Brandon Bell

Occidental Petroleum (NYSE: NYSE:OXY) is an almost $70 billion American petroleum that’s recovered incredibly well since bankruptcy was once on the table and the company was forced to pay preferred equity in stock. The company has hit the point where it’s owned more than 20% by Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B), which has permission to buy up to 50% of the company.

Occidental Petroleum 3Q 2022 Results

The company had impressive 3Q 2022 results, helping to highlight the strength of its asset portfolio.

Occidental Petroleum Investor Presentation

Occidental Petroleum 3Q 2022 Results – Occidental Petroleum Investor Presentation

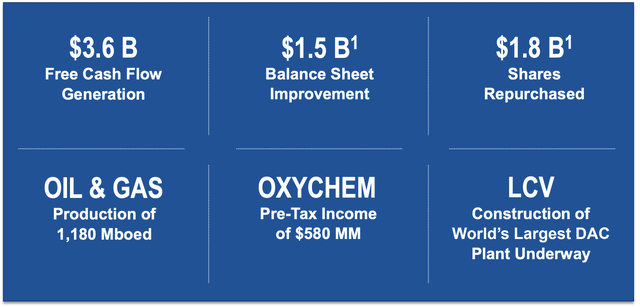

Occidental Petroleum had strong 3Q 2022 results. The company earned $3.6 billion in quarterly cash flow, or a roughly 20% FCF yield on market cap. The company used that for $1.5 billion in balance sheet improvement along with $1.8 billion in share repurchases, showing how the company is taking advantage of higher prices.

The company’s quarterly production of almost 1.2 million barrels / day is remaining strong and the company is continuing to focus on its pre-tax business such as Oxychem. Lastly, the company is constructing the world’s largest DAC plant which will enable it to move toward its goals of efficiency and shareholder returns.

Occidental Petroleum Asset Development

Occidental Petroleum has continued to work on its asset development, especially direct air capture.

Occidental Petroleum Investor Presentation

Occidental Petroleum Investor Presentation

Occidental Petroleum Assets – Occidental Petroleum Investor Presentation

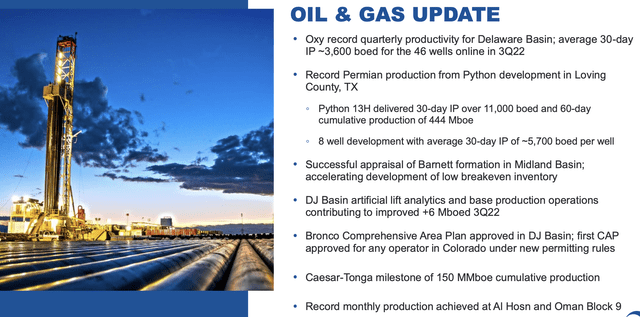

Occidental Petroleum assets have continued to perform well. The company’s Permian Basin operations have continued to set new records along with its international operations. However, it remains to be seen how much the company can continue to improve these high volume businesses over the long run.

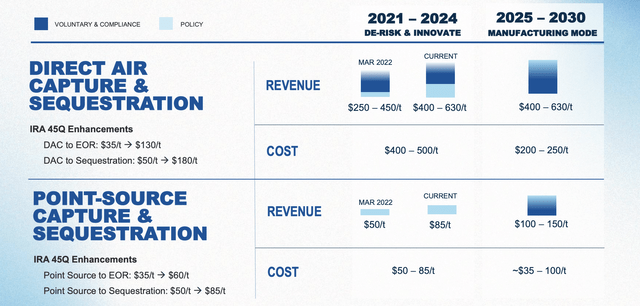

In Direct Air capture & Sequestration, the company is expecting ~$500 / tonne in revenue with costs at half of that. That could enable the business to be profitable while enabling it to mitigate the impact of the remainder of its business. It’s worth noting that 2.5 barrels of oil produce ~1 tonne of emissions across their lifecycle, so this is still not profitable on scale.

Overall, the company’s assets are impressive and profitable, however, the company hasn’t provided guidance on how it can ramp that up.

Occidental Petroleum Financial Picture

Occidental Petroleum has continued to maintain an incredibly financial position, highlighting its asset strength.

Occidental Petroleum Investor Presentation

Occidental Petroleum Financial Results – Occidental Petroleum Investor Presentation

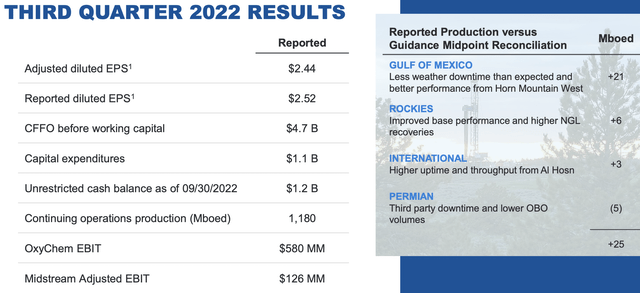

Financially, as we discussed above, the company’s FCF has remained strong. That’s on top of $1.1 billion in quarterly capital expenditures which will continue to support its assets and additional shareholder returns. The company has the ability to maintain production and has been slightly outperforming guidance and we expect all of that to continue.

Occidental Petroleum Shareholder Returns

Occidental Petroleum has the ability to continue driving shareholder returns as it shifts its focus.

Occidental Petroleum Investor Presentation

Occidental Petroleum Shareholder Returns – Occidental Petroleum Investor Presentation

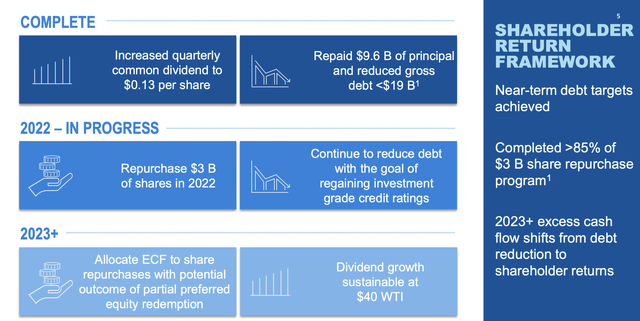

The company has completed its initial goals for its 0.7% dividend and $9.6 billion in debt paydowns to <$19 billion in gross debt. It’s worth noting that this isn’t counting the $10 billion in preferred equity the company has attributable taking its total capital stack of roughly $100 billion. The company spends ~$2 billion on preferred equity and debt.

The company is working to regain its investment grade credit rating, which we expect to happen, and it’s completed the majority of its $3 billion share repurchase program. We expect the company to be able to repurchase shares and maintain dividend growth at $40 WTI showing the strength of its asset portfolio.

Our View

Occidental Petroleum is a great company that’s continuing to execute well.

However, as is clear from Berkshire Hathaway’s tapered down share purchases, the company is seeing minimal value as well. The company still has the option that it will likely exercise to get 84 million shares for just under $60 / share. That implies that current shareholders are underwater by roughly $1.5 billion on those shares as they’ll be diluted.

The company is trading at a 20% equity FCF yield, however, it’s worth noting that that’s in an incredibly expensive oil environment. On the overall capital stack, the FCF yield is roughly 15%. The company is buying back shares, but there’s a risk if prices were too drop that it’s buying back too many shares at too high of a price.

The company continues to have preferred equity and interest obligations that cost it roughly $2 billion a year it needs to continue paying attention to. We’d like to see the company focus on improving its capital stack more for a rainy day. In the meantime, if prices do remain higher, we see more interesting opportunities in the market.

Thesis Risk

Occidental Petroleum’s recovery has been spectacular and it was definitely one of the stocks that we once thought was one of the most undervalued. However, at this point the company is overvalued, and while it’s profitable, it’s priced for a more expensive oil environment. We expect that will hurt the company’s ability to drive future returns.

Conclusion

Occidental Petroleum continues to have an impressive portfolio of Permian Basin assets with almost 1.2 million barrels / day of high-margin production. That has resulted in the company earning incredibly strong free cash flow, roughly $33 / barrel, which it was able to use for both share buybacks and capital stack improvement.

However, it also shows the company’s risk if oil prices drop from $100 a barrel to $70 a barrel. The compression in the company’s margins could hurt its ability to drive future returns. The company is a moderately valuable company, however, if oil prices drop it’s ability to provide returns decreases and if prices remain higher, there’s more interesting opportunities.

Be the first to comment