DINphotogallery/iStock via Getty Images

Today, I’m going to be taking another look at Diana Shipping (NYSE:DSX), a shipping company operating in the dry bulk sector. Those that have read my previous articles should know that there are very specific reasons why I like this company, the most important being its defensive and conservative profile, when it comes to vessel deployment. In this article, I’m going to look into the company’s recent vessel acquisitions and time charter schedule and try to assess whether Diana Shipping is still a long opportunity.

Recent vessel acquisition activity

A few months ago, the company announced the agreement to purchase 9 Ultramax vessels at a cost of $330 million, of which $220 million would be paid in cash and the rest would be paid as company shares, at a price of $5.95 per share. Now, this is an interesting development for several reasons. Firstly, we can see a shift in the company’s policy towards smaller vessels. Until now, Diana’s fleet was comprised exclusively of Capesizes, Newcastlemaxes, Kamsarmaxes and Panamaxes. These are large to very large ships. Ultramaxes, on the other hand, are much smaller vessels. Post transaction, the company will have a total of 43 dry bulk vessels with an average fleet age of 10.5 years and a total carrying capacity of 4.5 million DWT. In terms of tonnage diversification, this transaction brings approximately $550k of Ultramax carrying capacity, which represents 12% of the company’s total carrying capacity.

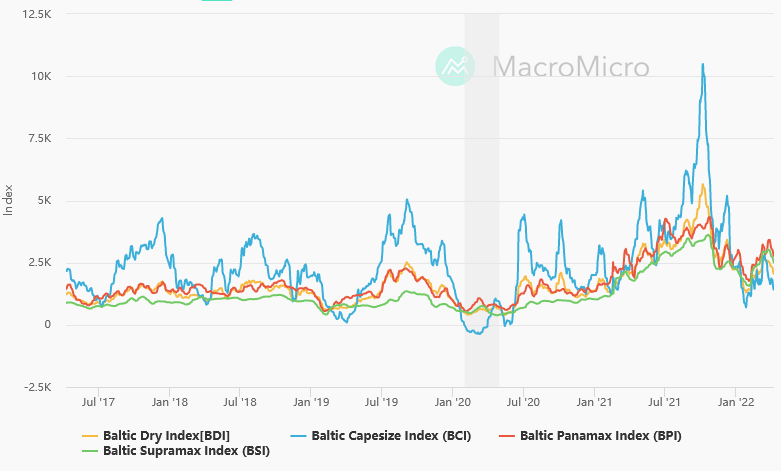

As I’ve written several times in my previous articles, (for instance, refer to this pure Supramax / Ultramax play in “Eagle Bulk Shipping’s Modern Fleet Pays For Its Dividend, Debt Cost And Your Vacation“), smaller dry bulk vessels come with a certain set of advantages against their larger counterparts. In general, their rates are more resilient to changes in economic conditions, as their smaller size makes small changes in commodity prices negligible, regarding their economic viability. Secondly, their small size and their on board docking / undocking equipment makes them suitable for smaller ports, where no such equipment exists. On the contrary, larger vessels are associated with higher volatility in their freight rates, which increases the overall risk of returns. This can be seen in the graph presented below, where the BSI, the index following Supramax / Ultramax vessels, is obviously far less volatile than the BCI, the index following Capesize vessels.

Different Dry Bulk Indices and their Correlation (MacroMicro)

So, what the new transaction brings, is an even higher degree of conservatism, which makes this stock suitable for investors looking for exposure in the dry bulk market, but with the least possible risk.

In addition, there’s another thing hidden between the lines. The seller agreed to receive one third of their compensation in the form of Diana’s shares, at a price which is 40% higher than the current share price. I mean, whether they are the sucker of the century, or they expect things to improve rapidly in the future. And Sea Trade don’t strike me as suckers. From the 9 ordered vessels, only the one is chartered right now with Cargill at a gross rate of $17.1k per day until August 2023. The remaining 8 vessels are expected to be delivered during this quarter.

Fleet charter contracts expiration allow for a smoother rate transition

Diana Shipping operates exclusively on time charters, avoiding the volatile spot markets. Time charters are considered therefore less risky and are able to provide better returns during a market downtrend, due to their term length. Although I wouldn’t consider this dry bulk market to be a bearish one, we’re definitely experiencing some turbulence from various economic and geopolitical reasons. A look into their time charter schedule will provide some insights.

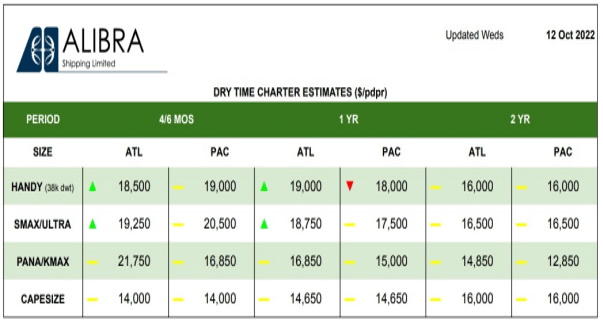

One of their worst time charter contracts, that of the post Panamax “Phaidra” for $11.25k per day expires today, while the current daily rates for 1-year time charter contracts regarding Panamaxes range from $15k to $17k. In the next month the time charter contracts of Panamaxes “Melia” and “Maera”, currently at $14k and $14.25k per day expire.

In addition, the company has some long term, above market rates time charter contracts in place, such as the Capesize “Florida”, which is leased at $25.9k per day until 2027. Also, Capesize “New Orleans” is currently chartered at $32k per day, until November 2023, while Newcastlemax “Philadelphia” is chartered until February 2024, at a rate of $26k per day.

On the other hand, some nice, above market time charter contracts also expire soon. For example, Capesize “G. P. Zafirakis” is currently chartered for $22.75k per day, with expiration being in November 1st. Current Capesize 1-year time charter rates are at $14.65k per day. The same is true for Kamsarmax “Myrsini”, currently chartered at $22k per day at a contract expiring in December 1st this year.

Dry bulk vessels time charter rates (Hellenic Shipping News)

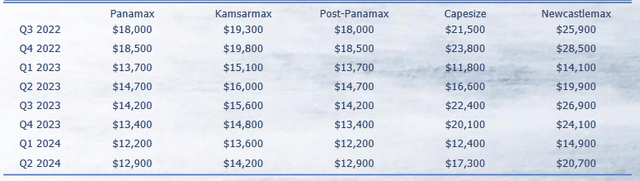

The examples above are indicative, and show the nature of long term charter contracts. What is important here, though, is to consider where rates will be in the next few quarters. As we can see in the table below, some pain is expected in the following quarters, with rates picking up from Q3 2023. So, the company has a good part of its fleet chartered until the end of the first half of 2023 – a total of 12 vessels out of 35 (excluding the 8 Ultramaxes that haven’t been delivered yet).

FFA rates across different vessel types (July 2022) (Diana Shipping Q2 2022 Earnings Presentation)

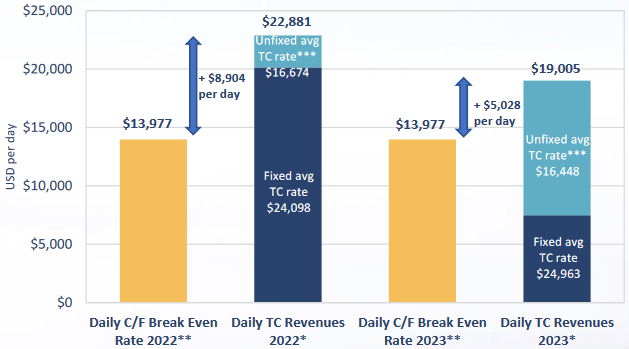

The company has $93 million in fixed time charter revenues in 2023, while based on the table listed above, there’s also $143 million of unfixed revenues. On the other side of the equation, the expected cash flow breakeven rate in 2023 is $174 million, which leaves the company with a projected surplus of $62 million, of $5k per day.

Daily estimated cash uses vs daily estimated revenues (Diana Shipping Q2 2022 Earnings Presentation)

Bottom line

While it goes without saying that investing in shipping is not for the faint hearted, Diana Shipping’s game plan alleviates some of the inevitable pain. With Sea Trade having accepted 33.3% of their payment in the form of Diana’s shares at a high premium, and with all daily profit despite the eased rates in 2023, I would surely consider a long position in the company at this point. After all, who owns a football team without a cornerback?

Be the first to comment