SolStock/E+ via Getty Images

Clothing and other apparel can be an interesting space if you can find the right companies to buy into. Sometimes, the best way to do this is to focus on niche providers. And one great example of this can be seen by looking at Carter’s (NYSE:CRI), which is the largest branded marketer in North America of apparel aimed exclusively toward babies and young children. This industry leader does not, unfortunately, have a consistently growing operating history. But it does have a history of attractive cash flows and shares are trading at fairly cheap levels at this time. All things considered, the company seems to offer a decent amount of upside potential. And as such, I’ve decided to rate it a soft ‘buy’ at this time.

Clothes for little ones

As I mentioned already, Carter’s is the largest branded marketer of apparel for babies and young children on this continent. The company does this through a variety of brands that it owns, including two megabrands: Carter’s and OshKosh B’gosh. Under the Carter’s brand, the company focuses on high-quality apparel and accessories for children ranging from newborn size to age 14. The OshKosh brand focuses on the same demographic, except that its emphasis is on apparel and accessories. In particular, it also has a special concentration regarding play clothes for toddlers and young children.

At present, the company also has a few other brands under its belt. One of these is Skip Hop, which operates as a leading baby and young child lifestyle brand. Under the Child of Mine banner, the company sells its Carter’s products exclusively to Walmart (WMT). Similar arrangements have been made with other retailers. For instance, the company does the same thing with Target (TGT) under the Just One You banner, while for Amazon (AMZN) the brand name used is Simple Joy. Another interesting brand is Little Planet, which focuses on providing sustainable clothing through the sourcing of mostly organic cotton. Like many of the company’s other lines of products, it focuses mostly on baby apparel and accessories. It also has its hands in sleepwear and gift bundles. It’s also worth noting then the company does generate some of its revenue from licensing its brands to its partners. If you ever see one of its brand names on footwear, outerwear, hair accessories, jewelry, toys, paper goods, home decor, cribs, baby furniture, or bedding, then it is almost certainly a scenario of the company licensing out its products to a third party.

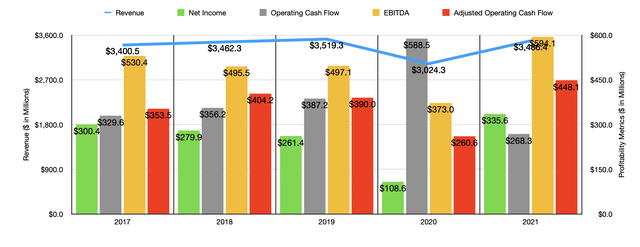

Author – SEC EDGAR Data

For most of the past five years, the overall trajectory for the company’s revenue has been positive. Revenue rose from $3.40 billion in 2017 to $3.52 billion in 2019. The COVID-19 pandemic pushed revenue down to $3.02 billion in 2020. But that decline was short-lived, with sales climbing to $3.49 billion last year. This is not to say that all is well with the company. In fact, the firm is experiencing some weakness in sales this year. For the first half of the year, revenue totaled $1.48 billion. That’s down from the $1.53 billion generated in the first half of the 2021 fiscal year. According to the data provided, this 3.4% decrease in revenue year over year was driven largely by decreased net sales associated with the company’s U.S. Retail segment. This is not to say everything on that front was bad. Net sales in the exclusive Carter’s brands, combined with strength throughout Canada and through the international wholesale channels, ultimately increased. But those improvements just weren’t enough to offset the weakening market here at home.

When it comes to profitability, the picture for the business has been a bit more complicated. Between 2017 and 2020, net income for the firm fell year after year, declining from $300.4 million to $108.6 million. But then, in 2021, profitability shot up to $335.6 million. Other profitability metrics, meanwhile, have generally been positive. Operating cash flow, for instance, rose between 2017 and 2020, eventually dropping though from $588.5 million in 2020 to $268.3 million last year. If we adjust for changes in working capital, however, it would have risen from $260.6 million in 2020 to $448.1 million last year. Over that same window of time, EBITDA has also been volatile. But what’s most important is that the metric ultimately hit $594.1 million last year for what was an at-least five-year high.

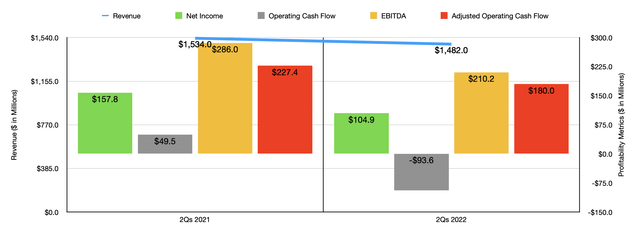

Author – SEC EDGAR Data

As you might expect, profitability so far this year has taken a step back. Net income in the first half of the year totaled $104.9 million. That’s down from the $157.8 million we get using 2021 results. Even though revenue decreased for the company, its cost of goods sold managed to rise year over year, climbing by 1.2% in all. That, offset some by adverse purchase commitments, help to push the company’s gross profit margin down from 49.6% to 46.3%. On the fabric purchase commitment side, management said that they booked a charge as a result of reduced forward inventory commitments aimed at better aligning with lower demand forecasts. It also involved increased inventory provisions and other related changes. In addition, the company also experienced an increase in transportation costs, largely associated with its U.S. Wholesale segment. This could be a sign of further pain to come. You see, year over year, the company increased its inventory reserves by 14.8%, with total inventories rising by 38.5%. This follows a similar trend seen with some major retailers recently, indicating that excess inventories might ultimately weigh on profitability for the near term. Naturally, as the chart above illustrates, these issues have also negatively impacted the company’s other profitability metrics like operating cash flow, adjusted operating cash flow, and EBITDA.

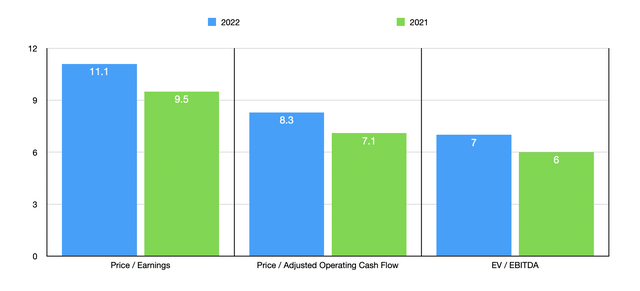

Author – SEC EDGAR Data

When it comes to the 2022 fiscal year as a whole, management does think that revenue will come in at between $3.25 billion and $3.30 billion. This does imply continued weakness for the rest of the year. As part of this, earnings per share should come in between $7.10 and $7.60. At the midpoint, that would imply net income of $286.6 million. That’s quite a decline from the $335.6 million reported last year. If we annualize results achieved so far this year for the other profitability metrics, we should expect adjusted operating cash flow of $382.7 million and EBITDA of roughly $507.4 million. Even with these declines, shares of the business are attractively priced. The forward price to earnings multiple of the company should be 11.1. That compares to the 9.5 reading we get using 2021 results. The price to adjusted operating cash flow multiple should rise from 7.1 to 8.3, while the EV to EBITDA multiple should increase from 6 to 7. To put this all in perspective, I compared the company to five similar businesses. On a forward price-to-earnings basis, these companies ranged from a low of 9.5 to a high of 34.8. Two of the five companies were cheaper than our prospect. Using the price to operating cash flow approach, the range was from 8 to 13.8, with only one of the companies cheaper than Carter’s. And when it comes to the EV to EBITDA approach, the range was from 8 to 10, with our prospect being the cheapest of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Carter’s | 11.1 | 8.3 | 7.0 |

| Hanesbrands (HBI) | 9.5 | 8.0 | 10.0 |

| Ermenegildo Zegna N.V. (ZGN) | 34.8 | 12.3 | 9.9 |

| Under Armour (UAA) | 16.5 | 13.8 | 9.6 |

| Kontoor Brands (KTB) | 10.0 | 9.0 | 8.0 |

| Canada Goose Holdings (GOOS) | 15.8 | 10.8 | 9.5 |

Takeaway

Operationally speaking, Carter’s seems to be doing quite well considering recent economic issues. Having said that, this year will be somewhat painful for the business compared to what last year was. It’s also possible, depending on how bad things get, that this pain could worsen further next year. But that is highly speculative. Assuming the picture doesn’t get much worse, shares of the company do look to be trading on the cheap on an absolute basis and are even trading on the lower end of the spectrum compared to similar firms. I am somewhat unnerved by the historical performance of the firm from a profitability perspective. But all things considered, I do believe a soft ‘buy’ rating for the company is appropriate at this time.

Be the first to comment