Leon Neal

Since I put a buy rating on the British pharmaceutical company GSK (NYSE:GSK) last month, its share price is up by 8%. At the time, as per my estimates, a 15% upside was possible for the stock. It’s more than halfway there already. Not only is the market mood better, but developments at the company have driven this as well. This analysis delves into them and assesses what it means for the stock’s price in comparison with its peers.

Could there be a sales surprise in store?

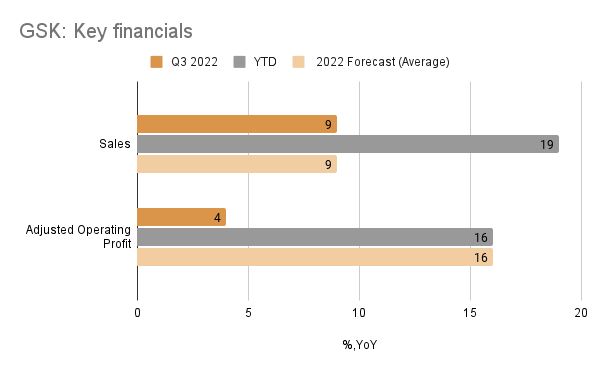

The company’s recently upgraded outlook is for me, the highlight of the positives that have happened for GSK in the last month. Along with releasing its third quarter (Q3 2022) results, the company also said that it now expects sales to grow between 8-10% at constant exchange rates [CER], up from 6-8% earlier. This is the second time it has revised its sales projections upwards for the year.

On a standalone basis, this sounds like a significant positive anyway. But there’s more. And that has to do with a disconnect between the sales outlook and performance so far. Year-to-date [YTD], it has seen a CER revenue increase of 19% on a year-on-year (YoY) basis. Its Q3 sales have slowed down in CER terms to 9%, to be sure, but the YTD figures are still going strong. This indicates that GSK’s expectations of an 8-10% rise for the year are either exceptionally conservative or that it expects sales in the final quarter of the year to be low enough to significantly drag the growth down to possible single-digit figures. Going by the fact that it expects “continued strong sales growth” in Q4 2022, it’s likely to be the former. It follows that the company’s full-year sales figures could show an upside surprise compared to its outlook.

Source: GSK

Operating profit growth slows

Next, it also expects its CER adjusted operating profit to grow between 15% and 17%, up from an expectation of 13-15% it reported during its Q2 earnings update. It’s also the second time that this metric has been updated, which reflects well on GSK’s performance in the year. The outlook seems completely plausible considering that it has reported a 16% increase in the number for the first nine months of the year.

There is one note of caution here though. Adjusted operating income growth has slowed down from a much bigger 26% for the first half of the year to a rate of increase of 16% YTD and just 4% in Q3 2022. Its CER operating margin was also lower by 1.6% during the quarter. The company explains that this is partly due to lower margin COVID-19 solutions sales, which accounted for 15% of its Specialty Medicines sales, its biggest segment and also the fastest growing at 24% YoY in CER terms in Q3 2022. But this is also due to an increase in increase in operating costs during the quarter. If sales of Xevudy, its COVID-19 treatment do stay strong, its margins could stay under pressure. Moreover, its selling, general and administrative expenses grew by 12% in Q3, down from 16% YTD on an adjusted basis, so it’s not clear how much further they’d need to decline for its operating margin to improve. In other words, I wouldn’t rule out the adjusted operating margin coming in below expectations, even as its sales could exceed projections.

Market multiples indicate upside

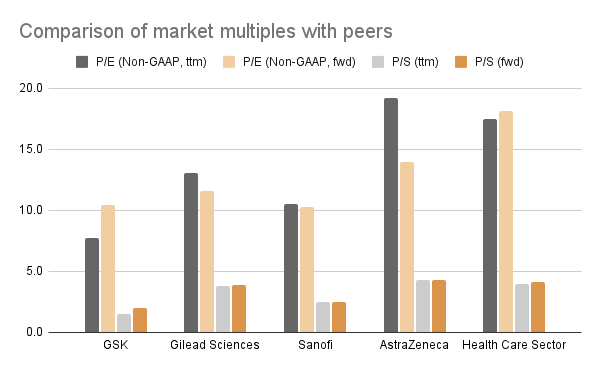

These forecasts have implications for its market multiples, which are already below that for the sector. Its twelve months trailing [TTM] price-to-sales (P/S) and forward P/S are at 1.5x and 2x respectively. This compares to the Health Care sector’s median TTM P/S at 4x and forward P/S at 4.1x. Even if only its pharmaceutical peers like Gilead Sciences (GILD), Sanofi (SNY) and AstraZeneca (AZN) are taken into account, the multiples are at about 3x. A higher-than-expected sales growth could give further impetus to the stock.

Source: Seeking Alpha

GSK’s TTM and forward price-to-earnings (P/E) ratios at 7.7x and 10.4x are also significantly lower than the Health Care median and that of its own peers as well (see chart). In my last article on GSK, I noted that at least its forward P/E is close to that for GILD, but the gap there has increased as well. To put it another way, the earnings multiples for its pharmaceutical peers have actually risen. GSK’s have too, but not quite as much, indicating that there could still be an upside to the stock even if its profit numbers don’t quite reflect the increase expected in the latest outlook. Based on analysts’ estimates for its 2022 earnings and going by its forward P/E ratio, I reckon there can be at least another 10% increase in the stock. The company’s 5.8% dividend yield also makes it quite attractive, which would be another reason why its price could rise further.

Progress on treatments

Besides this, the company has also made solid progress with its treatments in the past month. Its Boostrix vaccine, which prevents whooping cough in infants as well as its vaccines against meningitis-causing bacteria got FDA approval. It also got an FDA priority review for its vaccine against lower respiratory tract diseases in older adults. Most recently, its COVID-19 booster shot was approved by the European Commission. The company is optimistic about the prospects for its Shringix vaccine that prevents shingles in its earnings update, as also for its respiratory tract disease treatments.

What next?

So far, the company has performed well since the spin-off of its consumer healthcare segment into a new company, Haleon (HLN) earlier this year. Ideally, any analysis of the stock would be complete only if data were available for at least one year. However, considering its de-merger that’s not possible. That apart, the one ongoing concern with GSK, which probably affects its price too, is the overhang of Zantac-related litigations. There are 77,000 claims alleging it to be cancer-causing and was pulled from the US markets. The first trials start only in February next year and there’s no way of knowing where it goes from there. This could have financial implications for GSK if the charges are proven right.

For now, though, the company is looking good and at least for the next few months. There is an upside to the stock especially as the overall markets are looking somewhat healthier for now. This calls for reiterating a buy on it for now.

Be the first to comment