Kameleon007

Introduction

With Avalon Holdings Inc. (NYSE:AWX) reporting earnings after the close of the market last Friday and also filing it’s 10Q with the SEC, I thought I would take the time to dig a little deeper into its Q2 earnings and highlight some of the positive trends that are developing in their businesses, especially within the hotel and golf business. I will then address some of my concerns about the Q2 report as well. I will take a closer look at what I believe is a litigation catalyst for some significant upside appreciation in the stock price from 2 pending lawsuits awaiting final judgments in the coming months and conclude with an analysis of why I believe AWX is significantly undervalued at current price levels

Company Background

For those readers who are unfamiliar with the company, AWX in the past was primarily known as a waste management company based in Ohio, with more than 80% of its revenues being generated from that business. Starting in 2014, they purchased the Magnuson Grand Hotel and proceeded to invest over $34,000,000 in renovations and rebranded it as The Grand Resort.

Sunset at The Grand Resort in Warren, Ohio (Facebook Page)

During this same period AWX also purchased several other golf courses and tennis facilities in the neighboring vicinity. The company has now transformed itself into a hotel & leisure company as well as a waste management company. In fact the real growth opportunity, in my opinion, lies in this sector of the business, which now accounts for almost 50% of the company’s overall revenues. Below is a great video of all that Grand Resort has to offer and why it is fast being recognized as a destination resort

A Tour of The Grand Resort in Warren, Ohio

And also a video of the 4 golf courses they either own or hold long term leases on where hotel guests and club members along with the general public are able to play

Q2 Earnings Analysis

As we dig into the 2nd QTR earnings report, the first thing that stands out is that revenue grew to $19.5 million from $16.4 million in 2021, a healthy 19% YOY growth. The waste management services grew 23% YOY, with gross margins increasing to 21% from 20% in 2021. This increase in gross margins is particularly impressive during the higher inflationary period we are experiencing. It means AWX is having no problem passing on costs to its customers. The hotel & golf business grew 14% YOY. In looking closely at the hotel & golf business, we see that hotel room revenues grew at over 30% which stemmed from both higher occupancy rates and higher room rates. Their spa & salon revenues grew at over 80% YOY which obviously means more guests are utilizing these premium services. Their restaurant & bar revenues and their membership dues revenues grew at 8%, while their golf, tennis and fitness revenues grew at only 3%. My take on these #’s is that the Grand Resort must be attracting a lot of new and repeat visitors who are utilizing the resorts premium services. This bodes well for it becoming a destination resort for vacations and romantic getaways. The revenues from ongoing membership to the various golf & tennis country clubs is not showing as much robust growth as the hotel is. This could just be related to seasonality or weather factors during Q2. We will have to look closely at Q3 comparisons to see whether this was just a seasonal slowing of revenue growth in the country club business or a trend caused by members having less discretionary income. Inflationary pressures and economic slowdown in the region may be behind this more subdued growth.

Avalon Lakes CC in Warren, Ohio (website)

On the income side of the equation, at first glance it looks like the earnings comparisons are negative when comparing the $.12 EPS in Q2 2022 to the $.19 EPS in Q2 2021, but the 2021 EPS figures would have been a loss of ($.03) EPS in 2021 had it not been for the PPP Loan forgiveness gains which added $877K or $.22 in EPS to those 2021 Q2 figures. Operating income in 2022 Q2 was $592K versus only 27K in 2021 Q2, so in reality not only did revenues grow YOY but operating income did as well. So overall the Q2 was a solid quarter in terms of both revenue and net income growth. I did see one area of concern on the operating costs side of the ledger and that was the 20% rise in operating costs YOY in the hotel & golf business. If operating costs had not risen as dramatically, then EPS figures would have been even better. The driving factor behind this spike in operating costs was mainly associated with wage increases and overall price inflation in cost of goods. I am sure that the tight labor market had something to do with the wage increases, as the need for employee retention is important in the services sector. Hopefully a slowing economy combined with the possibility of peak inflation will allow revenue growth to outpace operating costs in the coming quarters.

Moon over The Grand Resort in Warren, Ohio (website)

Potential Legal Catalyst

I want to point out two important pending legal cases that are highlighted in AWX’s recent 10Q and should the company win one or both of these cases, I believe they may act as a catalyst on the upside for the price of AWX’s stock. The first lawsuit is a case against Guy Gentile that was filed by AWX in 2018 relating to Mr. Gentile breaking the SEC short swing profit rule with his trades in 2018 of AWX’s stock. The company has already been awarded judgement in its favor, but the final monetary amount to be rewarded has yet to be determined. There is a conference scheduled to be held on Sept 7, 2022 to determine the amount. Guy Gentile claims the amount should be $1.2 million, while AWX claims the figure should be $6.2 million. AWX will get 2/3 of whatever is recovered as the attorneys who represent AWX will get 1/3. Whether that amount is $800K or $4.2M or something in between, if collected from Mr. Gentile, will have a positive impact on reported EPS in the quarter it is declared.

The other lawsuit is potentially an even more significant lawsuit. One of AWX’s subsidiaries AWMS filed suit against the Ohio Department of Natural Resources seeking recovery of damages related to the company’s saltwater injection wells being shut down in 2014. Here is very relevant information related to this case taken directly from the most recent 10Q:

“On March 18, 2019, Avalon received notice that the 11 Appellate District Court in Trumbull County, Ohio issued summary judgment in favor of the Ohio Department of Natural Resources in the writ of mandamus action that resulted from the suspension order of the Company’s saltwater injection well. The decision was appealed to the Supreme Court of Ohio on April 5, 2019. Oral arguments in the case occurred on April 7, 2020. On September 23, 2020, the Supreme Court of Ohio ruled in favor of the Company. The Supreme Court of Ohio reversed the decision of the 11 Appellate District Court and remanded the case back to that court for a trial on the merits. The trial occurred in September and October 2021. The Company is currently awaiting judgment from the 11 Appellate District Court.”

Should the court rule in favor of AWX, the damages in my conservative estimation could be somewhere between $5 and $15 million. This estimate is based on AWMS’s initial cost for the wells plus revenues lost from the wells being shutdown since 2014. A ruling in favor of AWX would be a significant positive impact on EPS, especially for a company that only has 3.9 million shares outstanding.

My Valuation & Risk Thesis

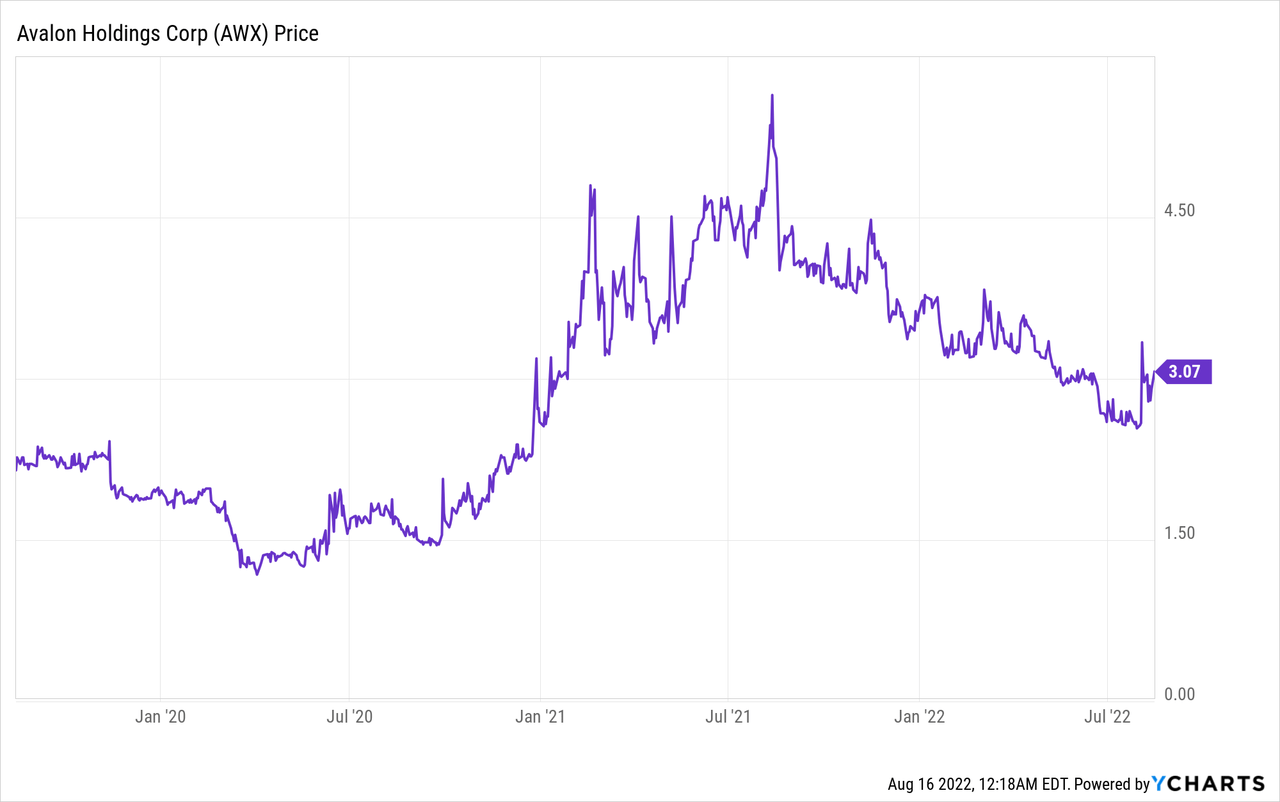

I want to discuss why I believe the stock price is significantly undervalued based on today’s closing price of $3.07. At this price the market capitalization for the company is only 12M, which means AWX currently trades at a Price to Sales ratio of < 0.20 and a Price to Book Value of < 0.30. There are not many companies that you can buy for pennies on the $ that have the high quality of assets that AWX currently has. Keep in mind they are carrying these assets net of depreciation and market value of these assets if sold may be significantly higher than the depreciated value on the books, especially as inflation positively impacts the real estate market in Ohio. The other positive factor potentially impacting the price appreciation potential in the future is the relatively low float available (2.31 million shares). It does not take a lot of demand for price to appreciate from these extremely depressed prices and price swings of 20% or more occurred quite frequently in the past 3 years as seen from the chart below. In fact one of those type price swings just occurred in the past 2 weeks. see chart below

The low valuation combined with the past price volatility will allow both long term focused investors and short term traders to participate in ownership of AWX. The proverbial best of both worlds.

I analyzed the potential reward side of investing in AWX, but it is always appropriate to consider the risk side of the investment as well. While the low float and small market cap offer incredible upside potential, it also provides less market liquidity on a day to day trading basis and also limits some institutions/mutual funds from participation. There is geographic risk associated with an investment in AWX since all of their businesses are located in Ohio and western PA. There is also the risks associated with the ongoing pandemic and its effect on their businesses and an extended recession with continued rising inflation could also negatively impact their businesses as well. I do believe however, that even with these risks and the worst case scenario of a bankruptcy filing, the current valuation of AWX’s real estate holdings provides ample cushion to payoff all debts and still provide shareholders a return on their investment.

Conclusion:

For me over the past 20+ years anytime the price of AWX got under $4 it was a time to start accumulating a position based solely on the value of their underlying assets. I estimate fair market value based on tangible book value, to be around $10 a share. My investment in AWX was usually never about earnings or revenue growth potential. Now however, with the completed renovations of The Grand Resort and after taking a closer look at AWX’s 2nd quarter earnings, not only is AWX a good investment based on asset valuation at current prices, but I now believe the company also has growth and earnings potential moving forward. If you combine this with the potential legal catalysts and low trading float, the upside potential exceeds the downside risks. I do believe patience will be rewarded in the long run, and yet the opportunity for short term traders exists as well.

Be the first to comment