Gearstd/iStock via Getty Images

The big hand of BYD has taken Elon Musk’s crown away! This article is primarily about Tesla, Inc.’s (NASDAQ:TSLA) still excessive stock market valuation that has been primarily based on its leadership in getting electric vehicles – EVs – onto the roads worldwide and the admiration Elon Musk has earned for his drive in achieving that. That admiration became almost worship by some and drove TSLA’s stock market valuation to crazy levels, way above those of other car makers.

Musk is also a great salesman for Tesla (and himself), which gained the company rapid recognition while a much less noisy competitor was doing similar things also in a big way. That is BYD, and I will say more about that company first, following with more about Tesla and why I think it will stay dethroned as the number one EV maker irrespective of attempts to get that crown back.

I would mention that I am not suggesting BYD is a buy or sell, I feature it only as one big reason why I think Tesla’s stock market valuation will not return to former highs and will probably not do anything other than decline from existing levels in coming months.

BYD

BYD Company Limited (OTCPK:BYDDF, OTCPK:BYDDY) is a Chinese EV maker that started as a battery maker. BYD stands for Build Your Dreams (比亚迪 bǐyàdí) and was founded by a guy – Wang Chuanfu – from a poor family background who became a professor at a research institute for non-ferrous metals in Beijing.

Today, he is among the world’s richest men, because while in Beijing he had the vision that China’s startup battery producers could compete with Japan. In the mid-1990s, Wang relocated to Shenzhen just as it was transforming from a sleepy fishing village into a global manufacturing hub. The mass migration from rural areas gave the city’s factories the cheap labor they needed to compete with rivals in Japan, Korea, and Taiwan. In the next 20 years, BYD in some ways followed the proven path among leading East Asian corporations of examining Japanese and U.S. products and finding ways to duplicate the basic technologies without actually making direct copies of them.

Today, BYD has overtaken South Korea’s LG as the world’s second-biggest producer of EV batteries, behind China’s Contemporary Amperex Technology, known as CATL.

Along the way, its EV unit was born in 2002 from an acquisition of Tsinchuan Automobile, then the sixth-largest car manufacturer in China by sales volume. Wang took out the petrol engines from existing models and put in electric motors. In some ways he was ahead of Tesla and now is way ahead because Wang set about a process of mastering technologies from their finished batteries all the way to the lithium and nickel mines. Today, BYD’s vertical integration — controlling the supply chain from the minerals to the computer chips used in vehicles — is considered world class by industry executives and analysts. Elon Musk has long touted Tesla’s vertical integration, but Tesla is way behind even on crucial things like battery making, which is one of the main reasons he has lost his “crown.”

Interestingly, Warren Buffett’s Berkshire Hathaway (BRK.A, BRK.B) owns 7.7% of BYD, bought in 2008. There are suggestions he is selling out now. He has not bought into Tesla!

In April 2020, BYD and Toyota Motors announced a joint partnership in a new company — BYD Toyota EV Technology — that will research and manufacture EVs for the Chinese market.

Latest news tells how numbers took away Musk’s crown: BYD sold 641,350 EVs in the first six months of 2022, representing a 315% increase from the same period last year. Tesla, on the other hand, delivered a total of 564,743 vehicles in H1, as it contended with supply chain problems including computer chips, factory Covid-19 lockdowns, and sales disruptions in Shanghai.

BYD did not have those problems, being located in Shenzhen. That once-sleepy fishing village in the heart of the vibrant Greater Bay area has become the economic dynamo of China that the Chinese government plans to be China’s answer to Silicon Valley, according to that linked guidemehongkong.com report.

Unlike Tesla – that sells worldwide – BYD is unknown in the West. However, it plans to change that with its much wider range of EVs and much lower prices. BYD is embedded in the mass market – that Musk once claimed he aimed for with aspirations of making 20 million cars per year by 2030 – with its cheapest car model at $15,000, against Tesla’s $35,000 Model 3.

BYD’s sales are heavily concentrated in the Chinese market – the largest car market in the world where it is the number one EV seller. In 2021, EV sales in China, including plug-in hybrids, hit 3.3 million units, dwarfing the 608,000 EVs and plug-ins bought by U.S. consumers. BYD makes plug-ins too – PEVs – and Tesla does not. This is important! In one way, it gives Tesla the advantage of being specialized, and many buyers only want battery EVs – BEVs – but it is a disadvantage in that it restricts its access to the plug-in market that is growing too. Also – and very importantly – they are classified as equivalent in China and the EU, being new energy vehicles alongside BEVs and hydrogen-powered models.

BYD exported only 3,300 vehicles in the first five months of 2022, but it now has significant international ambitions. It already sells electric buses in Europe, Japan, and India, and it is taking steps to launch cars in Europe, Australia, Latin America, and the Philippines. This week, it signed a deal with Netherlands car dealership Louwman for its first European launch. It has also been signing up dealerships in south-east Asia.

Importantly, Wang has aligned himself closely with Chinese government policies, which can bring important advantages over Tesla that – unusually for a foreign company – owns 100% of its company there and has no Chinese partner as a shareholder. Elon Musk is also not making friends in the Chinese government, whose leaders have aims to shrink the huge number of around 300 EV makers in China to 20 large ones. BYD will probably remain number one if it continues to toe the party line carefully.

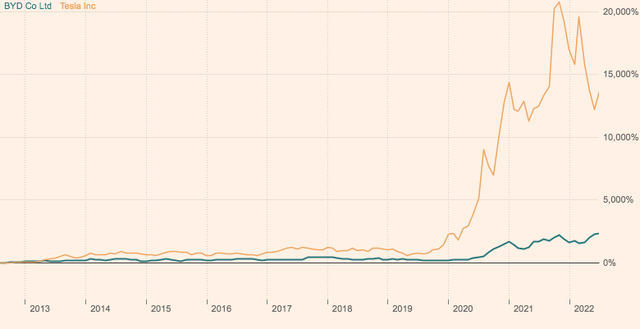

Perhaps because BYD did not have a super salesman as its king, its stock market valuation has gone nowhere, compared to Tesla’s rocket-like takeoff that started in 2019 and remains in high orbit even after descending rapidly in the second half of 2021. This FT chart shows the dramatic difference.

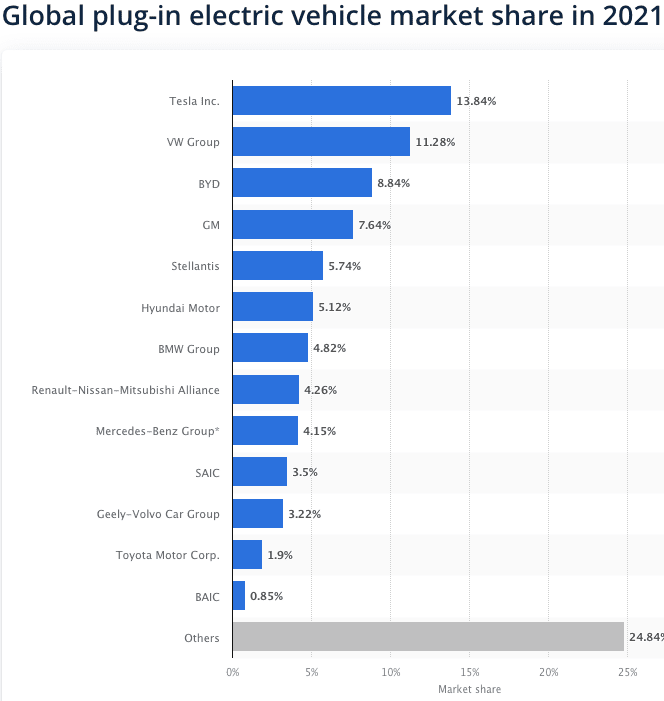

Market shares do not justify that difference, as this chart for 2021 shows…

Global EV Market Share (Statista)

And since then, BYD has taken the lead, surprising all, including Volkswagen (OTCPK:VWAGY, OTCPK:VWAPY, OTCPK:VLKAF), which thought it would be the leader by 2025.

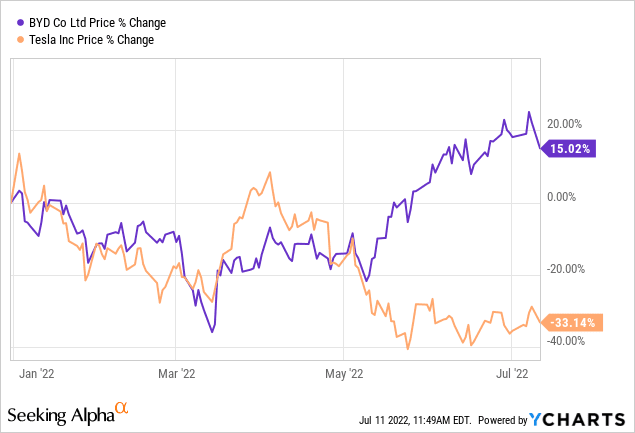

As I wrote in this article, Tesla’s Tide Has Turned, and as this chart shows, that tide has turned dramatically, too…

Seeking Alpha

BYD will not have an easy task dislodging Tesla as king outside China, but the cars look good.

BYD

Given its bigger product range, much lower prices and so many other competitors trying to do so too, I hope the above – among other things below – shows why the tide will continue to go out for Tesla…

Tesla

Tesla needs no introduction because its Technoking – Elon Musk – has done that better than I ever could.

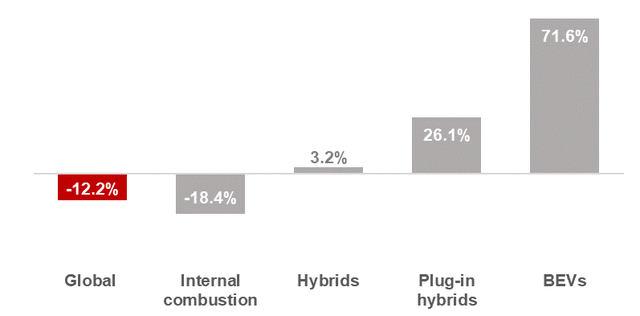

First, it has a big positive from being a BEV only maker; BEVs are the biggest sellers…

The lower the emissions, the higher the growth.

Global light vehicle unit sales growth YTD

On the negative side, some are asking if Tesla’s Elon Musk is Above The Law?, as did Chris DeMuth Jr. in that linked SA article. If he is found to have done so, he will have behaved like kings of old who were above the law. Either way, such questions are not good for Tesla or its shareholders. Actions can speak louder than words, and he and Tesla face many of those!

Lawsuits, among other things, are in place for Musk’s on/off bid for Twitter (TWTR). Twitter has taken him to court, and legal experts have said that the agreement to buy Twitter is watertight. He has laughed at such opinions. His offer represented a 38% premium to Twitter’s share price before he started building a stake in the company. The judge has ordered a fast trial, which he has opposed, so he has lost the first round. Additionally, the SEC does not take kindly to potential bidders creating a false market. The markets regulator has previously fined Musk $20mn and forced him to step down as Tesla chair after allegedly misleading investors about his plans to take the car company private.

We shall see, but if the Twitter takeover agreement is enforced, there is the chance that Musk could use his Tesla shareholdings as collateral for loans which could reduce the value for all owners of those shares. In any event, it is a distraction from his duties as CEO of Tesla.

Previously, Musk faced court action from shareholders for using Tesla money to buy out and rescue the loss-making solar panel company owned by his brother and cousin. He won the case, but that acquisition remains a loss-maker, and the action further shows his apparent contempt for normal rules. More losses will come from solar after U.S. Senator Joe Manchin pulled out of talks about a potential spending bill. Investors worried that the development lowered the chances that the industry would receive government stimulus measures that were under consideration. President Biden is also dropping tariffs on cheap solar panels for several Asian countries and may add China to that list.

Wikipedia has this list of lawsuits against Tesla. I know of no other reputable company that has stirred up so much controversy. The “autopilot” – the word used by Elon Musk to describe Tesla’s driver assistance technology – fatality case could prove to be fatal or near-fatal for the whole company. Autoblog reported that:

“[A] NHTSA investigation already underway covers 765,000 vehicles, almost everything that Tesla has sold in the U.S. since the start of the 2014 model year. Of the crashes identified by the National Highway Traffic Safety Administration as part of the probe, 17 people were injured and one was killed. NHTSA says it has identified 11 crashes since 2018 in which Tesla cars on Autopilot or Traffic Aware Cruise Control hit vehicles at scenes where first responders have used flashing lights, flares, an illuminated arrow board, or cones warning of hazards.”

This July 18 SA report tells us that:

“The National Highway Traffic Safety Administration’s (NHTSA) Office of Defects Investigation (ODI) announced yet another investigation into Tesla (NASDAQ:TSLA) autopilot issues on Monday. The new special investigation will review a 2021 crash involving a Tesla Model Y and a motorcyclist that resulted in the death of the latter.”

Currently, in a car accident in the U.S., the driver of one car sues the driver of the other car. It is only very seldom the car manufacturer is sued. For self-driving cars, however, things are likely to be different. There aren’t other drivers to sue. There is just the car – and the company that made it. It won’t take long for plaintiffs’ lawyers to start filing big lawsuits, even class actions, against the car and technology companies that made the cars and designed the self-driving technology. And, as we have seen in other such situations, there could soon be billion-dollar judgments against Tesla.

Cash Burners, in dv.com, reported that Elon Musk recently said that Tesla’s new German and Texas factories were “gigantic money furnaces” losing “billions of dollars.”

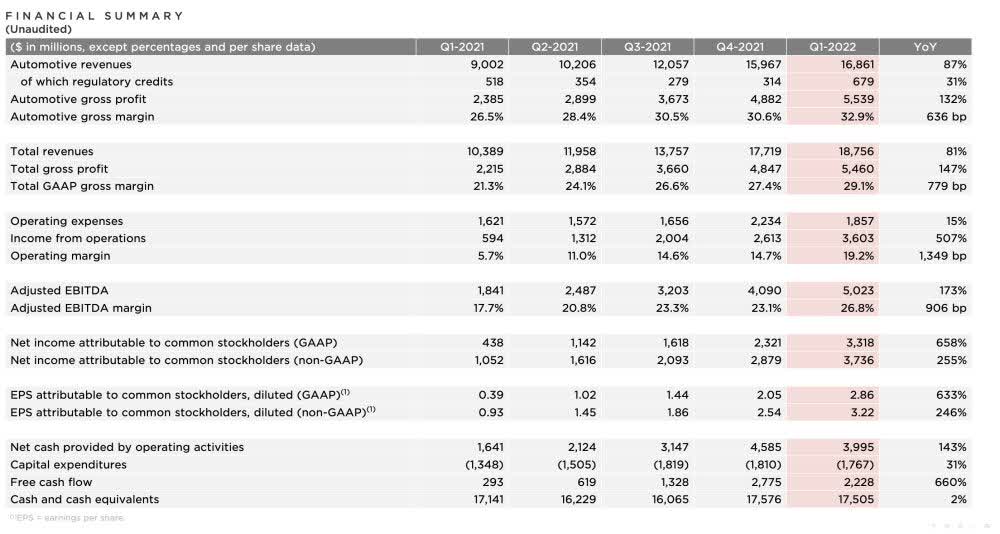

I cannot get my head around that statement, given the Q1 2022 results that show free cash flow of $2.228 billion.

Tesla

We know that the solar business is a cash burner, but that FCF figure would have taken that into account, and the positive numbers also came after investments in its Berlin-Brandenburg Gigafactory had driven up expenditures.

SA article writer RD Barris has questioned the 2021 figures in “Tesla’s Free Cash Flow: Less Than Meets The Eye.” And Musk has now told investors that the Berlin factory is a gigantic money furnace less than 3 months after the Q1 results were published! He should also tell Tesla investors they are also putting their money into a furnace if they buy in now!

Barging through opposition. Tesla may yet face other challenges due to his behavior in Germany. That country is a conglomeration of bureaucracies, some of which wanted to prevent the car and battery factory near Berlin from being built in the first place. Also, local residents and environmentalists – including Green party politicians – did not want their environmentally and visually valuable forest torn down, as this report shows.

Elon Musk apparently barged through those bureaucratic regulations and local and environmental objections and started building without proper approvals. In some ways, that was admirable, because had he not done it his way the factory might still not be built. However, those bureaucracies and Green party politicians – who since have become part of a coalition federal government in Berlin! – will be seething and will seek revenge on Tesla at any opportunity. The battery factory has still not been started. Their unanswered environmental problems remain. This CNBC article tells more.

Factory closures this month (July) in China and Germany will affect production yet again, and Covid-19 closures might return in China soon. Why is the newly built German plant being shut down for two weeks so soon after it opened?! And why was needed maintenance not done in the Shanghai factory during the Covid-19 lockdown that stopped production?!

Key team members are leaving. SA recently reported that the Technoking has lost his AI chief. His exit also comes only about 2 months before the company’s planned AI day. Tesla is expected to part ways shortly with Omead Afshar, who is running the Texas factory. Afshar is reported by Bloomberg to be under investigation internally for his role in purchasing hard-to-find construction materials. Sources indicated that the investigation was started after a purchase order for construction material was tagged as suspicious. Afshar is considered one of Elon Musk’s top lieutenants. Maybe more key people will follow.

Competition is building worldwide. The chart above shows the shares of the main carmakers, but shares of others are growing fast. In Q2 2021, there were 19 EV models for sale in the U.S. One year later, the number had jumped to 33.

Some of those makers are mostly still unknown names like BYD; Fisker (FSR); Rivian (RIVN); NIO (NIO); XPeng (XPEV); Li Auto (LI); and Lordstown Motors (RIDE). Some might not survive, but they are all fighting for a slice of the action now, and Tesla has the most to lose.

Europe is the second largest market for EVs after China. A recent report from Merics says “Europe is now the main target for electric vehicle exports from China.“

Hydrogen-fueled car are also hitting the highways in bigger numbers and more will do so as more and more refueling facilities are installed. Toyota (TM) is a leading maker of those. Elon Musk has scorned them, calling fuel cells “fool cells,” according to this Forbes report.

China problem for Tesla

Elon Musk’s SpaceX company may also compound Tesla’s potential problems in China. The South China Morning Post published this article, titled “China military must be able to destroy Elon Musk’s Starlink satellites if they threaten national security.”

There are also many reports that the Chinese government sees Tesla’s cars as a spying threat, having banned them in places requiring tight security and stopped government departments from buying them for official use. This getjerry report tells some of that story.

Given the influence the government has over its people, it could easily encourage them to buy Chinese brands in preference to Tesla.

Bitcoin. What buying these things has to do with car-making I know not, because it cannot be used to pay suppliers etc., but Elon Musk made a big gamble on these with Tesla shareholders’ money. He said at the time it was so that customers could pay with Bitcoin, in which case Tesla would be a receiver and not a buyer! The Street published this article recently: Tesla’s Bitcoin Bet Turns Into A Nightmare. From its high point in November 2021 – also Tesla’s stock price high point – Bitcoin is down nearly 70%! If Muck sells, he realizes a huge cash loss too, and apparently he intends to sell some soon to raise cash, according to this SA article! Why when those Q1 2022 results showed free cash flow of $2.228 billion?!

Recalls. In 2021, Tesla recalled 475,000 vehicles for safety issues in the U.S. alone. Barron’s recently reported that, since January, 2022, Tesla has issued four recalls for almost 1.5 million vehicles worldwide, according to the National Highway Traffic Safety Administration. That’s roughly four times the 360,000 cars that Tesla delivered in the U.S. in 2021, and a half-million more, at least, than the 936,000 delivered worldwide. Global deliveries rose about 87%, compared with 2020. Those problems have to be fixed free of charge, plus many other problems require fixing under warranty.

They all require the vehicle to be returned to a dealer to be fixed – pit stops that are a nuisance for the owners and costly for Tesla shareholders, meaning they are…

At the end of the road.

Latest results. I found the following on SA. Quote: Musk takes the mic:

Tesla (TSLA) weaved in and out of traffic in after-hours trading on Wednesday, ultimately settling up 1.5% at $753/share. The electric vehicle maker posted stronger than expected financials, with adjusted EPS of $2.27 (+57% Y/Y) on revenue of $16.9B (+42% Y/Y). The strong bottom line figure appeared to put to rest some concerns about the “gigantic money furnace” gigafactories in Austin and Berlin, while free cash flow rose above estimates at $619M (vs. consensus forecasts of $500M). Changing lanes: While prices for Tesla cars are up 25% to 30% from a year ago, the firm’s automotive margins compressed to 27.9% in Q2. The margins also fell below the 32.9% number that impressed in the first quarter, and 28.4% notched in 2021. The EV maker previously reported a disappointing quarterly delivery figure of 254,695 vehicles and is facing headwinds that include higher raw material and logistics costs. “We’ve raised our prices quite a few times. They’re frankly at embarrassing levels. But we’ve also had a lot of supply chain and production shocks, and we’ve got crazy inflation,” Elon Musk announced on a conference call. Tesla will also have to jack up production by 70% in the second half of 2022 to meet its annual delivery goal of 1.5M vehicles in the face of China’s zero-COVID strategy and supply chain crises impacting all automakers. Musk didn’t give a production forecast for the rest of the year, but he said the company was likely to achieve “record” output..

In my view, it will be impossible to “jack up production by 70% in the second half of 2022,” not least because the German and Chinese factories will be closed for maintenance for much of this month, July.

Aging models. The main Tesla Model S sedan came out in 2012, the Model X SUV in 2015. They have aged very well, but the many EV newcomers are putting new models on the road. If Tesla does not do so soon, that will cause it to get further behind.

Insiders may have known for some time that Tesla is losing the race and have been selling. Robyn Denholm – Chairman of the Board – was a huge seller in May and June this year, and Musk in April and earlier. Perhaps the Technoking knew then he would soon lose his crown!

I doubt the stock price will be much more that $300 by year end – down from $816 today. Traders might make money in the short term by buying and selling in the $600 – $700 range but I would advise investors to stay out of harm’s way.

Tesla does not engage officially in car races, but the losers make more pit stops than the winners. Tesla investors should expect many more pit stops to come!

Be the first to comment