Leon Neal

Thesis

Coinbase Global, Inc.’s (NASDAQ:COIN) Q2 earnings release didn’t surprise us, even though the media and some investors were disappointed. The market already knows that Coinbase is undergoing the crypto winter, and the results will be underwhelming for a while.

Moreover, we are increasingly confident that COIN had already formed its medium-term bottom in June (which we discussed in our previous article), as the near-term crypto market pessimism reached its heights. But, the market is forward-looking, and we believe long-term crypto investors understand that the current cycle will not sink Coinbase, similar to what it has experienced over time. Therefore, investors who capitalized on the significant pessimism in June to add more positions were rewarded as COIN had a massive momentum spike pre-earnings (after the BlackRock announcement).

Bitcoin (BTC-USD) and Ethereum (ETH-USD) have also climbed out from their nadir in June, helping lift Coinbase’s buying sentiments further. While we remain cautiously optimistic about its medium-term projections, we believe the near-term upside has been sufficiently reflected.

As a result, we revise our rating from Speculative Buy to Hold.

Coinbase’s Q2 Earnings Were Bad. But, Was The Market Surprised?

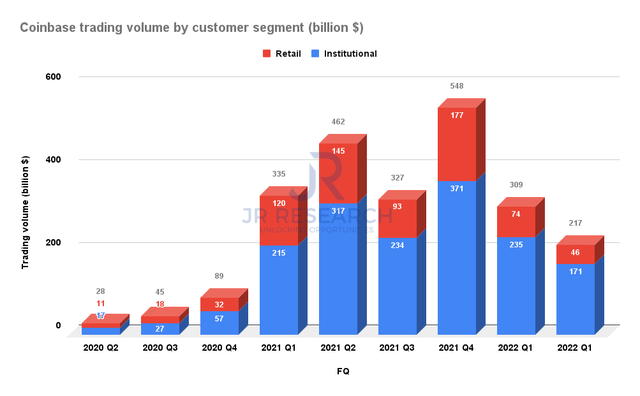

Coinbase trading volume by customer segment (Company filings)

Some analysts, investors, and even the media slammed Coinbase’s Q2 card as it was underwhelming, as Coinbase’s trading volume suffered as retail and institutional investors pulled back. The diversion of market makers’ volume to competition from offshore exchanges also hit Coinbase, further exacerbating the decline in trading volume.

As a result, Coinbase’s trading volume fell to $217B, hitting both its customer segments, as seen above. It also represented a 29.8% QoQ decline from FQ1, as the crypto market cratered in June. Furthermore, management guided that its retail base (Coinbase’s most crucial customer segment) remained tentative in July, as retail investors were cautious about re-entering the fray, given the current macroeconomic headwinds.

We believe management’s cautious guidance is reasonable. Retail investors’ positioning in risky assets has remained cautious even though our analysis indicates that the equity market bottomed out in June. Therefore, it’s only reasonable to expect investors to reflect their concerns about the crypto market, given the credit/default events we observed across the crypto space.

Hence, we believe retail investors could avoid adding exposure aggressively to crypto assets in the near term until the crypto market has recovered most of its losses. Like in late 2021, the retail hype was more pronounced toward late 2021, as crypto assets reached new heights. We believe similar moves should play out in 2022/23, as aggressive buying sentiments among the retail base may not return until we are closer to Bitcoin’s previous all-time highs ($69K). Hence, we believe it’s reasonable to expect a prolonged winter for Coinbase, given its significant transaction revenue exposure to its retail base (94% transaction revenue share).

Notwithstanding, Coinbase highlighted that it could probably meet its adjusted EBITDA loss guidance of $500B for FY22 if the crypto market cap decline didn’t worsen through H2’22. However, the fallout in the crypto credit environment continues to keep management on its toes, despite improving crypto prices since their June lows. Management articulated:

Based on the expense initiatives we took in Q2, we’re cautiously optimistic about our ability to operate within this [$500M] guardrail. That optimism is conditioned on crypto market capitalization not deteriorating meaningfully below the July 2022 levels and that we don’t see another significant change in the behaviors of our customers. We are looking at the headwinds of still seeing some fallout in the crypto credit environment. And so I think that we need to see a little bit of stabilization there as well as we’d like to have more certainty in the regulatory market, and that’s all influencing what we’re expecting for the second half.

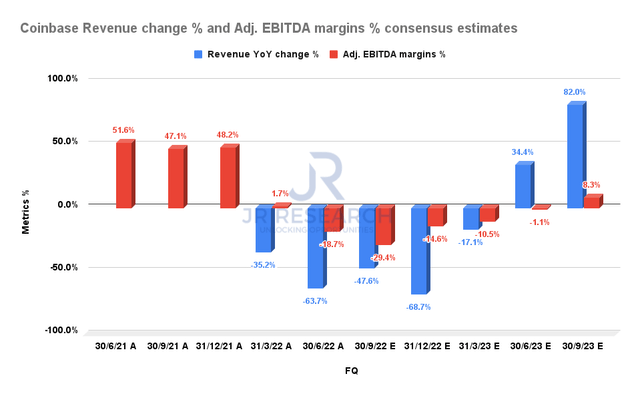

Coinbase revenue change % and adjusted EBITDA margins % consensus estimates (S&P Cap IQ)

The revised Street’s consensus (bullish) suggests that Coinbase’s results would likely continue to come under pressure through H2’22 as it treads through the crypto winter. However, the Street is also confident of management’s loss guidance as it estimates an adjusted EBITDA loss of $477M for FY22. Notably, Coinbase’s revenue growth and profitability are expected to recover from their nadir in FY23.

However, we must caution investors that the consensus estimates have generally been formulated based on management’s guidance. In addition, our past analysis of COIN has also demonstrated that Coinbase’s inherent revenue volatility (due to its massive retail transaction revenue base) impacts its revenue visibility markedly.

As a result, it carries concomitant risks on its adjusted EBITDA estimates, leading to significant earnings volatility. Hence, we urge investors to continue monitoring the recovery in retail investors’ sentiments as a proxy to determine the reliability of the revenue and earnings estimates, as we expect the crypto market volatility to continue in the near term.

Notwithstanding, management is confident that it can continue to gain share amid the crypto rout that has befallen several of its competitors. It is optimistic that its ability to navigate the crypto fallout would cement its leadership and trust with crypto investors as the market emerges from the crisis. CEO Brian Armstrong accentuated:

This is probably the fourth crypto cycle that we’ve gone through. And they always seem a little bit scary, especially if people haven’t gone through them before. But we’ve seen this all before. We were selected by BlackRock and Meta as their partners as they develop their crypto offering. This is actually a really huge deal for a few reasons. BlackRock is the largest institutional asset manager in the world. It took several years of diligence to go through with them and close this deal. I think it really shows that Coinbase is situated uniquely to be the preferred partner to the largest companies in the world who want to integrate crypto into their offerings.

Is COIN Stock A Buy, Sell, Or Hold?

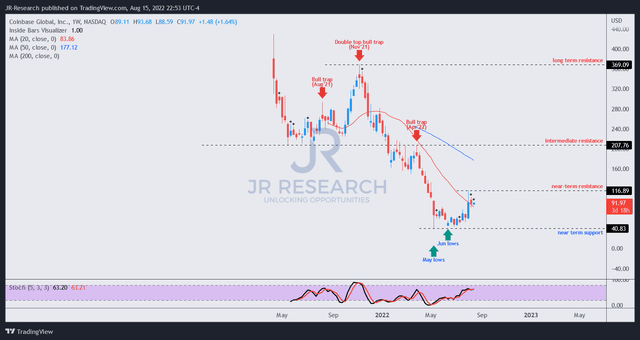

COIN price chart (weekly) (TradingView)

COIN stock staged a remarkable bottom in June, as we posited. It surged nearly 92% from the buy point in our previous article, taking out the short sellers brutally. Even though the momentum has subsided since its unsustainable surge, we aren’t surprised.

However, we believe the near-term upside has already been reflected and think a period of sideways consolidation is expected.

Therefore, we revise our rating from Speculative Buy to Hold. New investors are urged to wait for a meaningful retracement before considering adding more positions. Current investors are encouraged to use the recent momentum spike to cut exposure and take some profits if they added at its June lows.

Be the first to comment