Scott Olson

I. Introduction

Please forgive this stream of consciousness, but I wish to set down some thoughts about Elon Musk’s acquisition of Twitter (formerly listed on NASDAQ as TWTR) and what I forecast as its follow-on effects on Tesla (NASDAQ:TSLA).

As many of you know, I have been following Musk’s activities for some time. Almost as long as he has been following mine.

Musk launched Tesla with the idea that electric vehicles could save the Earth by helping to dramatically reduce carbon emissions. In my judgment, and that of many others, it’s a horribly flawed idea that fails to take account of the many hidden (many hidden in plain sight) costs of (1) finding, mining, transporting, and refining the necessary raw materials for motors and batteries, (2) charging the batteries (Tesla vehicles are, in the bon mot of Andreas Hopf, external combustion vehicles), and (3) disposing of the toxic stew remaining when the battery has gasped its last (recycling is not yet, and may be a long way away from being, an economically sensible option).

A focus on hybrid vehicles, and a direction of governmental policies (subsidies, mandates, etc.) in that direction would have been far more efficacious.

But it was not to be. Elon Musk hitched himself to the zeitgeist, and did so brilliantly, and the California political luminaries quickly fell into line. It was more than simply a California phenomenon, of course. Much of Europe, and Germany in particular, developed the same fever. As did Australia. As did other parts of the globe.

Subtract from Tesla’s lifetime profits the economic value of subsidies, mandates, free land, favorable utility tariffs, tax abatements, and assorted other special favors (HOV lane privileges, parking privileges, etc.) that have benefitted Tesla. As I say, subtract those (paid for knowingly or mostly unknowingly by taxpayers and ratepayers), and Tesla would be deep in the red. That said, I suppose we must salute Musk for so brilliantly trimming his sails to the political winds.

II. Enter the Dragon

Fast forward to 2018. This was the year Tesla became heavily dependent upon the good graces of the Communist Chinese Party (the CCP), which arranged a favorable land lease for Tesla’s Shanghai factory, favorable financing for building and operating the factory (see Exhibits 10.70 through 10.75 of Tesla’s 2021 10-K), and favorable (indeed, unprecedented for an automaker) 100% foreign ownership.

MaxedOutMama and I have written at length about Tesla in China. For instance, here, here, here, and here. Suffice it to say that, today, most of Tesla’s profits come from China, and the CCP has its boot on Tesla’s neck. It can press it down hard any time it wishes by decreeing that “special circumstances” have arisen that make it in the “public interest” to repossess the factory site (Article 22 of the 2018 Grant Contract). Or, alternately, that the factory is failing to meet “relevant standards” (Article 30 of same) whatever they might be, and hence must cease operations.

Alas, to Musk, merely being the guiding genius of Tesla (dependent on Chinese government contacts, and SpaceX (dependent on United States government contracts), and the Boring Company (dependent on local government stupidity), and Neuralink (dependent on public gullibility), was not enough.

He had to fashion himself a free speech hero, too. He had begun rehearsing for the role when, during a famous Tesla conference call, he declined to answer the “boring” and “boneheaded” analyst questions and instead appealed directly to his retail investors for proper inquiries.

The rehearsal continued when the health officials in Alameda County, California, decreed that Tesla should shutter the Fremont plant for a period of days while COVID raged. Musk, who had infelicitously averred that COVID would be a mere memory by April 2020, defied the authorities, and later engaged in a rant about how his rights were being threatened by the “fascists” of California.

I, too, am a critic of California governance. After all, it was the California Air Resources Board (known as CARB) which, when it knew better, allowed Tesla to collect undeserved and valuable ZEV credits for “battery swapping” claims that were always exceedingly dubious (indeed, Tesla years ago removed all references to battery swapping from its published materials). That said, at the time Alameda County health authorities attempted to shut down Tesla’s Fremont plant (along with all similar facilities in the county), COVID posed a major danger, we had no vaccines against it, and much less was known about the disease than is known today.

III. The Twitter Debacle

Now, fast forward to this momentous year of 2022.

In which Musk agreed to buy Twitter, making what he insisted was a non-negotiable offer. And then attempted to exit the deal. And then engaged in a highly public but ultimately fruitless fight to escape from his contractual obligations based on claims that were patently silly. While being mocked for the insincerity of his legal claims. And while suffering the humiliation of ruling after ruling, written in clear and engaging prose, from the Chancellor of the Delaware Court of Chancery, throwing shade at his counterclaims and strongly suggesting he had attempted to hide evidence that he was required to produce.

In the process, reportedly losing an opportunity to buy the company at a discount of several billion dollars.

‘Mischief & delay’: How Musk & Twitter finally sealed the deal, Financial Times, Oct. 30, 2022 (Financial Times)

While instead, making endless disparaging attacks on the company, thereby damaging the goods he would eventually have to purchase. And refusing to consent to “stay bonuses” that would have kept in place key Twitter employees after the acquisition. And, in the process, racking up stupendous legal fees for himself and for the company he was buying, the latter fees being drained from the company’s treasury before Twitter became Musk’s property.

And, worst of all, not only causing serious business people to distrust him, but also alienating much of his suburban, left-leaning customer base.

IV. The Geopolitical Genius

The wondrous deeds of Musk in 2022 went far beyond the Twitter deal. He famously suggested that Ukraine make material concessions to Russia. Again, alienating yet another large chunk of actual and potential customer base.

He followed that up by suggesting Taiwan should become a “special administrative zone” of Communist China, much like Hong Kong, yet with the Chinese authorities somehow more liberal and benign. This time, not only alienating yet more potential customers, but also italicizing, underlining, capitalizing, and bold-facing the extent to which Tesla and Musk are, of necessity, supporters of the Chinese government. A government which the United States (and much of the rest of the West) has, with good reason, become exceedingly wary of.

The most recent masterstrokes came with the closing of the Twitter deal. Musk summarily fired its top executives, alleging the firings were “for cause,” thereby depriving those executives of severance payments, and almost surely guaranteeing the fired executives will sue.

And, to top it off, Musk retweeted a sketchy report from the Santa Monica Observer suggesting Paul Pelosi’s attack resulted from an encounter with a male prostitute. The uproar was instantaneous, and Musk quickly deleted his tweet, but the further damage was done.

Musk may have been correct in cautioning that there might be more to the attack than meets the eye. Indeed, there’s evidence that the attacker may have acted more out of emotional instability than any deeply held political convictions. But, to have embraced the absurd conspiracy theory, emanating from the far right, once again alienated yet more potential customers.

V. Free Speech v. Twitter Revenue

The good ship Twitter took on $13 billion of debt when Musk acquired it. The annual interest payments alone will total near $1 billion. How to pay for all that?

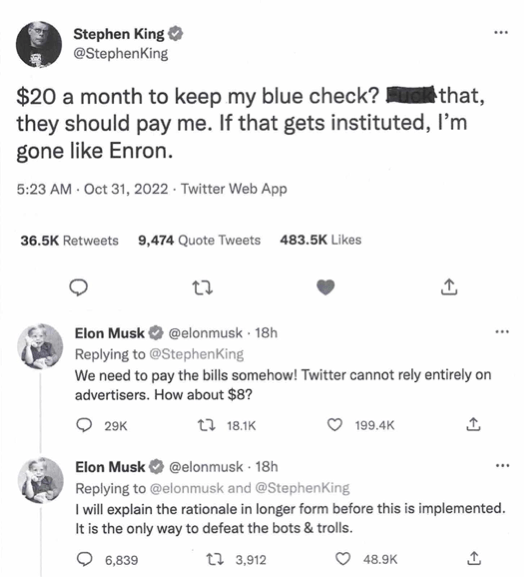

Musk’s first idea was to quadruple the amount charged to the “blue check” Twitter posters. It doesn’t appear to be going well, and it has the feeling of a financial plan that’s ad hoc and extemporaneous rather than carefully mapped and methodically implemented.

Elon Musk Conducts Market Survey (Twitter)

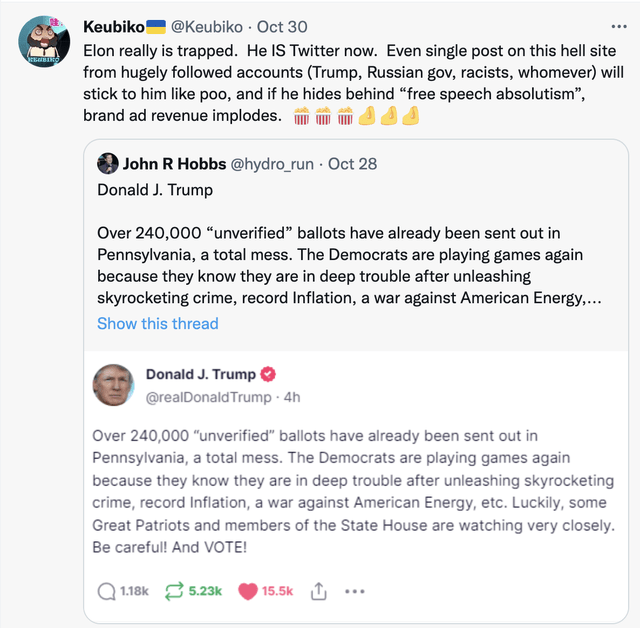

For Musk to own Twitter could well be the worst thing that ever happened to Tesla. Monitoring what’s posted at a vitally important social media site is an exceedingly difficult business. It’s hard work. I would agree that Twitter sometimes went too far in its censorship, and one can plausibly argue that its exuberance tended to favor the narratives of the U.S. left. But Musk has now discovered how easy it’s to err in the other direction.

While revenue from the “blue check” posters is material, Twitter’s major source of revenue has always been advertising. The controversy engendered by Musk’s takeover threatens that revenue source. At least one large advertiser has already announced it is pausing ad purchases while it waits to see kind of social media platform will emerge.

Yes, that advertiser was General Motors (GM), a Tesla competitor, but it’s easy to imagine that General Motors is not alone, and that other potential advertisers will be wary as well. And not without good reason. Musk’s ownership of Twitter will place him at the center of endless political storms, made all the more perilous by the upcoming mid-term elections and by the evident desire of Donald Trump to run for U.S. president in 2024.

Indeed, as I prepare to submit this article comes a report that a group of left-leaning organizations is urging an advertiser boycott of Twitter. The question is not whether this is well-advised or ill-advised (and I disfavor these types of boycotts, no matter who is urging them). The question is: In buying Twitter, has Musk placed himself into a political maelstrom? And I think the answer may well be yes.

Tweet from @Keubiko of Twitter (Twitter)

Musk will very likely find himself walking a tightrope as he endeavors to satisfy his new right wing fans while not completely alienating his former left wing fans, and at the same time building the “blue check” subscriber model, attracting more advertisers (or, at least, maintaining the ad revenues Twitter already enjoys), and fending off those who (correctly or otherwise) view his ownership of Twitter as a threat to free speech.

It’s not only Twitter that likely will suffer. Be you of the right or be you of the left (or be you of the shrinking middle), love Trump or hate him (or, as many did, hold your nose in voting for him because you viewed the alternative as even worse), none of this can be good for Tesla, an already ridiculously overvalued company with shrinking market shares in China in Europe and with no vehicles on offer for other than luxury car prices.

In several ways, Musk has shackled Tesla to Twitter. First, having already depressed the Tesla share price by selling shares to raise money for the purchase, there is the possibility Musk will need to sell yet more Tesla shares to finance the purchase. Some bulls (most famously, Gary Black) believe the “Twitter overhang” lifted when the deal closed:

Tweet by Tesla bull, Gary Black (Twitter)

However, it’s by no means clear that Musk is finished selling Tesla stock. It’s just as likely, if not more likely, that Musk engaged in some short-term borrowing to help pay the purchase price, and there will be more sales ahead.

Moreover, even if Musk sells no more Tesla shares to finance the Twitter purchase, Twitter is yet one more distraction – and a huge one – for a corporate leader who is already spread thin.

Add to all this: (1) Pending scrutiny by the Department of Justice over Tesla’s full self-driving (or FSD) claims, as well as a host of lawsuits involving FSD that are headed to trial, (2) the imminent decision on an appeal to the Delaware Supreme Court of the SolarCity decision, (3) the imminent commencement of trial before the Delaware Chancellor on Musk’s compensation in the Tornetta case, (4) the recent price cuts and other indications of slackening demand, and (5) excess capacity looming in Germany and Texas, and one would need to be brave indeed to feel bullish about the prospects for Tesla’s share price.

Yes, it’s Musk. He has escaped many jams before. He may escape again. Indeed, he may transform Twitter into a money-making behemoth. But the risks that things won’t work out, for either Twitter or Tesla, are huge.

Be the first to comment