grandriver

Investment thesis: US shale producers suffered a dramatic loss of investor interest following the 2014 oil & gas price crash. It turned out that too many of them were drilling inferior quality acreage, which was a fact hidden by excuses of lack of profits being mostly due to ramp-up costs. Many producers went bankrupt, while others faced a great deal of market skepticism. They were mostly forced to live within their means and started paying down some of the massive debt pile that the industry accumulated most of the last decade. For some shale producers, especially those that are heavily involved in natural gas drilling, things may be looking up again, for the first time in almost a decade. The recent Biden administration’s statement suggesting that there will be no export curbs on natural gas suggests that we are set to see a significant narrowing of the price gap between the European markets and the US markets, mostly with US prices headed up. The high-price environment is set to last for the foreseeable future, paving the way for certain shale producers to see a significant improvement in their financial results, making them a potentially attractive investment opportunity.

US Henry Hub price could reach new all-time records this winter on the back of efforts to bail out Europe’s energy shortfalls

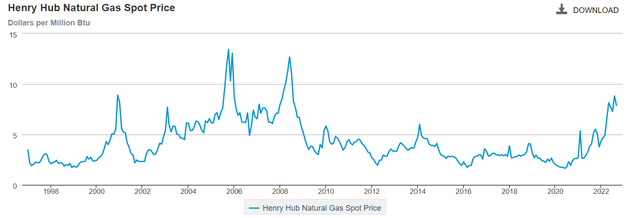

It seems it was not so long ago that US Henry Hub natural gas prices were at times dipping under $2, while shale drillers were desperately praying for $3 gas in order to lessen the financial pressures they were increasingly feeling after 2014.

In parallel with the start of the European energy crisis about a year ago in the US, natural gas prices started rising. We are currently sitting at levels not seen for about a decade and a half. The recent announcement made by the Biden administration, namely that it does not intend to implement curbs on US exports of natural gas may be the factor that keeps the trend we are seeing above on track to perhaps take out the old all-time record natural gas spot price of over $13 for Henry Hub.

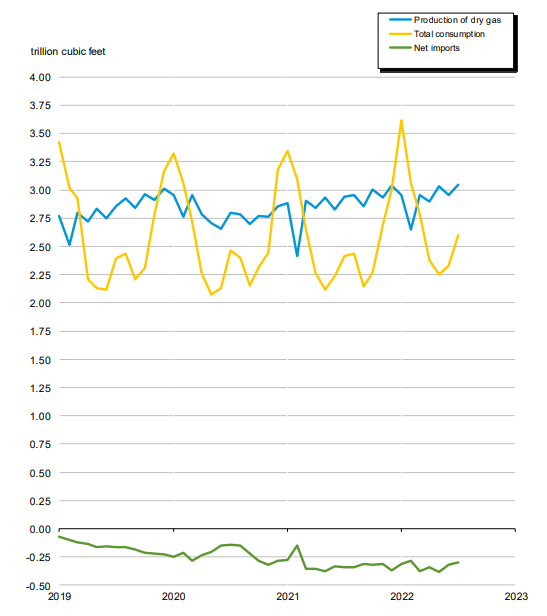

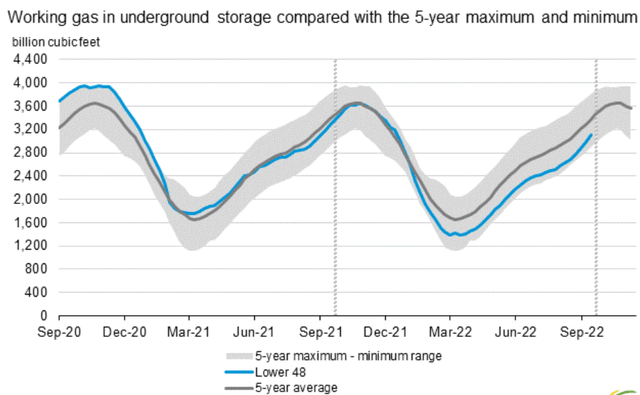

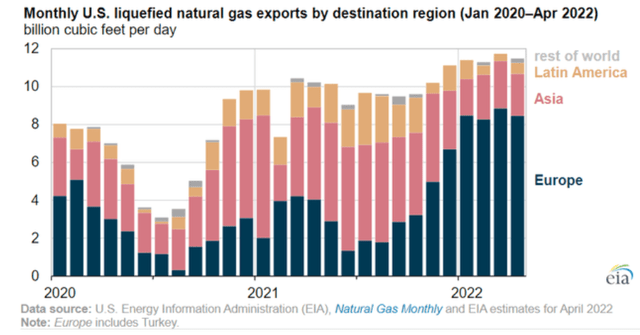

Since the US started shifting its LNG exports to Europe in a bid to prevent the energy crisis from escalating into a full-blown economic crisis, a constant gap in US gas storage levels relative to five-year average levels opened up and we are currently about 8% below those average levels.

A great deal of production was shifted from other customers, but overall LNG exports also increased significantly, even though total US natural gas production did not have a spectacular increase since the end of 2019.

Exports seem to be pushing market tightness aggressively in the past few years.

EIA

Given the geopolitical situation, which increasingly suggests that the EU rupture with its dependence on Russia for energy is going to be permanent, the upward pressures on the US natural gas market prices are set to last as well.

Production growth is not likely to provide price relief

As is always the case since the start of the shale boom story a decade and a half ago, the industry tends to be attributed with a practically infinite potential to ramp up production. It is thought that with proper governmental policies in place, high oil & gas prices as well as more investment in transport infrastructure in order to prevent bottlenecks, production could be ramped up significantly. There are three main reasons why that is not the case within the current context.

Higher interest rates

Perhaps the most important factor that made the shale boom of the last decade possible was the low-interest rate environment. Shale producers were able to access cheap money, as the search for yield and returns was pushing money wherever there was any yield available. Investors increasingly closed their eyes to any suggestions that some shale projects or entire companies were not really viable from a profitability point of view. In fact, there was significant hostility to any such naysaying, as I discovered myself back in 2015 when I wrote a series of articles entitled “Economics Of A Shale Well“, which led to not only much criticism of my work on forums, but also with Seeking Alpha. I received intense push-back despite the fact that looking back, it was a pretty good predictor of the fortunes of the companies I covered in the series. The idea that many projects or entire companies were not viable was simply a message that too many people did not want to hear.

With the deep losses to investors and creditors that followed, financial capital inflows dried up for the shale industry. Even the recent display of profits may not be enough to wipe away those bitter memories. Furthermore, with interest rates now significantly higher and some reluctance to lend money within a high inflationary environment, it is neither easy to find large inflows of credit that would be needed to produce a significant ramp-up in drilling nor is it as cheap as it was for most of last decade. This makes it less tempting to ramp up drilling, which is what we have seen in the past year, despite the improved oil & gas price environment.

Dwindling prime acreage reserves

If there is one aspect of the shale industry where we are still seeing some lack of acceptance of the limitations to production prospects, it is the idea that not all prospective shale reserves are economically viable, even at very high oil & gas price levels. Technological improvements can only go so far in bridging those gaps between geological and market realities. The most important factor that led to the remaining shale drillers becoming profitable has been an industry-wide retreat away from second-tier acreage drilling, and consolidation into the sweet spots that companies had in their portfolios. Those that did not have much prime acreage went through bankruptcy. Those that are still sitting on decent prime acreage drilling prospects will be in no rush to drill themselves out of those acres, leaving them with increasingly poor drilling opportunities.

The Bakken field, as well as the Eagle Ford, are both major shale fields that are most likely past their all-time high production levels, precisely because drillers ran out of most of their prime drilling opportunities. The three remaining major fields, which together make up an increasingly important part of the global natural gas supply, namely the Marcellus-Utica fields, as well as the Permian and Hayneville will eventually reach that point as well, it is just a question of how soon that will be. Drillers in these fields know that the faster they drill the faster they will reach that point, which is why they will not drill too fast, regardless of what prices will do.

Transport bottlenecks:

Perhaps the favorite topic raised by those who want to downplay the dwindling prime acreage issue is the transport bottleneck issue. My take on it is that both are valid issues, and one does not exclude the validity of the other. Transport bottlenecks will continue to impede production growth, together with other factors. It is by no means the one issue that could unleash a new era of shale production boom if it were to be solved. It would help some, but not to the extent that is often claimed.

Investment implications

While I was perhaps the most critical author on SA of the shale boom’s profitability aspect last decade, I am currently seeing a paradigm shift in this regard, and thus I think there are some intriguing potential investment opportunities in the shale patch. Companies that are well-positioned to take advantage of higher natural gas prices for the foreseeable future should be considered to be viable investment options within the context of the trend I identified. I personally prefer well-established shale drillers, with years of proven ability to be profitable, and I think those shale gas producers which are situated in the South, in other words, Texas, Louisiana, and New Mexico have a transport advantage over Appalachian producers. However, perhaps one of the best-positioned companies to take advantage of the situation might be a major shale producer that recently re-emerged out of bankruptcy.

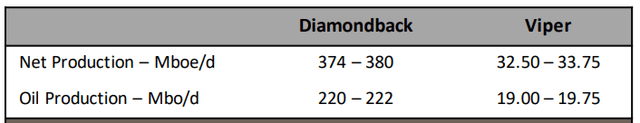

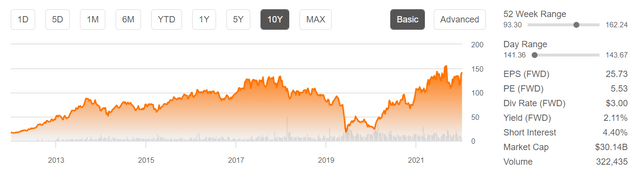

Some examples that fit the solid driller profile include Diamondback (FANG), which used to be thought of as a mostly oil producer but is increasingly seeing a higher proportion of its total production being taken up by natural gas.

I believe that it will see a further increase in natural gas production going forward, in line with the wider industry trends in the Permian.

As far as its financial metrics, it trades at a forward P/E ratio of almost 6.

Among my major concerns is the $30 billion market cap versus my estimate for revenues this year based on production volumes, which should come out to roughly three times lower than the market cap. While other metrics may not signal that this company is trading at a very expensive price, this particular metric does seem to suggest exactly that. It arguably still trades as a growth stock, even though production growth has not been on a tear and it is not forecast to do so in the future either.

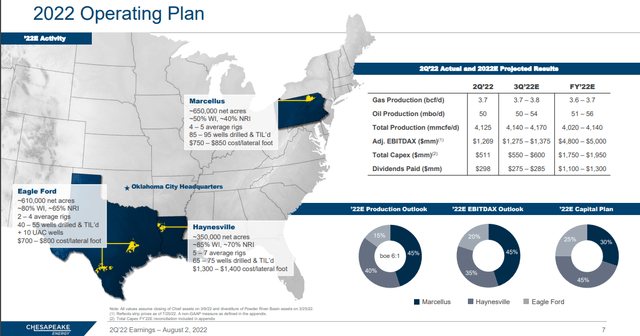

A more daring investment option would be Chesapeake (CHK), which emerged from bankruptcy and it has a sizable natural gas footprint. About 90% of its production is natural gas.

After struggling for a decade as a mostly shale gas producer, within the context of a supply glut that kept prices low, it is now arguably a company that is well-positioned to take advantage of current and possible future market trends. It is currently producing strong financial results on the back of those fundamentals. For the latest quarter, it saw a net profit of $1.24 billion, on revenues of $3.52 billion. If I am correct and US natural gas prices will continue to rise on continued ramping up of LNG exports to Europe and stay at those elevated levels for a prolonged period, this stock might emerge as the main winner within the shale patch.

There are of course many other companies that one might be able to point to as potential investment options, within the context of the fundamentals that I have laid out. There are also some risks to those fundamentals, such as geopolitical trend reversals, such as the Russia-EU economic relationship experiencing a dramatic reversal from the current path of deterioration. The US government could cave to public pressure and opt to keep natural gas prices low, in order to avoid domestic upheaval, to the detriment of the economic survival of the EU. A dramatic reduction in US LNG deliveries to the EU would in my view inflict a severe economic calamity on the continent, which is why I personally doubt that the US government will opt to go in that direction. There are certainly some risks to my thesis, but in the absence of some increasingly unlikely political decisions, I think the shale patch increasingly offers some intriguing long-term investment opportunities that should be considered.

Be the first to comment