Ryland Zweifel/iStock via Getty Images

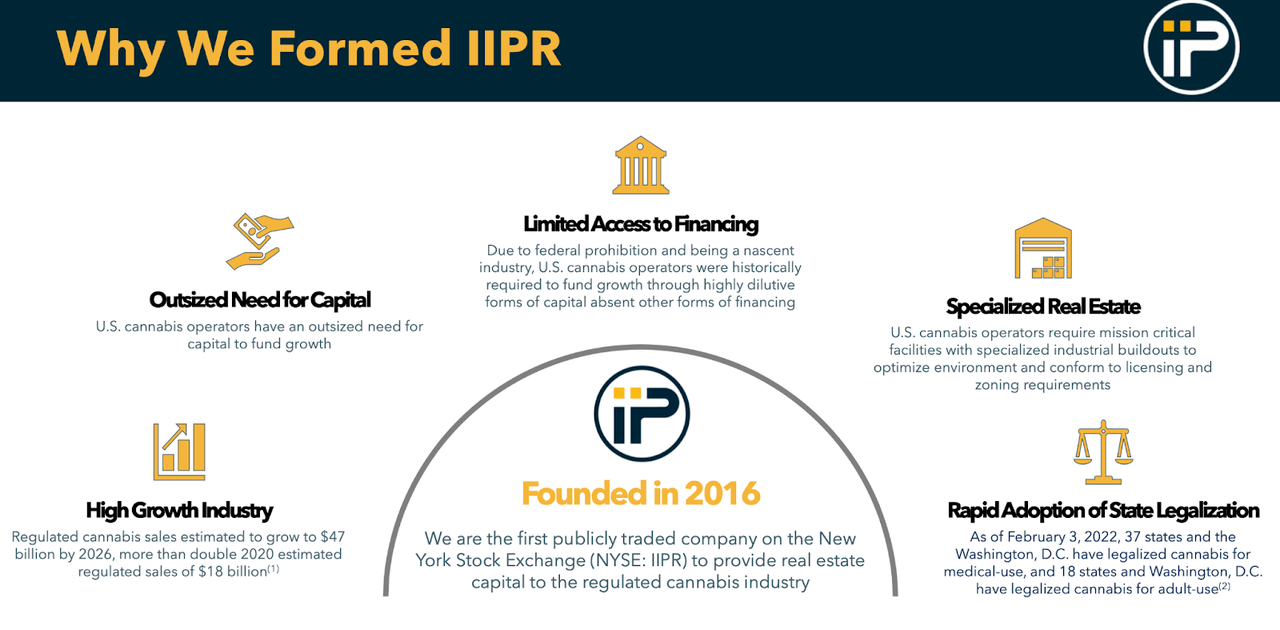

Innovative Industrial Properties (NYSE:IIPR) is often considered one of the safer ways to invest in the cannabis sector, and for good reason. IIPR is a real estate investment trust (‘REIT’) and legitimate income play, offering a 3% dividend yield as of recent prices. Unlike typical REITs, IIPR is growing at tech-like growth rates and the struggles in the cannabis equity markets may allow for rapid growth over the next several years. While the prospects for the passage of SAFE banking muddy the outlook, the company offers strong return potential the longer regulatory reform takes place. I rate shares a buy, especially for those looking for income-oriented investments in the cannabis sector.

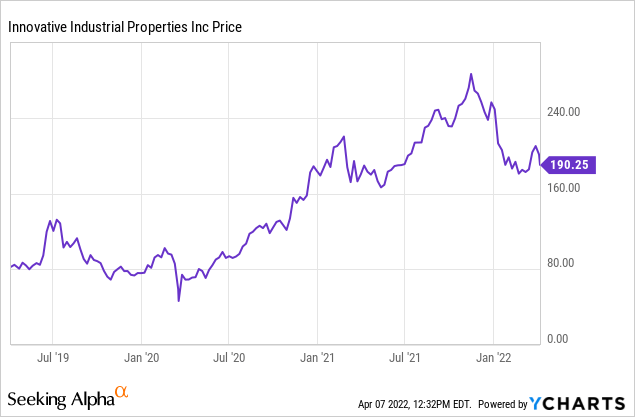

IIPR Stock Price

It took a while for Wall Street to embrace IIPR. Like many high-growth stocks, the pandemic helped the stock realize its full potential as investors warmed up to the long-term thesis.

Previously, many investors may have expressed concerns regarding the perceived risk of cannabis real estate. The pandemic allowed IIPR to show that such fears are misplaced, as the company is strongly positioned to capitalize on the rapid growth of the industry.

What is Innovative Industrial Properties?

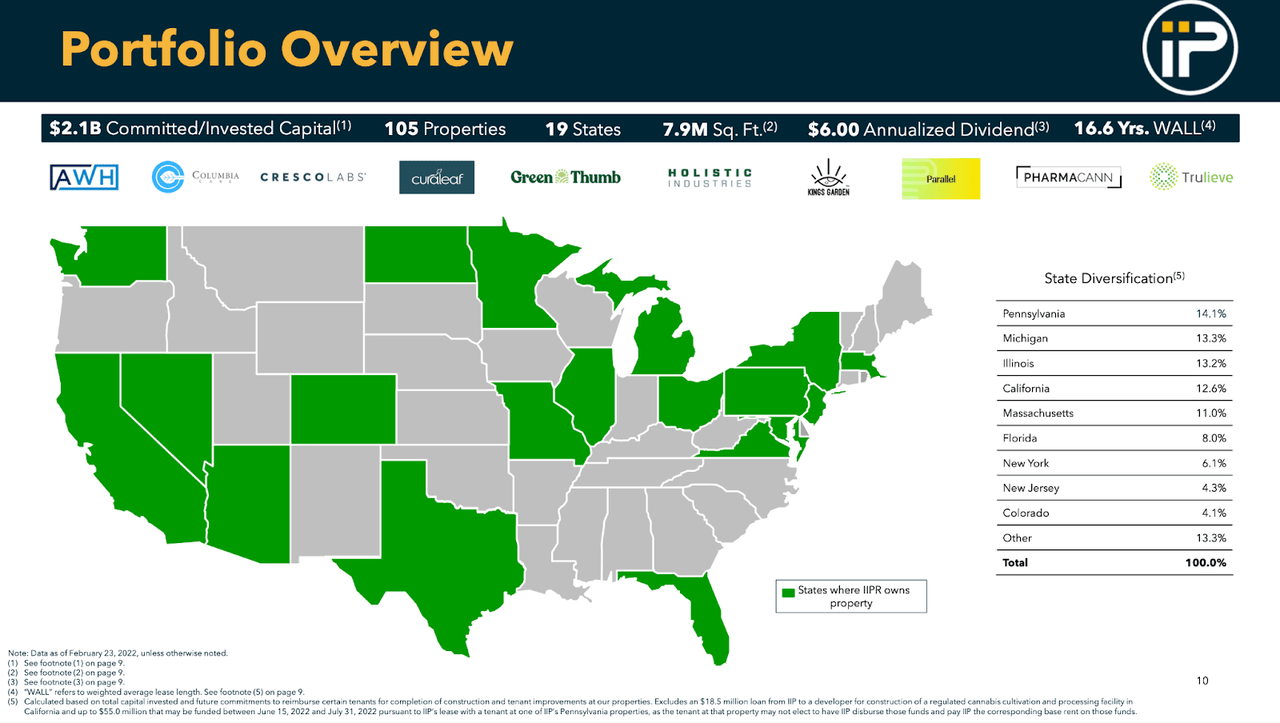

IIPR owns 105 properties spread across 19 states.

IIPR 2022 Presentation

IIPR’s tenant list includes well-known cannabis operators such as Trulieve (OTCQX:TCNNF), Curaleaf (OTCPK:CURLF), Green Thumb Industries (OTCQX:GTBIF), Cresco Labs (OTCQX:CRLBF), and others. If you are unfamiliar with the cannabis sector, the names listed above are considered “Tier 1 operators.” I should note that in general, IIPR works with multi-state operators (‘MSOs’), and MSOs have strong competitive advantages relative to smaller operators due to scale and the strict regulatory environment.

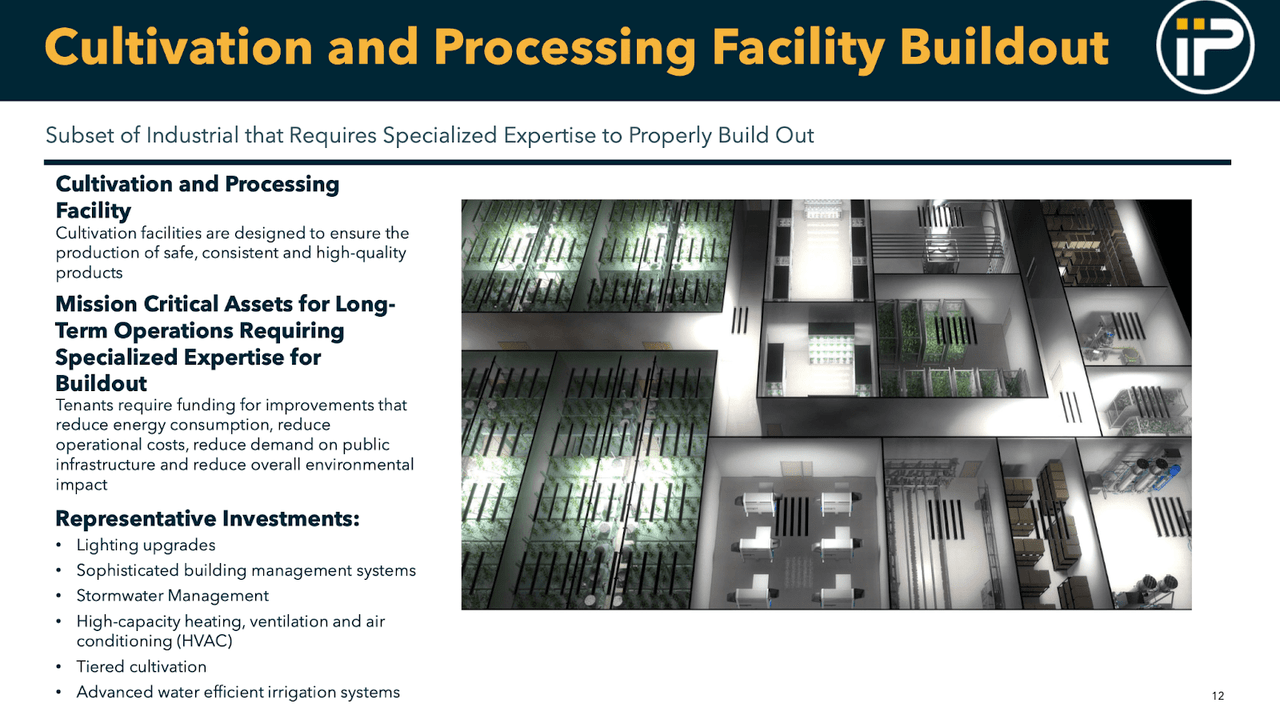

IIPR’s properties are primarily cultivation and processing facilities – its tenants use the buildings to grow cannabis. In addition to providing financing for the buildings itself, IIPR also helps fund tenant improvements.

IIPR 2022 Presentation

IIPR uses triple net leases, making it a cannabis version of the investor favorite Realty Income (O). A net lease is one in which the tenant is responsible for real estate taxes, insurance, and maintenance costs. This allows for IIPR to generate strong profit margins with minimal recurring capital expenditure responsibilities. IIPR is best thought of as a “real estate bank.” Its tenants might approach IIPR looking to sell some real estate assets while simultaneously signing a long-term lease. These leases typically last around 16 years with annual rent equivalent to around 13% of the purchase price, with annual lease escalators of around 2% to 3%. Realty Income on the other hand typically signs leases with rent equivalent to 6% of the purchase price with annual lease escalators of around 1%.

IIPR is able to realize more attractive lease terms due to the fact that cannabis remains illegal at the federal level. US cannabis operators, even if they are operating only in legal states, are largely blocked off from institutional capital. These operators pay onerous 280e taxes which prevent them from deducting operating expenses (like rent, interest costs, employee costs) from taxable income. With limited access to financing, even the best cannabis operators have no choice but to accept the expensive lease terms from IIPR and others.

Cannabis is a high growth industry, but that growth needs to be powered by substantial capital investment, ranging from cultivation facility buildout to dispensary buildout. When you combine the vast need for capital with the attractive lease terms, it is easy to see why IIPR has been such a successful investment for investors.

IIPR 2022 Presentation

IIPR Stock Valuation and Price Target

Unlike most NNN REITs, IIPR has delivered rapid growth more resembling a tech company than a real estate landlord. In 2021, IIPR grew revenue by 75% and AFFO by 33% to $6.66 per share. The reason that AFFO per share grew at a slower pace was due to much of the growth being funded by stock offerings.

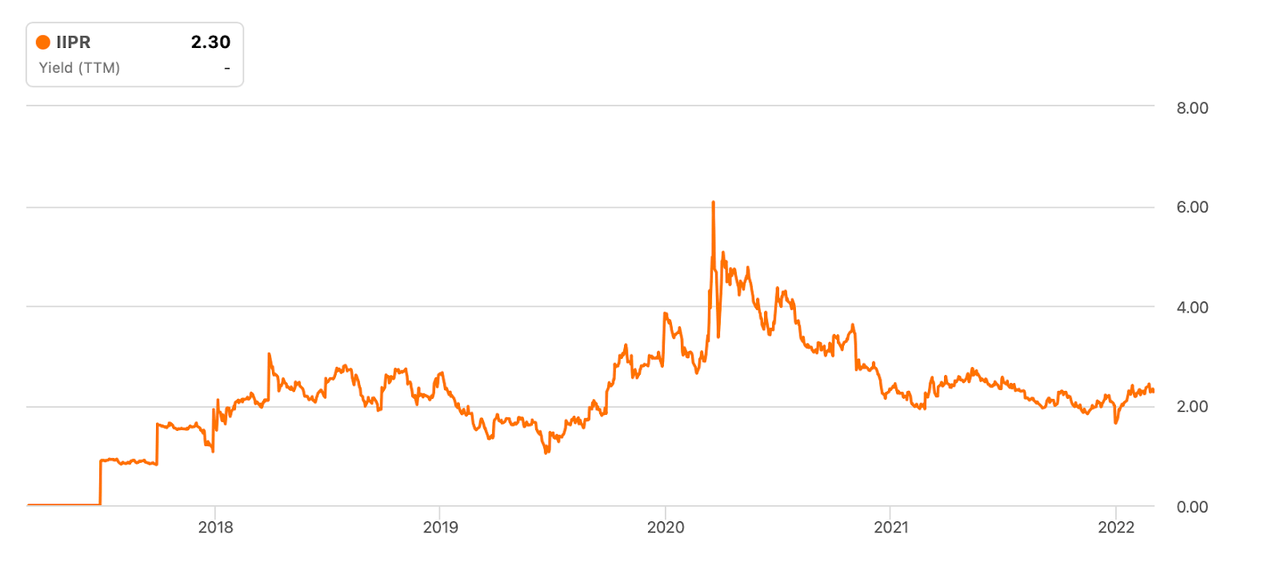

As of recent prices, IIPR is trading at a 2.3% trailing dividend yield, or 3.6% based on the forward dividend payout of $7.00 per share. We can see that IIPR has traditionally traded at a lower dividend yield.

Seeking Alpha

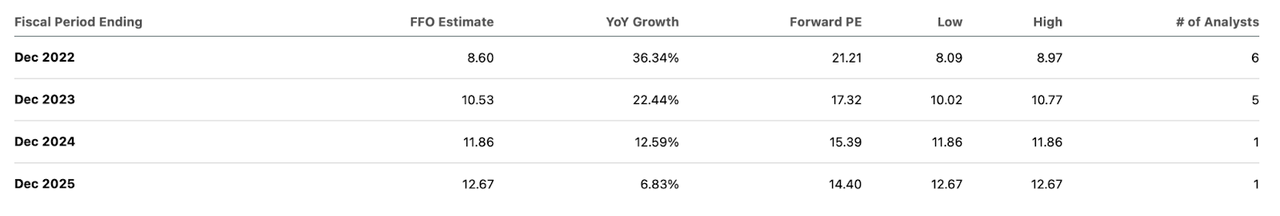

In comparison, NNN REITs like Realty Income typically trade at yields around 5%. The discrepancy is because of the much stronger growth and longer growth runway at IIPR. At recent prices, IIPR is trading at 27x AFFO. Looking forward, consensus estimates call for AFFO to grow at a rapid rate.

Seeking Alpha

Is IIPR A Buy, Sell, Or Hold?

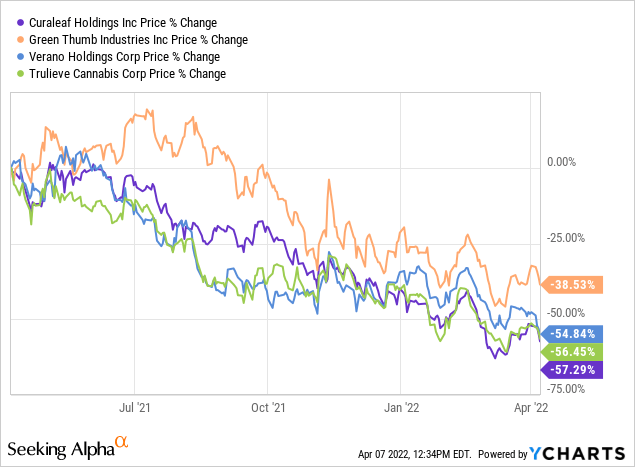

Is IIPR a buy today? We can see below that the stocks of cannabis MSOs have tumbled over the past year in spite of roaring fundamentals.

That has led US cannabis stocks to trade at their lowest valuations ever as public companies. Low equity valuations reduce the appetite for equity offerings, making these operators more likely to raise funds through debt or sale-leaseback transactions with operators like IIPR. Because cannabis debt tends to come with high interest rates (even the best operators need to pay at least 8%) and that interest costs aren’t deductible from operating income, I predict that IIPR will see substantial leasing volume this year.

We must address the elephant in the room. What if SAFE banking happens, as that would allow institutional capital to flow into the sector? In this scenario, I would expect cap rates and annual lease escalators on new leases to decline rapidly. Considering the strong fundamentals of cannabis stocks, I wouldn’t be surprised to see cap rates come down as low as 6.5% – nearly half of where they stand today. In spite of those possibilities, we mustn’t forget that IIPR’s existing portfolio still has an average 16.6-year remaining lease term and the ~3% annual lease escalators will enable the portfolio to maintain stronger comparable growth than NNN REIT peers. Is there a risk of its tenants backing out of its leases upon expiration? This is possible, but due to the highly regulated nature of the cannabis industry, cultivation facilities tend to be attached to cannabis licenses, making it a non-trivial task to move facilities. Moreover, the passage of SAFE banking would improve the financial position of IIPR’s tenants, increasing the credit quality of its portfolio. In the event that SAFE banking passes, I expect IIPR to see its AFFO multiple decline from the current 27x level, but likely not too much considering that slower-growing NNN REITs like Realty Income trade at around 18x FFO. Perhaps IIPR settles around 23x to 25x FFO, though the current 27x multiple is arguably sustainable as well considering that industrial REITs like Prologis (PLD) often trade at 30x FFO or higher.

In the meantime, IIPR can continue growing its bottom line at 15% rates or greater until SAFE passes, as there remain many states which have yet to reach maturity in the cannabis sector.

This all suggests that the stock price reflects a distorted risk-reward opportunity, one which appears to have already priced in regulatory risk but containing substantial upside the longer it takes for SAFE banking to pass. I note my preference for portfolio holding NewLake Capital Partners (OTCQX:NLCP), which trades at only 14x my estimates for forward AFFO. That said, I rate IIPR a buy as its long-term growth story remains intact.

Be the first to comment