Filip_Krstic/iStock via Getty Images

An increasing number of plastic surgeons in the U.S. and globally are performing non-surgical cosmetic procedures like fat reduction, hair removal and skin tightening through the use of medical devices that rely on energy-based technologies like radio frequency and laser to achieve results without surgery.

Non-invasive or minimally invasive cosmetic procedures, as these kinds of non-surgical procedures are called, have become incredibly lucrative for surgeons. The amount of money that patients in the U.S. spent on energy-based cosmetic procedures reached a record $1.55 billion in 2021, a 52% jump from $1.02 billion in 2020. This is according to industry statistics published by the Aesthetic Society, the apex trade association for board certified aesthetic plastic surgeons in the U.S.

Long-term trend

Because non-invasive and minimally invasive cosmetic procedures are associated with less pain, fewer complications and shorter hospital stays, they are rapidly growing in popularity among patients seeking cosmetic treatment.

In 2020, for example, 13.2 million cosmetic procedures in the U.S. were categorized as non-invasive/minimally invasive vs the 2.3 million that were categorized as surgical, according to data from the American Society of Plastic Surgeons.

Aesthetic plastic surgeons are therefore keen on getting the best energy-based surgical devices in the market as this can easily make the difference between a successful practice and an unsuccessful one. Surgeons likely don’t view the cost of these devices as a cost, but rather, as an investment that guarantees increased future income given the industry trends.

This is in my view a reliable long-term trend that investors can bet on by gaining or increasing exposure to InMode (NASDAQ:INMD), an Israel-based medical devices company.

INMD produces and sells radio-frequency powered surgical devices directly to plastic and facial surgeons, aesthetic surgeons, dermatologists and OB/GYNs in the U.S. and other international markets. Its latest US/International revenue split is roughly 67% to 33%, as per its latest quarterly financial and operating results, indicating it is reliant on the more mature U.S. cosmetic surgery industry.

Thanks to the explosive demand for its devices in the US and internationally, INMD has grown in leaps and bounds in the past few years. Its revenues more than doubled from $156.4 million in FY 2019 to $357.6 million in FY 2021. The company is on track to extend this impressive growth streak in FY 2022 with revenues expected to come in between $445 million and $450 million, according to guidance issued by the management on the Q3 earnings call held on October 27.

The quintessential cash cow

One of the main reasons why investors should consider investing in INMD is the fact that it enjoys incredibly high industry-leading margins. The business is the quintessential cash cow with gross margins of 83.92%, EBITDA margin of 44.69% and net income margin of 40.93%.

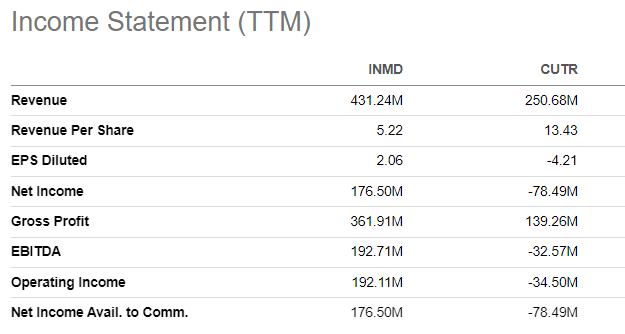

INMD has maintained these mouth-watering margins year over year for a considerable time now, which is impressive and makes a huge difference in its ability to profitably deliver growth. Cutera, (CUTR), a direct competitor, doesn’t enjoy similar margins and this is reflected in a side by side comparison of its income statement with INMD’s as shown below.

INMD income statement vs CUTR (Seeking Alpha)

Another compelling reason to consider giving INMD a more prominent place in your portfolio is the pristine balance sheet it has built through the years. The company literally has no net debt as its last reported total debt of $3.7 million is negligible for a business that was holding total cash of $486.4 million at the time.

INMD is essentially able to pass down most of the cash it generates to its EPS measure, increasing shareholder value. This explains the rapid EPS growth it has been able to achieve in recent times, with the record $0.66 EPS in FQ3 2022 being more than double the $0.32 EPS in FQ3 2020.

A great investment

INMD is a great business, but is it a great investment? The two can sometimes be mutually exclusive as a business’s great prospects could have already been priced into a stock at the time of buying, thereby limiting the upside potential for new investors.

However, in the case of INMD, the current valuation is low relative to the underlying business’s future potential. It is therefore an investment worth considering at current levels. There are several pointers to INMD’s low valuation.

The first obvious one is a look at INMD’s valuation metrics relative to where they were several years ago. It is currently trading at a P/E of 17.15x vs a five year average of 25.21x and EV/EBITDA of 12.69x vs a five year average of 22.63x. The stock has basically gotten cheaper, which is not unusual given the bearish market environment in 2022.

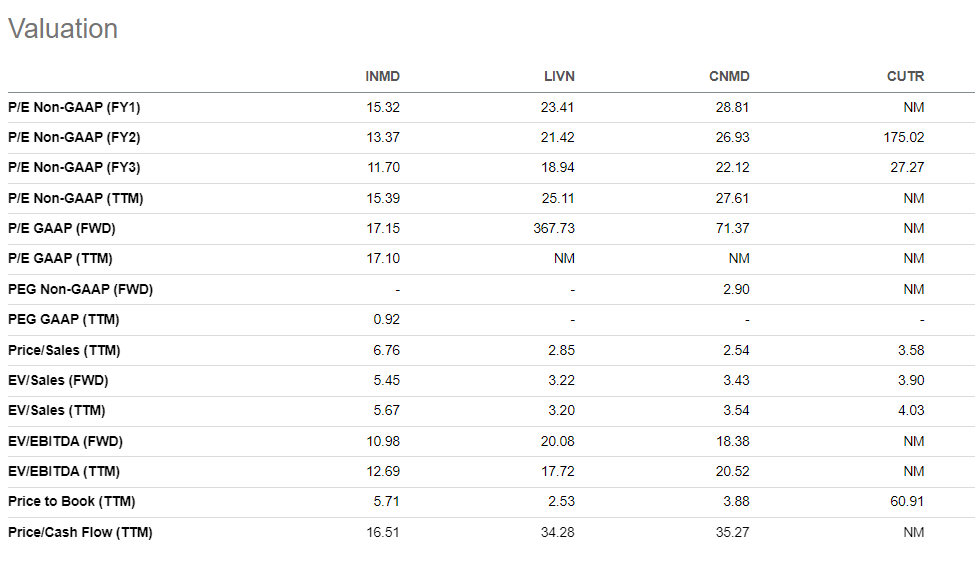

The second and perhaps more compelling sign of INMD’s undervaluation is a look at its valuation relative to a number of peers in the medical devices industry.

INMD valuation vs peers (Seeking Alpha)

For this comparison, I have looked at CUTR, a direct competitor selling devices to aesthetic surgeons worldwide. I have also included LivaNova PLC (LIVN), a medical device maker that sells its devices to neurologists, neurosurgeons and other physicians. LIVN focuses on treatments for drug-resistant epilepsy, difficult-to-treat depression, and obstructive sleep apnea. Lastly, I’ve also included CONMED Corporation (CNMD), which offers orthopedic surgery products.

INMD’s is the most undervalued in this group of medical device manufactures, yet is the most financially stable and has the most promising prospects. Despite this relative undervaluation, INMD is sitting on cash of $486.4 million with virtually no debt while CUTR is loss making and has net debt of $65.2 million, LIVN is loss making and has net debt of $346.68 and CNMD is also loss making and has net debt of $1 billion.

Ask yourself, if you could pick only one of these companies to fully own, which one would you pick? It’s a no brainer that you would own INMD in my opinion. The fact that it is the cheapest of the group shows how great the potential upside is.

Manageable risk profile

The first risk I believe investors should be concerned about is competition. INMD is in a fast growing space that still has considerable time to go before it reaches saturation and it is possible that it could face serious competition in future.

While there’s no sure way to predict what the future competitive landscape looks like, it is reassuring that INMD is now thinking of putting its cash to use through acquisitions.

“In addition to our active pipeline of new technology, we’re also exploring potential acquisitions that could complement our presence in the wellness market. This could be companies with an established track record and an existing customer base in the U.S. and globally,” said INMD CEO Moshe Mizrahy on the Q3 earnings call. In my view, an acquisition could add far greater value for shareholders than buybacks, which INMD has done at a very small scale in the past.

The other risk to look at is the possibility of a recession and what that could do to demand for cosmetic procedures. For this risk, I believe INMD is well insulated by the fact that its end users and customers are generally people in the high income bracket. INMD’s strong balance sheet also works to its advantage in the event of a recession as it can continue growing without taking on debt. In a recession, competitors with weaker balance sheets are likely to face constraints due to the difficult economy and tightening financial conditions.

The recession risk is also offset by the fact that INMD is expanding its product offering and diversifying its revenue lines. Some of INMD’s newer products, such as its Empower Platform for women’s health and wellness that it sells to gynecologists, have been doing incredibly well. The company noted that sales performance for the new product line has consistently exceeded expectations in 2022, which is its launch year.

“If you recall, we gave a target for Empower for Women Health at the beginning of the year. We said it will be $20 million and then we raised it to $30 million, and now we’re raising it to $40 million,” said Moshe on the earnings call.

I personally think there is a lot of potential with INMD getting into women’s health. Not only is this a highly promising area given the initial positive response to its new product, but there are also great synergies with other existing and established product lines.

The Aesthetic Society notes that women accounted for approximately 94% of all cosmetic surgical and non-surgical procedures in 2021. It is telling that some of INMD’s greatest champions from a marketing standpoint have been female celebrities such as socialite Kim Kardashian, who has posted on Instagram before about Morpheus8 laser treatment, one of INMD’s flagship devices.

INMD this September announced award-winning actress, director, and producer, Eva Longoria, as its global brand ambassador. This further highlights its strong appeal to women. That’s why I am of the view that INMD’s early success with Empower could do wonders for the business’s overall sales by leading to an uptick in sales of its other product lines in Empower distribution channels.

Conclusion

INMD is a wonderful company at a fair price. Its peak market cap was $7.2 billion in October 2021 vs $2.9 billion today. While this peak was in part because of the speculative frenzy that gripped markets in 2020 (post-covid) and 2021, it gives an indication of the lofty expectations investors have for this stock. These expectations are well founded and not yet reflected in the current stock price, which is undervalued. I’ve been bullish on INMD for a while and it is one of my big buys going into 2023. I will continue adding to my existing position if the valuation remains reasonable.

Be the first to comment