Klaus Vedfelt/DigitalVision via Getty Images

In the articles that follow, I will be analyzing each B Corp individually, delving deeper into their financials and sustainability characteristics.

Although still primarily useful in a B2B realm, B Corp certification has gained some relevance for consumer-facing companies given the pandemic-induced surge in online shopping and the concomitant increase in ethical spending. The status is notoriously difficult to attain, which lends weight to claims of enhanced transparency and accountability. The end result, in theory, is greater consumer trust.

At present, as mostly small outfits, B Corps are hardly present in the stock market. As of February this year, there were only 11 US listed B Corps, 8 having come off relatively fresh IPOs. (This excludes public companies with non-principal certified subsidiaries as well as benefit corporations, a type of corporate governance, that are not B Corps.) In total, over 5,000 companies from 83 countries have been certified since 2007.

B Corps Listed in the U.S.

|

Company |

Sector/Industry |

IPO |

Market Cap ($ million) |

B Impact Score (out of 200) |

|

Natura &Co |

Consumer Staples/ Personal Products |

January 2020 |

18,435.6 |

110.4 |

|

Coursera |

Consumer Discretionary/ Education Services |

March 2021 |

2,353.8 |

84.9 |

|

Warby Parker |

Consumer Discretionary/ Specialty Stores |

September 2021 |

1,559.8 |

85 |

|

Lemonade |

Financials/ Property and Casualty Insurance |

July 2020 |

1,079.9 |

83.2 |

|

Allbirds |

Consumer Discretionary/ Footwear |

November 2021 |

699.2 |

89.4 |

|

Amalgamated Bank |

Financials/ Regional Banks |

August 2018 |

620.5 |

115.1 |

|

Vital Farms |

Consumer Staples/ Packaged Food and Meats |

July 2020 |

367.9 |

98.7 |

|

Appharvest |

Consumer Staples/ Agricultural Products |

January 2021 |

317.4 |

95.4 |

|

Zevia |

Consumer Staples/ Soft Drinks |

July 2021 |

174.1 |

82 |

|

Broadway Financial Corporation |

Financials/ Thrifts and Mortgage Finance |

January 1996 |

64.2 |

146.8 |

|

VivoPower |

Utilities/ Renewable Electricity |

December 2016 |

35.3 |

83 |

Source: B Impact Assessment, Google Finance as of 20 June

Performance: Between bad, worse and worst

For around a year now, B Corp stocks have been falling in tandem with the overall market but only a bit more since they are prone to wilder swings in prices due to their modest size. Now inflationary pressures on input costs are starting to alter their unit economics.

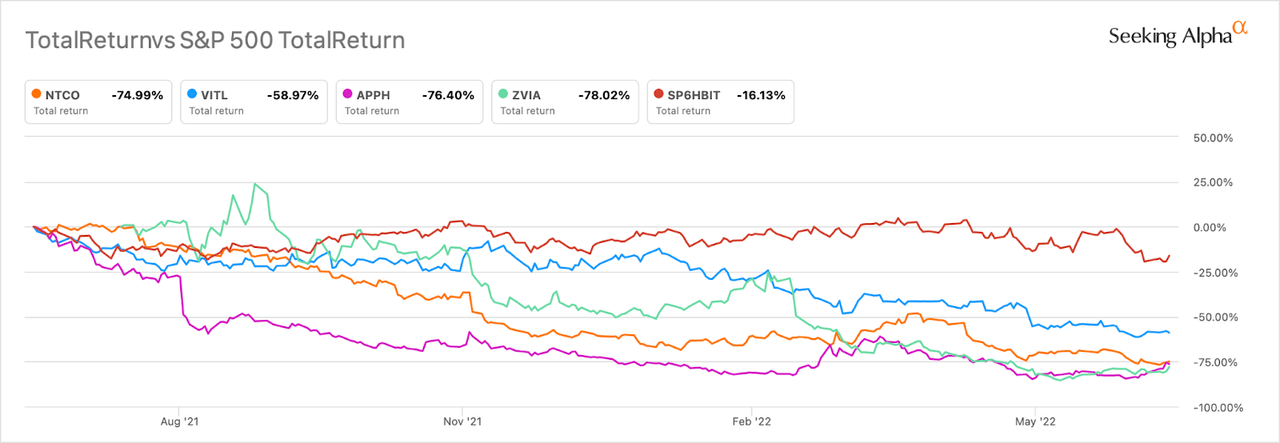

Consumer Staples B Corps: 1 Yr Total Return as of 24 June

Seeking Alpha

Compared to the S&P SmallCap 600 High Beta, a sub-index of small-cap American stocks with the highest Beta scores, Consumer Staples B Corps are much deeper in the red. Their total return over the past year averaged -72% against S&P’s -16%.

Sao Paulo headquartered Natura &Co (NTCO), the largest B Corp of all with a market value of just over $18bn, dropped 75%. Three of NTCO’s four personal care brands — Aesop, Natura and The Body Shop — have so far been certified. It is taking more time and effort than initially hoped to reanimate its newest business unit Avon that had been struggling for years before acquisition. Once that hurdle is jumped, synergies between the brands could stimulate new growth. Dylan Waller has written positively about NTCO.

Another one in Consumer Staples, Vital Farms (VITL) fell 59%. The seller of pasture raised eggs and butter, VITL has been a B Corp since 2015 and profitable since 2017 due to strong top line growth and decent gross margins, although it has not been a linear progression. Technically a single-product company, VITL seems to know what to do to keep its leading position as a pasture-raised egg brand. Busted IPO Forum has more.

AppHarvest (APPH), that grows farmed produce, was down 76%. APPH is busy expanding its farm network to diversify the product line, hence capital spending has gone up; but technological efficiencies promise to offset some of the upfront costs. It may, however, take a long time, and there will be pain along the way. Leo Imasuen and West Coast Fundamentals provide disparate views on the company’s prospects.

B Corp certified public benefit corporation Zevia (ZVIA), a maker of naturally sweetened soft drinks, experienced the group’s steepest drop of 78%. A micro cap by definition, ZVIA is no longer delivering high-growth numbers it used in the early years after launch in 2007, and profitability remains elusive. But because household penetration is still low at 5.8% as of end-March 2022, there is at least the potential for long-drawn expansion. ZVIA was last covered by The Investment Doctor in April.

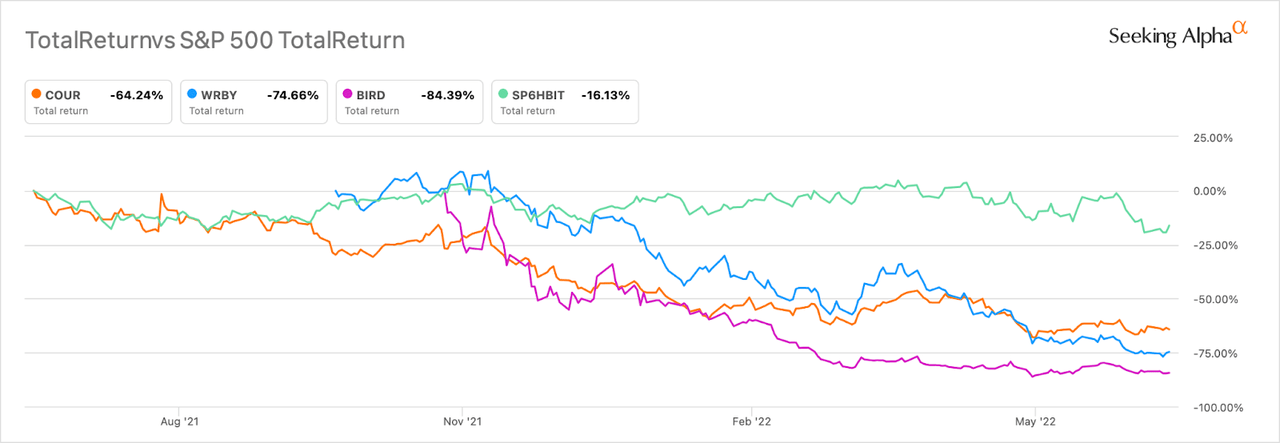

Consumer Discretionary B Corps: 1 Yr Total Return as of 24 June

Seeking Alpha

Consumer Discretionary B Corps have fallen almost as much as the previous group of stocks, returning -74% on average over the past year. With inflation on everyone’s mind, consumers are becoming ever more discerning about non-essential spending.

Down 64%, Coursera (COUR) is a benefit corporation whose charter formally outlines its social mission. Founded exactly a decade ago, the platform was one of the early breakout stars of digital learning. It became a B Corp in February 2021 and a public company a month after. The second largest B Corp valued at $2bn, the company is still very much in the aggressive growth mode, characterized by rising revenues and high overhead. Although it is yet to reach profitability, COUR’s Enterprise and Degree offerings are steadily filling up the coffers. Donovan Jones rated the stock Neutral in May.

Warby Parker (WRBY), an eyewear retailer, has always had a clear social proposition, so it made sense for it to turn B Corp certified early on. Oddly, though, the company’s overall impact score has dipped significantly through the years. The stock, meanwhile, declined 75% since IPO in September 2021. WRBY’s prospects do not look especially exciting given slowing growth and steep competition from bigger profit-making shops. David Trainer and WideAlpha offer opposing recommendations on the stock.

Sustainable shoemaker Allbirds (BIRD) holds the record for having delivered the largest negative return among all B Corps with -84% since its listing in November 2021. However, it is still very early days as a public company, as evidenced by a recent bout of exuberance around the stock. BIRD’s solid domestic business performance and an innovative product line-up are convincing many investors, including WideAlpha, to buy.

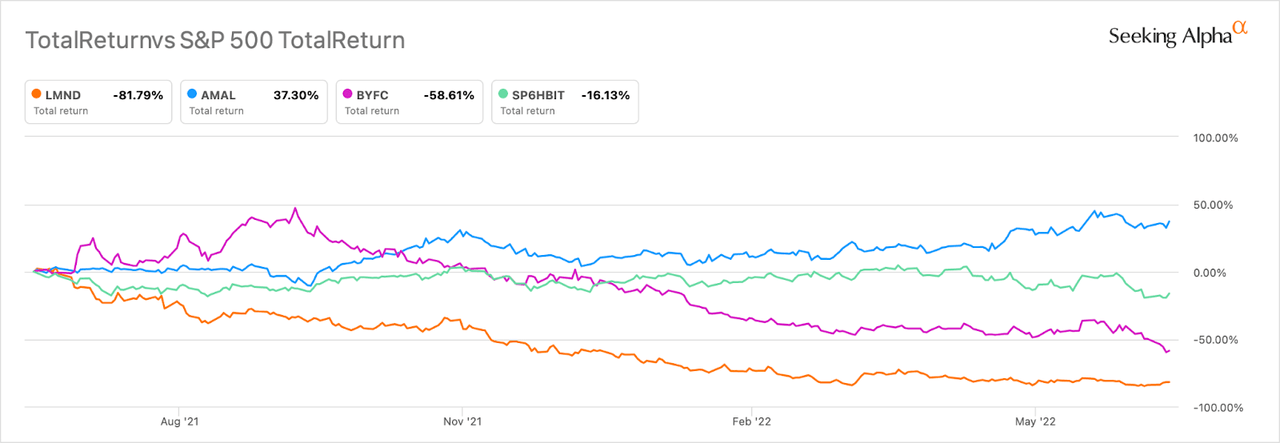

Financials B Corps: 1 Yr Total Return as of 24 June

Seeking Alpha

The total return of Finance B Corps over the past year averaged -59% compared to -13% of S&P SmallCap 600 Financials. Two of the three are somewhat obscure stocks with relatively staid businesses.

Lemonade (LMND), an insurtech company, is B Corp certified because of its emphasis on social impact. LMND listed at the start of the pandemic, in July 2020, and since then has delivered consistent growth in revenues. Bottomline figures have been more choppy, but not unlike those of insurance peers. Though it came down 82% from a peak in mid-2021, there are plenty of investors who believe in its business model. One of them is Stocks and Savings.

Broadway Financial Corporation (BYFC) effectively became a B Corp in April last year as a result of a merger with City First Bank which has been certified since 2017. A micro cap, BYFC is the largest Black-led Minority Depository Institution in the US. Its social-first nature might explain historically low profitability (and a lack of analyst coverage). Higher interest rates have led to slightly better trailing 12 months numbers.

Amalgamated Bank (AMAL) is a New York headquartered responsible bank with formal stances on a number of social and environmental issues, as well as more typical fundamentals (net interest margin 2.76%, efficiency ratio 62% at 1Q22) that are closer to Financials sector medians. Even so, the small cap attracts little interest from the investing community.

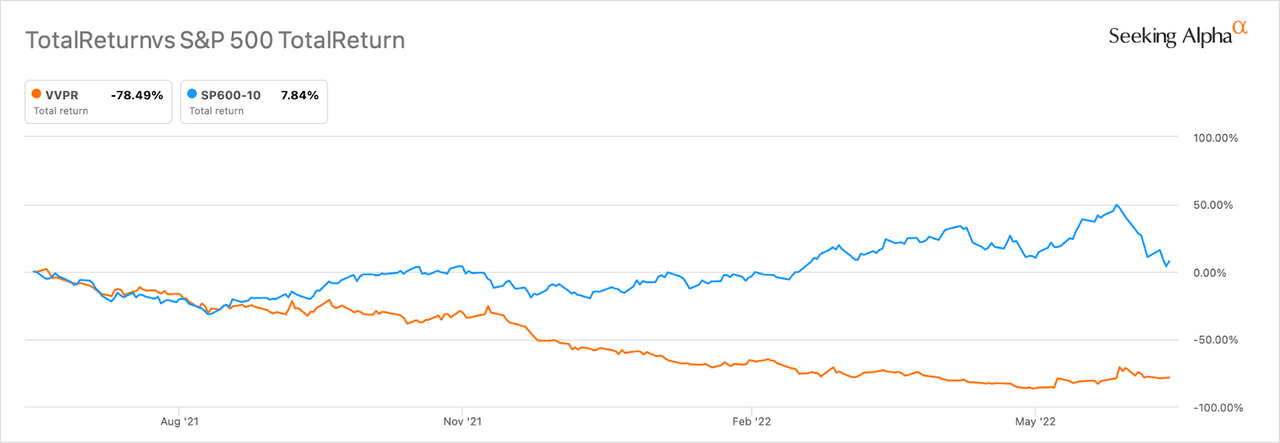

Utilities B Corp: 1 Yr Total Return as of 24 June

Seeking Alpha

VivoPower (VVPR) is the only listed B Corp in the Utilities sector. While the energy sub-index of S&P 600 delivered 7.8% over the past year, nano-cap VVPR returned a negative 78.5%. The company is loss-making, and its recent revenue record has been patchy, not least due to supply chain restrictions. It is burning through a lot of cash to scale solutions in high-potential sustainable energy areas such as battery technology, electric vehicles and solar power. This might pay off in the long-term but external hurdles will remain for some time. VVPR was recently mentioned by Keith Williams and before that by Mark Schiavo.

Conclusion

Clearly, the B Corp status does not yet add to price performance. B Corps have suffered disproportionately, even compared to the most market sensitive small cap stocks. For a number of them, the abysmal performance of the past year is not a strict reflection of fundamentals or their prospects. After all, they are mostly young companies, previously the darlings of venture funds, operating within fast growing industries. So there just might be an opportunity to accumulate few good companies at presenting low prices — which is what I will be exploring over the following articles.

Be the first to comment