Dina Damotseva/iStock via Getty Images

The sharp rise in interest rates has caused many assets to experience material devaluation in 2022. Unsurprisingly, one of the worst-performing sectors this year is REITs, with the sector being the second-worst (next to consumer discretionary) with a 26% YTD loss. Rising interest rates asymmetrically impact REITs because they cause assets’ capitalization rates to decline and the “discounted fair value” of estimated future cash flows. Additionally, some REITs with high debt have become at risk of losing much of their cash flow if they refinance at higher rates or have variable-rate debt.

As discussed in “XLV: US Healthcare Sector Getting Crushed By Its Own Weight,” regarding the healthcare ETF (XLV), the healthcare sector has faced increasing challenges over the past years which have accelerated in 2022. The rise in inflation, combined with already sky-high healthcare spending, has caused the prices of most medical care to decline relative to inflation. While this has not negatively impacted the earnings of most healthcare stocks, I believe it will slow their growth and negatively impact many over the coming years.

Hospitals, which are not a factor in XLV, are experiencing the most pain from inflation as rising labor, supply, and energy costs overwhelm the system, particularly given the inability to increase healthcare premiums simultaneously. This shift has resulted in the bankruptcy of a growing number of hospitals – a trend that may accelerate as inflation (and the hospital labor shortage) remain factors. Surveys show that most hospitals are seeing growing financial strain this year amid rising costs and falling sales, with most struggling at an increasing pace for years.

The combined trend against REITs and hospitals has weighed down medical REITs. One notable example is Global Medical REIT (NYSE:GMRE), which has lost 48% of its value this year and is now trading below its pandemic lows. The core cause of this decline is growing investor concerns about the growing financial strain on medical REIT tenants and the variety of negative impacts of rising interest rates on REITs (and, to a lesser extent, hospitals). That said, GMRE now trades at a very low “P/FFO” of only 10X and has a 9% forward yield, making it an attractive investment to many value-oriented investors. While most analysts are very bullish on the firm despite its immense losses, investors may benefit from taking a level-headed look at its growing risk exposures.

GMRE May Face Growing Tenant Bankruptcy

Global Medical REIT suffered a significant decline in October when one of its tenants, Pipeline Health System, which operates seven hospitals in three states, announced Chapter 11 bankruptcy. The company will continue to operate through the restructuring process and is meeting its rental obligations. Global Medical REIT believes that the firm will meet its lease payments. That said, Global Medical REIT has given relatively little information on how it expects the bankruptcy to impact the firm over the coming year.

In my view, the core risk is not the direct impact of the Pipeline Health System bankruptcy but the potential for more similar events on the immediate and medium horizon. Pipeline Health System is not an isolated rural hospital; it is a national operator with a diversified portfolio. The chief stated reason for its bankruptcy is “skyrocketing labor costs and supply costs, and decreased ability to generate revenue.” Those same factors are negatively impacting virtually all hospitals in the US.

The nurse shortage, the primary factor driving labor costs, is still growing and shows no signs of letting up, forcing many hospitals to utilize much higher-cost travel nurses. The nurse shortage, and labor shortages in general, create added strain and safety risks on remaining workers, often spurring greater burnout and job-switching. As such, surveys suggest that half of all nurses are currently considering leaving the profession altogether. Similar trends are likely being seen across hospitals’ workforce, indicating a significant probability of continued growth in the shortages and, therefore, even higher wage costs.

To add to the strain, many hospitals are also grappling with growing supply chain pressures which have caused supply costs to soar. At the same time, insurance premiums are no longer rising after two decades of immense growth. Inpatient and outpatient care comprise the most considerable healthcare spending and is over 2X higher than the cost in comparable countries (even after tax and payee differences). In my view, that factor is a strong indication that hospitals will not see their revenue rise over the coming year or two and likely longer as the US GDP can not afford to put more money into the sector (already putting nearly 2X as much as peer countries). Further, as the prices of food, energy, and other necessities grow (and real wages fall), people will certainly not be able to afford higher insurance premiums.

Overall, I believe this economic trend clearly illustrates the significant risk to GMRE as it appears more of its tenants will likely experience bankruptcy over the coming years. The Chapter 11 filing of its tenant is probably not a “one-off” but a “canary in the coal mine,” signaling more considerable trouble ahead as hospitals lose their ability to generate excess earnings amid a combination of long-term strains. The pandemic accelerated this trend, but it was becoming an issue before 2020. Additionally, a recession may also accelerate the trend by increasing non-payment risks. Still, it appears likely to persist regardless, given the secular trends within the hospital and healthcare sectors.

What is GMRE Worth?

Investors in GMRE should be attentive to the high fundamentals risks the firm faces. To a large extent, those prospects are not apparent looking directly at GMRE’s financial data since they primarily relate to the financial deterioration of its tenants. However, if a more significant number of medical offices go bankrupt, then GMRE could see highly rapid declines in cash flow. While only 6% of its rent comes directly from surgical hospitals (with most, 68% from medical offices), all of its tenants are likely facing a growing labor shortage and wage strains, and a great deal are probably struggling with supply costs and falling revenues.

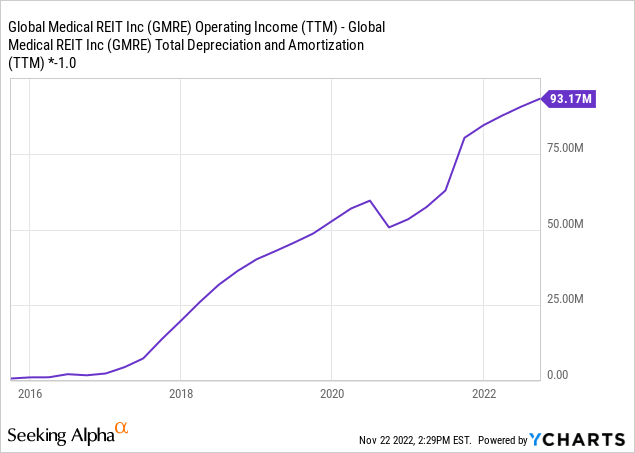

Global Medical REIT’s assets were purchased with a weighted-average capitalization rate of 7.7%, according to the firm. The REIT has generated roughly $93M in net operating income over the past year, measured as operating income plus depreciation and amortization. See below:

While the firm’s NOI has risen dramatically over the past five years, it has not risen on a per-share basis as it has grown by raising new equity capital (as is the case for most REITs). Its current TTM NOI per share is roughly $1.4. At a 7.7% capitalization rate, the total estimated value of its property assets is around $1.21B. The company had around $86M in additional tangible assets at the end of the last quarter, giving the firm a total estimate asset value of ~$1.297B. Subtracting $742.2B in total liabilities, $75M in preferred equity, and $15.9M in minority interest, the firm’s total estimated net asset value, based on a 7.7% capitalization rate, is $464M (or $6.96 per share). Accordingly, the stock is likely 36% above its NAV at its current market capitalization of $630M.

There are a few other core issues I see with the firm. For one, it has a relatively high debt level compared to its assets, particularly considering it owns higher-risk properties with above-average capitalization rates. Secondly, the firm has consistently had negative free cash flow since its inception. That is partly due to its effort to acquire properties, but it also indicates that it faces relatively large maintenance expenses that may not improve asset values sufficiently. Of course, the pandemic and its various impacts on hospitals may skew that factor as it relates to the 2020-2021 period.

Some investors may argue that using a 7.7% capitalization rate is too high. Indeed, in 2021, medical offices carried a lower average capitalization rate of 5.9%, with capitalization rates generally ranging from 5-7% across the healthcare sector last year. Using the lower 5.9% capitalization rate, GMRE’s property assets would be worth closer to $1.58B and total assets of $1.66B. Subtracting liabilities and other interests, its estimated NAV rises up to $832M, 32% above its current market capitalization. As such, assuming capitalization rates are still at extreme lows, then one could argue GMRE is undervalued and should be worth closer to $12.5 per share.

In my view, it is not logical to assume 2021’s extremely low capitalization rates apply to the market today. For one, interest rates, and specifically mortgage rates, are tremendously higher than they were a year ago. Indeed, at today’s mortgage rates, an investor would need a capitalization rate of at least around 6% just to break even after interest, over twice as high as levels from last year. Considering interest rates are the primary driver of capitalization rates, cap rates should soar from 2021’s extreme lows. Indeed, even if commercial property prices have yet to adjust, the 90% decline YoY in REIT capital raises makes it quite clear the CRE market will face a sharp reversal in sales activity.

Even a 7.7% capitalization rate does not fully account for the rising bankruptcy risks in many medical offices, hospitals, and other medical buildings over the past year. If we account for that factor, then a capitalization rate valuation of 8-9% may be justifiable. Of course, the market may not realize healthcare establishments’ seemingly large (and growing) financial risk for some time, so I do not expect such a risk re-valuation in healthcare cap rates to occur soon.

The Bottom Line

Overall, I am bearish on GMRE due to its high risk of material overvaluation. The primary reason for this apparent overvaluation is a rise in capitalization rates associated with increased mortgage rates. Most REITs share this risk factor, and I expect will become more apparent in 2023 as CRE sales plummet. The second and equally large risk factor facing GMRE is a rise in cap rates of healthcare establishments associated with increasing default risks. In my view, the recent default of one of its smaller tenants is likely a signal for a larger wave, given there are no indications that healthcare operators will see greater financial stability in 2023 (and many point to further deterioration). I expect this risk factor will result in fewer investors wishing to buy medical buildings, causing their cap rates to rise like those of retail and lodging. This risk may also be realized more directly through a decline in NOI associated with a sharp rise in tenant bankruptcies; however, that may still be some years away.

In my view, GMRE is likely worth closer to $6.9 per share today as indicated by my initial NAV estimate. The stock fell quite close to this level in October when its tenant declared bankruptcy, indicating there may be a $7 price floor. Hypothetically, there may be a short opportunity in GMRE due to the seemingly high immediate risk that it re-touches this floor as the REIT is revalued. GMRE indeed appears cheap due to its low valuation and high yield, but that is largely due to its greater leverage level and higher-risk assets. Obviously, a risk of shorting the stock is the carry cost of its ~9% yield (which should persist for now) and the potential for the stock to rise due to a perceived value opportunity. That said, with commercial mortgage rates where they are and medical offices facing growing long-term financial burdens, I believe it is almost inevitable that Global Medical REIT eventually faces material devaluation from its current price.

Be the first to comment