Luis Alvarez/DigitalVision via Getty Images

Cable one (NYSE:CABO) is a fully integrated data, video, and voice service provider to business and residential customers. The company focuses on non-metropolitan, secondary and tertiary markets, providing low-cost services to its customers. And about 74% of the customers are located in Arizona, Idaho, Mississippi, Missouri, Oklahoma, South Carolina, and Texas which gives the company access to relatively low competitive markets.

The company serves approximately 1,2 million residents and business customers. And generates most of the revenue from residential data (52.0%), residential video (21.2%), and business services (19.2%).

Recently the company has shifted its focus from residential video service to residential data and business services which have nine and eleven times greater EBITDA, respectively, than its previous residential video business.

Also, in the last few years, due to substantial programming costs and retransmission fees, the margins on residential video services were dropping, and management decided to focus on higher-margin products. As a result, the business has improved significantly since its spin-off in 2015.

Currently, residential data and business services contribute most to the EBITDA margins. Since its inception, the residential data segment has performed very well, and due to COVID-related sharp increase in users, the segment has seen usually strong growth.

Since its spin-off, the stock rose significantly to about four times by the end of 2020, which has created huge value for the shareholders. Such phenomenal growth is attributed to the business model shift and Covid-related increased demand. But in the last few quarters, the share price has dropped more than 65% to date. Having high debt and a recessionary environment might be the reasons behind the share price drop. Still, the business model is robust, and management focuses on developing a solid competitive advantage.

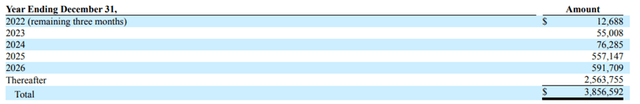

Also, the company has high debt, but obligations due in the next two years are considerably low. Due to the consistent improvement in the business model, the company could produce significant cash flows to comply with its debt obligations.

The stock has become substantially undervalued despite significant improvement and provides huge value to long-term investors; I assign a buy rating to the stock.

Historical performance

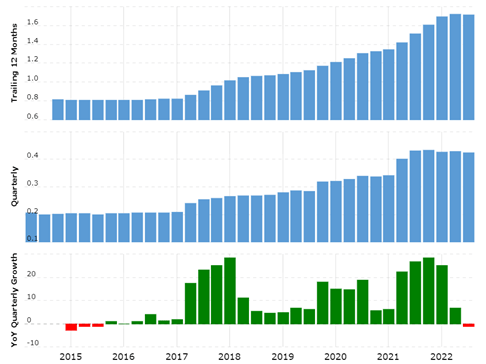

revenue growth (macrotrends.net )

Since its inception, growth in revenue has been subdued, but in the last few years, the revenue has grown significantly from $1 billion in 2019 to about $1.6 billion by 2021. Also, over the period, margins have fluctuated considerably. As a result, overall net profits remained substantially volatile. Still, in the last two years, due to the business model shift towards higher margin products, the company has seen considerably improved margins, producing enormous profits for the business.

The revenue growth is primarily attributed to recent acquisitions. And the acquisitions were funded through debt, resulting in a considerable rise in long-term debt. Therefore, debt has increased from $1.7 billion in 2019 to approximately $3.8 billion. Also, the current asset levels are significantly lower; such a financial position can bring a huge risk to the business model.

Furthermore, despite fluctuations in the net profits, the cash flow from operations remains very attractive and has produced $491 million, $574 million, and $704 million in 2019, 2020 and 2021 respectively, which shows that the business model is substantially strong and sound.

Strength in the business model

Focus on higher margin products along with continuous improvement in the business has given considerable strength to the business model.

High-speed data

Over time management has focused on developing infrastructure to provide the highest possible speed to the customers. As a result, the company offers 100 MBPS and higher speed to residential customers, which seems significantly higher than its peers.

Also, the management expects the upgrade of DOCSIS 4.0, which will begin in late 2022, to enable symmetrical Gigabit speeds. As a result, plant capacity will increase significantly, strengthening its competitive strength over its peers.

The company operates in the secondary market, where cable one faces relatively lower competition. As a result of consistent improvement, the company has increased its significant market share over the past few years. Also, due to its presence in the secondary market, the company could benefit from an upcoming government initiative to develop data access in the underserved market.

Low-cost operator

A disciplined cost management approach has given a significant advantage to the company, where due to its low-cost operations, the company could provide services at a significantly lower cost compared to its peers, which has played a significant role in strengthening the business model.

Also, high-speed data services along with the low-cost structure, provide significant value for the customers, resulting in a strong customer loyalty.

Risk factors

The company operates in an extensively regulated industry, where policy changes can substantially affect business performance. Therefore, further changes in regulations might bring a substantial cost to the company, which might hamper its margins.

Also, the company operates in a rapidly changing industry. Although the management focuses extensively on adapting new technology, any rapid change in the industry or shift in consumer preference might affect the company’s profitability.

Also, I’d like to point out that the higher margins the business has been enjoying are primarily attributed to considerably lower competition. But due to higher margins, competition in the secondary market might increase in the upcoming years, affecting the company’s earning power.

Currently, I do not see any significant threats to the business model.

Recent developments

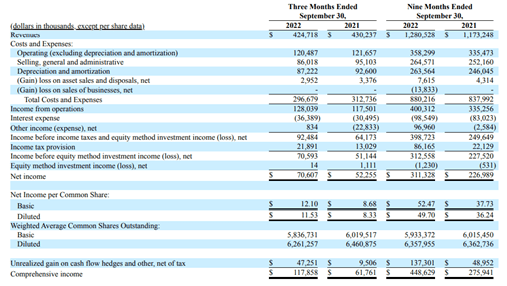

quarterly revenue (quarterly report)

In the latest quarter, revenue dropped slightly, but due to lower operating costs and reduced losses on other income, the net profit rose significantly to about $70 million. Also, over the last nine months, the company could achieve higher revenue along with improved EPS.

Overall results from its residential data and business services remained attractive, and management has been working relentlessly to improve the business strength.

Furthermore, over the period, the company has been trading for a price-to-earnings ratio ranging from 20 to 42. Still, in the last few quarters, the stock price has dropped from an all-time high of nearly $2201 to about $ 724, and the company has been trading for just 13 times its 2021 earnings, despite significant improvement in the business model. Therefore, I assign a buy rating for the stock.

Be the first to comment