nimis69

(Note: This was in the newsletter on November 9, 2022)

Chart Industries (NYSE:GTLS) has a very long history of successful acquisitions. Management has in the past sold convertible bonds and then converted the bonds to equity. This financing allowed the company to pay a whole lot less for the “borrowed money” while often converting the bonds at a price that was above the market at the time of the financing. But now management is going to change the playbook.

As Chart has grown bigger it takes larger and larger acquisitions to “move the needle”. Those bigger acquisitions can be accomplished by either using stock as part of the deal or by concurrently selling stock to raise money to finance part of the deal. The idea is to keep the financial leverage low. That idea appeals a lot to Mr. Market in the current environment.

But lately the pace of deals has accelerated, and leverage has grown as the company waits for bonds to convert. That accelerated pace has included larger deals. So of course, there is more debt than ever before. But the spate of good news from the quarterly reports and a sky-high stock price indicated that the debt would likely convert. So, there would not be that much cash required to repay the debt. Once the debt converts then the company clearly has room for more debt to make acquisitions.

Departure From Established Norm

Then that whole system changed on November 9th with the announcement of the acquisition of Howden.

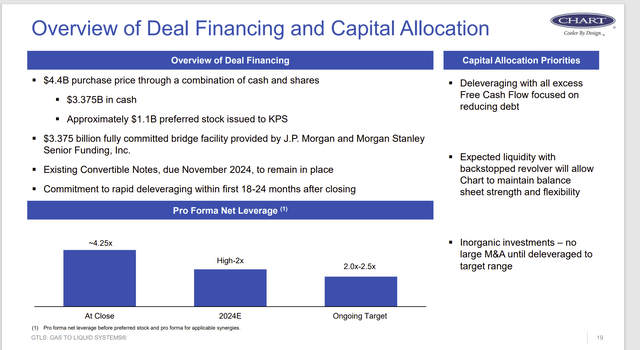

Chart Industries Description Of Howden Financing (Chart Industries Corporate Presentation Of Howden Acquisition)

Management obviously has plans for rapid deleveraging. But in the past the only time the company did any significant deleveraging is when the convertible bonds converted. That is because this company is constantly on the lookout for deals to acquire new products and broaden the product line.

So, the idea that the company would focus upon deleveraging because they need to repay debt before they start acquiring products again in the future strains credibility. This is a company that makes several acquisitions a year. It may make more if the economy tanks as so many have predicted.

It really does not seem wise to leverage the company. Management paints an optimistic picture of the company leverage by including a fair amount of preferred stock in the deal. However, that preferred stock is the same as debt to shareholders. When the preferred stock is included in the leverage calculation, then that 4.25 leverage shown is an optimistic but incomplete picture for common shareholders.

More to the point, increasing leverage by using preferred stock and debt limits the options a company has in the future should anything unforeseen happen that might need cash. Companies with low financial leverage usually get as many tries as they need to succeed. Leveraged companies generally only get one try. That one try is coming at a time when interest rates are climbing while many are worried about a recession.

Business Opportunities

As against that, the company is looking at the market serves as well as the opportunities available to service more markets with an extended product line.

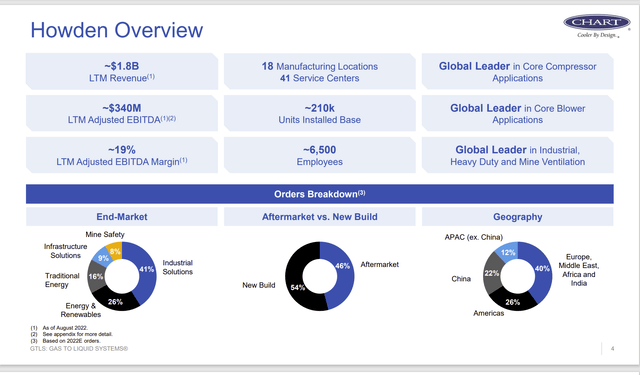

Chart Industries Presentation Of Howden Business Advantages To Chart (Chart Industries Presentation Of Howden Business Combination)

The acquisition would expand the aftermarket business considerably (with an emphasis on repair and maintenance). It also further diversifies the company away from oil and gas.

The usual strategy for Chart is to keep all the personnel and all of the locations (unless management knows of severe overcapacity somewhere). The combination usually involves synergies in sales as well as opportunities to offer a broader array of solutions as part of that sales synergy.

This management will from time to time consolidate operations as products age. However, that usually happens during an industry downturn. Generally during cyclical upswings this company needs all the capacity it has and often more. Therefore, duplication of some facilities is not really an issue.

Risks

Chart has long been a cyclical growth company with an emphasis on the big natural gas projects. As such, when those projects are available to bid upon, Chart has gotten its share of those projects. In the last decade or so, management has diversified away from that to the point where management now claims they are not dependent upon that one market.

That may be true, but oil and gas is still a very significant contributor to the business of this company. Should a downturn in the industry occur before all the benefits of the business combination occur, then this company could have strained finances along with a low stock price.

The company has entered a fair number of hot markets. Management is depending upon enough of those markets (like hydrogen and marijuana) to succeed. Any new market may or may not succeed long-term. Investors need to assume that management chose more of the right markets than the wrong markets.

Even a diversified company can be affected by economic downturns. We had a severe one in 2008 that affected pretty much all sectors. A recession is currently predicted. If it is worse than predicted that could be fatal to a leveraged company.

Key Takeaways

Management has long grown the company by acquiring products rather than developing its own. In the past, the acquisitions were basically funded with convertible debt that converted to equity. Small acquisitions predominated.

This time around, the funding is debt and preferred stock. The acquisition is very large compared to the size of the company. The assumption appears to be that the company can quickly deleverage. But that deleveraging process does not appear to include the preferred stock. The result is more initial leverage than the company has had in some time combined with a potential perpetual overhang of preferred stock requirements.

This kind of leverage often is very risky, and management does not usually get second chances if those chances are needed. For common shareholders, the debt and the preferred stock have to be paid first no matter how well the acquisition works out. In this case, management, as always is sure of success. But that sure success comes with the risk of high leverage which could be fatal should something unforeseen happen.

One of the risks of an acquisition strategy is that management tries for steadily larger acquisitions because all the previous ones worked out. Some managements love that challenge. But Mr. Market does not.

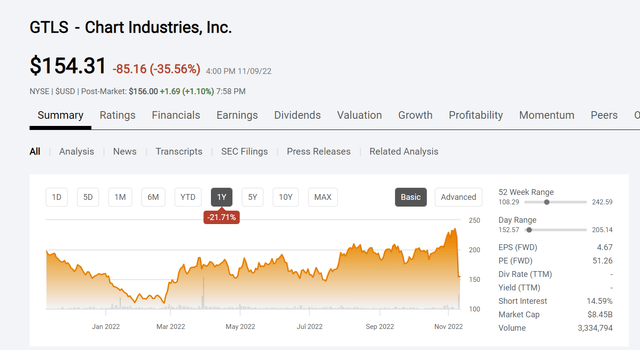

Chart Industries Stock Price History And Key Valuation Measures (Seeking Alpha Website November 9, 2022)

The stock reacted as one would expect to a company that suddenly became highly financially leveraged. Raising money through a stock offering would have been much better even though significant dilution would have been involved. The negative market attitude continued into November 10, 2022.

I agree with Mr. Market that the company is better off watched from the sidelines for solid evidence that the deleveraging is proceeding according to schedule, and that management stops the shopping spree long enough for the balance sheet to be repaired.

This much leverage allows for little to no “mistakes” or unforeseen circumstances. This management has been very good for a very long time. But I believe they overestimated the surety of the result of this combination. That would mean they underestimated the risks involved. Management can “get away with that”. But that does not mean it’s not risky. Therefore, I personally intend to watch from the sidelines for a while.

Be the first to comment