piranka

On a relative return basis, 2022 has been a good year for dividend and growth stocks. In fact, it has been one of the few sweet spots in the market this past year. Consider that as of Tuesday’s (11/22/2022) close, the DJIA is down just -6.2%, while the Nasdaq is down -28.6%.

There are obviously a lot more dividend and growth stocks in the DJIA than in the Nasdaq. This year’s rising interest rate environment has taken a bigger toll on longer duration higher PE ratio stocks than on shorter duration lower PE ratio names. We warned about this back in an article that we wrote in February of this year.

The Impact Of Rising Interest Rates On Stocks

The yield on the 10-year U.S. treasury began 2022 at 1.51%. It closed on Tuesday (11/22/2022) at 3.83%.

Stockcharts.com

In rising interest rate environments like the one we are in, multiples on stocks contract. The longer the duration of the stock and the higher the PE (or in many cases no PE), the more vulnerable the stock.

A great case in point is the fact that Cathie Wood’s flagship ARK Innovation fund (ARKK) is down more than -62% year to date. We discussed the headwinds rising rates create for high PE names in January’s article, highlighting the inverse ARKK position (SARK).

2022 has not been a good year for stocks like Zoom (ZM), Roku (ROKU), Teladoc (TDOC), Carvana (CVNA), Robinhood (HOOD), etc. Furthermore, we do not think that 2023 will be a favorable environment for this high-flying segment of the market either.

The Multiple Contraction Impact On The Indexes

At the beginning of the year, the stocks that make up the DJIA traded at much lower PE ratios than the stocks that make up the Nasdaq. Therefore, they were much less vulnerable to rising interest rates.

The PE ratio gap one year ago between these two indexes was also much greater than it is today. Twelve months ago, the DJIA was trading at a PE ratio of 22.2X, while the Nasdaq was trading at 36.1X. As you can see the Nasdaq was much more vulnerable to rising interest rates than was the DJIA.

As of Tuesday (11/22/2022), the DJIA is trading at a PE ratio of 21.2X, while the Nasdaq is trading at a multiple of 24.4X. Multiple compression has accounted for most of the drop in the indexes this year. It has not been so much of an earnings problem, as a multiple problem.

We think that yields will continue to grind higher in 2023. Dividend and growth stocks should continue to be one of the better places to be invested in 2023.

3 Current New Buys

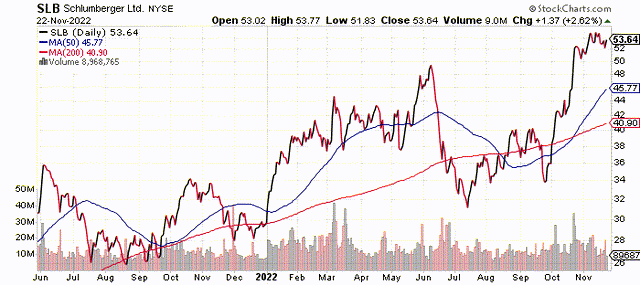

Schlumberger Limited (SLB)

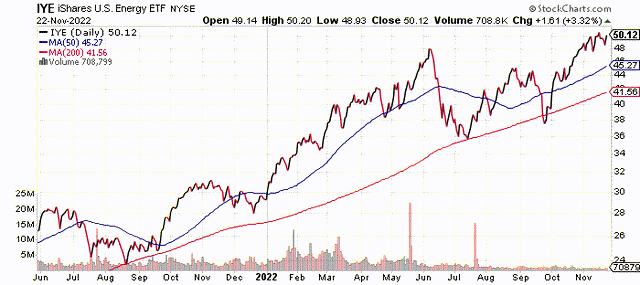

The energy sector is one of the few sectors that has done well in 2022. The iShares U.S. Energy Index (IYE) ETF is up 50.8% YTD, as of Tuesday’s close.

Schlumberger is now up 79.1% year-to-date and is one of the best performing stocks in the group.

Like it or not, the war on fossil fuels continues and this has been a big reason behind the rise in oil prices and oil stocks this year.

At a $76B in market cap, the stock is a large-cap dividend and growth stock. By this I don’t mean that the company is only growing the dividend, but more importantly it’s also growing earnings.

For me, this is a much preferred scenario to big lumbering stocks like AT&T (T) 5.8% yield, Altria (MO) 8.3% yield, or Verizon (VZ) 6.7% yield, that sport hefty dividend yields but are barely growing their earnings.

By contrast, Schlumberger has a smaller dividend yield (1.3%), but it’s expected to continue to grow its earnings at an average annual rate of 15%-20% over the next five years. This gives the company’s stock price upside potential and increases SLB’s ability to grow future dividend distributions.

We currently have a five-year target price on the stock of $108 per share. It’s currently trading at $53. The major risk to the price of the shares going forward would be a global recession or continued tightening of drilling regulations.

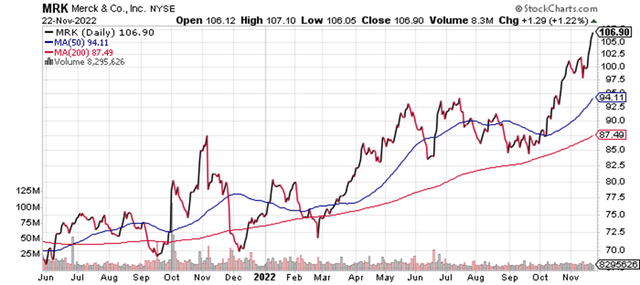

Merck & Co., Inc. (MRK)

Merck & Co. has a fantastic chart right now. In fact, it continues to hit new highs.

Stockcharts.com

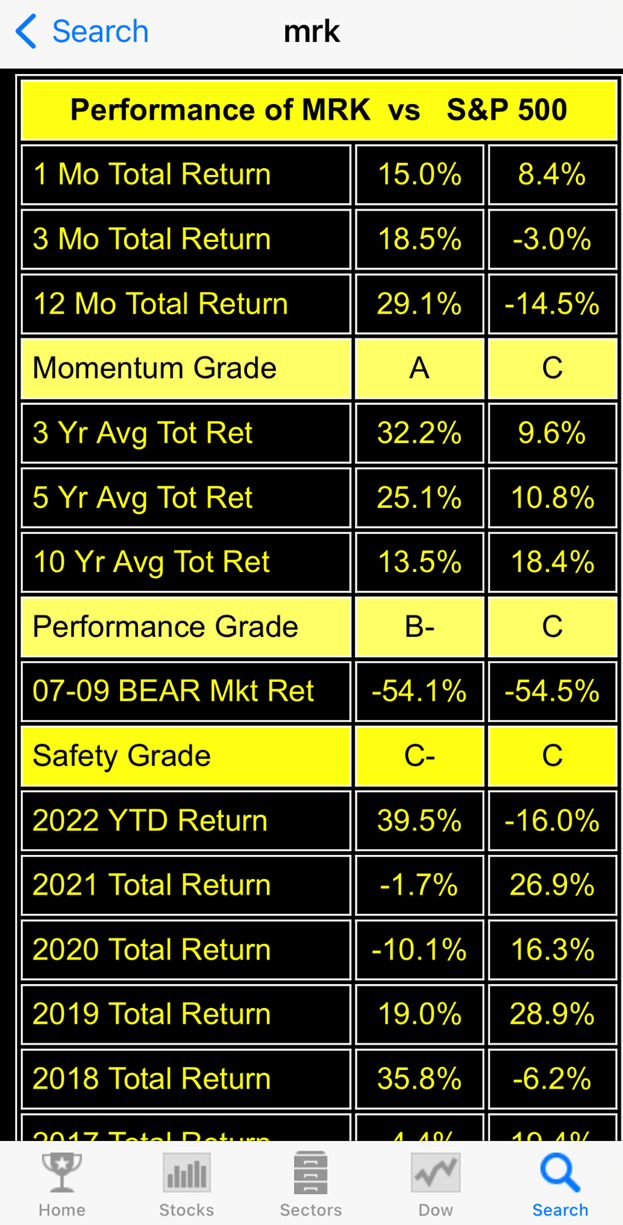

The stock is up 39.5% so far this year. This compares to a drop of 14.5% in the S&P 500 during that same period of time. Over the last three years it has delivered an annual return 32.2% per year while the S&P 500 has delivered an average return of 9.6%.

BSN App

Data from www.BestStocksNowApp.com

But, can Merck continue to deliver alpha going forward? We think that Merck can continue to deliver 11%-12% average annual growth over the next five years. This is based on their current lineup of their blockbuster drug Keytruda, Gardasil, Bridion and possible future drugs that will either come through their pipeline or potential acquisitions.

We have a five-year target price of $175 per share, which gives it plenty of upside potential along with its current dividend yield of 2.6%

The risks lie in too much reliance on the main drug Keytruda and in their drug pipeline failing to produce new drugs.

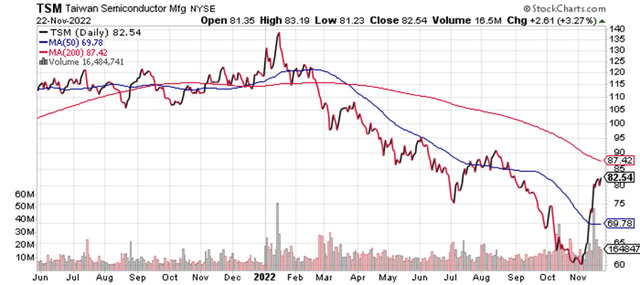

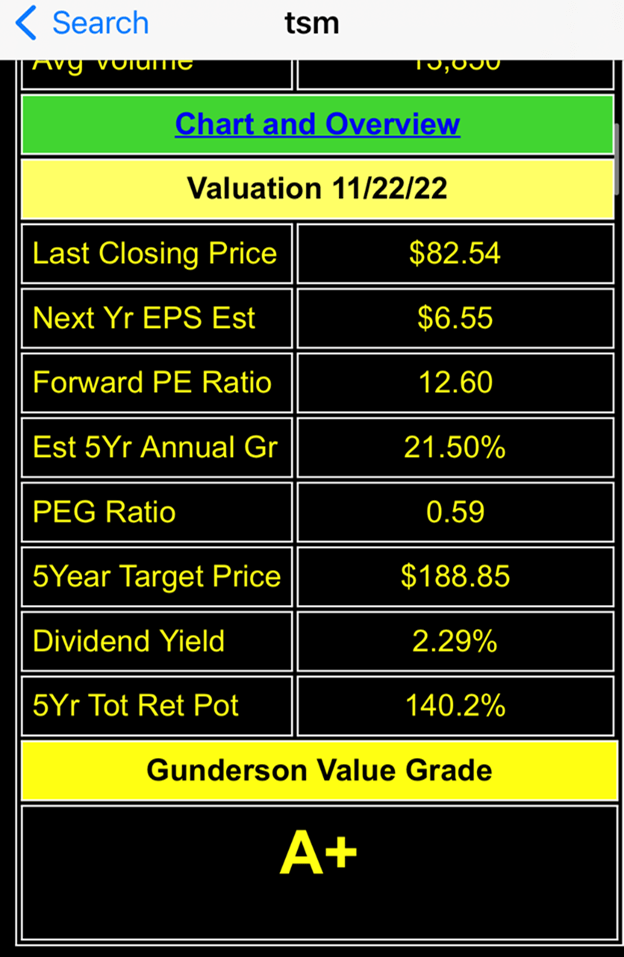

Taiwan Semiconductor (TSM)

We wrote an in-depth article on Taiwan Semiconductor way back on Nov. 16, 2020. The stock was trading at $97.98 at the time. It got as high as $142 per share just a little over three months later on Feb. 19, 2021.

The stock then went sideways for most of 2021, but finally topped out in mid-January of this year at $145. But, then interest rates started to rise and with TSM trading at a PE ratio that was ranging between 25-30X it became vulnerable to multiple contraction.

Stockcharts.com

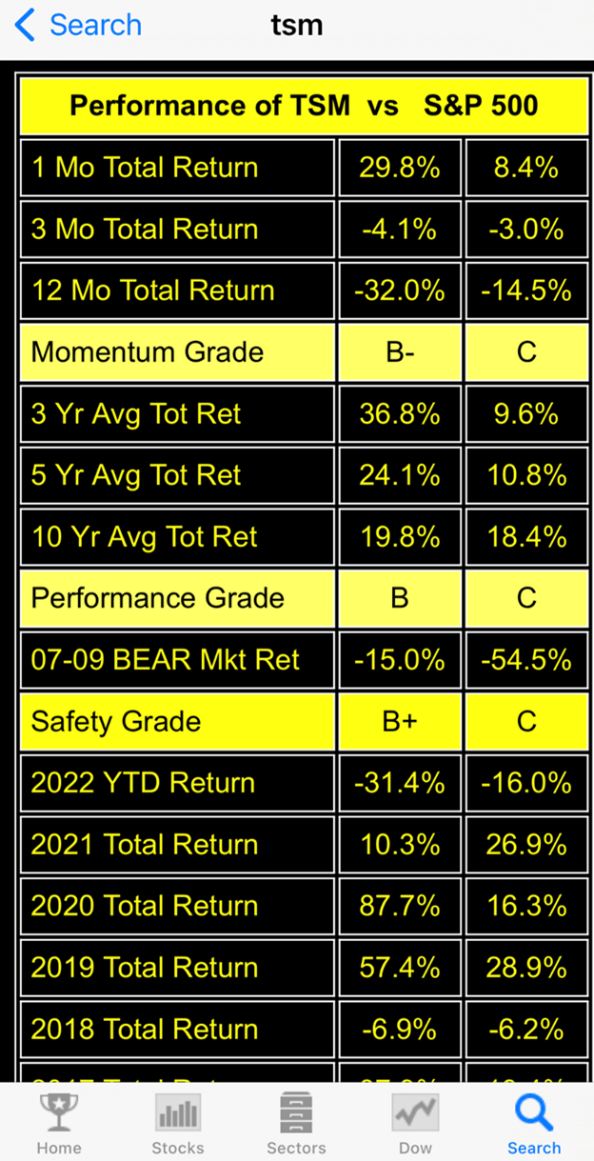

The stock is now down -31.4% year-to-date, but it has been a good deliver of alpha over the years.

BSN App

Data from www.BestStocksNowApp.com

The PE multiple has now contracted to a very attractive PE ratio of 14X. In fact, it has become so attractive from a value proposition, that it has attracted the buying of Warren Buffet’s Berkshire Hathaway (BRK.A) (BRK.B).

Our valuation methodology calculates a five-year target price of $188.85 on the shares of Taiwan Semiconductor. This gives the stock 140.2% upside potential when you include an annual dividend of 2.29%.

BSN App

Data from www.BestStocksNowApp.com

We got back into Taiwan Semiconductor at $82.09 per share last Friday. We own it in both our Premier Growth and Dividend & Growth Portfolios. It represents a 5% overall position in each respective portfolio. These are two of the six portfolios that we make available on our premium subscription service.

The biggest uncertainty for Taiwan Semiconductor is geopolitical risk and a potential global recession.

As of now, 2023 is shaping up to be a “skinny” year in the market, meaning that there’s not going to be a lot of upside potential in the indexes. Goldman Sachs recently predicted zero growth in S&P 500 earnings for 2023. We’re currently at about 5% growth. That does not leave a much room for error. Investors will have to look for individual opportunities that have a better than average potential of delivering alpha against the indexes. We think that all three of these stocks present that opportunity.

Be the first to comment