andresr

Investment Summary

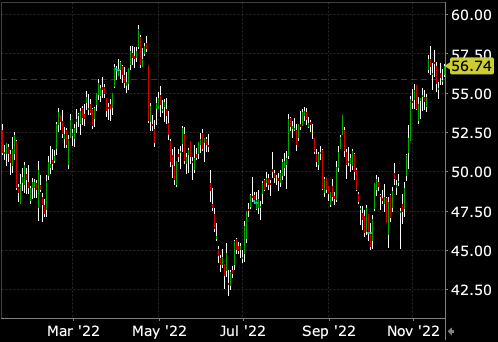

We’re seeing good upside capture on our defensive healthcare longs we called earlier in the year. Since our last rating on Encompass Health Corporation (NYSE:EHC), we remained bullish on the stock. It has continued building an ascending base and is up nearly 9% towards our long-term target of $84.75.

In the previous analysis, we noted the following:

- Return on invested capital (“ROIC”) and free cash flow (“FCF”) remain a standout for the company.

- CMS had established a 4% update to its final rule for the FY23 inpatient rehab franchise (“IRF”) basket.

- Adjusted-EBITDA pulled in from $279mm in Q2 FY21 to $240mm in Q2 FY22.

- A fair valuation of $84.75.

Macro data has been kind to equity investors in Q3, Q4 FY22, so we continue to see medium-term value in defensive healthcare names like EHC. We are now paying ~15x trailing P/E for EHC and this is a reasonable number in our opinion that’s also below sector averages. Net-net, we rate the stock a buy on 20x forward P/E, seeking a second target to $74.5, and retain our long-term target of $84.75.

Exhibit 1. EHC 6-month price evolution

Data: Interactive Brokers TWS

Q3 earnings growth abundant, despite industry headwinds

EHC reported its Q2 FY22 financial results in October. Management noted demand for core services is strong, as total discharges grew 7.5%, with same-store discharge growth of 4.1%.

We note it opened 3 de novo facilities in Q3 bringing the YTD total to 9. It remains on track to open 8 de novo facilities in FY23. We should also bear in mind EHC added 20 beds to its existing hospitals last quarter, 87 in total this YTD. It now expects its de novo facilities to break even in Q4, after setbacks from the hurricane and labor-related costs.

Speaking of the labor market, EHC says it’s built a centralized recruiting function to good effect. As such, same store hires lifted 62% YoY to 459, from 289 a year ago. Same-store RN hires were also up to 183 from 149 last year. Labor shortages are impacting the wider industry, and this could be a key differentiator for EHC looking ahead.

Turning to the financials, and we observed EHC’s 7.8% YoY revenue growth to $1.09Bn, on adjusted EBITDA of $195mm. We can see it pulled this down to FCF of $294mm. and net earnings of $0.64 per share, down from $0.76 a year ago.

Drilling further into the numbers, our analysis is as follows:

- Firstly, revenue per discharge resulted in an 820bp YoY growth in inpatient turnover.

- Unlike many of its peers, management note that labor challenges didn’t limit volume growth. This is definitely a key differentiator in our opinion.

- Nevertheless, it did factor higher staffing expenditures within its input costs. To illustrate, contract labor and sign-on/shift bonuses lifted substantially to $49mm from $24.8mm last year. Despite this, it was down ~29% sequentially from Q2 FY22.

- We consider this a tailwind for EHC, as our findings indicate it’s realized sequential declines in contract labor expenses for every month since March 2022. Should the trend continue, this is accretive to net operating profit after tax (“NOPAT”).

- Moreover, agency rates per full-time equivalent (“FTE”) was $205,000, down from $233,000 from the previous quarter. Hence, we are seeing various input costs trending down for EHC across the remainder of FY22.

No change in profitability trends from last findings

In our last report, we were impressed by EHC’s NOPAT conversion from its invested capital. We also pointed out that capital intensity is flattening, providing good headroom for NOPAT to grow.

These trends continued into Q3. It was no wonder, therefore, to see the TTM return on average equity (“ROE”) come into 22.6%, 4 percentage points higher than last year. It continues to recognize a c7% quarterly return on assets (“ROA”) and this is matched by its longer-term trends in ROIC, discussed last time.

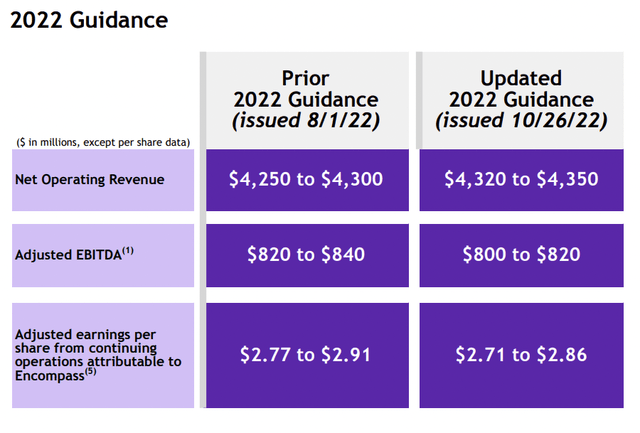

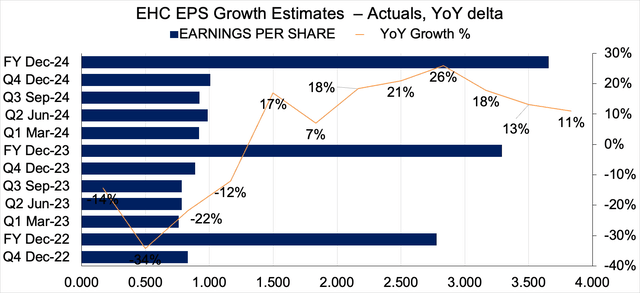

We also point investors to the fact management revised FY22 guidance down slightly. However, this is expected in the current macro landscape. It now sees $4.35Bn at the top line on adjusted EBITDA of $820mm at the upper end of guidance. Similarly, it’s revised its EPS range down to $2.86 at the high end [Exhibit 2].

Underlining these assumptions is a 4% increase in Medicare pricing for Q4 FY22, before sequestration resumes. It also sees a 5–6% increase in salaries and benefits per FTE [including sign-on and shift bonuses]. This is in keeping with its current strategy, and thus not a surprise in our opinion.

Exhibit 2. EHC FY22 guidance

Data: EHC Q3 FY22 Investor Presentation

By comparison, our internal forecasts derive a steady line of growth at the bottom for EHC downstream, with EPS stretching up from FY23 [Exhibit 3]. At the same time, we argue the downside in revenue guidance is well reflected in the stock price and investors are happy paying the current multiples in spite of this.

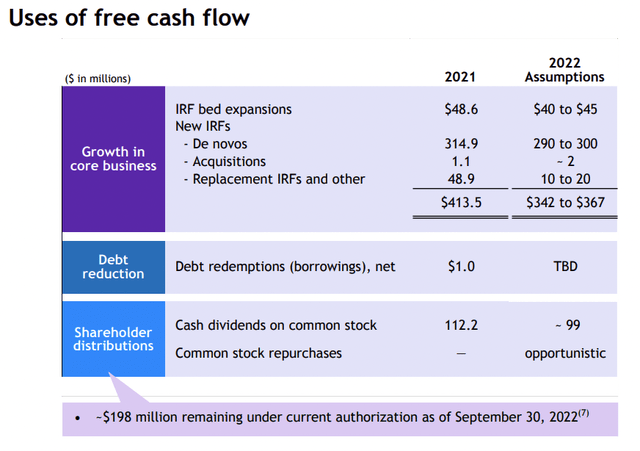

It’s also worth mentioning EHC projects ~$215m in maintenance CapEx for FY22 and to record FCF of $385mm. Management note it intends to distribute its FCF reinvestment between growth initiatives and deleveraging [Exhibit 4].

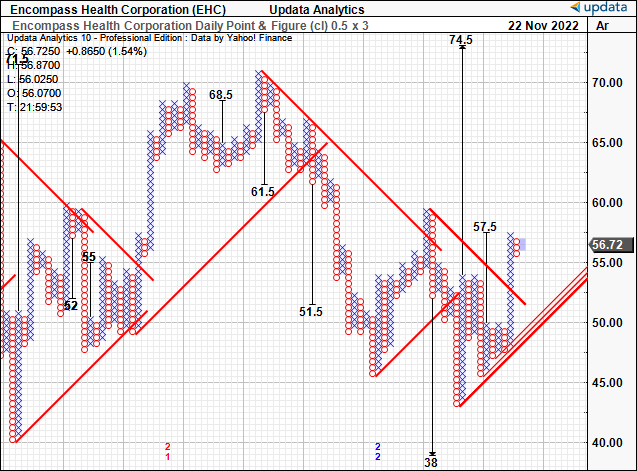

Exhibit 3. EHC Forward EPS estimates FY22-24′, Qrtly, annual. FY23 continues to be key growth route.

Exhibit 4. EHC intended uses of FCF [it projects $385mm for FY22]

Data: EHC Q3 FY22 Investor presentation, pp. 15

Valuation and conclusion

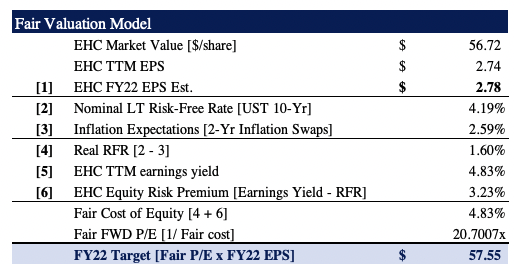

We note that consensus values EHC at 19x forward earnings, and this could be a fair estimate given growth assumptions looking ahead. We’d be a step above consensus at 20x forward P/E. Assigning the 20x multiple to our FY22 EPS estimates of $2.78 derives a price objective of $57.55 [Exhibit 5].

We, therefore, believe EHC is fair and reasonably valued, and that investors would be paying a fair price at this multiple.

In addition, we see additional upside targets to $74.5, based on point and figure charting seen in Exhibit 6. The $57.50 target is also well supported with this study, as seen. These targets have served us well to date.

Exhibit 5. EHC fair and reasonably priced at current market price

Note: Fair forward price-earnings multiple calculated as 1/fair cost of equity. This is known as the ‘steady state’ P/E. For more and literature see: [M. Mauboussin, D. Callahan, (2014): What Does a Price-Earnings Multiple Mean?; An Analytical Bridge between P/Es and Solid Economics, Credit Suisse Global Financial Strategies, January 29 2014] (Data: HB Insights Estimates)

Exhibit 6. Upside targets to $57.5 then $74.5, these targets have served us well to date.

Data: Updata

As such we continue to rate Encompass Health Corporation a buy on fundamental value. There are multiple supporting factors in the investment debate. We rate the stock a buy with price targets of $57.50, then $74.50, finally retaining our long-term target for Encompass Health Corporation of $84.75.

Be the first to comment