Prapat Aowsakorn/iStock via Getty Images

Bloomberg reported this week that Altice USA Inc. (NYSE:ATUS) was working with Goldman Sachs (GS) on a potential deal to sell the company’s Suddenlink subsidiary. For those who do not follow Altice USA all that closely, Suddenlink is the cable and internet service provider with assets in the central portion of the United States, namely Texas. The reasoning behind the move would be to help Altice pay down its debt load, which was north of $25 billion as of 12/31/2021. Previous reports had Altice USA interested in selling or trading certain Suddenlink assets to better position the overall portfolio and focus on urban centers, but this is a major change in strategy.

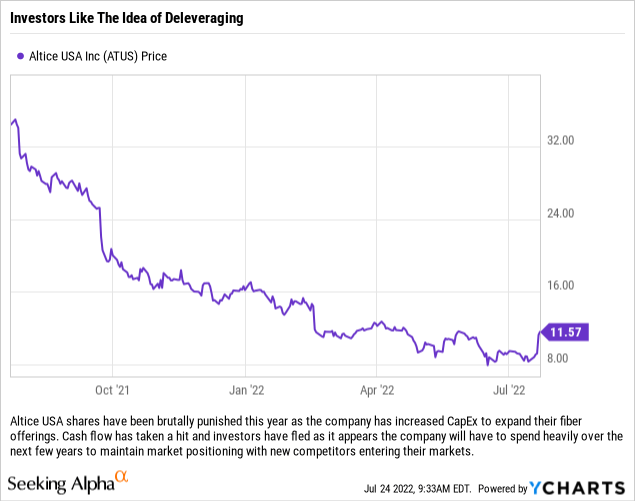

The reports indicated that a potential sale could result in a sales price of $20 billion, or more than double the $9.1 billion that Altice USA paid in 2015 to purchase Suddenlink (although it must be noted that Altice has invested in the business and purchased other providers, such as Morris Broadband, that were rolled up into the Suddenlink business). As one could have predicted, Altice USA shares spiked on the news, rising around 43% intraday before pulling back some.

Our Thoughts On The News

As shareholders in Altice USA, if this deal can be done for $20 billion, we certainly hope that management pulls the trigger. With competition heating up between the CATV and telecom companies, not to mention satellite and other competitors, we think that a roughly 15x EBITDA multiple for Suddenlink would be more than a fair price for shareholders. The problem is that we do not see a whole lot of potential natural buyers out there for this specific asset and think that a 15x multiple might be too steep an ask.

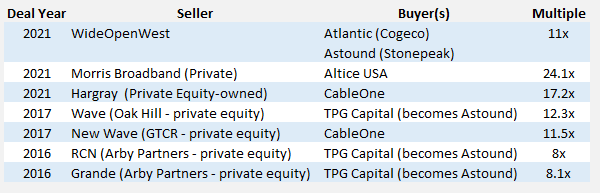

True, Altice USA does not have to sell Suddenlink in its entirety, but the multiple might be the sticking point. Cable deals had seen ever rising multiples, especially after private equity firms took an interest in the industry, but 2021 might have been the high water mark for the industry with Altice USA’s deal for Morris Broadband sporting an EBITDA multiple over 24x and CableOne’s purchase of Hargray with a multiple over 17x. In our view those two deals are outliers as both came in the fast-growing US Southeast, Morris Broadband was a relatively small deal with a $300 million+ total deal value and Hargray saw a rich multiple (and price paid per subscriber) because the company had spent the last few years building out its fiber network to connect Beaufort, SC to Savannah, GA and had built the fiber infrastructure to enable a buyer to grow quickly in its territories of South Carolina, Georgia, Florida and Alabama.

Looking at the landscape in the CATV space today, with added competition from 5G, satellites, telecom fiber and sometimes multiple cable companies competing in the same markets – one comes away thinking that many of these assets might actually be worth less today than they were a few years ago. With debt costs rising it also impacts what a potential buyer can pay for an asset, so multiples should contract on debt service coverage as well. When we have looked at this company before, we have utilized an estimated EBITDA range of 11-13x for valuation purposes when looking at the non-Cablevision assets. We think that range is a fair way to look at the assets, especially considering that WideOpenWest (WOW) did two deals in 2021 selling off assets and received roughly 11x EBITDA on the deals.

Potential Buyers

Looking at the industry right now, it certainly appears that everyone is looking for someone else to bail them out of their M&A and expensive capital outlay binges from the past few years. Even the industry heavyweights, Charter Communications (CHTR) and Comcast (CMCSA), are working to pay down debt and/or doing expensive network upgrades of their own right now. WideOpenWest has essentially been trying to sell itself for months and does not appear to be any closer today, other than rumors that surface from time-to-time, to having a buyer than when they announced they were exploring the possibility.

So this basically leaves other foreign competitors and private equity buyers as the only parties that might be interested in buying some or all of Suddenlink. Cable One (CABO) is probably not big enough to purchase Suddenlink outright, but could be a buyer of certain territories if Altice USA wanted to offload some geographic areas. Similarly, Canada’s Cogeco (OTCPK:CGEAF), owner of Atlantic Broadband, could be a purchaser of certain territories, but likely nothing more. That leaves the usual private equity players or privately held companies such as Astound (Stonepeak), or even Cox.

Pre-2017 many transactions were completed at single digit multiples, but since then most deals (some of which are not listed here) have been between 11-13.5x EBITDA. (SEC Filings, News Releases, News Reports)

The other issue buyers may have is the cost per subscriber. With Suddenlink having around 1.7 million broadband users, a $20 billion price tag would equate to paying roughly $11,800 per subscriber. For reference, that is over double what WideOpenWest sold its assets (in two separate deals) to Atlantic and Astound for in 2021 and significantly higher than all of the transactions in the above table other than the transaction where Altice USA was the purchaser of Morris Broadband (in that transaction, it appears that Altice USA paid between $9,800 and $9,900 per subscriber).

Our Thoughts Moving Forward

We purchased Altice USA shares after the market decided to punish the company for ramping up CapEx to roll out fiber. We think that over time this will be a good trade, and if the company can speed that realization up, then even better! The parameters (read expectations) that Altice USA has floated for this deal lead us to believe that the company is not entirely serious about selling the entire division and refocusing as a smaller, more nimble fiber company. Getting someone to pay a +15x multiple with these types of headwinds for the business would be great, but it just does not seem realistic right now.

One way to get to the desired multiple would be to do like the Canadian pensions/investors did when Altice USA purchased Suddenlink back in 2015, and that would be to keep a minority position. That would give Altice USA the desired multiple, allow them to mark up an asset on the balance sheet (the equity they keep in Suddenlink) and give Altice USA a large cash infusion to pay down debt with the potential for additional future cash flows based on distributions (much like the AT&T (T) deal where they sold DirecTV to private equity players).

Altice USA shares are a ‘Hold’ in our opinion, especially in the current situation because the controlling shareholders will not entertain an offer for the company in its entirety. So any transaction will likely be taxable and could leave minority shareholders once again at the mercy of a shift in management strategy. There are some scenarios where a deal could be great for minority shareholders, but with the current debt load, we think that a deal would have to be done at a +13x multiple to make sense and that is not the slam dunk for management that a 15x multiple deal would be. We will continue to watch this situation, but right now think that this is a buyer’s market and not a seller’s.

Be the first to comment