mikkelwilliam/E+ via Getty Images

Allied Esports Entertainment (NASDAQ:AESE) is a company going through a transition. What business this company ultimately ends up pursuing is still up in the air. Despite Esports being part of the name, Allied Esports Entertainment is trying to sell the Esports business that it currently operates. That announcement came in November of last year just a few months after former CEO Frank Ng resigned. His replacement Libing Wu resigned in February and those duties are now being taken on by Lyle Berman. Berman was formerly co-Chairman and President. Now on its third CEO in under 12 months, it’s clear the company needs to get the sale of its Esports business finalized so a permanent management team and business model can take form.

Plans and Financials

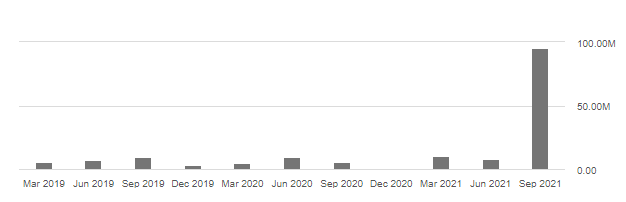

What makes this stock appealing right now is the corporate balance sheet. As of Wednesday’s close, AESE has a market capitalization of $72 million dollars. That market cap is actually less than the $95.2 million in cash that was on the balance sheet at the end of Q3-21.

AESE Cash Balance (Seeking Alpha)

That cash came from the completed sale of the World Poker Tour business that Allied Esports Entertainment previously owned. This is what CFO Roy Anderson said on the last earnings call:

Importantly, the company has zero debt having paid off the remaining convertible debt and bridge notes concurrent with the closing of the WPT sale during the quarter. In summary, we continue to see operational improvements in our Esports business that are being driven by strong growth of our in-person pillar and it returned to a more normalized operational environment.

On that same call, Lyle Berman noted that part of the decision to sell the Esports business was because the business has a high rate of cash burn. On what kind of business the corporate body wants to pursue, he added this:

But we’re wide open and looking at any industry that works, that makes sense. And most likely, we’re looking for a merger where there’s a very good management team.

In a follow-up question, Roy Anderson noted that cash burn is roughly $2 million per quarter. Thus, I am currently assuming a decrease of $4 million from the $95.2 million in cash stated at the end of Q3-21 while we await fresh year-end numbers. Similar to last year, the company was unable to get the annual report filed by the end of March and has requested an extension.

My read on this is the corporate entity is looking for a fresh start any way they can get it. They have a very strong balance sheet that should allow them to buy or merge with another small company. One thing that is notable though is that Allied Esports announced a non-binding letter of intent for the sale of the Esports business that has yet to come to fruition. Additionally, AESE has hired an advisor to help facilitate a sale. It’s interesting that despite the claimed interest in the Esports business and a letter of intent, there still hasn’t been a transaction yet.

EPICBEAST NFT Project

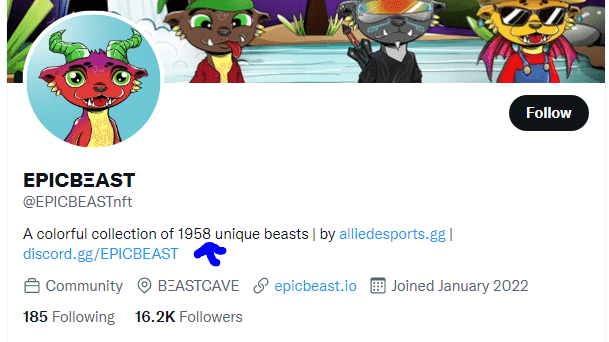

And that may be where the NFT project comes in. Yet another avatar NFT project. For full transparency, I like NFTs. I think there is a tremendous opportunity for the disruption of ownership rights broadly through NFTs. That said, I don’t particularly care for avatar NFT projects in most cases. There are a few companies doing avatar NFTs well, Yuga Labs comes to mind. However, most companies seem to be just jumping on the NFT bandwagon. Some of the keys to growing a successful NFT project are adoption, roadmap, and execution.

As far as roadmap goes, what some potential investors in NFT projects may ultimately want to see is a plan for merchandising and other monetization ideas. EPICBEAST actually does have some of those monetization goals laid out in its roadmap with collectibles and events that leverage the characters from the project. The synergy potential with the core business is interesting as well. I can’t help but wonder if there might be a video game down the line would make sense. That’s purely speculation though.

The main issue that I see with EPICBEAST is that the adoption doesn’t appear to be there. In the original press release announcing the project, EPICBEAST was described as 8,591 NFTs on the Ethereum (ETH-USD) blockchain. Now, on OpenSea and Twitter, we see just 1,958 NFTs.

EPICBEAST NFT Number (Twitter.com)

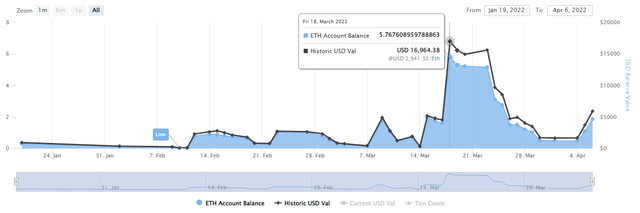

Evidently, the interest wasn’t there during last month’s launch. We can see what the sales volume turned out to be by looking on-chain at the wallet associated with the project.

EPICBEAST Address (etherscan.io)

The balance of ETH in the wallet never eclipsed $17,000. Based on that figure, EPICBEAST would be ranked down near 1,000 on the 30-day sales volume chart according to cryptoslam.io. However, that’s if it were listed on the site which it isn’t. While I am in no position to critique the quality of the cartoon art for the project, one thing that may have driven people away from buying these NFTs are the terms laid out in section 2:

Allied Esports hereby grants to you, to the extent of Allied Esports’ rights in the Digital Content, and solely for so long as you own the NFT, the worldwide, non-exclusive, revocable, non-transferable, non-assignable, nonsublicensable worldwide right to access, view, and/or display the Digital Content associated with the purchased NFT as part of the Digital Collectible, solely for your own personal entertainment and enjoyment, and not for any commercial use.

The lack of commercial use, while not unique to EPICBEAST, means that token holders can’t monetize their NFT the way they may like to. There are other NFT projects that allow for commercial use by the token holder. These terms are very much in the interest of the company rather than the NFT buyer. Which I think is an indication that this NFT project is probably more of a bargaining chip to appeal to a suitor than an actual initiative that the company truly wants to take on.

Risks

Right now the biggest risk is probably time. How long will it take to sell the Esports business and how much cash will be burned before that deal takes place? I can’t help but wonder if the NFT project was added to the fold as a way to make the Esports business more sellable to prospective buyers. There is a lot of hype surrounding NFT projects and they are becoming very mainstream.

While this EPICBEAST idea could have potential synergies with the Esports business, it’s very interesting to me that I can’t find a single mention of it in the company’s Q3-21 earnings filing. That coupled with the lackluster sales leads me to wonder if EPICBEAST is more about ginning up interest in what Allied Esports is trying to offload than anything else.

Conclusion

What happens with this company is completely up in the air. The NFT project seems hastily put together. The Esports business is clearly no longer of interest to the company’s management. There are serious risks here. There is a high likelihood this entity is going to struggle even if it can find a buyer of its Esports business. It also has to find a viable merger or acquisition to put the cash on the balance sheet to use.

I think the headline of this article properly illustrates where I come down on this idea. AESE shares are essentially a lottery ticket at this point. Most lottery tickets lose. But if you can buy a $1 lottery ticket for 75 cents, it’s probably worth a shot. I’ve taken a very small long position in AESE shares. We’ll see what happens.

One More Thing

I’m really excited to share that I’ll be launching a Marketplace service right here on Seeking Alpha called Heretic Speculator PRO very soon. As we get closer to the launch, I’ll be able to get into more of the details about the service and the value proposition for subscribers. Make sure you follow me so you don’t miss what’s coming!

Be the first to comment