scope to fund comparable share buybacks during the next twelve months in the lead-up to their now usual mid-year dividend review. This excitingly increases the outlook for more big dividend increases given the way they are pursuing capital allocation, as per the commentary from management included below.

“And on the dividend increase, what you’ve seen is we want that number one priority, resilient dividend. We wanted to be anchored in that word resilient. Therefore, we say $40 world because we think that is the prudent way to plan our company. You’ve seen the reduction in share count, which means a reduced dividend burden. Murray has also taken down gross debt, which has taken down our interest expense and the balance of all of that is that we can then afford a 10% dividend increase, while keeping the balance point — importantly, keeping that balance point constant.”

-BP Q2 2022 Conference Call.

Initially, their intent to keep their dividends sustainable with oil prices around $40 per barrel can sound as though it reduces the scope for more big increases but importantly, as they go on to mention, share buybacks and debt reductions still provide an avenue for growth. Whilst I am not normally a fan of share buybacks and would have personally preferred to see special dividends as the variable portion of their shareholder returns policy, at least they seem intent to translate the lower share count into comparably higher dividends.

Unless oil and gas prices plummet in the coming quarters, which seems unlikely given the current global energy shortage, they stand to significantly reduce their share count during the next twelve months. If their $3.5b share buybacks announced for the third quarter of 2022 are continued throughout the following three quarters in the lead up to their next mid-year dividend review, this would shrink their share count by an impressive almost 15% at their current market capitalization of approximately $95b. Even before considering any interest expense savings from lower debt, which are more difficult to assess given the prospects for higher interest rates, this would provide scope to see another big dividend increase this time next year of 10% at minimum, if not as high as even 15%.

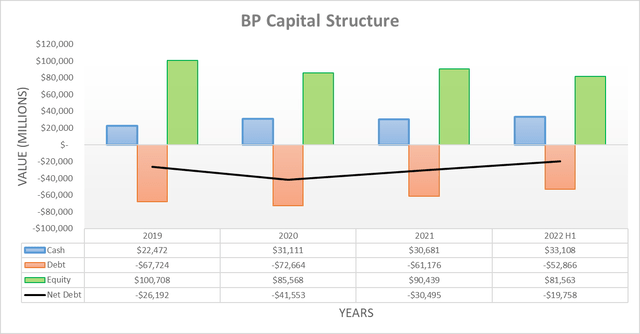

Even though they once again saw a sizeable working capital build of $2.946b during the second quarter of 2022 and conducted $2.288b of share buybacks along with $1.062b of dividend payments, they still pushed their net debt even lower to $19.758b. This represents another very impressive improvement versus its previous $26.192b level when the first quarter ended, which was effectively not aided by divestitures with them landing at only an immaterial $313m during the second quarter. Even if including their leases, as practiced by management, their net debt still only sits at $22.816b and thus sees a comparable decrease versus its previous level of $27.457b when the first quarter ended. When looking ahead, their net debt should continue marching lower as their free cash flow outpaces their shareholder returns, especially when their very large working capital build begins reversing and thus injects more cash into their coffers.

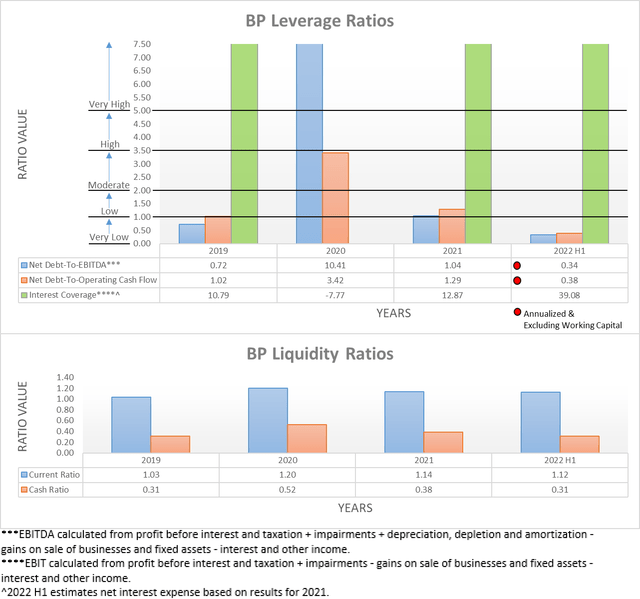

Since their leverage was already within the very low territory when conducting the previous analysis following the first quarter of 2022, it would be redundant to reassess their leverage in detail as the outcome is already obvious. The same can also be said for reassessing their liquidity, as their massive cash balance of $33.108b ensures it remains strong.

The two relevant graphs have still been included below to provide context for any new readers, which show the first quarter of 2022 ending with a net debt-to-EBITDA of 0.34 and a net debt-to-operating cash flow of 0.38. Similar to the end of the first quarter that ended with results of 0.54 and 0.53 respectively, these are easily beneath the threshold of 1.00 for the very low territory. Elsewhere, their liquidity saw its respective current and cash ratios of 1.12 and 0.31, broadly unchanged versus their previous respective results of 1.14 and 0.35 during these same two periods of time. If interested in further details regarding these two topics, please refer to my previously linked article.

Conclusion

Two years after their dividend reduction during the Covid-19 pandemic, they now seem to be back on track with management translating their improving fundamentals into a big dividend increase. More importantly, the way management speaks about their capital allocation strategy indicates that as their share buybacks reduce their share count, shareholders can expect comparable dividend growth to follow. When overlaying the outlook for this to see a double-digit share count decrease during the next twelve months, it sees more big dividend increases coming, and thus unsurprisingly, I believe that maintaining my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from BP’s Quarterly Reports, all calculated figures were performed by the author.

Be the first to comment