cmannphoto

So far this earnings season, good news stories have been very rare to pick out. In the tech sector especially, where “beat and raise” quarters used to be more the norm than the exception, the past two quarters were particularly painful with downward estimate revisions driven by macro trends, FX headwinds, and opex inflation.

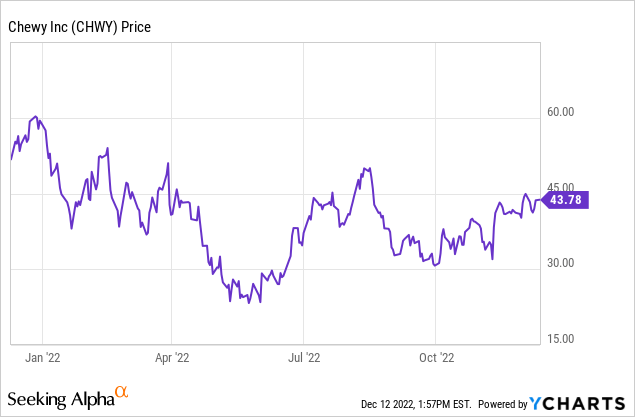

Chewy (NYSE:CHWY), however, stands out from the pack with a very positive Q3 story after its earnings report in early December. The company is bouncing back after a guidance cut in Q2, showing an acceleration in revenue growth on top of a huge boost in gross margins. Relative to the rest of the sector, Chewy isn’t as battered as other internet names, though it’s still down more than 20% on the year:

I remain bullish on Chewy and am holding onto the name in my portfolio as I expect the uptrend to continue. In my view, pessimism on this company has “bottomed out” – we should recall the fact that, per Chewy management, 83% of the company’s revenue is based on non-discretionary products such as pet food and health items. Macro headwinds are going to have a far flatter impact on a company like Chewy relative to its internet peers (apparel e-commerce companies are weighed down as customers pull back on discretionary spending; social media companies are tightening their belts as advertisers drain their budgets, etcetera): I view Chewy as a relative port in the storm.

Here is the full long-term bull case for Chewy:

- Expanding wallet share- A Chewy customer, especially those on Autoship, tend to be very loyal. The company notes that a customer in Year 2 tends to spend $400 per year, $700 in Year 3, and $900 in Year 4. As pet needs and the willingness to spend for pets continues to rise, Chewy is there to capture that growing wallet share.

- Pet ownership is taking off- The trend of “pandemic pets” is still driving increased pet ownership in the U.S., and a lot of those new pet parents skew young and are highly disposed toward convenient online services like Chewy.

- Beloved consumer brand- Chewy has built up quite a lot of brand equity around being a very customer service-oriented company.

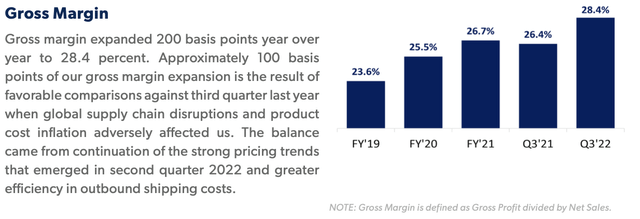

- Margin expansion driven by expanding product categories- Chewy’s push to grow its own brand (Tylee’s), plus focus more on selling higher-margin hardgoods, has proven very effective at producing margin expansion. Gross margins have recently expanded to ~28%, vs. low-20s at the onset of the pandemic. In addition, Chewy’s success at passing on price increases to its customers has allowed it to preserve this gross margin progress even in the current inflationary environment.

- Constant product innovation- More to the point above, the company recently also launched its own pet wellness brand “Vibeful”, which gives it access to a pet health and wellness TAM that it sizes at $2.4 billion alone.

- Nascent opportunities in pet telehealth and pet insurance- The craze in telehealth and doctor consultations via your mobile device is spilling over into the pet world, too. The company’s “Chewy Health” offering has built out a “Connect With A Vet” service, and it also has rolled out a pet pharmacy as well. In August, the company rolled out its “CarePlus” pet insurance plan, which was recently bolstered through a new partnership with Lemonade’s (LMND) pet insurance vertical. This is a broad, new opportunity for Chewy that can both accelerate its growth and grow its margins.

Stay long here: after the good news that rolled in during Q3, the tide looks set to turn in favor of Chewy bulls in early 2023.

Q3 download

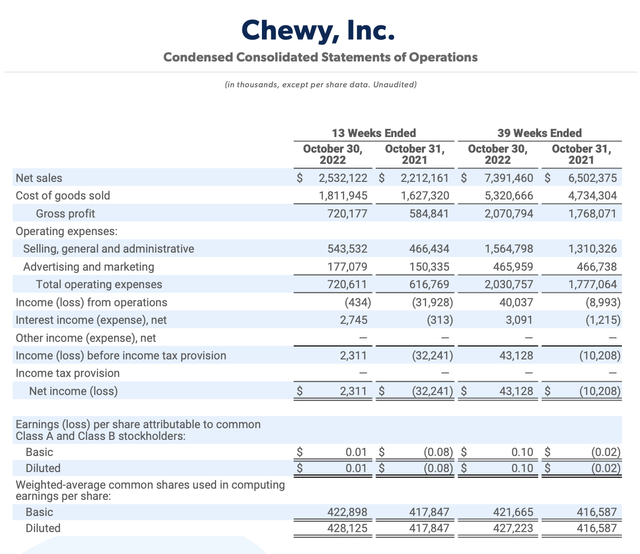

Let’s now discuss the positive trends that Chewy reported in its Q3 earnings, released in early December. The earnings summary, taken from the company’s Q3 shareholder letter, is shown below:

Chewy Q3 results (Chewy Q3 shareholder letter)

Chewy’s revenue grew 14.5% y/y to $2.53 billion in the quarter, beating Wall Street’s expectations of $2.47 billion (+11.8% y/y) by a three-point margin, as well as accelerating 170bps over Q2’s revenue growth rate of 12.8% y/y.

The company added 100k net-new active customers in the quarter (again, a marked distinction against more discretionary e-commerce companies, which are seeing active customer trends decline from the COVID era), while net sales per active customer also rose 14% y/y – driven in part by Chewy’s strategic price increases.

Here’s some helpful anecdotal commentary on the company’s revenue strength, taken from CEO Sumit Singh’s prepared remarks on the Q3 earnings call. Key to note is that the company saw improved market share, as well as an acceleration over Q2 in discretionary hard goods products:

Building on the momentum we reported in the second quarter, Chewy’s Q3 results showed accelerating double-digit top line growth, a sequential increase in active customers, sustained gross margin expansion and solid free cash flow generation. We experienced strong demand throughout the third quarter, especially across our non-discretionary categories, which provided a solid foundation for our growth. The resilience of the underlying demand in these categories, coupled with our ability to grow customer share of wallet, again enable Chewy to outperform broader industry trends and take incremental market share […]

Within discretionary categories, hard goods showed relative improvement in Q3 with sales declining 5% year-over-year, which is a 400 basis point improvement versus the second quarter year-over-year performance. We remain confident that hard good sales will return to their growth path as the economic environment improves. Taking a longer term view, over the last 3 years, our third quarter hard good sales are up 70%, gross profit has nearly doubled and gross margin has expanded by over 400 basis points.”

A great segue into gross margin: in Q3, Chewy’s gross margins grew 200bps y/y to 28.4%. On a y/y basis, about half of this improvement is due to an easy compare versus supply challenges last year that ate into margins (primarily due to logistics rate inflation), but half is due to Chewy’s decision to pass on higher costs to consumers (which, as can be seen from the top-line results, haven’t significantly dented demand). Another driver behind gross margin improvement is better inventory balancing across the company’s supply network, which has reduced average shipping distances by 25%. Chewy’s gross margins also grew 30bps sequentially versus Q2.

Chewy gross margins (Chewy Q3 shareholder letter)

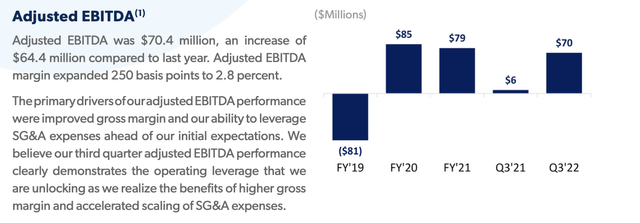

Strong gross margin trends also bled over into overall profitability: adjusted EBITDA grew to $70.4 million in the quarter, translating to 250bps of y/y margin improvement. Again we should stress here that most tech companies have cited opex inflation and weak revenue trends as drivers for downside margins, while Chewy is reporting the opposite.

Chewy adjusted EBITDA (Chewy Q3 shareholder letter)

Key takeaways

There’s a lot of hope for Chewy heading into 2023. Amid revenue strength stemming from resilient “pet parent” demand plus improving gross margins and overall profitability, Chewy looks on track to outshine many of its internet peers and regain lost ground.

Be the first to comment