Justin Sullivan/Getty Images News

After the bell on Friday, electric vehicle maker Tesla (NASDAQ:TSLA) filed its preliminary proxy statement ahead of this year’s annual meeting. As part of the filing, Tesla is looking to increase the number of authorized shares of common stock in an effort to execute a 3 for 1 stock split. With the stock having soared roughly two years ago around a previous stock split, investors may be hoping for large gains again. However, the situation is a lot different this time around.

Perhaps the most important item to look at here is market cap. When Tesla announced the 5 for 1 split back in August 2020, the closing market cap that day was about $256 billion. As of last Friday’s close, the company was worth about $722 billion and that doesn’t include the nearly 2% rally seen in the after-hours session. A market cap that’s nearly three times what it was for the previous split obviously makes it harder for the stock to rally, because a given level of buying (say $1 billion) doesn’t go as far this time around.

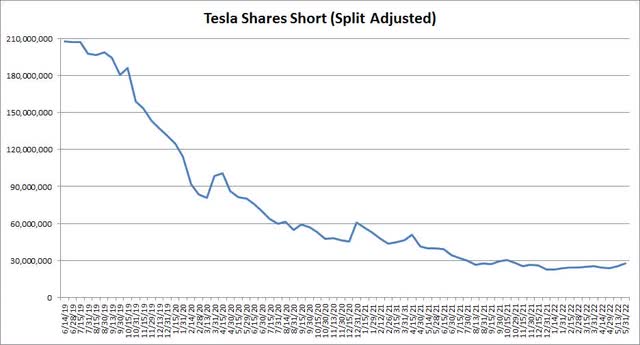

Also, the stock’s float as a percentage of outstanding shares is about three percentage points higher this year than it was back in the summer of 2020. That means that there’s a little more overall supply, and it’s mostly due to Elon Musk’s share sales from last year and earlier this year. Along the same lines, short interest in Tesla has dropped considerably over the last two years as seen in the chart below.

The number of shares short is down almost 54% since Tesla announced its stock split back in 2020. At the same time, the number of outstanding shares is up more than 105 million (on a split-adjusted basis), or 11.2%, while the float is up more than 15% since then. As a result, short interest as a percentage of the float has gone from more than 8% at the end of July 2020 to just 3.2% now. This significantly reduces the chances of a short squeeze happening. Back then, those betting against the stock might have been caught off guard a bit by the 2020 split, thus needing to cover which helped a little bit in the large rally.

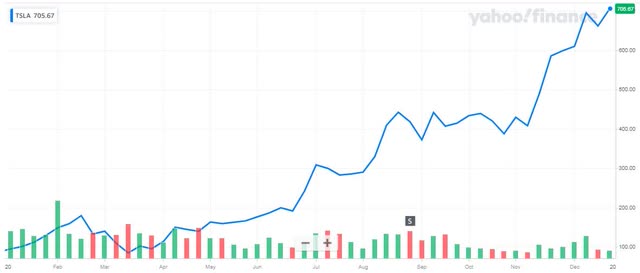

Some investors may also be looking at the entire rally in 2020 and be attributing it to the split. As the chart below shows, Tesla shares did move nicely higher on the split news, but that wasn’t the most important news item of the year. The major rally came later in 2020 after Tesla gained inclusion to the S&P 500 Index, which sparked a tremendous amount of buying. As it became more clear throughout the year that Tesla was about to meet the criteria to enter the index, part of the buying that occurred around the split may have been lumped in with S&P inclusion speculation. There is no major catalyst like that this time around.

Tesla 2020 Chart (Yahoo! Finance)

Another major item to look at is where Tesla was as a company back then. The previous stock split was announced just a few weeks after management reported a 5% year over year revenue decline for its Q2 period. With the Fremont factory shut down for a good portion of the quarter and Shanghai in its early Model 3 ramp, Tesla’s results were significantly pressured. While a new round of Covid shutdowns will hurt this year’s Q2, I don’t think even the most bearish person out there thinks we’ll see anywhere close to a 5% year over year revenue decline. Back then, people were worried about businesses just surviving, and Tesla ended up raising $10 billion in capital later that year.

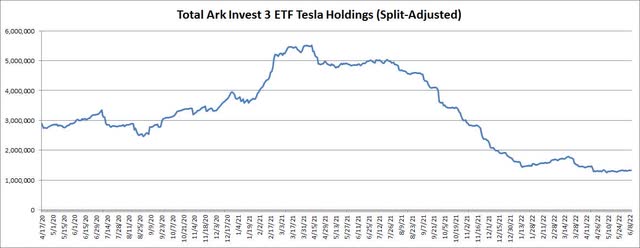

Another major reason this time is much different is in central bank and fiscal policy. Back in 2020, the Fed was expanding its balance sheet by trillions of dollars and governments were handing out stimulus checks to bolster economies. Today, central banks are now raising rates, like the Fed is expected to do again this week, with quantitative tightening about to start bringing the Fed’s balance sheet down by hundreds of billions of dollars this year. Speculative stocks were skyrocketing back then, and you had firms like Ark Invest with massive inflows increasing their Tesla holdings by the day. Cathie Wood’s firm has lost a significant amount of its net assets since then and its Tesla position has shrunk considerably as seen in the chart below partially due to redemptions but mostly because of allocation selling.

Ark Invest Active ETF Tesla Holdings (Ark Invest)

The final item is one that could be a bit of a wildcard this time around. Elon Musk is trying to acquire Twitter (TWTR), although the pending deal is in question due to how many bots are actually on the social media site. Should Twitter’s board try to force Elon to pay the agreed upon $54.20 price and some of Elon’s backers drop out, he might need to sell millions more of his Tesla shares to finance the acquisition. This issue has provided a bit of an overhang on the EV maker in recent months, and we could be getting much closer to some real fireworks surrounding this major purchase as we get closer to the stock split.

Tesla is proposing an increase in its authorized share count, so the stock can undergo a 3 for 1 split, but this isn’t the same situation as 2020. The EV maker has a much larger market cap this time around, combined with much lower short interest, and investors don’t have the major S&P 500 inclusion catalyst to help out. The business is also in a much better place than the summer of 2020 when it was reporting revenue declines and in need of a capital infusion. Finally, the overall market is in a completely different spot, going from a time of extremely easy money policy to one where the Fed is tightening things up quickly in an effort to combat high inflation. While Tesla shares might respond positively if a split does occur later this year, investors looking for significant returns again due to this singular catalyst will likely be disappointed.

Be the first to comment