skynesher/E+ via Getty Images

We are neutral on BIOLASE, Inc. (NASDAQ:BIOL) shares and note the company is ill-positioned to deliver capital appreciation in the coming periods. BIOL’s earnings model involves razor thin gross margins that feed minimal amounts of operating income to free cash below the bottom line. Hence, it prints a series of operating losses that require continuous external capital injection in order to maintain liquidity. A review of the company’s products is best left for a separate review; hence, we will take a hard data approach to gauge the investment debate. We price BIOL at $4 per share, and note it displays numerous characteristics investors are shying away from in their positioning for FY23. We rate BIOL neutral.

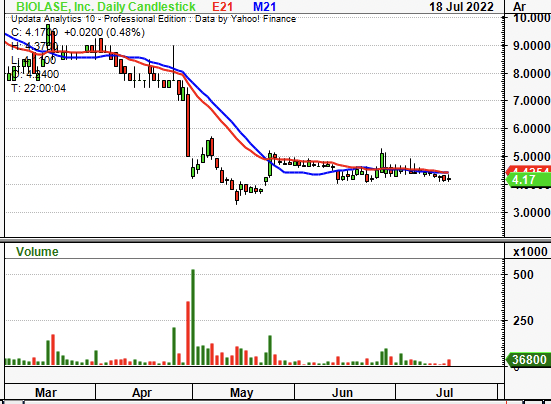

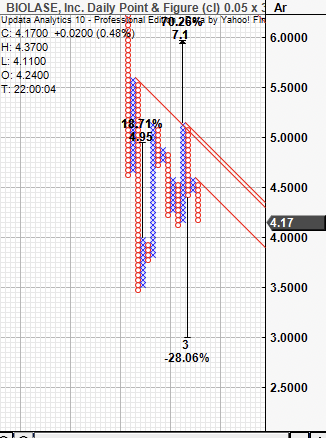

Exhibit 1. BIOL 6-month price action

Data: Updata

Market factors show divergence from equity premia

Investors have finally wound back the high-beta trade of FY20/21′ and are paying attention to quality and value factors once more. Fundamental momentum and earnings quality are more imperative than ever. Companies with proven market fit, strong economics, and above all, defensible business models have strengthened against benchmarks whilst reducing correlations in doing so.

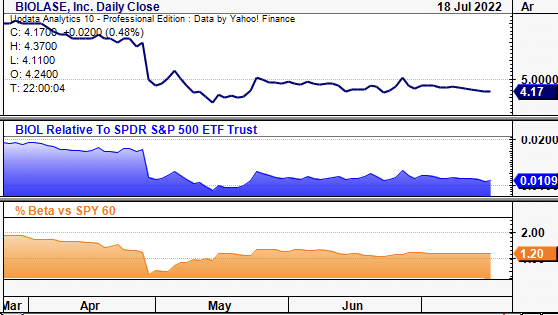

Later we demonstrate the weakness in BIOL’s earnings model. However, it’s abundantly clear BIOL displays a lack of the alternative premia investors are paying a premium for in FY22. Firstly, the stock has declined in relative strength against the benchmark sharply since April, as seen below. Meanwhile, after a small blip, its equity beta has remained substantially high at 1.2 indicating it is a high-beta play that will likely to have been punished this YTD. This much is true – BIOL has caught sellers all the way from $11, posting a 59% loss since January.

Exhibit 2. BIOL has weakened against the benchmark as equity beta remains high – factors investors are agnostic to in FY22

Data: Updata

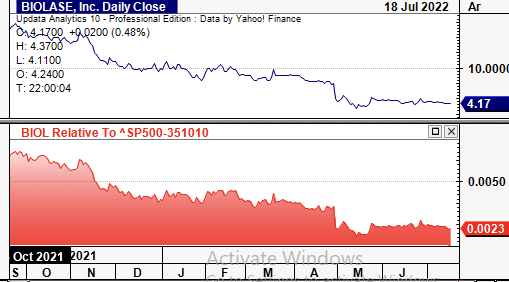

Unsurprisingly, the stock has also weakened against the US medical devices and health care equipment sector since equity markets began to downturn in October 2021. As seen in Exhibit 3, BIOL now trades at a 12-month low relative to the sector. As investors step up in quality and resiliency, they will look to defensible characteristics and high return on capital amid the shifting rates regime. On this, BIOL lags and hence potentially explains the relative weakness to the traditionally defensive US medtech sector.

Exhibit 3. BIOL continues to weaken against US medtech & health care equipment, as investors step up in quality in the space

Data: Updata

Fundamental Factors Don’t Stack Up

Q1 FY22 sales came in at ~$10 million, ~25% YoY growth. Performance was underlined by a 43% YoY gain to US laser systems and a 35% YoY gain to BIOLASE specific procedures. International turnover also grew 15% and have been steady for the last few quarters. On a marginal basis, the company lifted gross margin 13 percentage points to 47% – above pre-pandemic gross margin of 34%. This is still razor thin however, and leaves little headroom down the P&L for margin elasticity. On this, management notes it successfully passed costs through in Q1, printing operating expenses of ~$9 million, in line from last year.

To achieve is guided 10% YoY revenue growth in FY22/23′, BIOL has what it calls a 3-pronged strategy that’s been in situ since 2021. Chief to the first ‘prong’ is specialist adoption of the laser technology. To this effect, BIOL formed an academy to market the dental lasers amongst orthodontists, endodontists and periodontists back in 2021. It did this to hopefully drive up the acceleration of new accounts, management said on the Q1 earnings call.

Its second ‘prong’ is more of a speculative growth play at the US general practitioner dentist (“GPD”) market, by our estimate. It notes there are ~150,000 of these generalists in the US, and makes some very generous assumptions around its ability to penetrate this segment. Per CEO John Beaver on the Q1 earnings call, “[i]f an additional 5% of GPDs adopted our laser in the US, it would generate $225 million in laser revenue, not including consumables,” on the Q1 earnings call. Again, these are very generous assumptions around its addressable market that haven’t yet begun to materialise.

To get to $225 million from an additional 5% of GPD adoption, BIOL says it expanded its Waterlase Exclusive Trial program. This lets GPDs utilise the system in their office for ~45 days. Included is 2 days of in-person training and mentor support, all at no extra cost. Afterwards, the clinician is prompted to buy the laser. Firstly this is a timely and costly way of trying to convert GPDs. It takes longer than 1 30 day payment cycle and there’s no incentive structure to use the device on trial. Moreover, conversion has been light on these events to date. It held 30 in FY21 and 12 so far this YTD. Each had 4–8 GPDs participate, management said, 9.5%–19% participation rate.

The third ‘prong’ is driving the adoption of its lasers to corporate dentists. It has ongoing trials with 80% of the largest DSOs in the US, which targets new graduates as many new dentists are employed by the DSOs straight from dental school. BIOL hopes to educate them on using the lasers, and try and make lasers an “essential part of their practice moving forward”. Hence, when out in practice, they might be drawn to BIOL lasers. Again, fraught with assumption, by estimate, and it relies on the premise these dentists will prefer BIOL lasers in the first place. There’s no evidence to suggest this will be the case.

In that vein, BIOL’s profitability characteristics are an equity risk looking ahead. Investors have turned away from rewarding top-line growth in FY22 and are rewarding bottom-line fundamentals and profitability instead. Whilst it continues to build its top line at ~25% YoY, this doesn’t pull through the P&L to earnings and FCF.

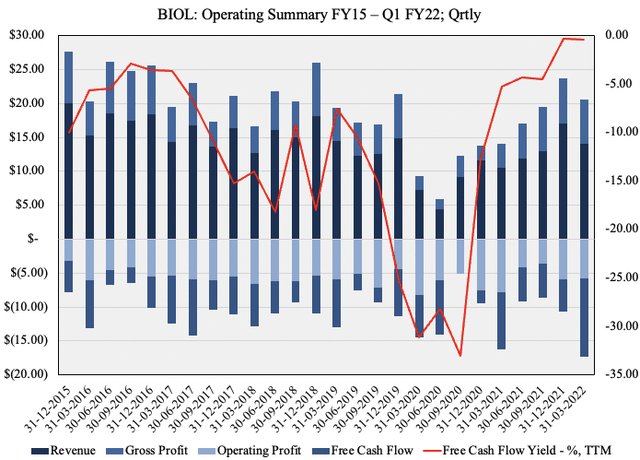

As such, BIOL has printed a series of operating losses since FY15 to date, whilst realizing a negative FCF yield across this entire time span. Moreover, sales were extremely lumpy pre-Covid, and haven’t grown back past these levels.

Exhibit 4. Series of lumpy sales performance and operating losses sees weak FCF conversion

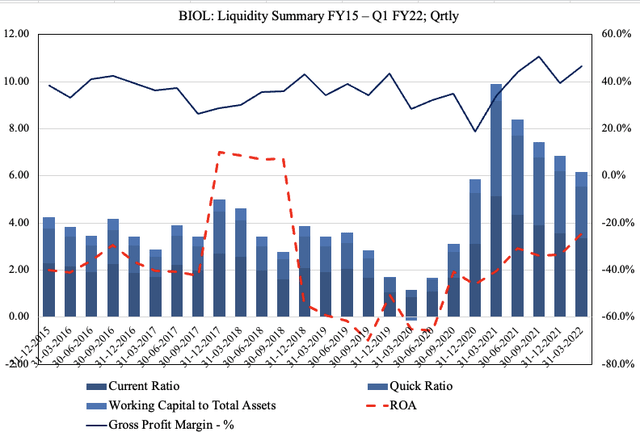

It also fails to compound sufficient return on assets or capital to overcome its WACC of 9%. Moreover, as mentioned, gross margins are so tight so the drip feed to operating income is equally as narrow. Therefore, the company realizes ongoing net-losses and must continuously raise capital in order to remain solvent. Case in point, the impulse effect from its ~$7 million capital raise in June 2020, then $18 million warrants issue in July 2020, $14 million raise in Feb 2021, and most recent $6.5 million warrants issue in June 2022, seen on Exhibit X. As seen, the company’s dwindling liquidity ratios have been propped up substantially by investor capital versus operating cash flows. Particularly as gross margins are only a few ticks higher than 7 years ago.

Exhibit 5. Impulse effect of capital raises to liquidity and operating capacity seen from FY20

Alas, the weakness of BIOL’s business model is now on full display, in that it recognises small sales, razor thin gross margins that pass minuscule amounts of gross profit to operating income, leading to a series of operating losses and lack of earnings and FCF conversion. Hence, without the cash conversion and retained earnings to power the growth engine, and more importantly, cover operating expenses, BIOL will continue to realise losses. Looking ahead, this is a key risk, as it will now have to head to the high-yield corporate debt capital markets, or look to raise additional dilutive equity – which investors are unlikely to participate in.

The most recent warrant issue and amendments to senior debt were on the basis of liquidity – it needed more. Hence, investors must consider the drains and pulls on liquidity outlined here, and BIOL’s incapacity to plug these with free cash flow.

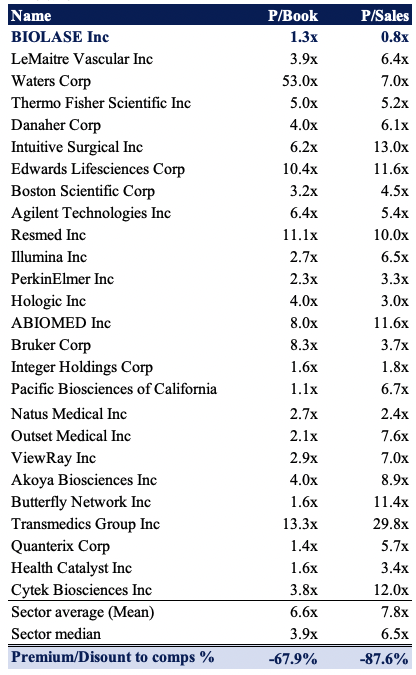

Valuation

Shares are trading at 1.3x book and ~1x sales, implying a fair valuation from the market. The stock trades at a deep discount to names within the GICS Health Care Equipment sector, although this discount is absolutely warranted considering some of the names in this list. Hence, BIOL continues to de-rate and diverge away from comparable investments, but to the downside.

Exhibit 6. Multiples and comps

Data: HB Insights

Point and figure charting also shows there’s downside targets to $3 per share and this isn’t an unreasonable expectation, by estimate. There’s been busy activity from sellers and price action appears bearish from this chart. At 0.8x forward sales, this sets a price target of $5. Combining this with the chart-derived price target, and we see a price objective of $4 in BIOL, suggesting all good news has been more than discounted into this stock.

Exhibit 7. Multiple downside targets, bearish price action

Data: Updata

In short

BIOL has extended losses this YTD in continuation of a multi-year long downtrend. We’ve demonstrated the stock displays a weak affinity to the equity premia investors are paying a premium for in FY22, resulting in a substantial de-rating that looks unlikely to reverse, by estimation.

Moreover, the company’s business model looks to struggle amid the current climate, and a series of ongoing losses means it could continue raising capital in order to remain solvent or tap liquidity. This has been the trend from 2020 to date. Investors need to position themselves to absorb the distribution of economic risks now before us. That includes allocating to names with a margin of safety of ~20%, to absorb another 20% decline in US earnings. This isn’t the case with BIOL; plus, we’ve valued the company at just $4 per share, suggesting it is fairly priced. With little projected movement either direction, we remain neutral in BIOL.

Be the first to comment