John Penney/iStock Editorial via Getty Images

This article was prepared by Eranda Kalhara, CFA in collaboration with Dilantha De Silva.

Etsy, Inc. (NASDAQ:ETSY), a company that made headlines in the pandemic era, has witnessed its market value dramatically decline by more than 60% this year, which may not come as a surprise given how the Nasdaq has entered the bear market territory. The pandemic-propelled business is now experiencing slow growth as health risks have taken a back seat while the world increasingly moves toward normalcy. The work-from-home concept is not getting the popular vote like many expected with industry giants such as Elon Musk and Sundar Pichai demanding their staff to be back in the office.

With the above-mentioned factors and the high inflationary environment, the elephant in the room is to determine the way forward for Etsy, especially on how the company plans to overcome these challenges and grow its business in the post-pandemic era.

In order to evaluate this, we need to look at multiple factors including the value addition the platform brings on to the table in comparison to its peers, the possible factors that helped the company to propel during the pandemic, and whether the same behavioral patterns of consumers will remain in the aftermath of the pandemic. We also need to determine whether this is a transitory slowdown in growth that we are seeing today or whether Etsy’s revenue-generating capacity has taken a permanent hit.

The objective of this analysis is to find answers to these questions.

A platform with a unique merchant network

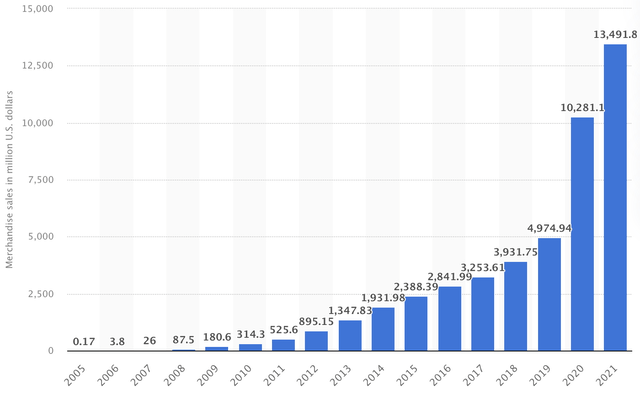

Etsy has managed to connect a base of 7.65 million active sellers – located mainly in six geographies – with 95 million active buyers in an online marketplace that generated over $13 billion in gross merchandise volume in 2021. The company’s four properties – Etsy, Reverb, Depop, and Elo7—have built a marketplace around non-commoditized inventories, generating commissions on third-party and peer-to-peer sales. The company’s focus has been to create a “treasure hunt” experience around a unique, customizable, and consequently less price elastic product suite.

Exhibit 1: Etsy gross merchandise volume

Source: Statista

In the e-retail business, the value of a platform arises not with a single sale, but by attracting a regular or habitual customer group. In that sense, Etsy has been successful in turning casual shoppers into frequent buyers representing around 9% of its active customer base with an annual run rate of $700 that supports 45% of marketplace gross merchandise value. Price competition and fulfillment speed with an emphasis on non-commoditized products have supported Etsy to clock in growth ahead of the U.S. e-commerce industry and also eclipse peer growth trends in client acquisitions in the recent past.

Etsy, in our opinion, has gained an edge over its peers through its search & discovery capabilities. Backed by a personalized search experience, Etsy helps buyers to discover unique products to match their requirements rather than presenting a set of homogenous products chosen from a few sellers on the home page.

Compared to other peer platforms, Etsy has a group of sellers that are unique to the platform. What do we mean by this? Most online retailers are not attached to one platform and they usually strive for higher volumes of sales. These sellers often do not offer customized offerings based on the platform they are working with either. But Etsy has managed to emerge as the go-to marketplace for small businesses/merchants that thrive on personalization and engagement by providing adequate infrastructure to do so. Etsy has managed to squeeze into an untapped market with a network of over 7.65 million merchants (and counting) that arrange craft fairs and live selling events. The company accumulated over 5.5 million small-scale merchants during the initial Covid period, and this boom, in our opinion, will leave a long-lasting positive impact on the company. For a merchant who sells crafts and artwork, it is difficult to find a retail platform that provides the same degree of scale and infrastructure support offered by Etsy. The company also offers a user-friendly interface and attractive advertising rates to merchants. For all these reasons, we believe Etsy is home to a unique group of sellers that view Etsy as their number one marketplace choice.

Etsy has won the trust of customers by maintaining a proprietary product database of more than 100 million listings that comprise items sold by some sellers that are only available on Etsy. Etsy’s search algorithm understands the language of the individual/micro-business owner with no merchandise experience and helps a buyer choose products that match their unique requirements. As deep learning algorithms have been the foundation of the platform, we believe the company’s discovery features will only get better and more effective as Etsy grows.

We believe the non-standardized product range unique to Etsy (As per Morningstar, roughly 44% of sellers on Etsy are only available on Etsy] coupled with the network effect benefits will help Etsy maintain steady growth in coming years. However, high inflation disrupting the discretionary spending of the average American will lead to reduced basket sizes in the short run, creating a challenging macro environment for Etsy.

Growth initiatives and strategic acquisitions

The prospects of the company rely on the ability of Etsy to remain competitive by offering an enhanced user experience to both sellers and buyers. We believe Etsy is doing a reasonable job by focusing on product investments while keeping the personalization and customization of products close to heart. In addition to this, we believe seller shipping promotions, performance-marketing, and the improving customer service function will add long-term value to the users of Etsy’s platforms. Etsy’s past investments in Google cloud migration, freeing up 15% of developers to focus on products than IT maintenance, are proving to be value accretive as well.

Non-U.S. revenue for the first quarter of 2022 increased to 45% of gross merchandise sales backed by an increase in marketing spending in international regions. This is an area the company has been focusing on recently to tap into the massive opportunity outside the United States, and we believe aggressive marketing will pay off handsomely in the long run by helping Etsy beat the competition.

Etsy launched a gender-neutral marketing campaign targeting male shoppers as well, in a bid to expand its horizons further in both new and existing markets. More than 35% of new buyers in Q1 2022 were shoppers that identified themselves as male, which gives reason to believe Etsy’s efforts to diversify its revenue sources are yielding promising results. In the Q1 earnings conference call, Joshua Silverman, CEO of Etsy, said:

We recently conducted research to better understand men’s shopping attitudes and behaviors and learned that those who identify as men are as likely as women to be intentional shoppers, valuing handcrafted items, supporting small businesses, wanting to make a positive impact with their purchases or buying items that reflect their personality.

In terms of strategic acquisitions, the recent buyout of Depop which is operating in the resale fashion industry was executed at a price of $1.625 billion implying a price/sale multiple of 23. Even though Etsy holds promise to capitalize on the growth prospects of the fashion resale market, the question remains whether the hefty premium paid on this acquisition is justifiable given the challenges the marketplace could face in the post-pandemic era.

Etsy is well-positioned to join the double-digit growth story of the e-commerce segment in Brazil with its recent acquisition of Brazil-based Elo7. We also believe the deal for Reverb, an online marketplace of vintage musical items, will help Etsy’s growth story. These marketplaces represent less than 15% of the consolidated GMV of the company, nonetheless, we appreciate these strategic acquisitions as these are in line with Etsy’s core operational values. We believe these investments should be viewed as expansions that could help Etsy broaden its buyer and seller base while consolidating shared expenses.

Exploring new opportunities to stay ahead of the game

The company’s house of brands has increased with the above-mentioned acquisitions and these deals have expanded its foothold in the international arena as well. We hypothesize that Etsy is not focused on a specific geographic location but is intending to be a global brand. With a population of 1.4 billion [annual growth rate of 1%] and an e-commerce market valued at $75 billion in 2022, India is at the forefront of e-commerce growth worldwide. During the pandemic, India witnessed a boom in the household handcraft market, which plays well into Etsy’s unique value proposition. We believe Etsy has identified this opportunity as it has been onboarding new merchants from India at an accelerated rate.

The globally stationed Indian expatriate community will also find Etsy’s expansion efforts in India welcoming, and we believe that India will become one of the key markets for Etsy in terms of both sellers and buyers in the long run. Success in India will also help Etsy expand aggressively into other neighboring markets in Asia as well, so it makes sense for Etsy to double down its efforts to capture market share in India.

Risks to monitor

Etsy’s unique value proposition may have helped the company negate competitive pressures so far, but the competition in the e-commerce sector cannot be ignored. Compared with industry behemoths such as Amazon.com, Inc. (AMZN), Alibaba Group Holding (BABA), and eBay Inc. (EBAY), Etsy has a smaller customer and merchant base and must also compete with merchants leveraging social media platforms such as Facebook in the wake of social shopping.

Etsy’s big hits have been homeware and home furnishing products followed by other discretionary items such as beauty products and apparel. This leaves the company vulnerable to macroeconomic challenges. With high inflation and rising interest rates [which most probably will lead to stagflation], Etsy will face challenges in maintaining the same growth momentum going forward. We need to be mindful of the future path of inflation as analysts are still divided on key factors such as the direction of energy prices from current levels and the impact of the Ukraine-Russia war. Etsy, like most e-commerce businesses, tends to witness seasonality of revenue with 31% of its 2021 revenues coming in the fourth quarter. If macroeconomic factors further deteriorate in the second half of this year, the disposable income of consumers will be impacted, thereby resulting in lower basket values. Additionally, non-U.S. revenue is subject to exchange rate fluctuations and geography-specific economic conditions.

Exhibit 2: Etsy Marketplace top 6 categories

Source: Q1 presentation

The e-commerce industry is being scrutinized through data protection laws, seller-buyer protection laws, digital taxes, and the health of online payment practices, and this regulatory scrutiny might lead to a compliance burden for Etsy as well.

Takeaway

Our findings suggest Etsy has a long runway for growth, and we believe the company is doing the right thing by focusing on the long-term sustainability of earnings growth by sacrificing short-term profits to invest in product development and marketing. What keeps us from investing in Etsy stock today is our belief the company is heading into a period of lackluster growth amid volatile market conditions that have opened up many new investment opportunities for us. We are planning to revisit our thesis on Etsy at the end of the third quarter.

Be the first to comment