Niall_Majury

Introduction

Brookfield Asset Management (NYSE:BAM) plans to distribute one-fourth of their Manager business to shareholders later this year. The Manager business will trade under the BAM symbol and the Corporation will change from the BAM symbol to the proposed BN symbol. This was explained in detail in the 2022 Investor Day presentation. My thesis is that investors have decisions to make in the coming months as businesses that are now traded as one entity under the BAM ticker symbol will soon be partially separated such that they will be traded as two entities under the BN and BAM ticker symbols.

Management’s Plan Value

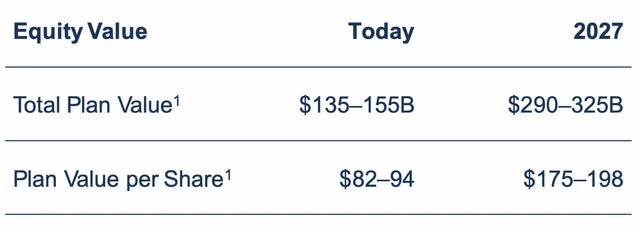

Investors should try to understand management’s plan value and decide how it relates to their own thoughts on the range for intrinsic value. Both of these ranges should then be compared to current market prices and the new market prices after the distribution. Management used a combined plan value range of $135 to $155 billion in slide 54 of the 2022 Investor Day presentation and they get to the higher end of the range by using a free related earnings multiplier of 35x instead of 25x which adds about $20 billion:

Brookfield plan value (2022 Investor Day)

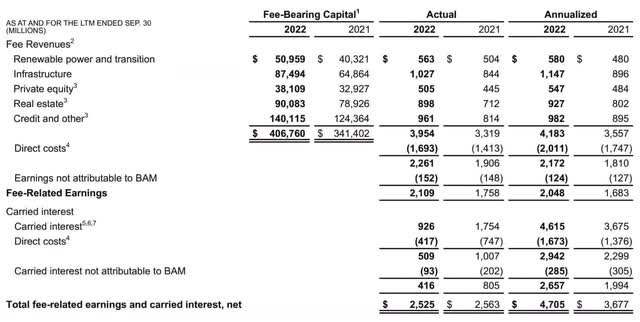

I think management was rounding to the nearest $5 billion above because slide 99 of the 2022 Investor Day presentation shows a plan value range of $133 to $153 billion. Either way, we can get close to this range with the numbers in the 3Q22 supplemental. Management was using older numbers in the Investor Day presentation so the ranges don’t tie exactly but they are close. We have $2,048 million in annualized fee related earnings and $2,657 million in annualized carried interest per slide 6 of the 3Q22 supplemental:

BAM asset management (3Q22 supplemental)

Per slide 17 of the 3Q22 supplemental, we also have $5,483 million in accumulated carried interest. Using the valuation template management has referenced in the past, the low-end valuation of the fee related earnings stream is 25x the $2,048 million annualized figure or $51.2 billion. The high end of the fee related earnings stream is 35x the $2,048 million annualized or $71.7 billion. The target carry component is 10x the annualized $2,657 figure or $26.6 billion. We add the $5.5 billion accumulated carry to get an asset management valuation of $83.3 to $103.8 billion.

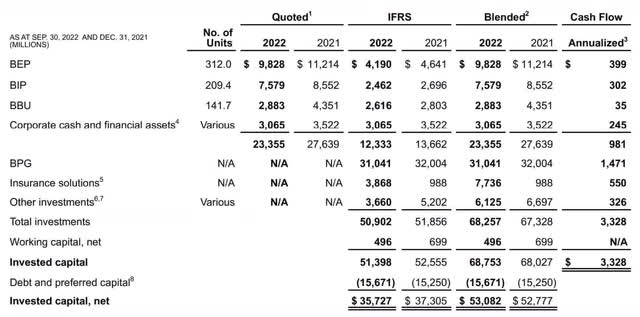

We have $53.1 billion in invested capital per slide 7 of the 3Q22 supplemental:

BAM invested capital (3Q22 supplemental)

Adding the $83.3 to $103.8 billion asset management business and the $53.1 billion invested capital gets us to a valuation range of $136.4 to $156.9 billion which is close to the $135 to $155 billion plan value range used at the 2022 Investor Day.

The invested capital lines with values of $5 billion or more deserve special mention as investors decide whether to accept the blended value figures.

$9,828 million is the blended value for Brookfield Renewable Partners (BEP) and it is based on quoted market prices since BAM has an ownership interest of 48%. BEP’s businesses tend to have high barriers to entry; dams used for hydroelectric plants are the perfect example. Other investment vehicles can pool capital together but they don’t have the operational experience that we see at Brookfield; other companies can’t go out there and operate a dam. BEP should continue to have outsized financial returns given their operational excellence that comes from years of experience. BEP tends to invest in businesses that are long term or perpetual in nature and they tend to do it at the right time. Years ago management made the determination that coal plants were not long term in nature. Rather than jumping right into solar and wind when the economics were challenging, they invested heavily in hydro. Then when the economics for solar and wind improved, Brookfield stepped up their investments in these areas. One of the problems with solar and wind is storage but BAM CEO Bruce Flatt said this is changing in his 3Q22 letter to shareholders:

The greatest criticism of wind and solar has been that there are times when the wind doesn’t blow and the sun doesn’t shine. Technology, though, is quickly moving towards breakthroughs that will allow batteries to store electricity efficiently, and for hydrogen to be utilized to store electricity in conjunction with renewables. As these technologies advance, renewables will soon become baseload electricity, eliminating the need for other historically important technologies to augment wind and solar.

The 3Q22 BEP shareholder letter from CEO Connor Teskey talks about the value of hydro and nuclear given the storage challenges above with solar and wind:

Further, any credible net-zero plan must include a meaningful and growing amount of nuclear power. Intermittent renewable technologies must be complemented by dispatchable resources. As the owner of one of the largest hydro businesses globally, we are seeing the increasing value of clean, dispatchable, baseload power generation. Like hydro, nuclear power provides a reliable and economic source of electricity to the grid. Going forward, we believe hydro and nuclear power will be the key technologies facilitating the rapid growth of intermittent solar and wind.

BAM’s Brookfield Infrastructure Partners (BIP) interest has a blended value of $7,579 million which is again based on quoted market prices as BAM’s ownership position is 27%. BIP’s 3Q22 funds from operations (“FFO”) figure was $522 million but that includes a loss of $106 million from Corporate. Ignoring the Corporate loss, the segment FFO and percentage of the total were $196 million and 31% for Utilities, $203 million and 32% for Transport, $172 million and 27% for Midstream and $60 million and 10% for Data. BIP’s 3Q22 letter from CEO Sam Pollock explains that the recent Intel deal should be impactful. BIP and Intel have a partnership for a $30 billion semiconductor foundry in Arizona:

Brookfield will be providing approximately $15 billion over the construction period for a 49% interest in the facility. The majority of our capital commitment has been sourced from non-recourse debt, with base interest rate exposure fully hedged concurrent with signing. Moreover, the majority of the Brookfield’s approximately $2 billion equity investment ($500 million net to BIP) is back-end weighted closer to the operational phase of the project. This investment is structured to achieve an attractive risk-adjusted return. We draw parallels to other data investments such as hyperscale data centers that are generally contracted on a long-term basis, with highly creditworthy counterparties, where we do not assume technological risk.

After taking BPY private, BAM owns 100% of BPG and the blended value is a massive $31,041 million. It is noteworthy that BPY’s quoted value was always below the plan value numbers from BAM management.

The blended value for the insurance solutions line continues to increase. I didn’t see the line in the 1Q22 supplement. In the 2Q22 supplement, it was $3,868 million for the period and $988 million for the 2Q21 period from the previous year. In the 3Q22 supplement, it was $7,736 million for the period and again $988 million for the period a year earlier – 3Q21. The “Other investments” line has a blended value of $6,125 million.

The insurance solutions line and the other investments line are tricky as they have no quoted value but the blended value is significantly higher than the IFRS value. The insurance IFRS value of $3,868 million is well below the blended value of $7,736 million and the other investments IFRS value of $3,660 million is well below the blended value of $6,125 million. Management is a bit taciturn with some of the details behind these enormous gaps. Footnote #5 says the insurance number comes from management’s view while footnotes #6 and #7 say that other investments include the fair value of comparable residential assets, energy contracts, timber and agricultural assets, BAM’s share of Oaktree and other investments:

5. Blended value represents management’s view of the fair value of our insurance solutions business.

6. Blended value includes the fair value of comparable assets in our Residential segment.

7. Other investments include energy contracts, timber and agricultural assets, other corporate investments, other listed investments and $1.1 billion of investments related to our share of Oaktree (December 31, 2021 – $869 million).

I am comfortable with the BEP and BIP plan value numbers but it’s possible that some in management might be a little optimistic with parts of the plan value considerations for BPG, insurance solutions and other investments.

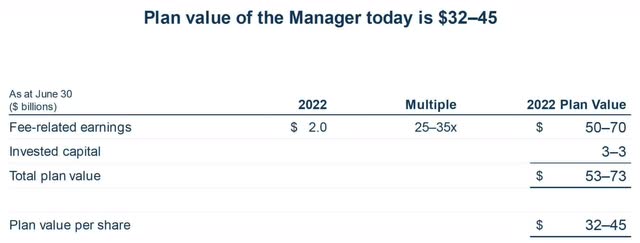

We see on slide 249 of the 2022 Investor Day presentation that the Manager has a plan value of $53 to $73 billion. This is significantly less than the $83.3 to $103.8 billion figure we saw above because of carried interest. Slides 165 and 166 from the 2022 Investor Day presentation explain this as follows:

Manager will earn 100% of fee-related earnings with upside from two-thirds of gross carried interest earned on new funds.

As such, the Manager is only valued with fee-related earnings in terms of today’s plan value numbers:

Manager plan value (2022 Investor Day)

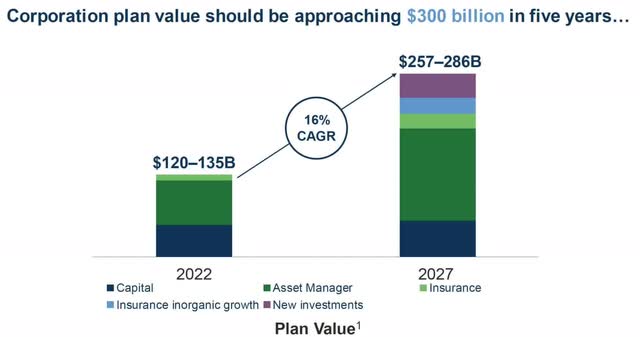

Again, 25% of the manager will be distributed later this year such that the Corporation’s plan value will decrease from the combined plan value above by 1/4th of $53 to $73 billion or $13 to $18 billion. In other words, the Corporation’s plan value will be $122 to $137 billion. Again, it looks like the Investor Day presentation rounds to the nearest $5 billion when showing the Corporation’s plan value as $120 to $135 billion after 1/4th of the Manager is distributed out on slide 97:

Corporation plan value (2022 Investor Day)

My Intrinsic Value

Based on management’s track record, I think the low end of the plan value in the Investor Day presentation is within reason. However, the low end of the Investor Day plan value range is the high end of my intrinsic value range. One reason for this is that years ago management used to use a multiple of 20x for fee related earnings instead of 25 to 35x. Given the increases we’ve seen in interest rates, I like to use the old multiple of 20x such that my intrinsic value for fee related earnings is only $41 billion based on 3Q22 numbers as opposed to the $50 to $70 billion range that management uses from older numbers. Another difference is the real estate business that used to trade as BPY before the parent bought out old shareholders. Again, most of what is now called BPG comes from BPY and it has a blended value of $31 billion but I think its market value could be lower. In addition to complications with BPG, I also question the optimism for the plan value figures of insurance solutions and other investments such that the sum of these 3 components might be $6 billion lower than the low end of management’s plan value. As such, the low end of my intrinsic value range is about $120 billion and the high end of my range is around $135 billion. Again, I think the 2022 Investor Day presentation was based on numbers from the 2Q22 supplement and things have changed a bit since then. The average number of shares outstanding on a fully diluted, time-weighted average basis for the three months ended June 30, 2022 was 1,617.1 million per the 2Q22 supplement. This changed to 1,611.4 million for the three months ended September 30, 2022 per the 3Q22 supplement. It gets confusing if I change the number of shares for the high end of my range so I’m comfortable sticking with the $82 figure from the Investor Day presentation. However, I use the share count of 1,611.4 million from the 3Q22 supplemental for the low end of my intrinsic value range which gives us a share price of $74. In other words, my intrinsic value range is about $74 to $82 per share.

Brookfield’s share price was $46.39 on November 15th, which is well below the low-end plan value figure of $82 used throughout the Investor Day presentation.

CEO Bruce Flatt said the following in the 3Q22 call:

Interest rates should be set to peak in the next six months.

I’m optimistic that CEO Flatt is somewhat correct about interest rates such that Brookfield is a buy for long-term investors. The combined company currently trades at 57% of the low end of management’s plan value. If the newly distributed shares in the Manager trade at about the same percentage of the proportionate low end of management’s plan value, then I’m leaning towards holding onto them.

Forward-looking investors should keep an eye out as BAM shares change to BN and the new BAM shares begin trading. It is important for investors to compare their intrinsic value to market prices and make decisions accordingly.

Be the first to comment