krblokhin

Thesis

One should know irrational euphoria is back when loss generating companies see their stock price quadruple over a great retail coordinated short squeeze. In our view the recent move up in Bed Bath & Beyond (NASDAQ:BBBY) marked the top of the bear market summer rally we just witnessed. We have a tough September and October ahead of us where fear is going to overtake euphoria and meme stock mania is going to subside.

We believe the rally is over in the BBBY stock and a savvy investor can take advantage of the extremely high implied volatility in the BBBY options chain to generate a high level of income via a short call position. This article is going to explore two topics: 1) why dealers are dis-incentivizing retail investors to take short call spreads positions via pricing, 2) how you can make a short call position work for you. With implied volatility in the options chain running above 250 levels for short dated calls an investor can monetize the current mania by shorting vega here. A September 30th naked call at the top of the current range can produce annualized yields above 70%.

Why are dealers trying to choke call-spread trades

For meme stocks the best way (in our humble opinion) to take advantage of the price move and short the name (or simply just make money here) is by utilizing call spreads. However, if we look at the option chain we can see an interesting development:

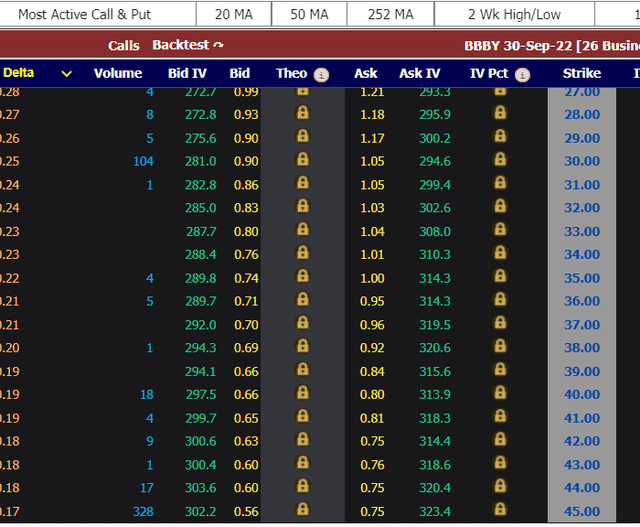

September 30 Call Options (MarketChameleon)

We can see from the above table (run as of August 25 before the market open) that even very low delta call options such as the $45 strike one have very high option premiums ! So if we look closer at the table we can see that $39 strike call premium is very close to the $45 one. And in effect the pickup from the $28 strike to the $45 strike is very low (0.93 – 0.56 =0.37 premium/contract). It does not work this way for normal stocks, even for highly volatile ones. Strikes way out of the money for such short dated tenors as September 30th usually command little to no premium. In a stock’s option chain there is usually an inflection point where the premium “falls off a cliff” because the market is assigning a quasi 0% probability of the event happening.

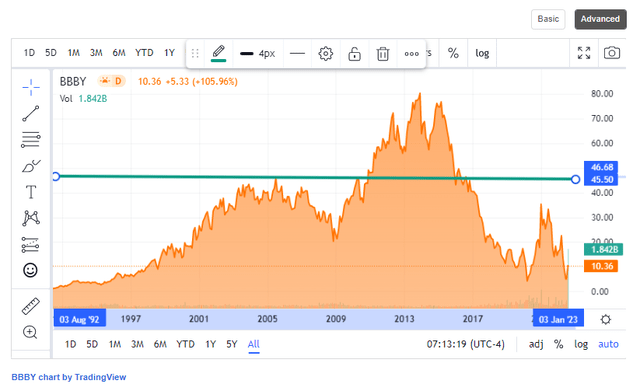

If we look at BBBY we will notice that all of the out-of-the-money strikes (irrespective of how out of the money) command a high premium. Why? Because dealers are trying to choke short call-spread trades. For example a savvy investor could say short the $28 strike and buy a $45 strike call in order to put a cap on potential losses or mitigate brokerage account margin requirements. In our case though the premium $0.37/contract is so small that the trade does not make sense. After the GME experience dealers have realized that the best way to price the call option chain for meme stocks is to have high premiums across the option stack even for options which are as far out of the money as you can think. Looking back historically we can see that BBBY has not traded at that level in the past five years:

How can you make a short call option position work for you

In our opinion the recent top in the BBBY rally is a good top range for a short call position:

On the back of a summer short squeeze we have seen speculative technology stock brought back to life as well as the re-emergence of speculative euphoria driven rallies in meme stocks. We believe the bear market rally is over and the respective momentum is going to percolate to the meme world as well. We are going to pick $20/share as the point to short via selling naked calls:

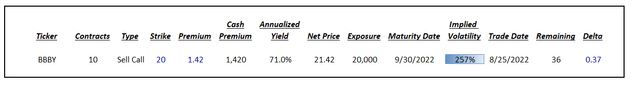

Options Chain (MarketChameleon)

Courtesy of Market Chameleon we can get a snapshot of the current pricing (as of August 25 before the market open) for the September 30, 2022 BBBY option chain. Our proposed trade is a naked $20 strike sell calls trade:

Firstly, this is a very short tenor trade with only 26 business days left until expiry. From the above table we can see that selling 10 contracts gets an investor a cash premium of $1,420, which can represent a 71% annualized yield on the maximum cash out of $20,000. The implied volatility one is monetizing here is enormous, standing at 257% !

The risk here is a massive gap up for BBBY through the strike. Please note that the stock has to double from here to go through the strike. An investor would also need to be aware of the brokerage margin requirements for BBBY in order to asses the capital requirements.

Conclusion

The BBBY stock is the new meme stock. After peaking at $23/share on August 17, the name has given back half of its gains. We believe that the bear market rally we witnessed in July/August is ending and that the “euphoria” trade as reflected in meme stocks is about to end as well. The most conservative way to take advantage of the recent moves in BBBY and the high implied volatility is through being short call spread trades. However, via their pricing, dealers have effectively choked off that trade. The article puts forward a September 30th expiration naked call option trade that can generate annualized yields in excess of 70%.

Be the first to comment