Thomas Barwick/DigitalVision via Getty Images

Investment Thesis

PGT Innovations (NYSE: PGTI) will see growth as a result of its high-quality products and continued acquisitions, plus organic growth. PGTI can provide an excellent return from covered call premiums and dividends even if the stock does not move much.

PGT Innovations

PGT Innovations manufactures and supplies premium windows and doors. Its highly engineered and technically advanced products can withstand some of the harshest weather conditions on Earth and are revolutionizing how people live by unifying indoor and outdoor living spaces. They are the nation’s largest impact-resistant windows and doors manufacturer and hold a leadership position in its primary market.

The company distributes products through multiple channels, including window distributors, building supply distributors, window replacement dealers, and enclosure contractors. The products are sold through authorized dealers and distributor networks in the Caribbean, Florida, Canada, and South and Central America, but most of its revenue is generated from Florida.

The PGT Innovations’ family of brands includes CGI®, PGT® Custom Windows and Doors, WinDoor®, Western Window Systems, Anlin Windows & Doors, Eze-Breeze®, NewSouth Window Solutions, and a 75 percent ownership stake in Eco Window Systems. In their respective markets, the company’s brands are the preferred choice of architects, builders, and homeowners. Their high-quality products are available in custom and standard sizes with massive dimensions that allow for unlimited design possibilities in residential, multi-family, and commercial projects.

Please go here if you want to view a four-minute video about PGTI. PGTI has annual sales of $1.4B with 5.3K employees. They are 95.1% owned by institutions, with 4.3% short interest. Their return on equity is 16.7%, and they have a 9.7% return on invested capital. The free cash flow yield per share is 13.7%, and their buyback yield per share is 0.2%. The price-to-book ratio is 2. Their Piotroski F-score is seven, indicating strength.

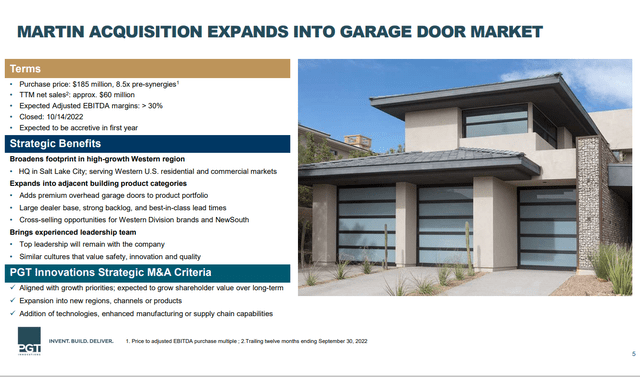

PGTI Acquisition of Martin

PGTI closed its $185M acquisition of Martin on October 14, 2022, allowing PGTI to expand into the garage door market. PGTI’s revenue potential from the acquisition is about $60M at EBITDA margins above 30%. There are cost synergies and cross-selling opportunities between the two companies.

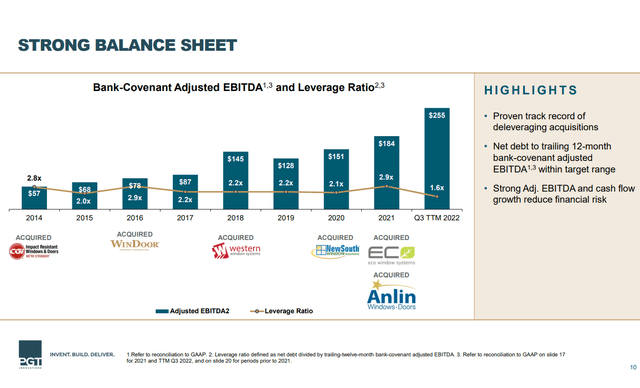

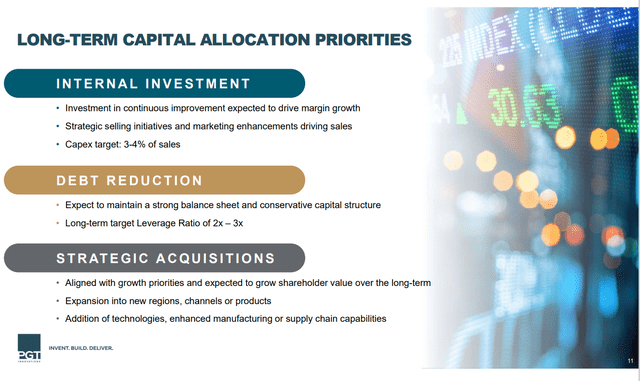

Strong Balance Sheet & Acquisitions

PGTI has $219M in cash and cash equivalents on hand. They show a bank-covenant adjusted EBITDA 1.6 leverage ratio. I show a 2.2 net debt to EBITDA ratio.

www.pgtinnovations.com/ www.pgtinnovations.com/

Q3 Earnings and Full-Year Outlook

PGTI’s Q3 press release showed strong results. Both earnings and net sales surpassed the analyst’s estimates and increased year over year.

“PGT Innovations delivered a strong third quarter. Net sales increased 28 percent to $386 million, year-over-year, despite the impact of Hurricane Ian, which made landfall on September 28 near our headquarters in Venice, Florida,” said Jeff Jackson, President, and Chief Executive Officer. “While our facilities were not damaged, storm-related disruptions caused approximately $12 million of third-quarter sales to be deferred.”

- Net sales in the third quarter totaled $386 million, an increase of 28 percent (including organic growth of 17 percent).

- Net income in the third quarter was $30 million, compared to a net loss of $5 million.

- Adjusted net income* in the third quarter was $33 million, an increase of 111 percent.

- Adjusted EBITDA* in the third quarter was $68 million, an increase of 58 percent.

- Net income attributable to common shareholders per diluted share in the third quarter was $0.50, compared to a net loss of $0.11.

- Adjusted net income per diluted share* in the third quarter was $0.55, compared to $0.26.

- Cash at the end of the third quarter was $219 million, an increase of 128 percent. Updated Fiscal Year 2022 Guidance

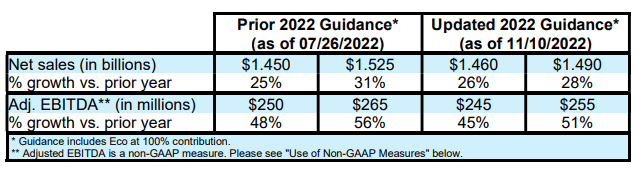

- 2022 Net sales range from $1.460 billion to $1.490 billion.

- 2022 Adjusted EBITDA* in the range of $245 million to $255 million.

The stock price fell 12.5% from $22.74 on November 10th before Q3 earnings were announced to $19.89 on November 14th. This is a market overreaction in my opinion and may be due to the following statement from their Q3 earnings report.

“Our previous fiscal year 2022 guidance did not contemplate the impacts of Hurricane Ian, the previously disclosed cybersecurity incident, or our acquisition of Martin Door. Our facilities did not sustain damage from the storm, but our employees could not safely travel to work, limiting our ability to produce in October. Additionally, the cybersecurity incident we experienced on November 5th impacted our ability to process orders and produce in November. As such, we are updating the fiscal year 2022 guidance for net sales in the range of $1.460 billion to $1.490 billion and Adjusted EBITDA in the range of $245 million to $255 million,” concluded Kunz.

www.pgtinnovations.com/

The revised full-year outlook is not much different than the previous guidance.

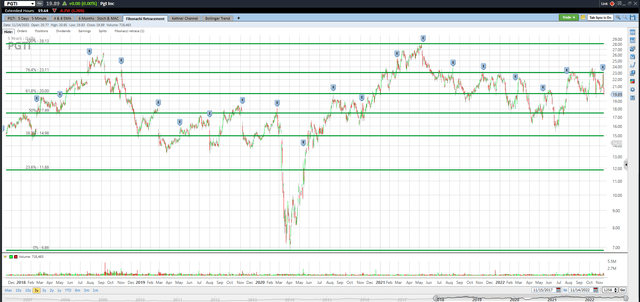

Good Technical Entry Point

The share price of PGTI closed at $19.89 on November 14th. I’ve added the green Fibonacci lines, using PGTI’s high and low for the past five years. It’s interesting to note how the market pauses or bounces off these Fibonacci lines. They can be one clue as to where the stock price may be headed. PGTI is at the 61.8% Fibonacci retracement level but could go lower. However, I believe that PGTI will trade above $20.00 by May for the reasons in this article.

The two most accurate analysts have an average one-year price target of $28.00, indicating a 40% potential upside from the November 14th closing price of $19.89 if they are correct. Analysts are just one of my indicators, and they are not perfect, but they are usually in the ballpark with estimates. They often seem a bit optimistic, so I suspect prices may end up lower than their one-year targets to be on the safe side.

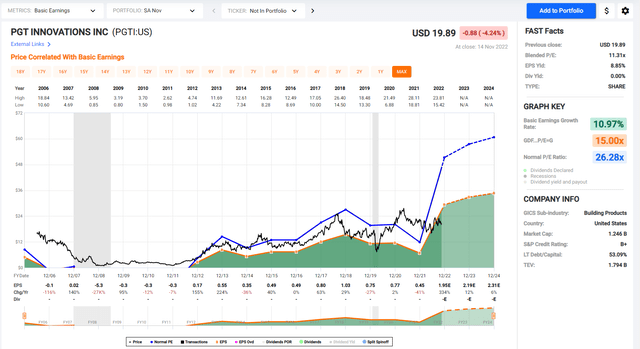

Trend in Earnings Per Share, P/E Ratio, and Net Margin

The black line shows PGTI’s stock price for the past seventeen years. Look at the chart of numbers below the graph to see PGTI’s EPS. Earnings were $0.75 in 2019, $0.77 in 2020, and $0.45 in 2021, and they are projected to earn $1.95 in 2022 and $2.19 in 2023.

The P/E ratio for PGTI is currently at 11, but the average ratio over the past ten years is 23. I don’t think the P/E will rally back to 23 anytime soon. If PGTI earns $2.19 in 2023, the stock could trade at $21.90 even if the market only assigns a 10 P/E ratio.

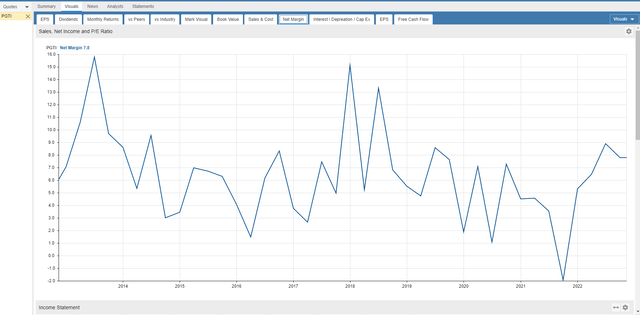

PGTI net margins for the past ten years show they have bounced off their covid lows and are now near 8%.

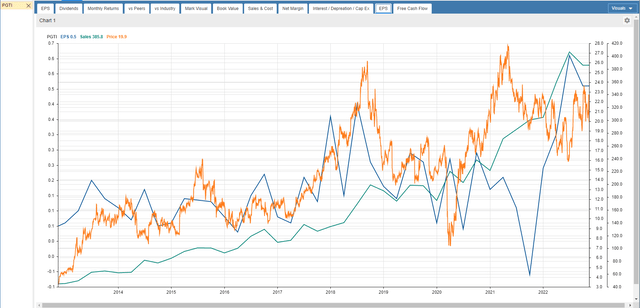

Sales, earnings per share, and the stock price have been appreciating since 2013.

Sell Covered Calls

My answer to uncertainty is to sell covered calls on PGTI six months out. PGTI closed at $19.89 on November 14th, and May’s $20.00 covered calls are at or near $2.70. One covered call requires 100 shares of stock to be purchased. The stock will be called away if it trades above $20.00 on May 19th. It may even be called away sooner if the price exceeds $20.00, but that’s fine since capital is returned sooner.

The investor can earn $270 from call premium and $11 from stock price appreciation. This totals $281 in estimated profit on a $1,989 investment, which is a 27.8% annualized return since the period is 185 days.

If the stock is below $20.00 on May 19th, investors will still make a profit on this trade down to the net stock price of $17.19. Selling covered calls reduce your risk.

Takeaway

I expect PGTI’s stock to appreciate as demand for their new and existing products remains strong. New housing starts are expected to decline by 20% in 2023, but the demand for PGTI’s new doors and windows will continue to be strong. Even if PGTI’s stock price only moves from $19.89 to $20.00 by May 19th, a 27.8% potential annualized return is possible, including a covered call premium.

Be the first to comment