J. Michael Jones/iStock Editorial via Getty Images

PARRS Trading Below Par

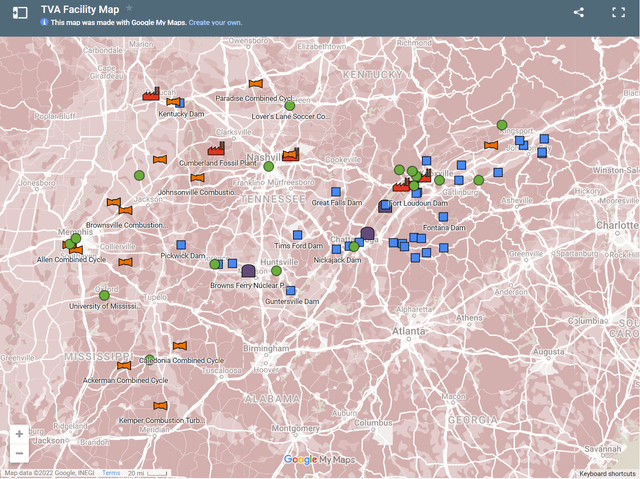

Tennessee Valley Authority (TVA) is a U.S. Government-owned corporation established in 1933 as part of the New Deal. TVA operates as an electric generation and transmission utility covering all of Tennessee and parts of the surrounding states. Assets include 30 hydroelectric plants and 3 nuclear plants along with fossil fuel and renewable generation. TVA also maintains 16,200 miles of transmission lines in the region.

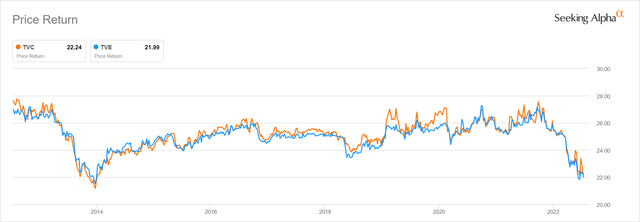

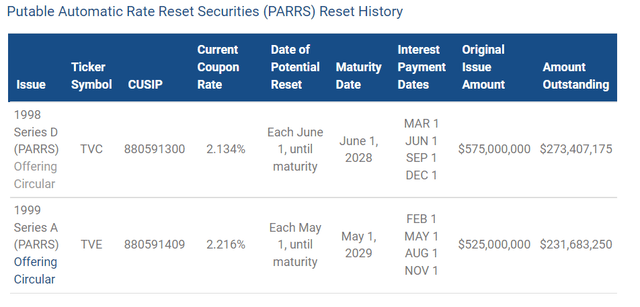

While owned by the U.S. Government, TVA supports itself through power system revenues as well as the issuance of debt. In 1998 and 1999, TVA issued two series of bonds with unusual features. These are known as Putable Automatic Rate Reset Securities or PARRS. The first of these was the Series D PARRS Due 6/1/2028 (NYSE:TVC), followed by the Series A PARRS Due 5/1/2029 (NYSE:TVE). These PARRS are $25 par value baby bonds that trade on the New York Stock Exchange. Investors may buy or sell them using the TVC and TVE tickers the same way they would trade a stock. The PARRS pay interest quarterly on the first of March, June, September, and December in the case of TVC or the first of February, May, August, and November in the case of TVE.

Due to the rising interest rate environment, the PARRS are trading at their lowest price since 2014.

Unfortunately, the coupon has declined since 2014 due to the resettable rate feature I will discuss below. Nevertheless, at these prices, the bonds offer a yield to maturity over 4% which beats 7-year U.S. Treasuries by over 1 percentage point as well as many lower-rated corporate bonds. The bonds are a good choice for investors who need cash in 6 or 7 years and desire safety of principal nearly as good as U.S. Treasuries but with a little extra yield.

How They Work

When first issued, these bonds paid an attractive coupon which lasted for 5 years. TVC paid 6.75% and TVE paid 6.5%. After this, the rate became resettable and indexed to the 30-year Treasury. Once per year, the existing coupon rate is compared to the following formulas:

For TVC, it is the average 30-year Treasury rate for the week ending on the last Friday in April, plus 0.92%.

For TVE, it is the average 30-year Treasury rate for the week ending on the last Friday in March, plus 0.82%.

If the formula rate is less than the existing rate, the coupon resets to the lower rate. If the formula rate is higher than the existing rate, there is no reset. Therefore, the coupon of these bonds can only go lower, never higher.

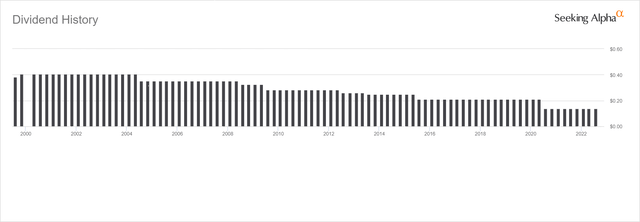

Thanks to the declining interest rate environment over most of this period, the coupons of these bonds reset lower several times. The most recent time was in the spring of 2020 which unfortunately happened to coincide with all-time low Treasury rates. As a result, TVC now pays a coupon of $0.1334 quarterly or 2.134%, and TVE now pays $0.1385 quarterly or 2.216% based on par value of $25.

TVE interest payment history (Seeking Alpha)

The good news is that if a reset is declared, investors have the option to put (sell) the bonds back to TVA for a guaranteed $25. While these bonds have traded above $25 in the past, at current prices there is no risk of principal loss (except in the extremely unlikely event of default.) Based on current prices at the time of writing, factoring in future interest payments and the gain on redemption at maturity, both bonds have a yield to maturity just over 4%.

| TVC | TVE | |

| Price | $ 22.30 | $ 22.08 |

| Face Value | $ 25.00 | $ 25.00 |

| Maturity Date | 6/1/2028 | 5/1/2029 |

| Quarterly pmt. | $ 0.1334 | $ 0.1385 |

| Current Date | 7/14/2022 | 7/14/2022 |

| Next Ex Date | 8/30/2022 | 7/28/2022 |

| # of future pmts. | 24 | 28 |

| Total Interest | $ 3.2016 | $ 3.8780 |

| Capital Gain | $ 2.70 | $ 2.92 |

| Total Profit | $ 5.9016 | $ 6.7980 |

| Total Return | 26.46% | 30.79% |

| Time to Maturity | 5.884 | 6.798 |

| Yield to Maturity | 4.07% | 4.03% |

| Current Yield | 2.39% | 2.51% |

The low current yields make these bonds less attractive for investors who desire current income. Still, the overall total return including the guaranteed $25 at maturity (or earlier if there is an unlikely rate reset) makes these bonds a good choice for saving cash for a planned expense 6-7 years in the future.

Nearly As Safe, Higher Yield

The prospectus for both bonds states that these bonds are not guaranteed by the US government.

The Bonds are obligations of TVA only, payable solely from TVA’s Net Power Proceeds. The Bonds are not obligations of or guaranteed by the United States of America.

Nevertheless, the rating agencies rate these bonds identical to U.S. Treasury bonds: Aaa by Moody’s, AA+ by S&P, and AAA by Fitch. Additionally, the tax treatment for these bonds is the same as Treasuries. They are subject to federal income tax but not state taxes.

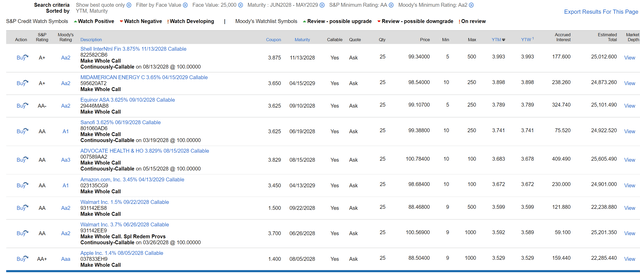

Despite the similar rating, the TVA bonds enjoy a spread of about 100 basis points over the 7-year Treasury which was yielding 3.05% at the time of writing.

If I search for corporate bonds available from my broker, I can’t find any with a similar maturity and rating that yield as much as the TVA PARRS, even if I expand my search criteria to slightly lower ratings including AA or better (S&P) or Aa2 or better (Moody’s). The only one with exactly the same rating is from Apple (AAPL) and still yields about 50 basis points less.

High Quality Corporate Bond Search, 2028-29 Maturity (Charles Schwab)

Risks

Aside from the minimal credit risk, these bonds are subject to trade down in price before maturity if interest rates continue to increase, although they will be worth $25 at maturity. These bonds are best for those with a specific cash goal in 6 or 7 years who won’t have to sell early and risk getting a lower price.

On the other hand, if interest rates go down a lot, there is a chance these bonds could trade higher than $25 as they have in the past. Investors might consider selling at that point, especially if the 30-year rate gets so low that a reset is possible.

Finally, the TVA PARRS trade at low volume. Thanks to investors exercising their put option after previous resets, there is less than half the originally issued number of bonds outstanding.

Average daily volume is only around 24,000 bonds for TVC and 14,000 bonds for TVE. If you buy these, please make sure to use limit orders and consider placing orders for no more than 1,000 bonds at a time.

Conclusion

The Tennessee Valley Authority PARRS have an interesting and unusual structure, but after many resets lower now look similar to a simple high-quality 2.1%-2.2% coupon bond. In the higher interest rate environment, the current prices result in yields to maturity above 4%. This is 100 basis points higher than a Treasury of similar maturity despite the same credit rating. The yield is even above slightly lower-rated corporate bonds. The bonds are also exempt from state income tax. The safe but higher yields make TVA PARRS a good choice for investors to save the cash needed in the 2028-2029 time frame.

Be the first to comment