Vasyl Dolmatov/iStock via Getty Images

A Quick Take On IBEX

IBEX Limited (NASDAQ:IBEX) reported its FQ4 2022 financial results on September 22, 2022, missing both expected revenue and EPS estimates.

The company provides outsourced customer experience services to organizations worldwide.

While the takeover rumor mill may turn out to be right or wrong, my discounted cash flow analysis indicates IBEX may be fully valued at its present level.

Accordingly, I’m on Hold for IBEX in the near term.

IBEX Overview

Washington, DC-based IBEX was founded to develop a full range of customer experience capabilities for businesses of all sizes worldwide.

Management is headed by Mr. Robert Dechant, who has been with the firm since 2015 and was previously chief sales, marketing and client services officer at Qualfon, a call center services firm.

The company focuses its efforts on the industries of Technology, Travel & Hospitality, Communications & Media, Financial Services, Education, Automotive, Retail and Health & Health Insurance.

The company’s primary offerings include:

-

Connect – Engage customers

-

Digital – Add customers

-

CX – Grow relationships

IBEX’s Market & Competition

According to a 2018 market research report by ResearchAndMarkets, the global market for customer experience management is forecast to reach $21.3 billion by 2024.

This represents a forecast CAGR of 22% from 2018 to 2024.

The main drivers for this expected growth are the growing demand for personalized customer experiences as well as continued innovation and efficiencies on the part of vendors.

Also, firms such as IBEX are able to provide customer experience capabilities for smaller customers, seeking the ‘long tail’ of clients at potentially higher revenue per client.

Major competitive or other industry participants include:

-

24-7 Intouch

-

Alorica

-

Atento

-

Concentrix

-

SITEL

-

Startek

-

SYKES Enterprises

-

TaskUs

-

Teleperformance

-

TeleTech

-

TELUS International

-

Webhelp

IBEX’s Recent Financial Performance

-

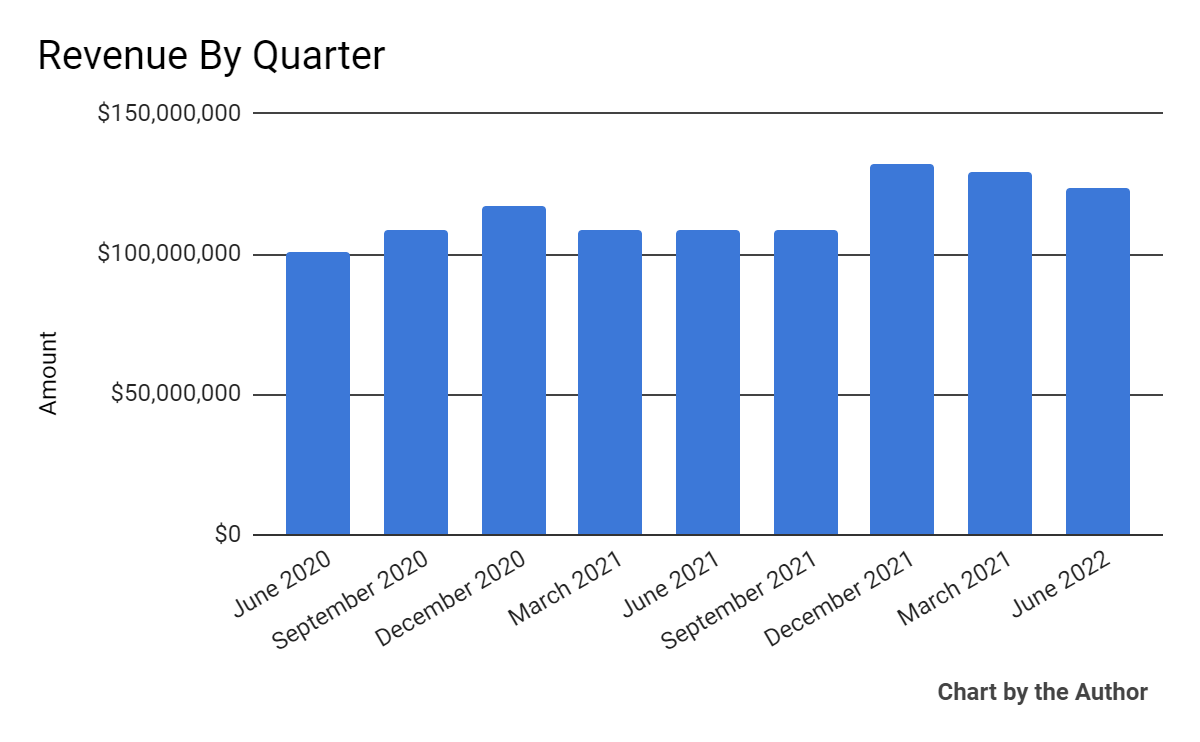

Total revenue by quarter has risen according to the following chart:

9 Quarter Total Revenue (Seeking Alpha)

-

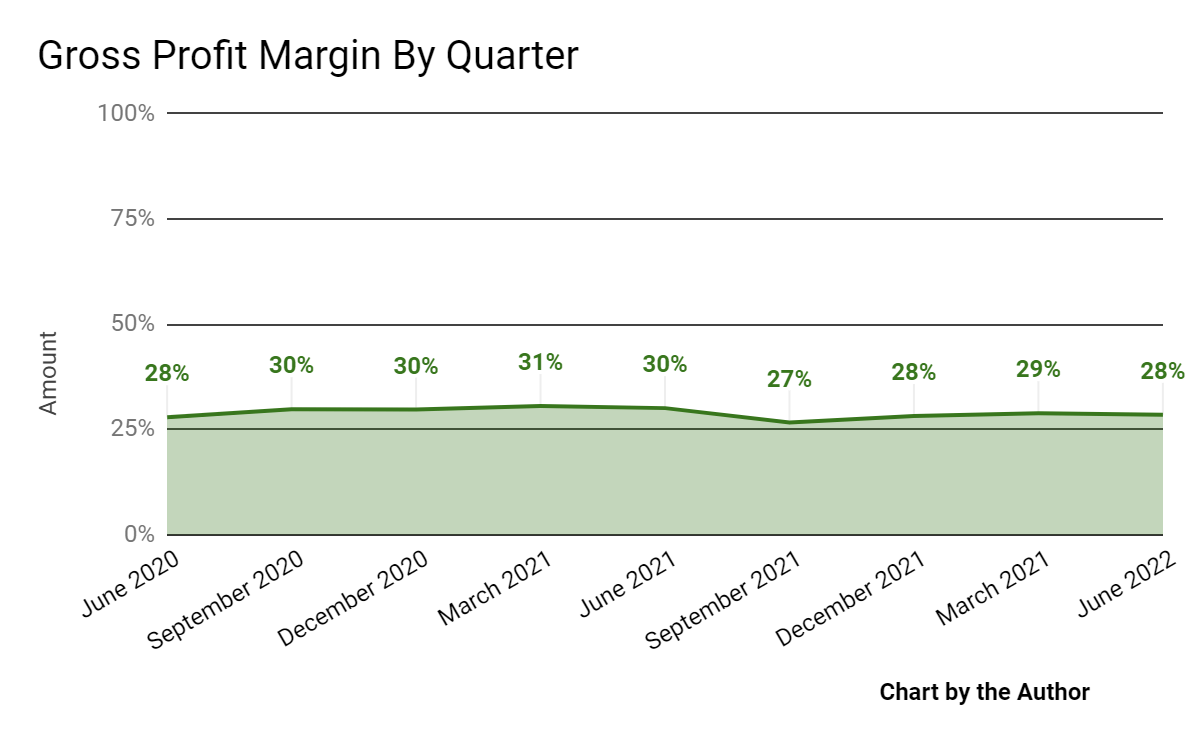

Gross profit margin by quarter has remained generally flat in recent quarters:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

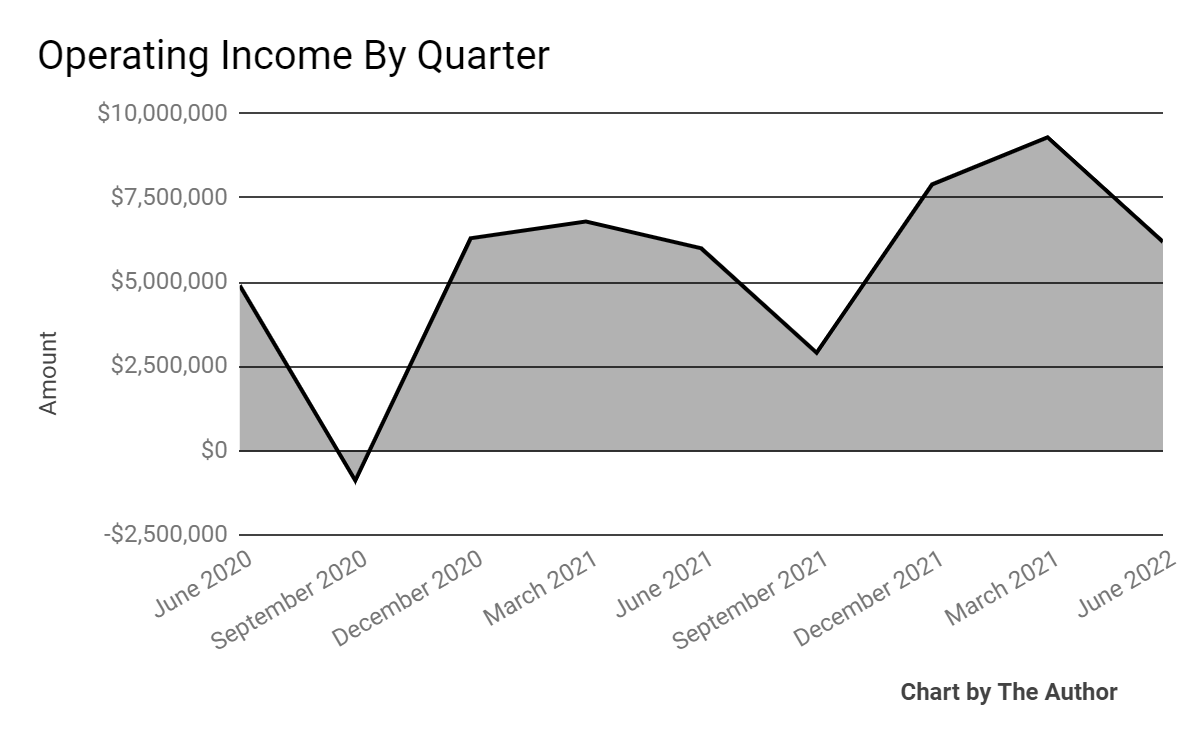

Operating income by quarter has trended higher in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

-

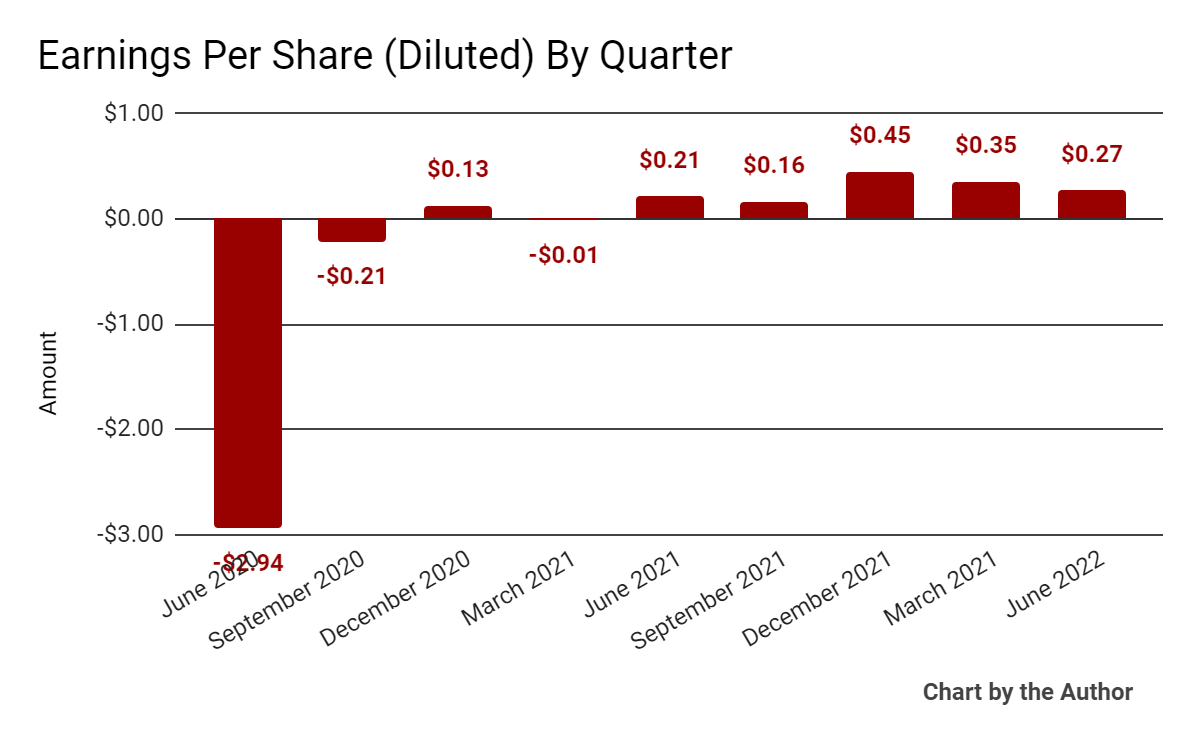

Earnings per share (Diluted) have remained positive in the last five quarters:

9 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

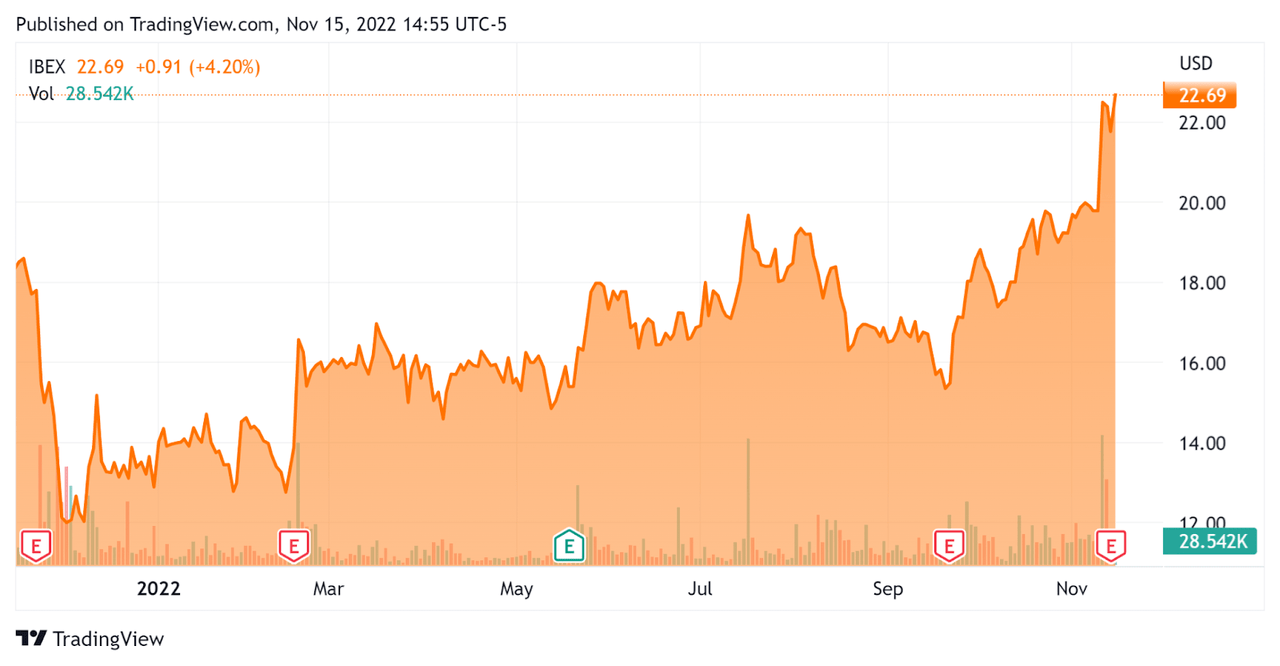

In the past 12 months, IBEX’s stock price has risen 22.7% vs. the U.S. S&P 500 index’s drop of around 14.9%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For IBEX

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.92 |

|

Revenue Growth Rate |

11.3% |

|

Net Income Margin |

4.7% |

|

GAAP EBITDA % |

8.7% |

|

Market Capitalization |

$397,260,000 |

|

Enterprise Value |

$452,320,000 |

|

Operating Cash Flow |

$50,130,000 |

|

Earnings Per Share (Fully Diluted) |

$1.23 |

(Source – Seeking Alpha)

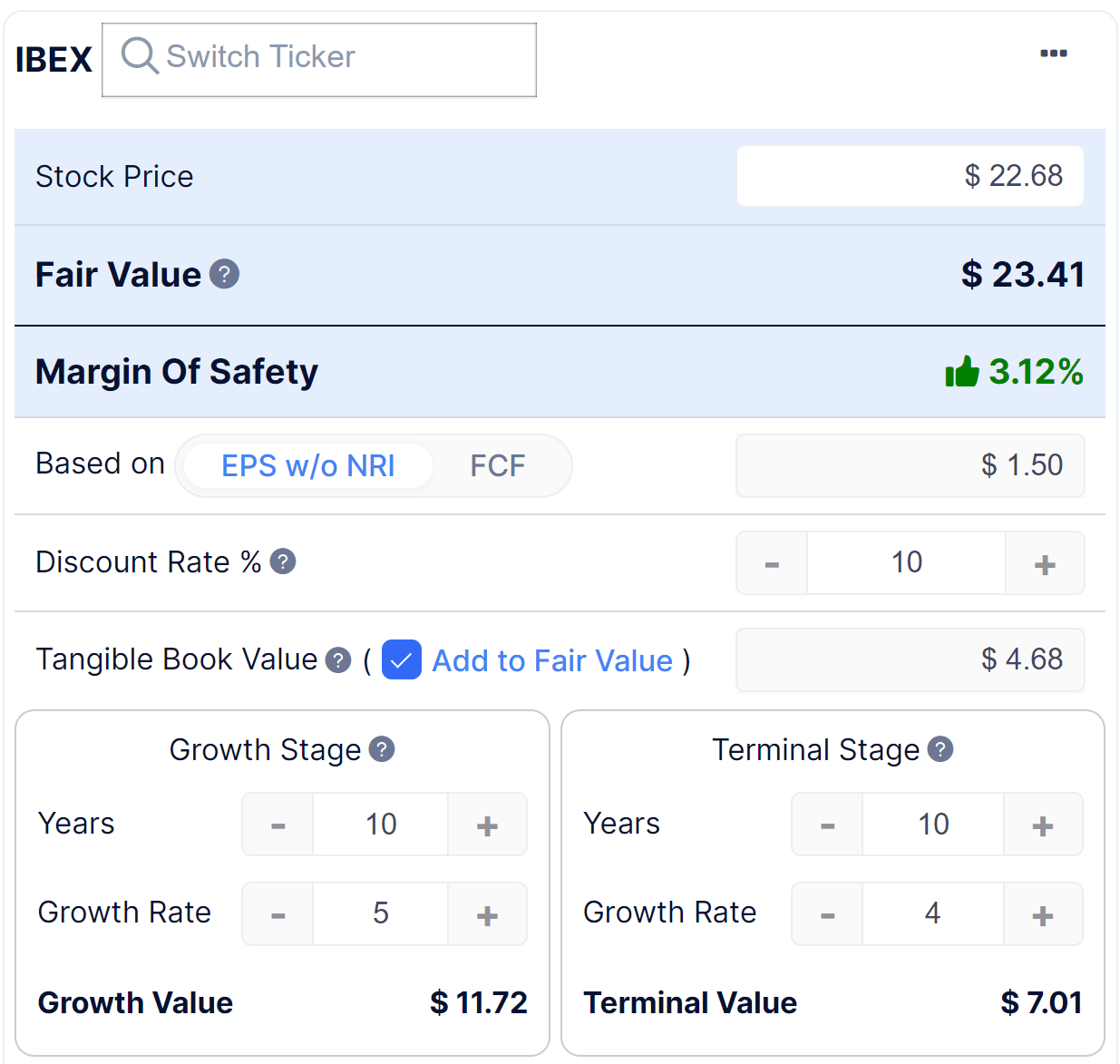

Below is an estimated DCF (Discounted Cash Flow) analysis of the firm’s projected growth and earnings:

IBEX Discounted Cash Flow (GuruFocus)

Assuming generous DCF parameters, the firm’s shares would be valued at approximately $23.41 versus the current price of $22.68, indicating they are potentially currently fully valued, with the given earnings, growth, and discount rate assumptions of the DCF.

Commentary On IBEX

In its last earnings call (Source – Seeking Alpha), covering FQ4 and full fiscal year 2022’s results, management highlighted the firm’s accelerating revenue growth to 15%, above its historical 10% growth rate.

The company gained 23 large clients during the fiscal year, which management credits in part to its ‘strategic decision to aggressively build out capacity throughout the pandemic.’

As a result of this build out, its sales pipeline is ‘at an all-time high.’

As to its financial results, total revenue grew by 13.6% year-over-year, with particular bright spots in the HealthTech, Fintech, retail, ecommerce, travel, transportation and logistics verticals.

Management did not disclose the company’s retention rate for customers or revenue.

An, management did not provide details on cost line items or reasons for fluctuation.

For the balance sheet, the firm finished the quarter with $49.7 million in cash, equivalents, and short-term investments and $104.7 million in total debt.

Over the trailing twelve months, free cash flow was $25.5 million, with $24.6 million in capital expenditures.

Looking ahead, for fiscal 2023, management guided revenue growth to 11.4% and EBITDA margin to be at 14.2%, up from 13.5% in the current fiscal year just ended.

Regarding valuation, the market has pushed up the stock price in recent days on rumors of potential takeover interest.

The primary risk to the company’s outlook is a slowing global macroeconomic environment into 2023 that may serve to dampen the firm’s growth outlook.

Potential upside would be in its capacity to add new clients, increasing the capacity utilization it built up over the past few years.

While the takeover rumor mill may turn out to be right or wrong, my discounted cash flow analysis indicates IBEX may be fully valued at its present level.

Accordingly, I’m on Hold for IBEX in the near term.

Be the first to comment