Viorika

By Tyrone Ross and Erik Smith

Over the past 13 years, the cryptocurrency market has reached a cumulative market capitalization in the trillions. As of September 2022, Lukka Enterprise Data has listed 50 cryptocurrency assets with a market capitalization of over USD 1 billion. With an increasing number of investment options to choose from, many market participants are wondering:

- Should digital asset portfolios be diversified?

- Can diversification of cryptocurrency assets mitigate risk in a highly volatile asset class?

Generally speaking, financial advisors and investors tend to diversify broadly across asset classes and within asset classes. After all, actively picking investments is incredibly difficult. As Craig Lazzara, Managing Director and Global Head of Index Investment Strategy for S&P Dow Jones Indices, points out, “Returns are typically driven by a relatively small number of strong performers, which pull the index’s return above that of most of its constituents.” There are decades of historical performance data that support this observation in the equity markets. Does the same apply in the digital asset markets?

Let’s take a look at four S&P Digital Market Indices:

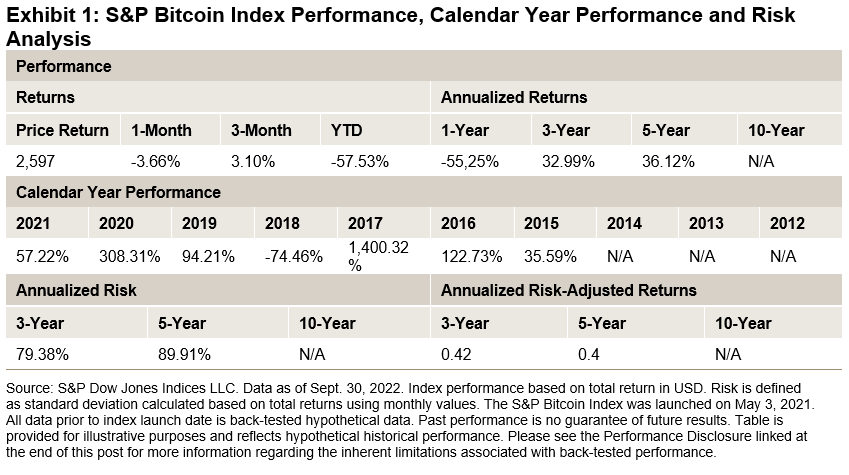

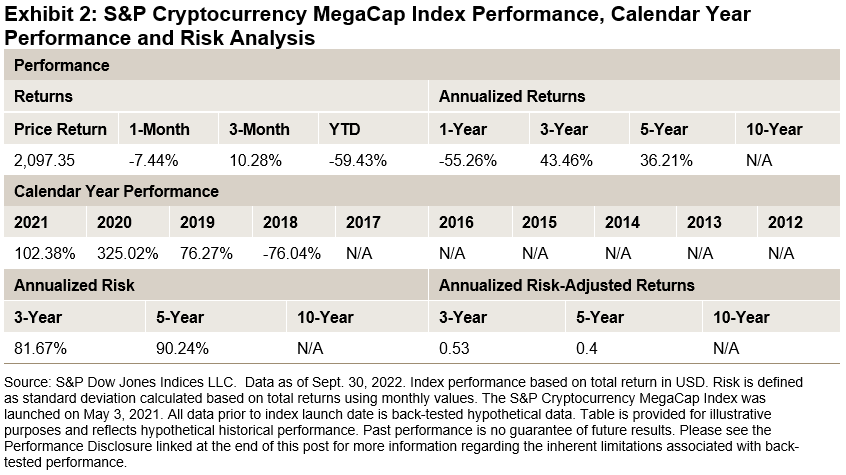

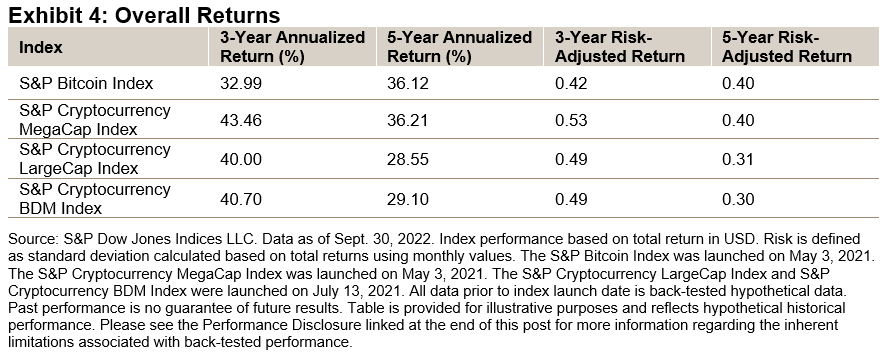

Looking at back-tested data, over the past five years (as of Sept. 30, 2022), the S&P Bitcoin Index and S&P Cryptocurrency MegaCap Index outperformed the broader cryptocurrency indices on an annualized risk-adjusted return basis. The S&P Cryptocurrency MegaCap Index, which combines Bitcoin (BTC-USD) and Ether (ETH-USD) into one index weighted by market capitalization, led the way in absolute returns, posting a 36.21% annualized five-year return. The S&P Bitcoin Index came in a close second on an absolute return basis, posting a 36.12% annualized five-year return. Similar to previous market downturns, Bitcoin has held up better than the vast majority of cryptocurrency assets in 2022.

However, over a three-year timeframe, Bitcoin lagged the more diversified crypto-asset indices in both absolute and risk-adjusted annualized returns. The S&P Cryptocurrency MegaCap Index, which includes Bitcoin and Ethereum, led the way during this timeframe (see Exhibit 2).

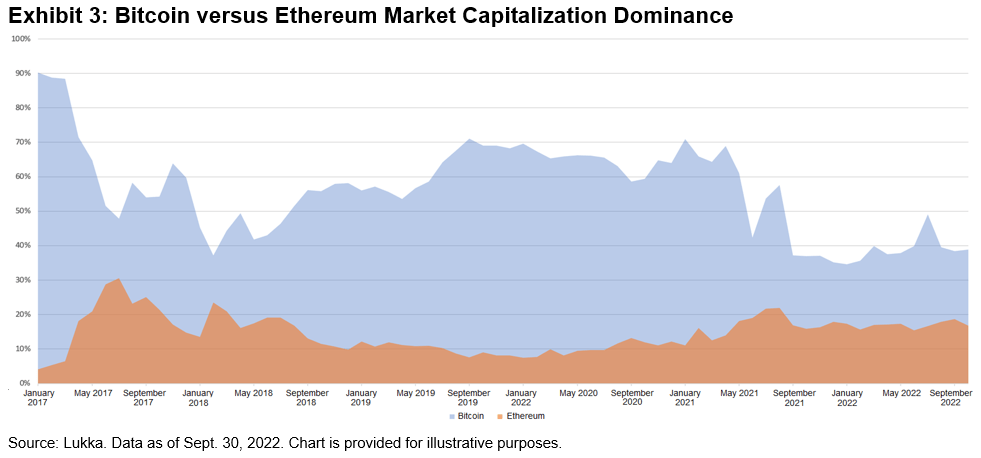

As we can see in Exhibit 3, Ethereum’s share of the total crypto-asset market cap has grown slightly since the beginning of 2017, now making up over 17% of the total digital asset market. Bitcoin’s market cap, which accounted for approximately 90% of the cryptocurrency market at the beginning of 2017, has fallen to around 39% dominance. This is still a high percentage compared to most asset classes.

So how could diversifying away from Bitcoin have affected portfolios? The data suggests diversifying would have resulted in higher absolute and risk-adjusted returns over the past three years, while underperforming Bitcoin over the past five years.

Closing Thoughts

As with any investment portfolio, timeframe, risk tolerance and risk capacity all play key roles. Similar to how investors had a difficult time gauging which technology companies would thrive following the internet boom in the 1990s, it is equally difficult to predict which cryptocurrencies will gain or lose market share in the future. With limited historical data to base our analysis on, we are left pondering what the future holds for this new asset class that is growing exponentially. The best way to make an informed decision on structuring a digital asset portfolio is to continuously learn about and evaluate this evolving market. Education comes first.

Disclosure: Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI, please visit S&P Dow Jones Indices. For full terms of use and disclosures please visit Terms of Use.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment