cagkansayin

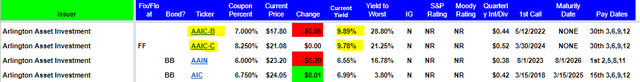

Arlington Asset Investment Corp (NYSE:AAIC) is a diversified real estate investment trust (REIT). The company has historically invested primarily in mortgage-backed securities. The company has two preferred share issues and two different baby bonds (debt that is publicly traded with a ticker symbol). The company’s preferred shares currently yield a dividend of nearly 10%, while the baby bonds hold yields to maturity of just under 9% with decent coupon prices. I’m currently a ‘hold’ on the preferred shares and a ‘buy’ on the baby bonds.

Public Database

Source: Public Google Docs Spreadsheet

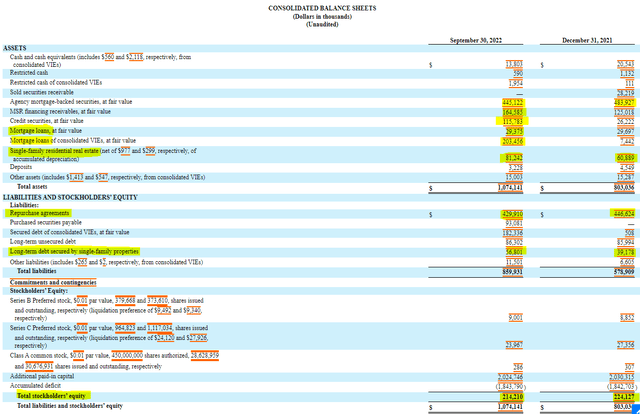

Arlington’s balance sheet highlights the company’s increasingly diversified investment structure. Over the last year, the company has greatly increased its investment in credit securities. Additionally, the company has invested in and increased its investment in single family residential real estate. The interest on credit securities and income from real estate rents are two totally different streams of income away from the company’s primary objective of investing in real estate mortgage securities.

Q3 2022 SEC 10-Q

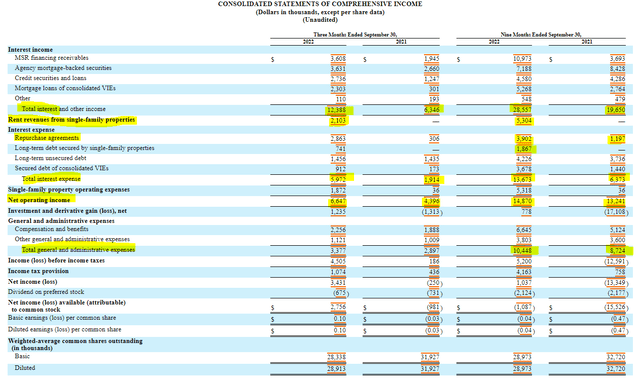

As it pertains to profitability, Arlington is not letting higher interest rates hold it back. The company has experienced a nearly 50% increase in year over year interest income in the nine months ending September 30 th. While interest expense has doubled commensurate with the increase in income, the company has still managed to increase its net operating income by 12% to $14.8 million year to date. While compensation and benefits absorbed the positive variance, its impressive that Arlington has managed to hold up in a higher interest rate environment.

Q3 2022 SEC 10-Q

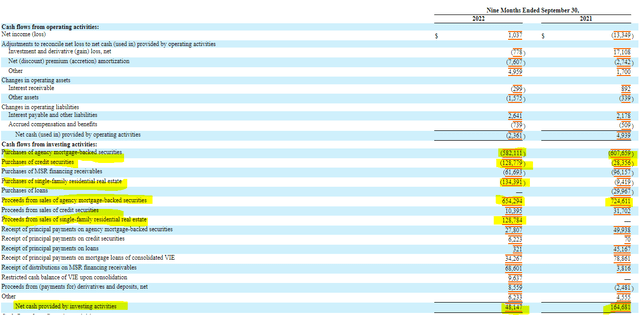

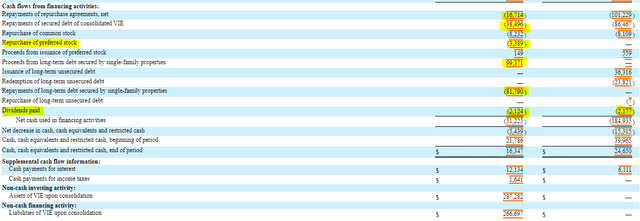

While operating cash flow is important to Arlington, and to many other organizations, the bulk of the company’s activity occurs in the in its investing activities. Arlington thrives on being able to trade mortgage-backed securities, but the company also engaged in the purchase of credit securities in 2022. By effectively managing investing cash flow in 2022, Arlington has been able to reduce debt through the repayment of repurchase agreements, and the repayment of secured debt. The only net debt increase came in the form of $17 million for the purchase of single-family properties.

Q3 2022 SEC 10-Q

Q3 2022 SEC 10-Q

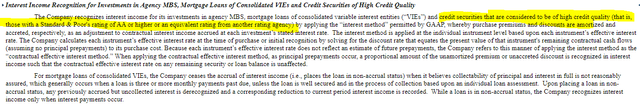

While credit securities carry their own risks, Arlington is not investing in high yield debt. According to their 10-Q, Arlington’s pivot into credit securities includes AA rated or better corporate bonds. This asset class is currently yielding over 5% and is providing a bit of a buffer to the mortgage market, which is undoubtedly getting slower as rates continue to rise.

Q3 2022 SEC 10-Q

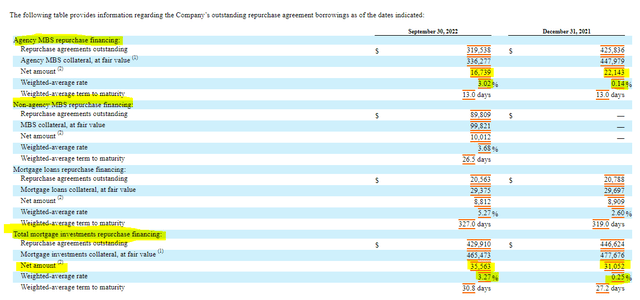

One risk for investors to watch is the interest rate on the company’s repurchase agreement borrowings. While it has risen from 0.25% to 3.27% in one year, Arlington has managed to increase its net value of collateralized investments less its outstanding repurchase agreements. The full effects of the Fed’s rate hikes have not been baked in yet, as rate increases have occurred after the end of the quarter. Should repurchase borrowing rates exceed the interest rates on AA corporate bonds, Arlington’s credit securities investment strategy may stall.

Q3 2022 SEC 10-Q

While interest rates, specifically spreads between loan origination and the repurchase agreements are an obvious risk to the company’s future earnings, there are a few other risks worth mentioning. One risk is the default of loans held by Arlington. Should loan defaults rise, it would lead to a downward revision to the value of the company’s assets, while maintaining the value of its counterparty liabilities and reducing its overall capital position.

The other risk worth mentioning is the freezing of funding available either through the decline in loan origination or the willingness of counterparties to lend into repurchase agreements. Under either circumstance, a forbearance agreement may be required to keep the company solvent and preferred dividends would be suspended (this was done by several industry peers during COVID). Overall, I believe Arlington Asset Investment will ride the storm out through its diversification of investments, both in hard and soft assets.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Be the first to comment