Kameleon007/iStock via Getty Images

The US Treasury 3 Month Bill ETF (NASDAQ:TBIL) is a new exchange-traded fund (“ETF”) that aims to provide low-cost exposure to treasury bill returns. With the Fed aggressively increasing interest rates, investors finally have a chance to earn high, low-risk nominal yields. The TBIL ETF may be suitable for investors looking for a safe haven place to park cash while they look for investment opportunities.

Fund Overview

The US Treasury 3 Month Bill ETF is a new ETF recently launched by F/m Investments. It seeks to provide investment results that correspond (before fees and expense) to the performance of owning 3-Month Treasury Bills.

Strategy

To achieve its investment objective, the TBIL ETF tracks the performance of the ICE BofA US 3- Month Treasury Bill Index (“Index”). The Index is comprised of a single issue of treasury bills that is purchased at the beginning of the month and held for the full month. At the end of the month, the treasury bill is sold and rolled into a new issue. The issue selected is the treasury bill that matures closest to, but not beyond 3 months from the rebalancing date. Periodically, the index will select the most-recently auctioned treasury bill (“on-the-run”), if there has been a recent public sale by the U.S. Government. The Index is calculated and administered by ICE Data Services.

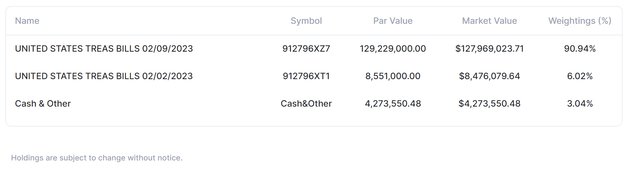

Portfolio Holdings

Figure 1 shows the TBIL ETF’s holdings. As the fund’s objective is to provide treasury bill returns, its holdings are simply treasury bills.

Figure 1 – TBIL ETF holdings (ustreasuryetf.com)

Returns

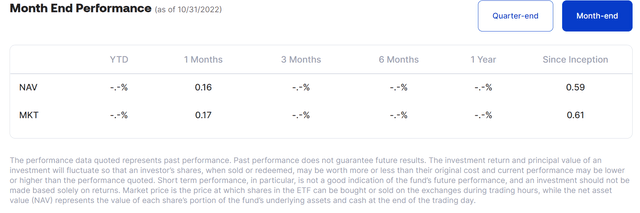

As the fund was only incepted on August 9, 2022, it does not have much returns history for analysis. Returns since inception has been 0.59% to October 31, 2022 (Figure 2).

Figure 2 – TBIL ETF returns (ustreasuryetf.com)

Distribution & Yield

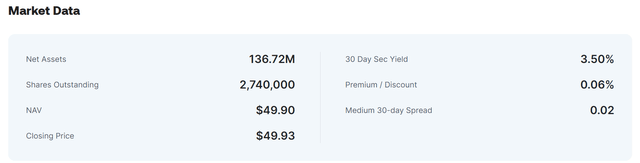

The TBIL ETF has a 30 Day SEC yield of 3.50% and pays a bi-monthly distribution payment.

Figure 3 – TBIL yield (ustreasuryetf.com)

The most recent distribution of $0.07335126 / unit was paid on November 3, 2022. The TBIL ETF’s distribution schedule can be found on the fund’s website.

Fees

The TBIL ETF charges a relatively low 0.15% expense ratio.

Finally Some Risk Free Yield

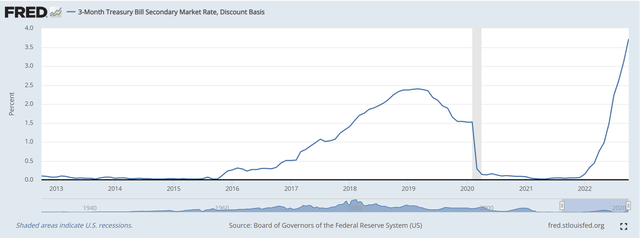

With the Fed aggressively raising interest rates in 2022 to combat inflation, investors finally have the chance to earn some nominal risk-free yield after many years of rock-bottom interest rates. Figure 4 shows 3-month treasury bill yields, which are at the highest levels in years.

Figure 4 – 3M treasury bill yields (St. Louis Fed)

As the Fed is expected to continue raising interest rates into 2023, we should expect 3-Month treasury bill yields to follow suit and continue marching higher in the coming months.

This gives investors an opportunity to earn high, low-risk (treasury bills have no credit risk and minimal interest rate risk) yield in an ETF structure while they wait out the current market volatility.

Conclusion

The TBIL ETF is a new ETF launched by F/m Investments that aim to provide low cost exposure to treasury bill returns. With the Fed aggressively increasing interest rates, investors finally have a chance to earn high, low-risk yield. The TBIL ETF may be suitable for investors looking for a safe haven place to park cash while they look for investment opportunities.

Be the first to comment