DKosig

Investment Thesis: While revenue growth for Deutsche Telekom AG (OTCQX:DTEGY) continues to be impressive, I take the view that investors will increasingly look for stronger balance sheet metrics to justify further upside.

In a previous article back in June, I made the argument that Deutsche Telekom AG could continue to see upside as a result of continued growth in average revenue per user across the United States market as well as further growth in overall ARPU and market share.

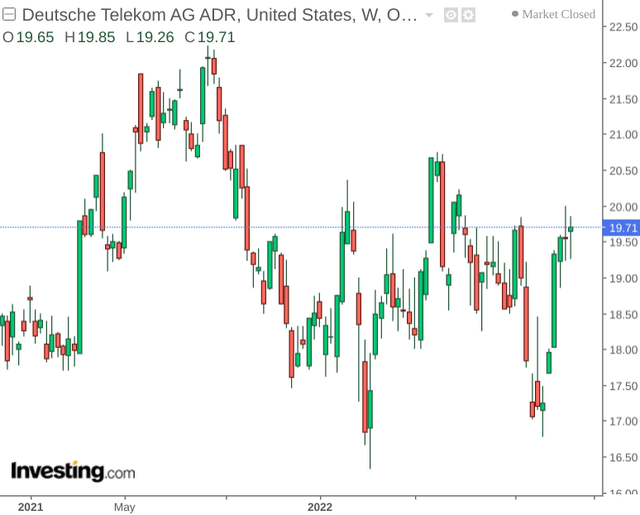

For the year to date, we have seen the stock trade in a stationary manner overall.

The purpose of this article is to assess whether the stock could have scope for upside from here – taking more recent financial results into account.

Performance

When looking at most recent Q3 2022 results, we can see that Deutsche Telekom has seen little change in its debt to assets ratio for the year to date as compared with that of last year – indicating that debt loads have not increased since 2021 relative to assets.

| Q1 – Q3 2021 | Q1 – Q3 2022 | |

| Net debt | 130,375 | 151,707 |

| Total assets | 273,355 | 321,357 |

| Debt to assets ratio | 0.48 | 0.47 |

Source: Figures sourced from Deutsche Telekom Q3 2022 results. Figures provided in millions of EUR, except the debt to assets ratio. Debt to assets ratio calculated by author.

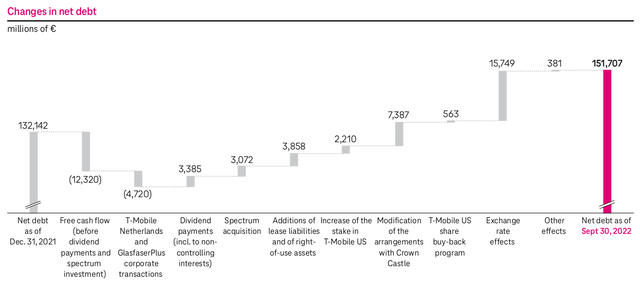

Net debt saw an increase primarily due to exchange rate effects of EUR 15.7 billion, as well as a change to arrangements between T-Mobile US (TMUS) and Crown Castle (CCI) resulting in an increase of right-to-use assets by EUR 6.6 billion. However, free cash flow of EUR 12.3 billion also had a reducing effect on net debt:

Deutsche Telekom Interim Group Report 9M 2022

With that being said, we can also see that the company’s quick ratio (calculated as current assets less inventories all over current liabilities) has decreased since last year – indicating that the company is in a slightly worse position when it comes to covering its current liabilities with existing liquid assets:

| Dec 2021 | Sep 2022 | |

| Current assets | 38,799 | 42,540 |

| Inventories | 2,855 | 3,154 |

| Current liabilities | 38,803 | 48,649 |

| Quick ratio | 0.93 | 0.81 |

Source: Figures sourced from Deutsche Telekom Q3 2022 results. Figures provided in millions of EUR, except the quick ratio. Quick ratio calculated by author.

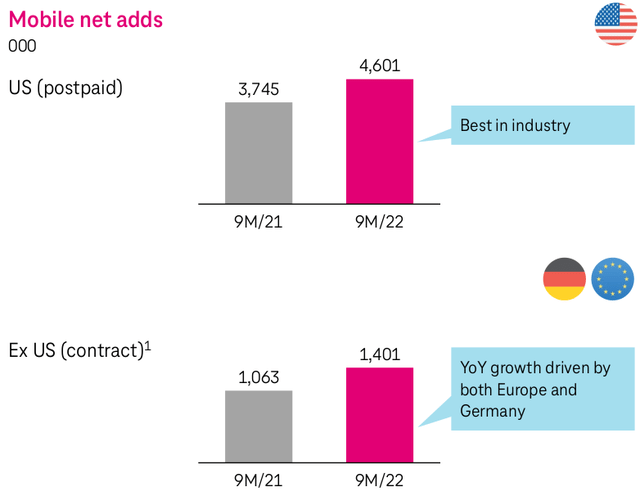

From a performance standpoint, we can see that when it comes to mobile net additions – the United States has continued to see strong growth across the postpaid market, up by nearly 23% from that of last year. However, it is also notable that growth across the contract market outside the United States saw more growth on a percentage basis, up by over 31% from last year:

Deutsche Telekom Q3 2022 results

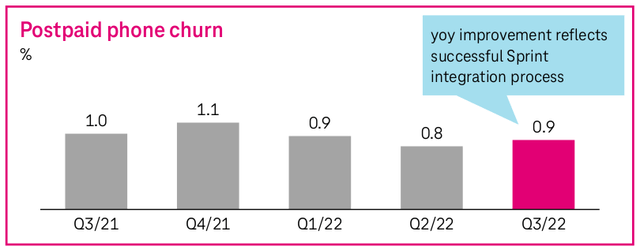

Moreover, while churn increased slightly across the German market from 0.8% to 1.0% which the company cites as being significantly influenced by TKG (or the reform of the German Telecommunications Act) – it is notable that postpaid phone churn in 2022 for T-Mobile US has been significantly lower than 2021 levels, to which the company credits a successful integration process of Sprint.

Deutsche Telekom Q3 2022 results

The fact that mobile net adds have been increasing and revenue growth has been improving across both the European and American markets in spite of inflationary pressures is encouraging.

Looking Forward

Going forward, Deutsche Telekom AG has significant potential for further growth given strong performance across the United States. The main risk for Deutsche Telekom, as well as for other companies in the industry – remains inflation and potential recessionary activity reducing demand and potentially placing upward pressure on churn.

Given that Deutsche Telekom has demonstrated significant revenue growth, I take the view that investors will increasingly start to look for evidence that the company can maintain a healthy balance sheet and pay down debt.

For instance, we have seen that while the debt to assets ratio has remained at the same level as that of last year in spite of the strong revenue growth. Moreover, the quick ratio remains below 1 and has decreased since last December. It would be preferable for investors to see evidence going forward that Deutsche Telekom can utilise the continued revenue growth to reduce its debt load and strengthen its capacity to meet short-term liabilities.

Conclusion

To conclude, Deutsche Telekom AG has continued to see impressive revenue growth and this does not seem to have been hindered by inflationary pressures. With that being said, I take the view that investors will increasingly look for signs of a stronger balance sheet if we are to see upside in the stock going forward.

Be the first to comment