imaginima/E+ via Getty Images

Several Dividend Kings’ members have asked me to compare Johnson & Johnson (NYSE:JNJ), and AbbVie (NYSE:ABBV), two of the most popular defensive dividend kings on Wall Street. And it’s not hard to see why.

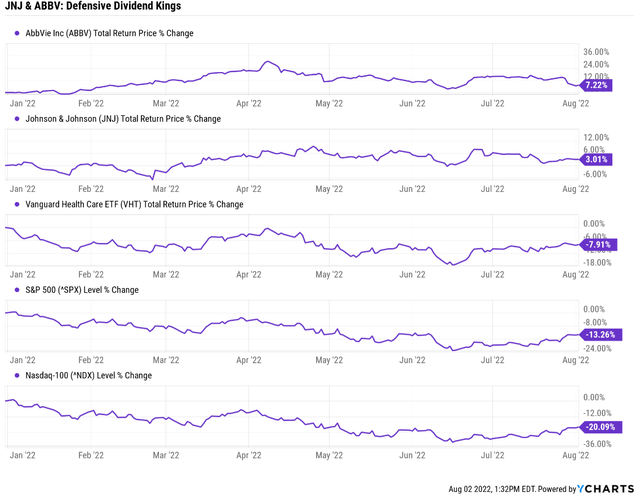

Let’s start with how well both have performed in this bear market.

Healthcare is a traditionally defensive sector and has lived up to that designation in the 2022 bear market. Vanguard’s Health Care ETF (VHT) is down about half as much as the S&P 500 and just 1/3rd as much as the Nasdaq.

But ABBV and JNJ have truly lived up to their Ultra SWAN (sleep well at night) quality ratings, with modest gains in a year of extreme market fear.

And if we look at their historical returns, we also see impressive results.

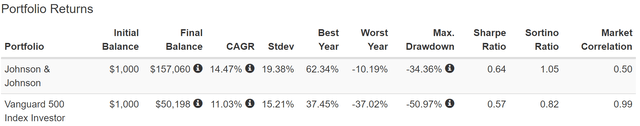

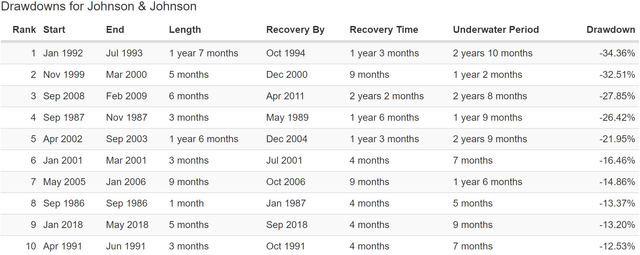

JNJ Historical Returns Since April 1985

(Source: Portfolio Visualizer Premium)

JNJ has delivered consistent market-beating returns and with some truly remarkable low volatility for a single company.

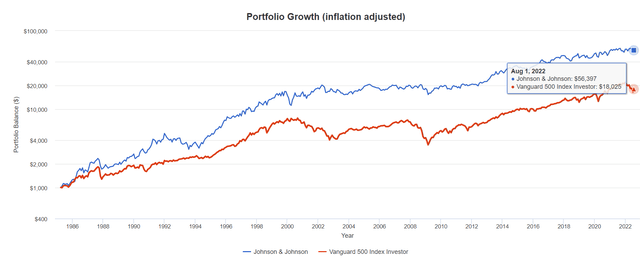

(Source: Portfolio Visualizer Premium)

JNJ has delivered 57X inflation-adjusted returns over the last 37 years, more than triple that of the S&P 500.

(Source: Portfolio Visualizer Premium)

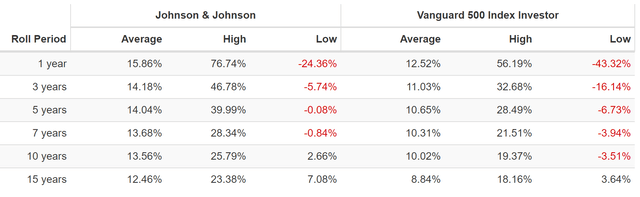

Across every time frame, JNJ’s average rolling return has beaten the market.

(Source: Portfolio Visualizer Premium)

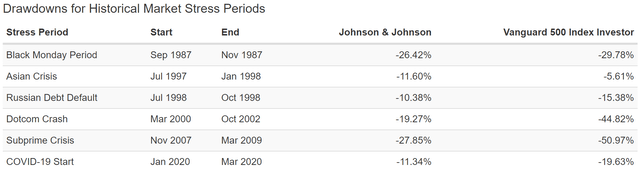

In nearly every period of market panic, JNJ has acted defensively, including a mere 11% decline in the Pandemic and a 28% decline in the Great Recession.

- a 60/40 portfolio fell 12% in the Pandemic

- and 33% in the Great Recession

JNJ’s average 15-year volatility is just 15%, matching the S&P 500.

- the average standalone company has 28% average volatility

- the average dividend aristocrat 23%

(Source: Portfolio Visualizer Premium)

JNJ has suffered plenty of bear markets in the last 37 years, but the longest it took to recover to record highs was 34 months, not even three years.

(Source: Portfolio Visualizer Premium)

The S&P 500 took as long as 6.25 years to recover from the tech crash and almost five years to recover from the Great Recession.

JNJ Cumulative Dividends Since 1986: $1,000 Initial Investment

| Total Dividends | $41,168 |

| Annualized Income Growth Rate | 14.09% |

| Total Income/Initial Investment | 41.17 |

| Inflation-Adjusted Income/Initial Investment | 15.25 |

(Source: Portfolio Visualizer Premium)

JNJ has paid investors 15X their initial investment in inflation-adjusted dividends over the last 36 years.

And what about AbbVie, which was spun off from Abbott Labs (ABT) in 2013 and inherited its dividend king status according to S&P?

- ABBV has grown the dividend for nine years in a row since the spinoff

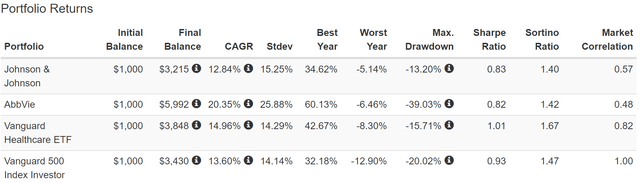

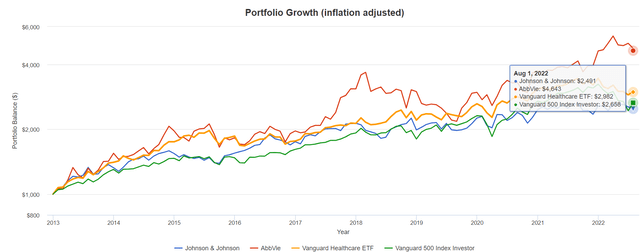

ABBV Historical Returns Since January 2013

(Source: Portfolio Visualizer Premium)

ABBV has done a remarkable job of growing investor wealth, a phenomenal 20% per year, or 6X total return since 2013.

(Source: Portfolio Visualizer Premium)

JNJ and VHT have also done well, with VHT even managing to beat the market in one of the hottest bull markets in history. But ABBV delivered almost 4.7X inflation-adjusted returns in less than a decade, Buffett-like 19% annual real returns.

ABBV Cumulative Dividends Since 2013: $1,000 Initial Investment

| Total Dividends | $1,344 |

| Annualized Income Growth Rate | 25.45% |

| Total Income/Initial Investment | 1.34 |

| Inflation-Adjusted Income/Initial Investment | 0.50 |

(Source: Portfolio Visualizer Premium)

ABBV’s income growth has been a remarkable 26% per year, resulting in investors recouping 50% of their initial investment in inflation-adjusted dividends in nine years.

- In less than years, they will fully recoup their investment in real terms

AbbVie Has Been A Dividend Growth Dynamo

| Portfolio | 2013 Income Per $1000 Investment | 2022 Income Per $1000 Investment | Annual Income Growth | Starting Yield |

2022 Yield On Cost |

| S&P 500 | $24 | $50 | 8.50% | 2.4% | 5.0% |

| Vanguard Healthcare ETF | $16 | $48 | 12.98% | 1.6% | 4.8% |

| Johnson & Johnson | $37 | $80 | 8.95% | 3.7% | 8.0% |

| AbbVie | $46 | $354 | 25.45% | 4.6% | 35.4% |

(Source: Portfolio Visualizer Premium)

JNJ and healthcare have delivered strong income growth over the past decade, but few companies have been as safe dividend friendly as AbbVie.

But don’t forget that past performance is no guarantee of future results, and both JNJ and ABBV are expected to grow a lot slower in the future, which means income growth will slow drastically.

What kind of income growth do analysts expect in the future?

AbbVie Future Income Growth Consensus Forecast

| Analyst Consensus Income Growth Forecast | Risk-Adjusted Expected Income Growth | Risk And Tax-Adjusted Expected Income Growth |

Risk, Inflation, And Tax Adjusted Income Growth Consensus |

| 6.6% | 4.6% | 3.9% | 1.4% |

(Source: Portfolio Visualizer Premium)

Analysts think ABBV can deliver about 7% annual income growth in the future, which, adjusted for the risk of the company not growing as expected, inflation, and taxes, is 1.4% real expected income growth.

Now compare that to what they expect from the S&P 500.

| Time Frame | S&P Inflation-Adjusted Dividend Growth | S&P Inflation-Adjusted Earnings Growth |

| 1871-2021 | 1.6% | 2.1% |

| 1945-2021 | 2.4% | 3.5% |

| 1981-2021 (Modern Falling Rate Era) | 2.8% | 3.8% |

| 2008-2021 (Modern Low Rate Era) | 3.5% | 6.2% |

| FactSet Future Consensus | 2.0% | 5.2% |

(Sources: S&P, FactSet, Multipl.com)

- 1.7% post-tax inflation-adjusted income growth from the S&P 500

- S&P 500’s historical post-tax inflation-adjusted income growth rate (current tax code) is 5.8% CAGR

ABBV may deliver inferior income growth in the future.

JNJ Future Income Growth Consensus Forecast

| Analyst Consensus Income Growth Forecast | Risk-Adjusted Expected Income Growth | Risk And Tax-Adjusted Expected Income Growth |

Risk, Inflation, And Tax Adjusted Income Growth Consensus |

| 5.6% | 3.9% | 3.3% | 0.8% |

(Source: Portfolio Visualizer Premium)

Analysts expect JNJ to deliver 5.6% income growth in the future, slightly less than ABBV.

To see why analysts are so much more conservative with future income growth, let’s turn to a comprehensive comparison of JNJ and ABBV.

That way, you can decide which defensive dividend kings are right for you whenever the next market crash finally arrives.

Johnson & Johnson Vs. AbbVie: 2 Amazing Defensive Dividend Kings

| Company | Johnson & Johnson | AbbVie | JNJ Wins | ABBV Wins |

| Yield | 2.6% | 4.0% | 1 | |

| LT Growth Consensus | 5.4% | 1.3% | 1 | |

| Total Return Potential | 8.0% | 5.3% | 1 | |

| LT Risk-Adjusted Expected Return | 5.6% | 3.5% | 1 | |

| Inflation & Risk-Adjusted Expected Return | 3.1% | 1.1% | 1 | |

| Years To Double | 23.0 | 68.3 | 1 | |

| Historical Total Return | 12.8% | 20.4% | 1 | |

| 12-Month Consensus Total Return Potential | 11% | 18% | 1 | |

| 12-Month Fundamentally Justified Total Return Potential | 5% | 4% | 1 | |

| Discount To Fair Value | 2% | -0.3% | 1 | |

| PE | 17.2 | 12.0 | 1 | |

| DK Rating | Reasonable Buy | Hold | 1 | |

| Automatic Investment Decision Score | 68% D+ | 77% C+ | 1 | |

| Quality Score | 91% | 85% | 1 | |

| Safety Score | 97% | 85% | 1 | |

| Dependability Score | 93% | 86% | 1 | |

| Long-Term Risk-Management Industry Percentile | 74% Good | 82% Very Good | 1 | |

| Credit Rating | AAA Stable | BBB+ Stable | 1 | |

| 30-Year Bankruptcy Risk | 0.07% | 5.00% | 1 | |

| Dividend Growth Streak (Years) | 59 | 50 | 1 | |

| 5 Year Dividend Growth Rate | 6% | 18% | 1 | |

| Return On Capital (12-Months) | 112% | 319% | 1 | |

| Return On Capital Industry Percentile | 95% | 98% | 1 | |

| Return On Capital (13-Year Median) | 106% | 222% | 1 | |

| Return On Capital (5-Year trend) | -1.4% | -4.2% | 1 | |

| Sum | 15 | 10 |

(Source: Zen Research Terminal)

JNJ is the clear quality and safety winner, though ABBV’s profitability is far superior in terms of return on capital or ROC.

JNJ’s balance sheet is the 2nd strongest in corporate America, second only to Microsoft (MSFT).

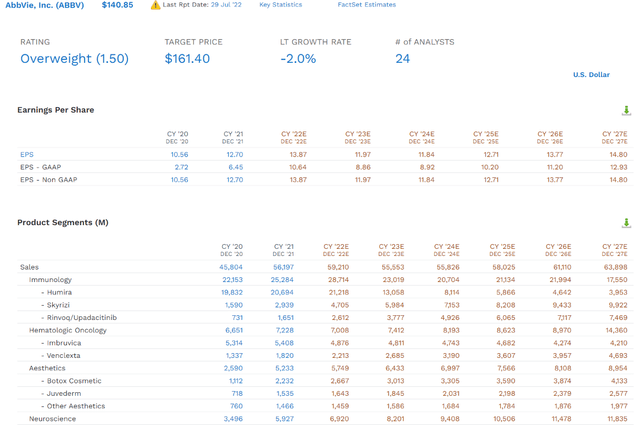

However, AbbVie investors are concerned about what kind of growth it can generate after the Humira patent cliff coming next year.

(Source: FactSet Research Terminal)

Analysts expect Humira sales to drop from a peak of $21.2 billion in 2022 to $4 billion by 2027 as it loses patent protection in the US. The hit to EPS is expected to be -15% in 2023 and 2024 before AbbVie’s Allergan acquisition starts paying off, with strong growth in Aesthetics (Botox), helping it return to modest sales growth.

- from 2022 through 2027, 1.3% CAGR EPS growth

- from 2024 (trough year) to 2027 7% CAGR EPS growth

The good news is that AbbVie’s excellent management team has been preparing for the Humira patent expirations from day one. That’s why neuroscience drugs are expected to see strong growth from $3.5 billion in 2020 to almost $12 billion in 2027.

And of course, AbbVie has been working hard on a superior version of Humira, the best-selling drug in history, through immunology blockbusters like Skyrizi and Rinvoq, superior 2nd generation immunology drugs.

By 2027, after Humira sales are down 80% from their peak, Skyrizi and Rinvoq are expected to generate $17.4 billion in sales.

JNJ, with the upcoming spin-off of its consumer health business, is going to be more diversified than AbbVie, thanks to its combo drug/medical device business.

That will help smooth out patent cliff pain in the future, though analysts think that the new business will grow about 3% slower.

(Source: FactSet Research Terminal)

The consumer business that JNJ is spinning off (and will potentially become a new dividend king) generated 15% of JNJ’s sales in 2021.

- 3.7% CAGR growth expected for consumer products through 2027

JNJ’s pharmaceutical business is expected to grow even slower.

- 1.2% CAGR from 2021 through 2027

The margins are naturally far higher on branded drugs, though patent cliffs create a hamster wheel that requires massive R&D to keep sales growing steadily over time.

For example, Moody’s, assuming no major regulatory changes, expects the pharma industry’s EPS to grow at about 4% over the long-term.

- a highly recession-resistant but slow-growing industry

- requiring lots of buybacks to keep EPS growth at even such modest rates

What about JNJ’s medical devices business? It made up 28% of 2021 sales and is expected to grow revenue at 3.6% CAGR through 2027, almost as fast as consumer and 3X faster than pharma.

JNJ’s rationale behind the spin-off is that medical devices and pharma are so much more profitable that it will be able to optimize for future growth by using retained cash flow to acquire other businesses and drugs and thus maximize long-term growth.

I am a bit skeptical of that since consumer, while with lower margin, didn’t have patent cliffs to deal with and thus resulted in smoother cash flow, a top priority for any JNJ investor.

- JNJ achieved a 59-year dividend growth streak because of smooth and recession-resistant cash flow

But what about the potential changes in the Inflation Reduction Act of 2022? How might that affect the pharma industry’s growth prospects and those of JNJ and ABBV?

What Pharma Investors Need To Know About Regulatory Risk

Drug Pricing Policy in the Inflation Reduction Act a Moderate But Manageable Negative to Biopharma

The likelihood of drug-pricing policy changes in the United States changed dramatically throughout July. We are now assessing the impact of the various measures included in the Inflation Reduction Act of 2022 in our Big Biopharma valuation models. Assuming the bill is eligible to pass via reconciliation (the Senate parliamentarian is reviewing the bill), we think Democrats will be able to pass the Senate bill, paving the way for it to be signed into law.

Overall, we don’t expect major changes to our fair value estimates or moat ratings, as the changes net out to a moderate negative that we believe is manageable, likely through a combination of cost-cutting, agreements with generic firms for limited authorized generic launches (to avoid the list for negotiated drugs), and higher launch prices (to counter pressure on price increases and earlier declines due to negotiation). – Morningstar

The IRA of 2022, at least as currently written, would allow Medicare to negotiate for SOME bulk purchase discounts.

Proposed drug pricing legislation from Senate Democrats, if passed, would have an impact on revenue for pharmaceutical and biotech companies, but the influence wouldn’t be that significant, according to RBC Capital Markets. – Seeking Alpha

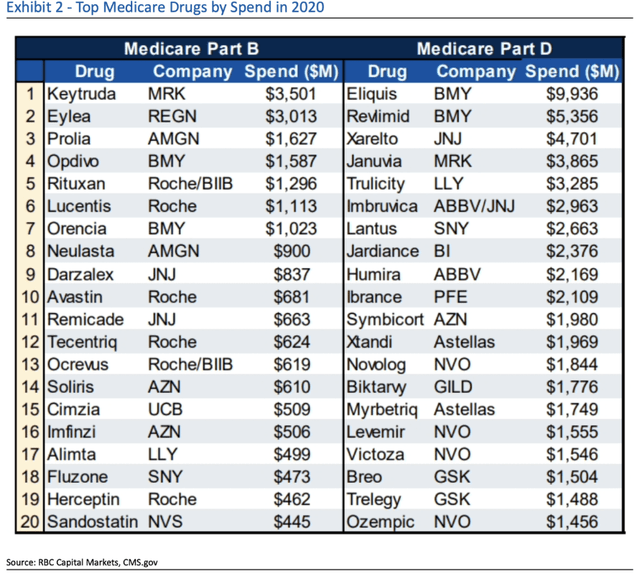

What exactly would this bill mean for the Pharma industry?

The Senate proposal says that beginning in 2026, HHS can choose 10 drugs from among the top 50 in Medicare Parts B and D to be discounted. Twenty more would be added by 2029.

The discount is based on how long the drug has been on the market. For drugs marketed more than nine years, a minimum 25% discount is required; greater than 12 years, 35%; and greater than 16 years, 60%.

In addition, drug prices can’t rise faster than inflation. Also, Medicare enrollees would have a $2k out-of-pocket max. After that level is reached, the cost would be split between the Medicare plan, government, and the drugmaker. The manufacturer would be responsible for 20% of that cost. – Seeking Alpha

OK, so that might sound scary to investors in drug companies, but what does it mean for the bottom line of these companies?

According to RBC (Royal Bank of Canada) analysts, a 10% to 15% maximum hit to sales, and only for the most affected companies. Who are those companies?

ABBV and JNJ would certainly be affected, as would pretty much every blue-chip pharma worth owning.

Does this mean it’s time to sell every drug maker? Almost certainly not. As both Morningstar and RBC make clear, it’s not certain this will even pass.

- first, the Senate Parliamentarian has to approve it for reconciliation,

- then Kyrsten Senema has to vote yes

- along with every other Democratic Senator

Even if it does pass, drug companies will have three years to prepare, and a blue-chip drug company that’s worth owning is one with a solid track record of adapting to new regulations.

Our analysis indicates that companies are already beginning to accelerate their rate of price increases, perhaps in part due to inflationary factors but potentially also due to anticipation of the legislation and its possible long-term impact,” the RBC team wrote. – Seeking Alpha

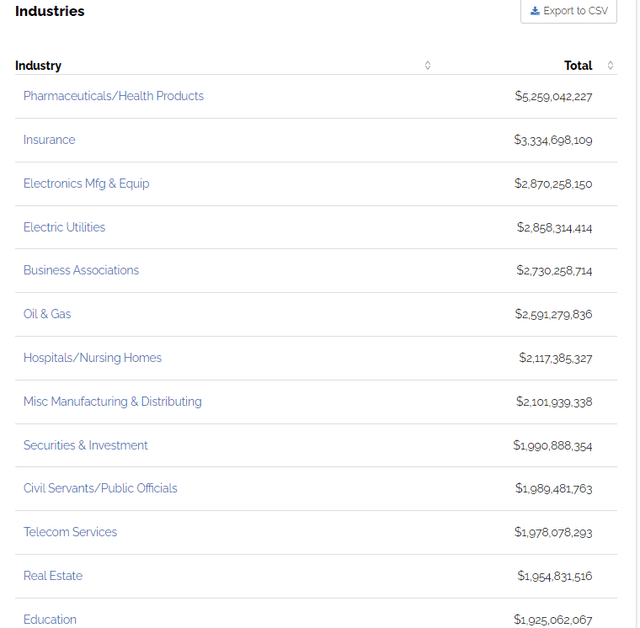

Companies have three years to jack up their prices before the legislation kicks in, assuming it even passes. That’s the power of an almost $400 million lobbying budget in 2021. Last year, the Pharma industry spent $10 million daily, including holidays and weekends, on lobbyists.

2021 Lobbying Spending By Industry

And since 1998, guess which industry is #1 in lobbying? Since 1998 big pharma has spent $219 million per year on lobbying, a total of $5.3 billion.

1998 To 2022 Lobbying Spending By Industry

I’m not saying this is a good thing; I’m saying that money talks in DC, and no one speaks louder than big pharma.

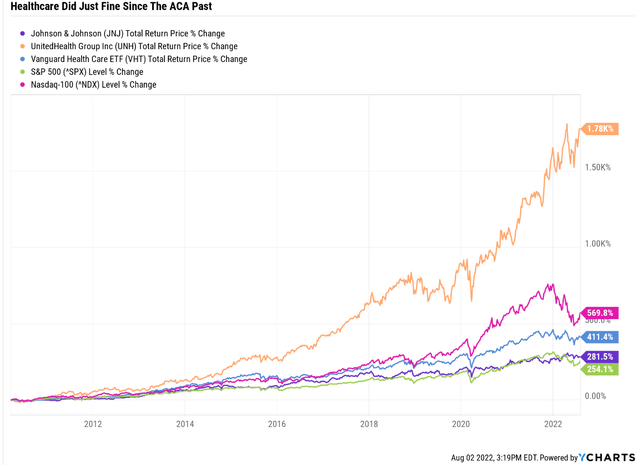

Remember how the ACA (aka “Obamacare”) would socialize medicine and destroy healthcare stocks?

The intelligent investor is a realist who buys from pessimists and sells to optimists. – Ben Graham

Do you remember the bargains you could find in early 2010 in healthcare? Remember how that turned out for investors?

JNJ has almost quadrupled since the ACA passed, VHT has gone up over 5X, and UnitedHealth (UNH) is up almost 20X.

So Which Is The Better Defensive Dividend King To Buy Today?

With regulatory risk relatively elevated, plus a recession likely beginning within 5 months, a focus on safety and quality first and prudent valuation and sound risk-management is more important than ever.

Pharma is too important an industry for the government to mess with it too much. And even if Medicare will have much stronger pricing power in the future, don’t forget that global giants like JNJ and ABBV sell in almost every country and deal with government buyers daily.

Regarding which defensive dividend king is best, JNJ or ABBV, it comes down to your goals and risk profile.

- JNJ has a better safety and quality profile, as seen by its AAA credit rating, the 2nd best in corporate America

- JNJ’s business is more diversified than ABBV’s, with both pharma and medical devices

- JNJ’s dividend track record is 2nd to none in the pharma industry, it will be a cold day in hell before they break that streak

At the moment, JNJ appears to offer higher long-term return potential than ABBV, but I’m skeptical that this is true.

ABBV offers a very safe 4% yield that’s one of the best in the industry and its management team is in the top 14% of its industry for long-term risk management.

- including every part of the pharma risk profile, including regulations and drug development risk

ABBV has a solid track record of successful growth through acquisition, much like Broadcom (AVGO) does in chips.

While patent cliffs often make it challenging to model long-term growth in this industry, between 2024’s Humira trough earnings and 2027, analysts expect 7% growth from ABBV.

Can ABBV keep putting together smart M&A deals to keep growing at 7% over time? Given management’s track record, I think it’s reasonable to assume they can.

That would give ABBV an 11% long-term return potential, similar to what analysts expect from the dividend aristocrats and superior to JNJ’s 8% CAGR.

JNJ and ABBV are effectively trading at fair value, so if I only had money to buy one, I’d go with ABBV, though you can’t go wrong buying either today.

That’s as long as you remember that no stock, not even recession-resistant low volatility dividend kings, are bond alternatives.

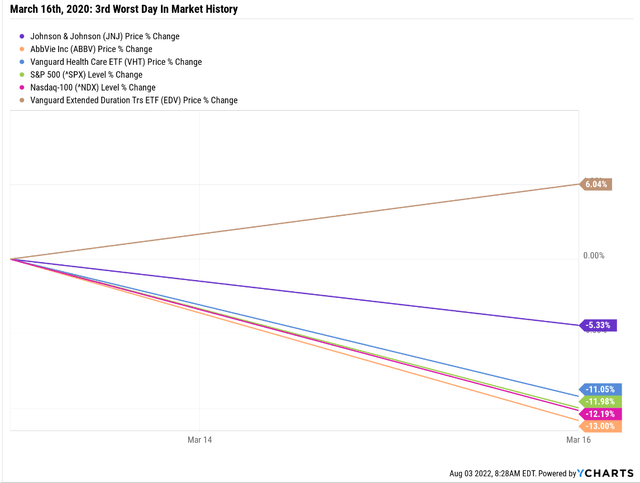

On March 16th, 2020, the stock market suffered the 3rd worst day in US history.

- S&P and Nasdaq -12%

- healthcare -11%

- ABBV -13%

- JNJ -5%

Long bonds, the best long-term hedge against bear markets according to Duke University, were up 6%.

- a 60/40 portfolio made up of 60% S&P 500 and 40% EDV was down 4.8% that day

- 60% less than the S&P 500

Both AbbVie and JNJ will likely outperform if the market rolls over and falls another 18%, as Morgan Stanley expects.

- 22% EPS decline expected in the coming recession

- 15.4X trough PE

- 3,003 S&P 500 (38% peak decline in this bear market)

That doesn’t mean they are likely to keep going up, but they are likely to help you sleep well at night, while paying steadily growing dividends in all future recessions.

Is Morgan Stanley right about this bear market is far from over?

The range of possible outcomes for this bear market is wide, ranging from a 24% peak decline (June 16th bottom), to a 52% market crash (UBS’s worst-case scenario).

No one can predict what will happen with inflation, which drives the economic bus and determines how bad this bear market gets.

But as long as you remember the six fundamentals of success long-term investing, you have nothing to fear from even the scariest recessions and most terrifying market crashes.

- the right asset allocation for your long-term goals and risk profile (the cornerstone of risk management)

- a diversified portfolio of ETFs, bonds, cash, and blue-chips

- sufficient safe yield for your goals

- sufficient growth prospects for your goals

- reasonable to attractive valuation

- periodic rebalancing (essential to good risk-management)

Be the first to comment