SergiyMolchenko/iStock via Getty Images

With the turbulent security and supply of the fossil fuel market in 2022, green energy policies gaining momentum across the globe, alongside record-breaking heatwaves, forest fires and floods filling our daily newsfeed, these are all shining a light on the importance of the renewable energy sector. Experts expect the global solar market to reach more than double its capacity from 1 terawatt to 2.3 terawatts by 2025. One company contributing to gigawatt production across the globe is seemingly undervalued stock, Maxeon Solar Technologies, Ltd. (NASDAQ:MAXN). Albeit volatile, this small-cap stock at $842.237 million experienced a 119.79% increase in stock price over the last six months.

Although the company has mixed analyst reviews, it is not expected to reach profitability soon and has missed EPS expectations for the previous four consecutive quarters. I believe it has upside potential due to new legislations opening up market penetration opportunities, an upward growth performance in revenue and volume, a recent renewal of an exclusive contract to supply SunPower until October 2023 in the USA and Canada, strong strategic partner alliances with TZS and TotalEnergies, technology advancements driving down solar panel costs, new contracts adjusted for supply chain disruption costs and the plan to invest in a substantial multi-gig solar manufacturing facility in the USA. This mouthful of information makes me excited about MAXN and makes me believe that investors may want to take a bullish stance on this company.

Stock price 6 month range (SeekingAlpha.com)

The Climate Bill and its immediate impact

Renewable energy company stock prices have had a considerable boost this week with a landmark climate bill announcement which aims to dedicate $370 billion to clean climate initiatives in the States to reduce greenhouse gas emissions dramatically. Irrespective of your thoughts on the ambitious bill, it could spur significant market transformations. This Saturday, the legislation has successfully been voted in. One of the benefits for solar companies is that consumers with solar systems will receive a 30% tax credit. For MAXN, a global manufacturer and marketer of solar systems, the bill would support its growth plans in the States, including investment plans to build its first-ever solar manufacturing facility.

Company Overview

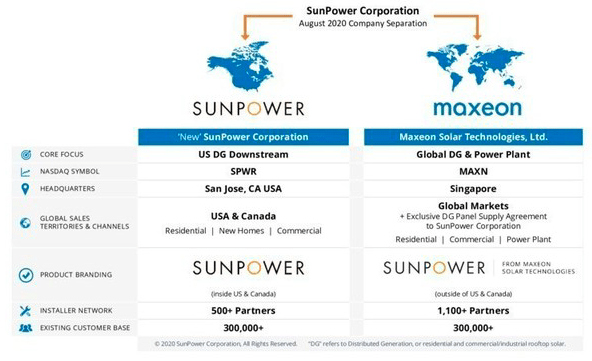

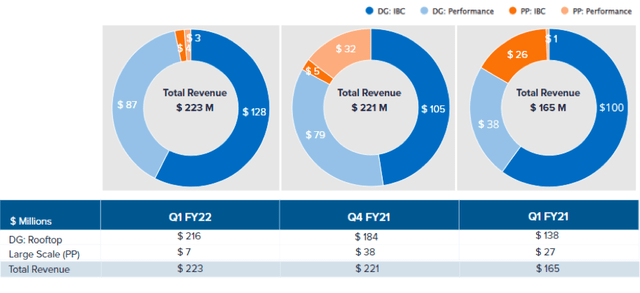

MAXN, located in Singapore, is a spin-off of SunPower (SPWR). The CEO, Jeff Waters, was previously part of SPWR. It became an independent public company in August 2020. The companies have several agreements which have created a framework for the relationship between the two. As seen in the table below MAXN focuses on producing solutions for two divisions, for residential rooftops (DG) and for its sizeable utility-scale power plant market. It manufactures SunPower branded solar panels for SunPower’s North American residential market.

SunPower and Maxeon Spinoff (Maxeon Investor Presentation 2022)

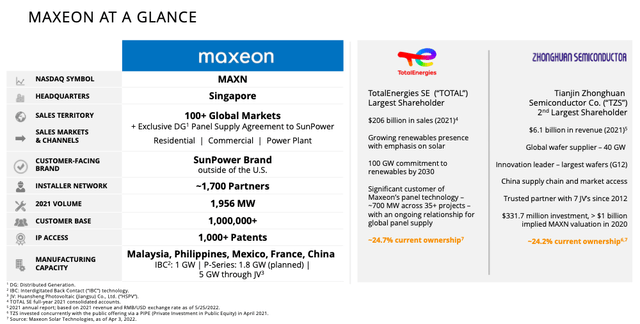

It is one of the market leaders worldwide in manufacturing and marketing solar power solutions with over 35 years of experience. Today the company holds over 1300 patents and is known as a premium, high-quality company within the industry.

Maxeon Overview (Maxeon Investor Presentation 2022)

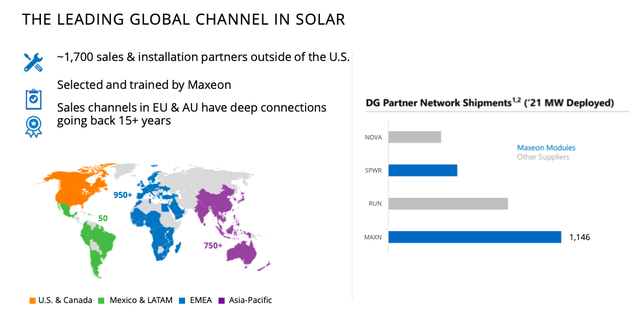

Technological innovation and investment drive its successful market growth and brand reputation. Furthermore, it has built strong strategic relationships with localised sales and distribution channels in over 100 countries with dealers, installers, distributors and white label partners. The company has over 930 sales and installation partners in EMEA, over 490 in the Asia Pacific region, and over 25 in Latin America. In the USA, it has an exclusive contract with SPWR to supply its residential products.

Solar manufacturing facilities are located in Malaysia and the Philippines, while solar assembly plants are based in France, Mexico and Malaysia. Furthermore, it has been utilising an assembly plant in China since 2017 through a joint venture with SunPower and TZS.

Maxeon Global Presence (Maxeon Investor Presentation 2022)

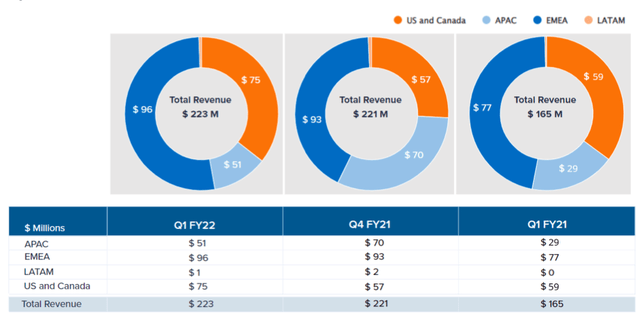

Up until now EMEA has been its biggest market, accounting for 43.8% of its 2021 fiscal year revenue, North America followed with 29.0% of revenue, and Asia Pacific accounted for 24.7%, lastly a small 2.5% is classified under other markets. The company has a goal to increase its direct engagement with the USA consumers, which is currently predominantly through SPWR.

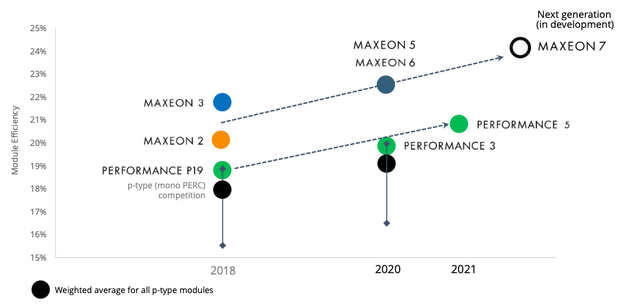

The company’s technology is said to deliver 20% more energy than competitors since 2012, irrespective of roof space, and over a 25 year span. It has a leading 40 year warranty. Part of its success is investing $543 million in R&D since 2007. In the graph below we can see the upgraded performance of its solutions.

Solar Solution Developments and Upgrades (Maxeon Investor Presentation 2022)

Investing based on green legislation, market expansion and technological advances

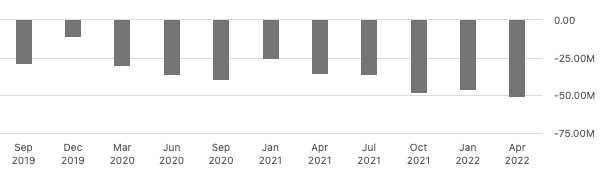

As with my previous article on solar panel manufacturing competitor NOVA, MAXN does not look attractive on the financial front. In Q1 2022, we saw a negative and growing adjusted EBITDA, and operating income is decreasing per quarter, as seen on the graph below. The company aims to reach 12% adjusted EBITDA in 2023. There is confidence that the ramp-up of nearly completed investment projects and direct sales in the US market will boost growth.

Operating Income per Quarter (SeekingAlpha.com)

Solar companies are very cost-heavy, requiring significant capital investments into manufacturing and assembly activities. If we look at capital expenditure over the years, we saw expenditure growing from $41.9 million in 2019, increasing by 286% to $154.2 million at fiscal year-end in 2021. Capital expenditure in Q1 2022 was $21.682 million. The spending is primarily related to expanding manufacturing and assembly capacity and improving technology. Operational cash flow, financing and additional forms of liquidity fund the activities mentioned above.

Furthermore, supply chain disruption heavily impacted costs for MAXN because of its fixed long-term contracts with customers and potential prospects. However, times are changing, and developers are starting to accept future cost index risk sharing on contracts.

We want to look at the capacity growth potential and market growth, and here we see some impressive numbers. Demand is soaring for solar, and the ability to match demand is part of MAXN’s growth plan. The residential rooftops (DG) is its largest division in terms of revenue, as seen in the graphs below.

Revenue by Division (Maxeon Investor Presentation 2022)

Its residential (DG) division’s volume and revenue grew by 75% YoY from the previous Q1 2021 results. The DG market also has a positive gross margin. The expectation is for growth to increase with the new legislation easing market penetration in the States and improving customer payback periods. The US utility-scale is a new division for the company, and results are due in the upcoming Q2 2022 financial report. There have already been 700 megawatts of bookings for 2023.

The European and Australian markets are the front runners for MAXN, as seen in the graph below.

Revenue by Region (Maxeon Investor Presentation 2022)

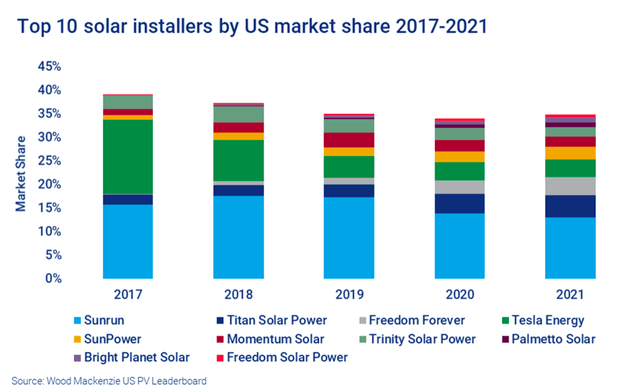

Although MAXN has a 35-year history in operations, it has only been an independent public company since August 2020. The company does not have a long history of financials to match its long history, and it has not yet released its Q2 2022 results. However, we can learn a lot from SunPower’s past performance. SunPower’s Q2 2022 results show that there has been an agreement to supply a more significant number of solar solutions until year-end to meet consumer demand, which is a positive indication for growth in the US market. It is also benefiting from SunPower’s YoY market share in the USA since 2017, as seen below.

Solar Power Market in the USA (Wood Mackenzie)

Today, its price to enterprise value to sales ratio 12-month trailing is 0.88, below the industry median. It has a negative profit margin of 32.7%, but the most sales growth has been 34.9%. The company will not be profitable in the next year. The company doesn’t pay any dividends, and analysts have mixed reviews about the future potential of this company. However, we cannot ignore the impressive upward trend over the last months. The one-year target price estimate on Yahoo Finance of $13.60 is 38.8% under the current stock price. However, we should be cautious of the volatile price history. Last year, February 2021 was as high as $50.17, and February 2022 was as low as $8.84.

Future and Final Thoughts

Cautious of the volatile nature of solar stocks, especially regarding geopolitical changes. We cannot ignore the fast pace at which the solar market is growing. Reduced cost of solar generation, government policies and incentives, media coverage, fossil fuel supply and security limitations, increased electricity demand and opportunities in regions without access to fuel resources are all reasons to take some interest in this industry.

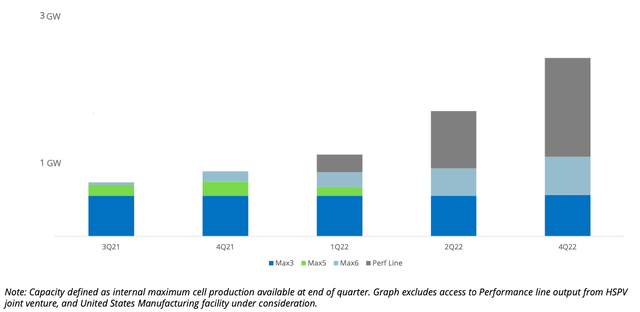

MAXN is increasing its production capacity with its newer products which, due to advanced technologies, have simpler processes, reduced costs and require 50% less capital intensity. Furthermore, it is innovating future products, namely Maxeon 7, which is currently under development and has the potential to grow the market and improve margins with a reduction in costs.

Increasing capacity over the quarters (Maxeon Investor Presentation 2022)

Finally, it has ambitious plans to grow its US market, and there are strong indications to believe it will be expanding its manufacturing facilities in the United States market very soon. Although this company is not yet attractive financially, its market presence, leading product reputation, and growth potential incentivised by new legislation make me believe investors may want to take a bullish stance on this company.

Be the first to comment