PM Images/DigitalVision via Getty Images

Introduction

This year, I’ve spent a lot of time discussing various issues – both on Seeking Alpha and Intelligence Quarterly. We’re seeing a lot of significant headwinds that are currently suppressing economic growth. We’re dealing with sky-high food inflation, labor shortages, and a growing need to export food due to shortages elsewhere. This is where one of my favorite stocks that’s flying under the radar comes in.

The North Carolina-based Sealed Air Corporation (NYSE:SEE) has become a leader in automated packaging, covering e-commerce, food production, and other areas. My last article was written in July of 2021, which means it’s time for a much-needed update.

The company has made tremendous progress. We can expect accelerating sales and EBITDA growth to last. I also expect that the current stock price outperformance will continue as it’s backed by high free cash flow, a healthy debt load, and a fundamental bull case.

Now, let’s look at the details!

Secular Growth

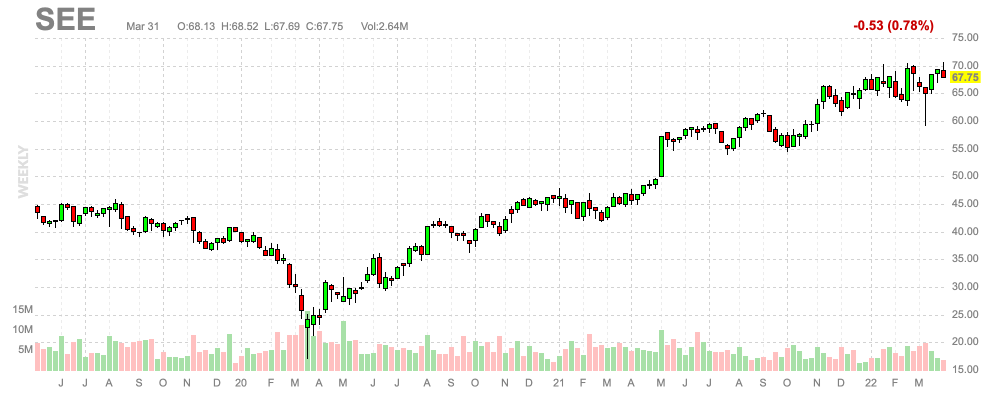

Sealed Air has a $10.0 billion market cap. The total return since my most recent article is 16.1%. Year-to-date, the stock is up 1.2%. The S&P 500 has returned -3.4% since the close on December 31, 2021. That’s not very bad but a result of high inflation, lower economic sentiment, imploding consumer sentiment, and uncertainty regarding the actions of the Federal Reserve. The war in Ukraine makes all of these things worse.

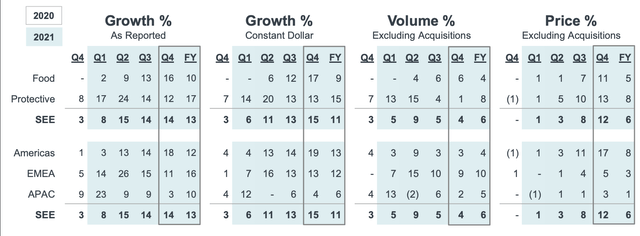

Sealed Air operates in two key segments: food and protective. In 2021, the company did $5.5 billion in sales. $3.1 billion, or 56% came from food, $2.4 billion were provided by the protective segment. 63% of sales came from the Americas, which includes South America as well. EMEA contributed 22%. APAC did $812 million in sales – or 15%.

One key issue in food production is labor-intensive operations. Companies like Tyson (TSN) did very poorly during the initial wave of the pandemic as they employ thousands of people in food processing plants. The stock dropped more than 50%. It recovered, but my point is that labor is an issue. It’s also a job not many want to do if they have a choice – it isn’t pretty work.

Now, my goal is not to give these jobs a bad name, my aim is to show why Sealed Air has an edge.

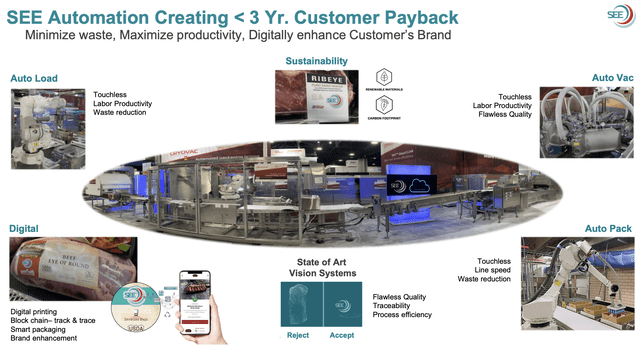

The company’s 2022 investor presentation shows its advantage. It has auto load and auto pack machines (among others) that reduce the need for manual labor in the food supply chain. It’s touchless and waste-reducing.

According to the company:

We start with the most labor-intensive processes in meat-packing facilities. See Auto Load automates the process of loading the meat in the bag. We are integrating cobots, robots and other automated systems to increase line speed, while producing flawless quality with Auto Vac and Auto Pack.

We continue to innovate an high performance Cryovac materials, making them more sustainable, recyclable and effective. Our state-of-the-art vision systems for quality control can see what humans cannot, an artificial intelligence and machine learning continuously makes the process smarter. We use our SEE Mark to validate and certify quality. Our advancements in digital printing will enable customers to improve their operations, and at the same time, digitally connect with their consumers.

By 2025, Sealed Air aims to have 100% of its solutions and products designed for recyclability or reusability with at least 50% recycled or renewable content.

In July, I wrote that the company’s customers enjoy up to 30% in cost savings and a 10% increase in capacity utilization using “touchless” automation products that come with 70% higher labor productivity. That’s a very big deal and a reason why the company is now generating a lot of value for both customers and shareholders.

So Much Value In SEE

The current environment is tough for consumer-focused stocks. Even the big guys like Home Depot (HD) are trading close to 25% below their all-time highs. Sealed Air gets roughly half of its sales from protective sales, which is consumer-focused. It helps companies like Continental to protect and ship tires, and it supports customers using its various brands including Autobag, BubbleWrap (hence the title), and Cryovac.

The company has built an impressive portfolio of brands, and now it’s paying off. Because automation is so important, the company is able to escape weakness in consumer stocks as these investments are being prioritized. In 2021, the company grew its total organic sales volume by 6%. Protective volumes were 2 points above food volume growth.

Note that the company is in a good spot to hike prices, which rose on average by 6%. That’s above 2021 inflation rates in all of its key regions, except for APAC.

This business transformation is now bearing fruit. Prior to the pandemic, the company was acquiring growth to restructure its business for the business environment we’re in now: automated supply chains, labor shortages, and higher e-commerce penetration.

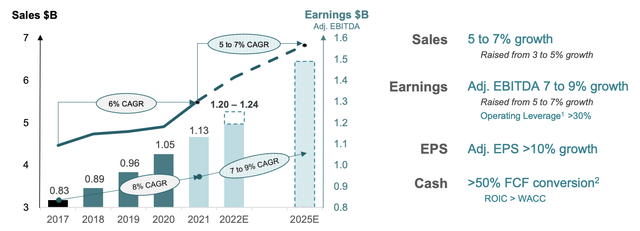

The company is now looking at 5-7% annual compounding sales growth. That’s up from 3-5%, which wasn’t bad, to begin with. Adjusted EBITDA is expected to grow between 7-9% per year, which is up 200 basis points from prior growth levels. Thanks to higher margins, EPS is expected to rise by more than 10% per year.

Free cash flow conversion is expected to be higher than 50%, which means investors are in a good spot to enjoy higher dividends on top of a healthier balance sheet.

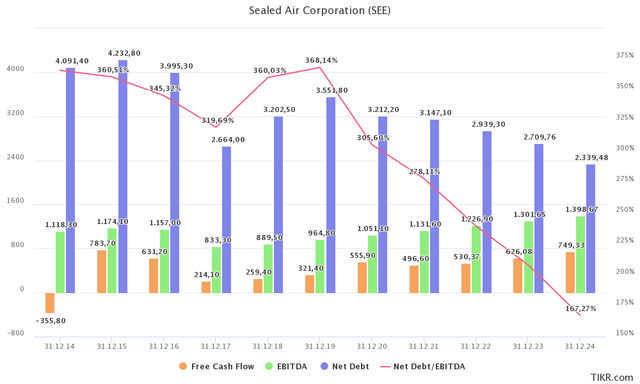

The chart below shows the company’s impressive transition. Prior to the pandemic, financials were a bit “messy” with volatile adjusted EBITDA and very low free cash flow. The net leverage ratio was close to 4x EBITDA. Now, we’re dealing with a long-term uptrend in EBITDA and close to $750 million in expected 2024 free cash flow. That’s 7.5% of the company’s current market cap. So, if the company comes anywhere close to that number, it’s a huge win for investors. Hence, net debt is expected to fall to $2.3 billion, or just 1.7x expected EBITDA.

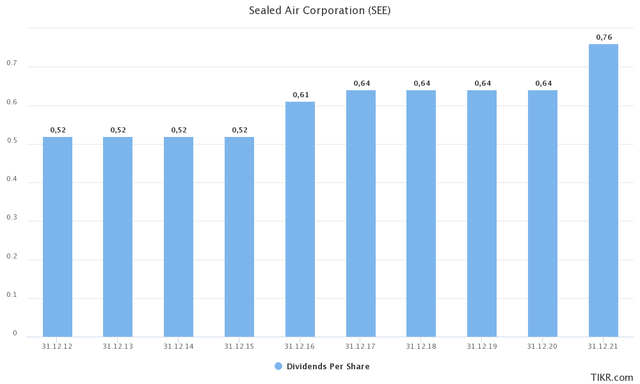

With this in mind, the company is not a well-known dividend growth stock. Dividend growth has been inconsistent and somewhat low in the past. Also, the current dividend yield is 1.1%, which is roughly 20 basis points below the S&P 500 average.

Yet, I’m still going to call this a dividend growth opportunity for a number of reasons.

- The company is now starting to consistently boost dividends as its business has more or less finished the turnaround.

- Dividend growth has taken off. On May 18, 2021, the company announced a 25% dividend hike. I expect a similar hike soon.

- Debt is sustainable as the net leverage ratio has fallen off a cliff.

- The company’s growth is sustainable thanks to secular developments in its industries.

- Implied free cash flow is close to 7.5% using 2024 estimates.

Valuation

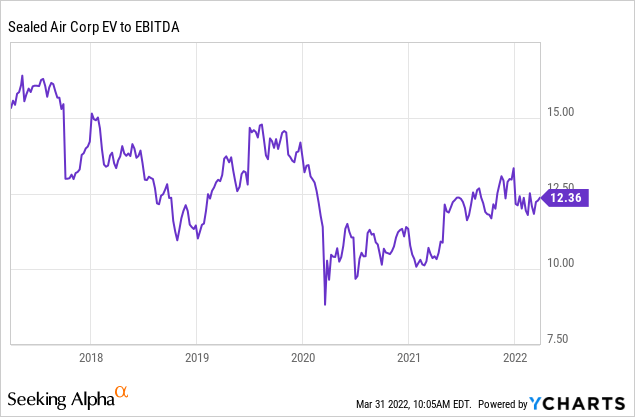

The valuation is too cheap for a company that grows earnings by 10% per year (EBITDA between 7-9%). Using its $10 billion market cap, close to $175 million in pension (and related) liabilities, and $2.7 billion in expected 2023 net debt, we get an enterprise value of $12.9 billion. That’s roughly 9.9x next year’s EBITDA estimate of $1.3 billion.

Hence, I believe that SEE should trade 20-30% higher from current levels based on the 2-year outlook. That’s what I consider to be a “fair” price. Longer-term, I expect the stock to add 10% without dividends per year if the company maintains between 8-9% earnings growth beyond 2025.

FINVIZ

Takeaway

I believe SEE is a nice addition to dividend growth investors’ portfolios in case investors don’t mind a low yield. The company’s turnaround is truly impressive. The company is now a leader in consumer-related and food packaging and the company benefits from secular growth in both of its segments. Volume growth is high and SEE is in a good spot to hike prices.

EBITDA and net income growth are accelerating and are expected to remain high in the foreseeable future. Free cash flow has improved and is now rapidly reducing the company’s debt load.

Moreover, despite high growth, the valuation remains attractive, which leads me to expect roughly 20-30% upside over the next 24 months.

Additionally, investors will more than likely benefit from strong, and lasting dividend growth, which makes the current yield of just 1.1% attractive gain.

I believe that by the time this stock isn’t flying under the radar anymore, investors will be sitting on high capital gains and a decent yield on costs.

(Dis)agree? Let me know in the comments!

Be the first to comment