kali9/E+ via Getty Images

Co-produced with PendragonY and Treading Softly

When people get worried, scared, or frightened, it is natural to want to return to the familiar, calm, and safe. For example, when scared, children run to their parents, looking for comfort and protection.

When the sky darkens and a storm approaches, midwestern Americans are very used to and adept at preparing for a tornado. Many have storm shelters built into the ground to keep them safe should a tornado develop and threaten their safety. Or a place in their house designated to take shelter.

We have entire movies built around the idea of hiding in a panic room when danger from other people comes to one’s doorstep.

We have a built-in fight or flight instinct, and when the danger is not something we can confront directly, we naturally flee for safety.

Investing is no different. While the risks are financial instead of physical, the impact on our lives can be equally as severe. So, where can investors run when the market and economy look scary?

Let’s look at two safe havens for income investors and retirees that are excellent opportunities to buy now.

Pick #1: DMB – Yield 4.6%

BNY Mellon Municipal Bond Infrastructure Fund (DMB) is a Closed-End Fund (‘CEF’) that invests in municipal bonds. With prices beaten down by inflation and rate hike fears, now is the time to buy municipal bonds. While both inflation and interest rate hikes represent real headwinds for municipal bonds, the market has done what it can always be counted on doing. It has over-reacted to an extent that has made municipal bond funds a good value. As income investors, now is the time to pick up a safe stream of income at a good price.

Municipal bonds are very defensive investments. Governments have a somewhat captive audience in the residents of their jurisdiction, so they have a much easier time increasing taxes than a regular business would in raising prices. This is true even during a recession, and why investors rush into municipal bonds when economic times get hard. This produces both good cash flow and price increases during recessions. Exactly what we want as income investors looking to get a jump on the hard times that might be coming.

DMB had paid out a monthly dividend of 5.3 cents per share since 2016. That produces a current yield of 4.6%. While municipal bonds tend to have lower yields than similarly rated corporate bonds, municipals are Federal Tax Exempt. Typically, the distribution from DMB is 100% federal tax-free. Depending on an investor’s highest marginal rate, this will correspond to a much higher rate on a fully taxable bond. If one’s highest marginal rate is 22%, DMB’s rate after taxes will be equivalent to a fully taxable bond paying 6.19%. Even at the 15% rate, DMB is still as good as 5.68% from a taxable bond.

Bridges, roads, utilities, and other infrastructure make up over 32% of the DMB’s assets. Funding such infrastructure is a basic function of government, with a long history of successfully repaying bonds in full. Healthcare, over 20% of the portfolio holdings, is another area where municipal governments have a good history of repaying debt.

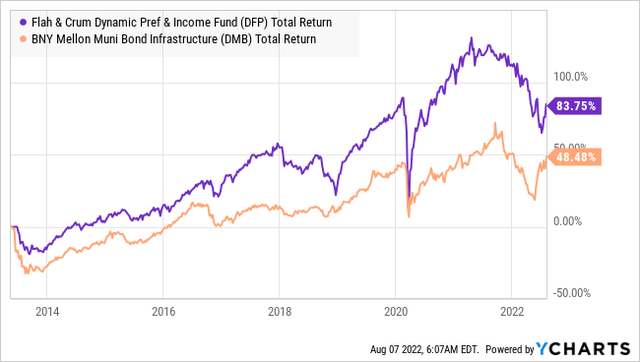

Below is the total return of DMB:

The fear of the impact of higher interest rates and inflation is having an outsized impact on the price of municipal bonds and funds like DMB that invest in them. This makes for a very good opportunity to pick up a fairly safe investment with a high yield. As the chart above shows, DMB has also produced better returns than an index of municipal bonds. So you get a good income from a manager with a good track record. Here is the tax information for DMB for 2021.

Pick #2: DFP – Yield 6.8%

Flaherty & Crumrine Dynamic Preferred and Income Fund (DFP) has one of the best CEF managers in the field. Being actively managed, unlike a passive ETF that tracks an index blindly, a CEF manager and its management of the fund’s assets are critical to the performance of the fund. DFP is a CEF generating current income with a heavy emphasis on the preferred securities of financial companies. These industries represent almost 82% of the fund’s holdings.

With the increase in interest rates over the last year, the NAV of DFP is down. This is to be expected and isn’t automatically a bad thing. New assets with higher yields can be purchased as rates go up. 90% of current assets are fix-to-float which will also eventually benefit from increasing interest rates. While investors have been trained to automatically think that rising prices are better than falling prices, being a net buyer means that lower prices can be an opportunity. That is the case today with funds that hold preferred shares. DFP is positioned to benefit from rising rates but is now priced at a bargain.

DFP fully covered its distribution last year with interest and dividend income from its holdings. It did not need to use any capital gains (long or short) to cover the distribution, nor did it have to use ROC (Return of Capital). So far this year, that has continued to be the case. While it has had to trim the distribution, it is well positioned when its assets with fix-to-float coupons increase due to higher interest rates.

Right now, the fear of the impact of higher interest rates is having an outsized impact on the price of preferreds and funds like DFP that invest in them. This makes for a very good opportunity to pick up a fairly safe investment with a high yield. Even with the announcement on July 21, projecting the most recent distribution for a year gives a forward yield of 6.8%, about the 5-year average. With about 45% of its portfolio in investment-grade securities (and another 40%+ in companies with investment-grade), the 90% fixed-to-float nature of the holdings makes this a good buy for income in uncertain times.

Shutterstock

Conclusion

Both DMB and DFP have long histories of paying excellent income to investors. Both are primarily focused on protecting NAV while only paying out what they earn. This means little to no return of capital while simultaneously adjusting their distributions as needed.

Over the last ten years, both DMB and DFP have provided excellent returns and continue to produce income. For investors wanting to stay in “safer” waters, both offer great tax-adjusted yields well within the yields we look for within High Dividend Opportunities.

Your retirement doesn’t need to be worrisome and anxiety-inducing. When the sky gets dark and the wind howls, you can grow your positions in safe income-producing picks like DMB and DFP. They will continue to produce outstanding income and allow you to get back to enjoying day-to-day life, not stressing over it.

That’s the beauty of our Income Method. That’s the glorious nature of Income Investing.

Be the first to comment