Luke Chan/E+ via Getty Images

Investors looking for a defensive growth company can consider accumulating shares of Jamieson Wellness Inc. (TSX:JWEL:CA). The company is a leading producer of vitamins and supplements in Canada. Due to the increased focus on health and wellness, I expect Jamieson’s products to remain in high demand. Although the stock trades at a premium valuation, I think it is justified because of its high international growth prospects.

Company Background

Jamieson Wellness is the #1 brand of vitamins, minerals and supplements (“VMS”) in Canada. Its products are manufactured in-house in 4 state-of-the-art facilities and are available in over 10,000 retail locations and major ecommerce platforms. Jamieson Wellness also has a fast growing international business with sales in 45+ countries, especially China.

Jamieson Has A Long Operating History

The core Jamieson brand was founded in 1922 as Jamieson Laboratories, focused on vitamins. It was sold to a New York industrialist, Henry Margolis, in 1951. The company was passed onto his son, Eric Margolis, who operated the company until selling it to private equity firm CCMP in 2014 for C$300 million.

CCMP restructured the business and rebranded the core business as Jamieson Vitamins, while introducing a holding company structure. After adding women’s wellness company Lorna Vanderhaeghe Health Solutions (“LVHS”) and sports-nutrition supplements maker Body Plus, CCMP took the company public via a C$300 million IPO in 2017.

Today, Jamieson Wellness operates six key brands: Jamieson, an iconic VMS brand sold in over 10,000 retail stores; Smart Solutions (formerly LVHS), a women’s natural health-focused brand of supplements; Progressive, a premium, specialized line of supplements; Precision, a premium sports nutrition brand of supplements; Iron Vegan, a premium sports nutrition brand of supplements for those looking for plant-based proteins; and youtheory, a U.S.-based brand of collagen and turmeric supplements (Figure 1).

Figure 1 – Jamieson brands (Jamieson Wellness investor presentation)

In addition to selling its own brands of vitamins and supplements, JWEL also engages in contract manufacturing for ‘strategic partners’. In 2021, strategic partnership revenue accounted for 24% of total revenues. Historically, owned brands generate 40%+ gross margin while strategic partnerships generate low double digit gross margins.

Jamieson Is A Well-Run Company

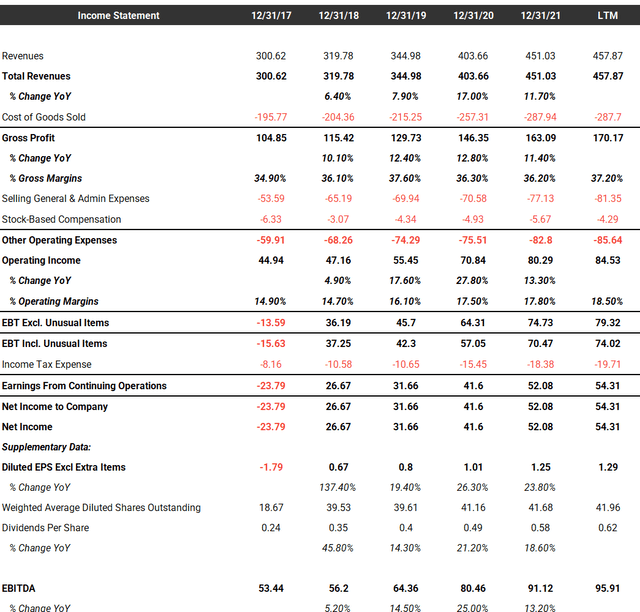

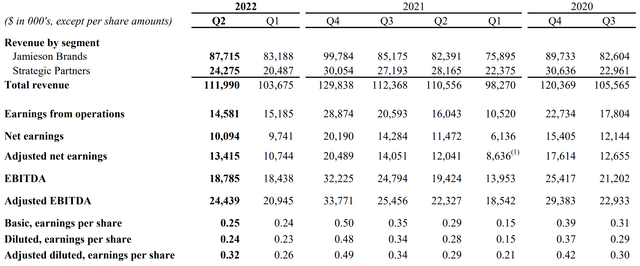

Since going public in 2017, Jamieson has been a well-run company. Revenues have increased by over 50% to $451 million in 2021, while operating margins expanded from 14.9% in 2017 to almost 18% in 2021. Diluted EPS grew from $0.67 in 2018 to $1.25 in 2021 (Figure 2).

Figure 2 – JWEL summary financials (tikr.com)

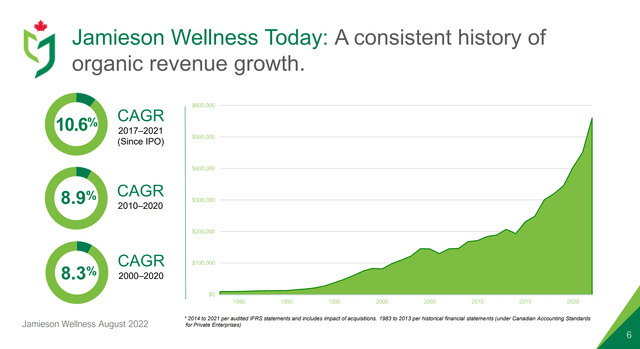

Impressively, Jamieson Wellness’ revenue has compounded at an 8.3% rate for over two decades (Figure 3).

Figure 3 – JWEL revenue has grown consistently (JWEL investor presentation)

Jamieson avoided the fate of GNC and Vitamin Shoppe

The strong operating performance is even more remarkable given the competitive operating environment which saw the 2020 bankruptcy of GNC Holdings Inc. (a North American chain of health supplement stores), and a dramatic downsizing and sale of the Vitamin Shoppe (another chain of health supplement stores) to the Franchise Group, Inc. (FRG) in 2021.

Both GNC and Vitamin Shoppe had faced increased e-commerce competition, as well as controversies surrounding their supplements. In contrast, Jamieson Wellness has largely avoided controversies and has adapted to e-commerce well.

International Is Next Stage Of Growth

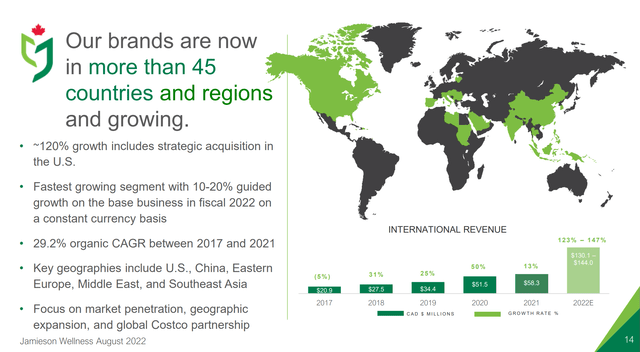

A key reason why Jamieson has performed well since the IPO is because of its international expansion. As seen in Figure 4 below, JWEL’s international revenues have grown from $20 million in 2017 to $58 million in 2021. In 2022, Jamieson is forecasting the international business to more than double to $130 to $144 million, on the back of its partnership with Costco (COST) and the youtheory acquisition.

Figure 4 – JWEL international growth (JWEL investor presentation)

Jamieson has a global strategic partnership with Costco, which has been the primary driver behind Jamieson’s increasing market penetration in international markets like the UK and China.

Figure 5 – JWEL / COST partnership (JWEL investor presentation)

In China, the #2 global VMS market ($20 billion in sales), Jamieson has a 3-pronged approach (Figure 6). In addition to selling through Costco club stores, Jamieson also sells on leading cross-border e-commerce platforms like T-mall, VIP.com, and JD.com (JD). Finally, Jamieson plans to gradually convert its Chinese domestic sales from a distributor model to a Jamieson owned and operated model. Note, Jamieson has an option agreement to acquire its Chinese distributor that expires at the end of 2022. I expect Jamieson will announce the exercise of the option and acquire its Chinese distributor in the coming quarters.

Figure 6 – JWEL China strategy (JWEL 2021 annual report)

Guiding For Strong Growth In 2022

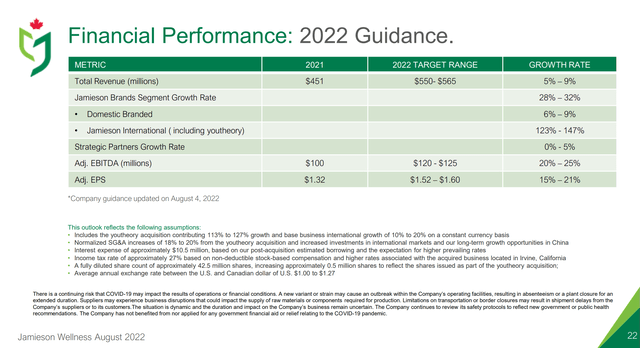

With its strong international growth and recent acquisition of youtheory, Jamieson is forecasting strong growth for 2022. Revenue is expected to come in at $550 to $565 million (22% to 25% YoY growth), and EPS is expected to come in at $1.52 to $1.60 (15% to 21% YoY growth).

Figure 7 – JWEL guiding to strong growth (JWEL investor presentation)

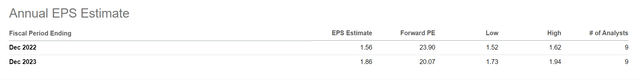

Premium Valuation Could Be Justified

On a forward basis, Jamieson is currently trading at 23.9x its consensus 2022 EPS estimate of $1.56. This is a ~4 pt premium to the consumer staple sector, which currently trades at 20.2x forward P/E. On 2023 EPS of $1.86, it is trading at 20.1x. I believe the premium valuation on Jamieson could be justified given the company’s strong top and bottom-line growth rates. Note, 2022 results will only include 5 months of youtheory (transaction closed in July), so the forward multiple premium is not as large as the headline 4 pts on a run-rate basis.

Figure 8 – JWEL premium valuation (Seeking Alpha)

Furthermore, Jamieson’s business is very ‘on-trend’ and defensive. If we look at the company’s quarterly performance, we can see that Jamieson did especially well during the COVID-19 pandemic, as consumers bought vitamins and supplements to boost their immune systems (Figure 9). As the world continues to battle with COVID-19 variants and emerging virus outbreaks such as Monkeypox, I expect VMS penetration will continue to remain high.

Figure 9 – JWEL quarterly performance (JWEL Q2/2022 quarterly report)

Risks

One of the biggest risk to Jamieson is that its business is vitally dependent on consumer trust. One of the reason GNC failed was because it was embroiled in controversies regarding its supplements. If such an incident were to happen to Jamieson, I would expect the stock to suffer significant declines.

Another risk is that much of the premium multiple is currently due to its international growth prospects, especially in China. If the international growth were to not materialize, that would have a detrimental impact to the stock.

Finally, Jamieson has been an acquisitive company. Integration of acquisitions like the recent youtheory acquisition, a US$210 million deal, is crucially important.

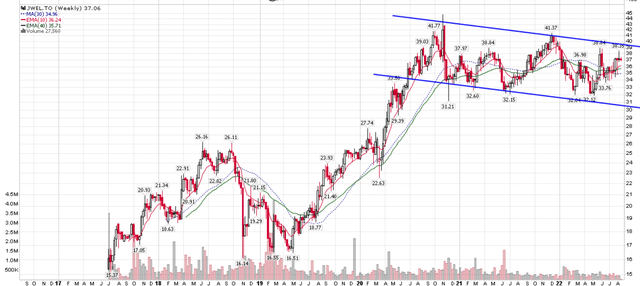

Technicals Consolidating

Technically, Jamieson Wellness has been in a multi-year sideways consolidation after the 2019-2020 run-up, as the company ‘grows’ into the valuation multiple awarded to the company from the COVID-19 pandemic (Figure 10). A breakout above $39/40 should lead to new all-time highs for the stock.

Figure 10 – JWEL in sideways consolidation (Author created with price chart from stockcharts.com)

Conclusion

In conclusion, I think investors looking for defensive growth can consider accumulating shares of Jamieson Wellness, especially on pull-backs. The company is delivering an ‘on-trend’ product that should stay in high demand as the world continues to battle COVID-19 variants and emerging new viruses. Although the stock trades at a premium valuation, it could be justified from its high growth prospects.

Be the first to comment