jetcityimage

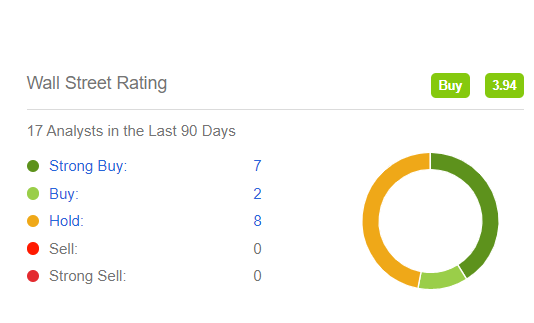

Simon Property Group Inc. (NYSE:SPG) remains a stock where the Seeking Alpha author community is decidedly bullish.

SPG – Seeking Alpha- Aug 25, 2022

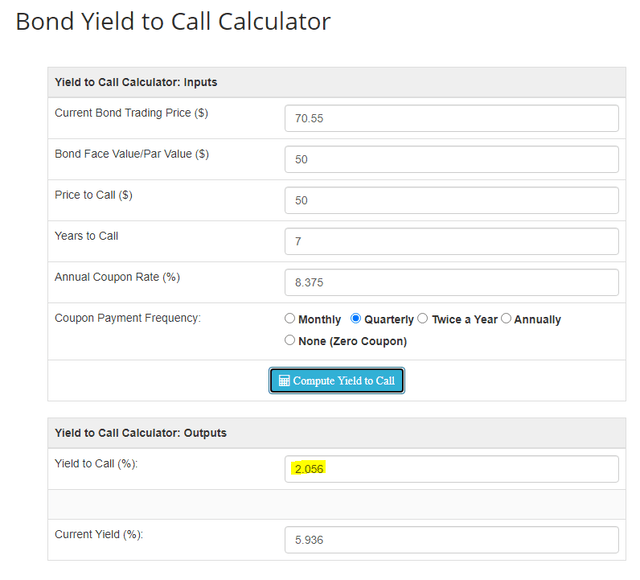

The premier mall and outlet real estate company has proven that it can grow its dividend during tough times while maintaining a solid A- credit rating. When we last covered this stock we stayed neutral on the common shares but warned investors that one of the company’s securities was poised for extremely poor returns. That security in question was Simon Property Group, Inc. PFD J 8.375% (NYSE:SPG.PJ). The 8.375% par yield created a large swath of “greater fools” that had bid this up to an extremely crazy level. At that time we wrote:

We also want to address those just long the preferred shares and getting what they think is a 5.94% yield. At current prices these shares are best sold. There is no scenario where you will do well over the next few years with these. If the bears are right and SPG is ultimately going to grace the footnotes of history books, SPG.PJ will join the common shares down. If the bulls are correct on the premise that SPG survives, you will get $50.00 paid back to you in less than 7 years and that capital loss will offset 5 years of dividend payments.

The Outcome

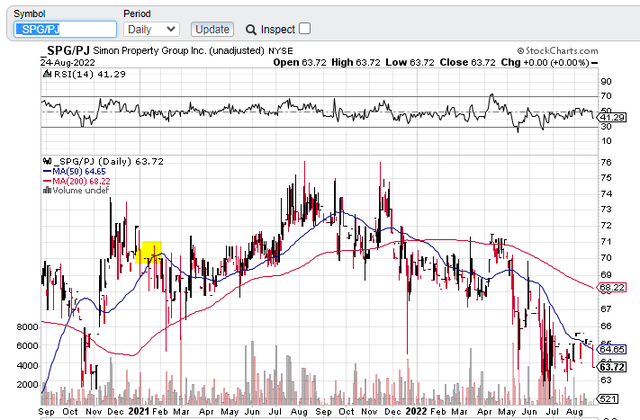

SPG.PJ was trading at $70.55 at the time and the loss of $6.83 in capital must hurt investors.

Investors of course got dividends and with the 8.375% yield coupon, accumulated a grand total of $7.33 in dividends. This gets us to a total return of 50 cents per share over 20 months or 0.42% annualized. Actual effective return would be less if you had to pay taxes on your dividends and you would land up with negative yield.

Outlook

SPG.PJ redemption is almost a certainty and the date is about 5 years away.

The Simon 8 3/8% Preferred Stock will not be redeemable before October 15, 2027. On or after October 15, 2027, Simon may redeem, in whole or in part, the Simon 8 3/8% Preferred Stock at any time at a redemption price equal to 100% of the liquidation preference plus accumulated and unpaid dividends, if any, thereon to, but excluding, the redemption date. The redemption price of the Simon 8 3/8% Preferred Stock (other than any portion thereof consisting of accumulated and unpaid dividends) shall be paid solely from the sale proceeds of other capital stock of Simon and not from any other source.

Source: SPG.PJ Issuance Information

When we last covered this, there was an element of doubt on how things would progress with the pandemic, but at this point, that element has disappeared. Simon’s recent dividend boost of 6% shows just how well the mall REIT is doing.

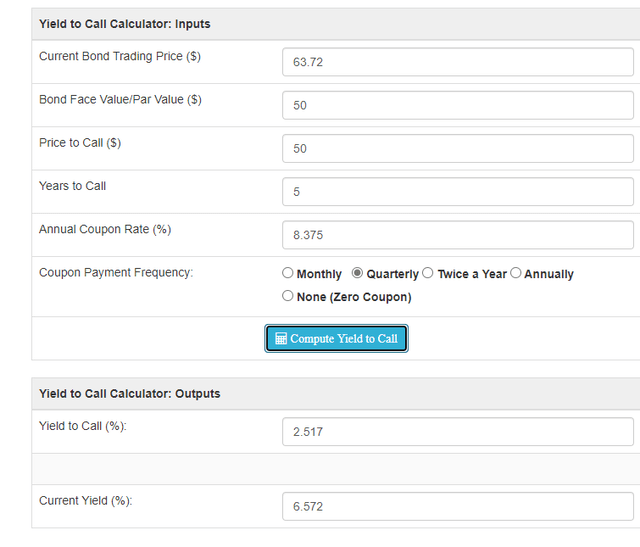

The very low returns on the preferred shares over the last 20 months have improved returns for current holders/buyers, but the amount is minuscule.

They currently offer a yield to call of 2.517%. This is of course better than the 2.056% offer in January 2021, but really unacceptable considering where interest rates are.

What Should You Do?

Holding to maturity is certainly an option for those that enjoy poor returns. That 2.517% real yield is better than what you enjoyed over the last 20 months if you held the stock. But you can do better and we suggest you look at the exact same company from a different lens. No, we are not referring to the common shares. While they have their merits, they certainly don’t have the riskless profile of a limited term preferred issuance.

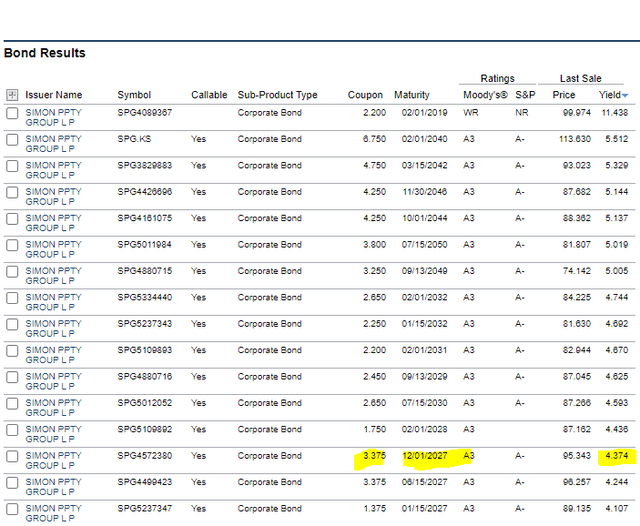

We are actually referring to the quality bonds of SPG, which as everyone knows, rank even higher than the preferred shares. The best one we can think of matures very close to the date when the preferred shares should be redeemed. The 21/01/2017 3.375% yielding bonds have a yield to maturity of 4.374%.

That is about 1.9% higher than your return on the preferred shares. Yes there is a built-in capital appreciation which you receive at maturity. Nonetheless you are getting a far better deal with A- rated bonds versus the preferred issuance.

Conclusion

Yield chasing never works. Efficient market hypothesis has its flaws. Those would be our two main takeaways here. There is no logical reason for bonds of SPG to have a better yield to maturity than the preferreds but the former are better deals by far. “Investors” continue to favor the high coupons which deplete their principal, something we also see in the CLO space. Investors should make the switch and not look back.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment