tiero/iStock via Getty Images

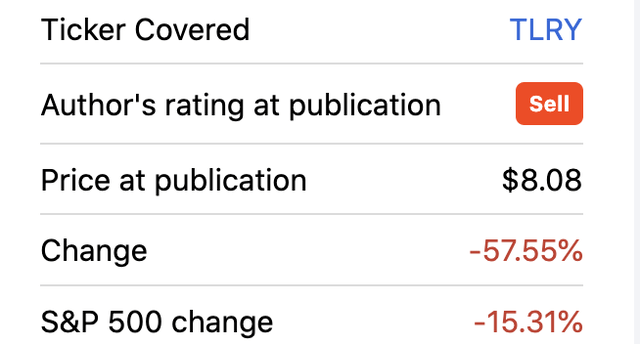

Canadian cannabis stocks like Tilray Brands (NASDAQ:TLRY) continue to crash to new lows. Most of these cannabis companies north of the border lack a strong business path forward being too reliant on the overly competitive Canadian market. My investment thesis remains Bearish on the stock even down at $3.50 despite once trading above $200 during the cannabis heydays of 2018.

Lower Is Not Cheaper

Only 3 months ago, my view saw Tilray as far too expensive above $8. The stock has lost 58% during a period where the S&P 500 fell 15%.

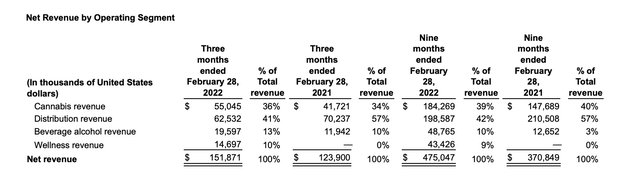

Even with a massive dip, Tilray still has a market cap of nearly $2 billion. When the company reported FQ3’22 results for the period ending in February, quarterly cannabis revenues were only $55 million. The stock recently had a valuation up at $4 billion in a sign of how out of touch the market was with the actual results of the business.

Source: Tilray FQ3’22 earnings release

The biggest revenue bucket is still the near-worthless distribution revenues. Tilray was still producing nearly $63 million worth of distribution revenue with gross margins below 10% in the February quarter leaving not even $90 million worth of revenues from the more promising non-distribution business units.

Until this recent dip, the market hasn’t wanted to fully address the valuation disconnect with the actual Tilray business. The stock still trades at 5x the cannabis/beverage/wellness revenues where adjusted EBITDA margins are around 40%.

Analysts from Piper Sandler suggest FQ4 results aren’t going to be any better. The company is forecast to lose more market share and partner HEXO (HEXO) is in a major struggle to even stay afloat. As with other deals in Canada, Tilray would’ve been better just getting out of the way and letting HEXO crash and burn. HEXO recently withdrew guidance for the next year and recently acquired subsidiary Zenabis Global filed for creditor protection.

No Path Forward

Not long ago, CEO Irwin Simon introduced a plan for Tilray to reach a FY24 sales goal of $4 billion. With a limited revenue base and opportunity in Canada, the company was clearly eyeing the potential to buy their way into the lucrative U.S. market once cannabis becomes federally legal. The CEO even went so far to make the following statement on the recent FQ3’22 earnings release:

Our third quarter results reflect progress and momentum across all of our key business segments and geographies, setting the stage to achieve our target for $4B in revenue by the end of fiscal 2024.

The problem now is that Tilray doesn’t have the balance sheet or equity valuation to aggressively enter the U.S. market, or any other credible plan. The company ended FQ3’22 with a cash balance of $279 million, but Tilray now has total debt of $692 million, leaving net debt above $400 million.

Despite being adjusted EBITDA positive for the year, Tilray actually burned adjusted free cash flow of $105 million for the first 3 quarters of the year.

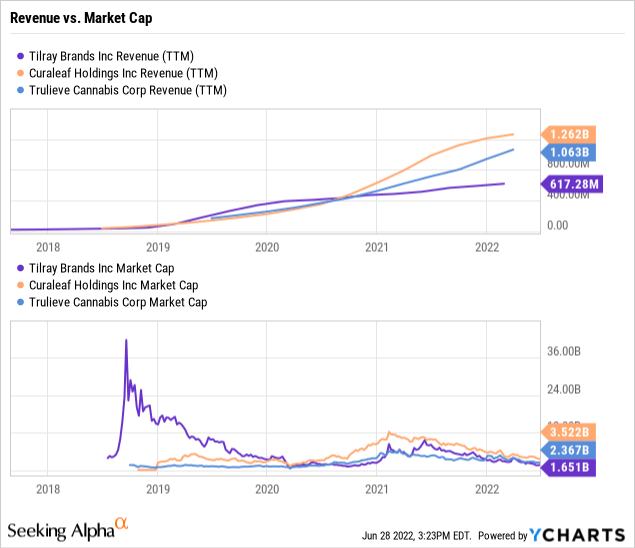

The company no longer has the financial position to compete with the top multi-state operators (MSOs) in the U.S. The script has been completely flipped in the last few years where Curaleaf (OTCPK:CURLF) and Trulieve Cannabis (OTCQX:TCNNF) are far larger companies on both a revenue and market cap basis.

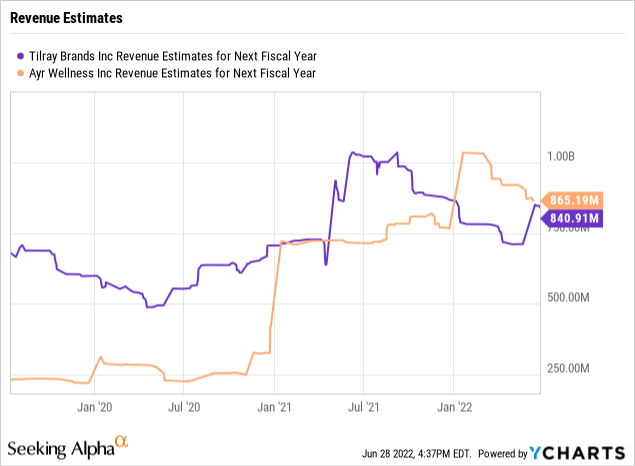

In fact, when looking at revenue targets, Tilray is much more like Ayr Wellness (OTCQX:AYRWF). The company doesn’t have a stock valuation anywhere near Ayr and one still doesn’t view Tilray in the same light as a minor player in cannabis. At least Ayr has access to a limited license in New Jersey, while Tilray has licenses in slow-moving European markets likely to turn highly competitive once recreational cannabis is approved in any particular country.

Tilray just isn’t going to miraculously come into the U.S. market on legalization that might take place several years from now and quickly build a dominant market position. At this point, Ayr Wellness will be out of their league by the end of the year with a booming New Jersey cannabis market alone headed to nearly 50% the size of Canada.

Takeaway

The key investor takeaway is that Tilray Brands has no floor here even at $3.50. The stock isn’t cheap, and the whole business plan doesn’t appear to have much credibility due to the weak balance sheet and limited equity to utilize to enter the U.S. cannabis market when the market finally legalizes.

Be the first to comment