krblokhin

All yields aren’t equal, and that is the case with the Net Payout Yield. Altria Group (NYSE:MO) doesn’t offer investors the highest yield, but the tobacco company has one of the better yields on the market now. My investment thesis is Bullish on the stock, with the strong NPY signal topping 10% as the buyback repurchases cheap shares.

Better NPY Signal

Most investors focus entirely on the dividend yield, where Altria shines the most. The company just announced the Q4 dividend at $0.94, payable on January 10.

Altria pays a large $3.76 annual dividend for a yield of 8.1% now. While this is impressive, a lot of companies actually pay similar NPY yields due to large stock buybacks returns.

The NPY combines the forward dividend yield and the net buyback yield in order to derive a better yield to truly reflect the strong capital returns of a company. The inflexibility of dividend payouts has pushed corporations into more flexible stock buybacks that can easily be paused, or at least adjusted on a quarterly basis.

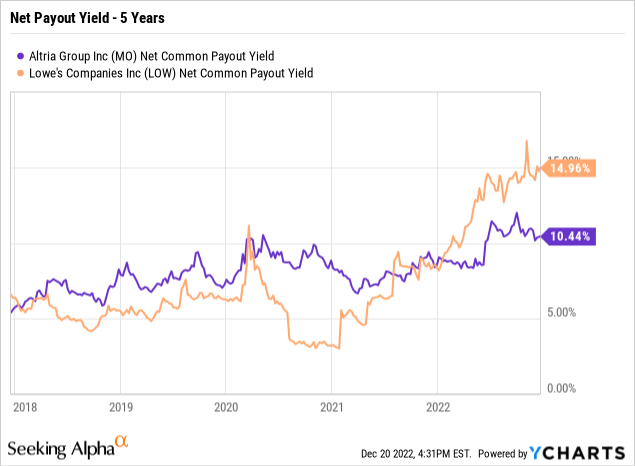

While Altria has a very impressive 8.1% dividend yield, the company has an even higher 10.4% NPY. The tobacco company regularly repurchases up to $500 million worth of stock on a quarterly basis to provide an additional boost to capital returns.

While the payout is impressive, a company like Lowe’s (LOW) has an even more impressive NPY at 15.0%. The NPY concept suggests investors should blindly buy Lowe’s over Altria, but investors should proceed carefully in that direction.

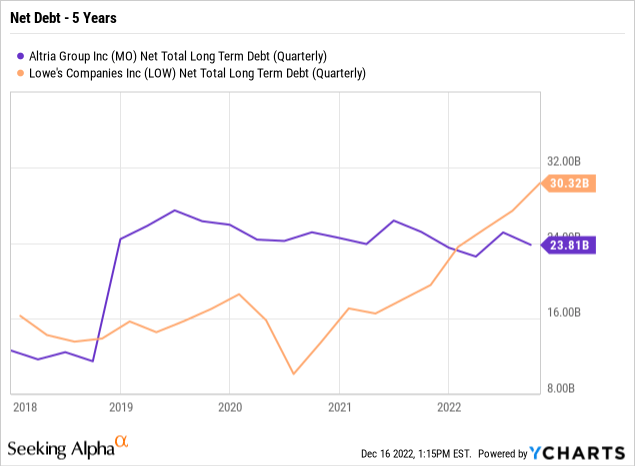

The biggest problem with the large yield of Lowe’s is that the company has made the large capital returns by boosting debt. The home improvement company forecasts a $13 billion stock buyback this year, but the net debt level has doubled from the starting levels in 2021 while Altria is producing a 10.4% yield with debt flat to down over the last few years.

Another major issue is that Lowe’s is repurchasing shares at close to 15x 2023 EPS targets, while Altria is paying close to 9x forward EPS targets. The tobacco company is loading up on share buybacks (and reducing dividend payouts in the process) while the stock is cheap, and Lowe’s appears to just be randomly buying stock at any price.

Shifting Away From Cigarettes

While the NPY concept doesn’t exactly care about any particular business model, Altria is an interesting story. The company has long slogged away with slow growth in selling tobacco products, generally hated by the public and government regulations alike.

Regardless, Altria has constantly grown the dividend, having pushed the quarterly payout 50% since the $0.61 quarterly payout recently in 2017. The stock could see higher capital gains from a successful shift away from cigarettes, providing another growth avenue.

Altria has investments in JUUL, Ambev (ABEV) and Cronos Group (CRON), though most of these haven’t worked out very well. The Cronos Group provides access to the global cannabis market, but the initial investment was far too early.

The tobacco company abandoned a warrant investment opportunity to push their ownership position to 52% due to the warrant exercise price far above the current price of just $2.65. Atria still holds 157 million shares of Cronos Group worth ~$415 million, but the Canadian cannabis company has failed to generate much in the way of revenues, with a 2023 target of only $100 million.

The JUUL investment was another major failure, but Altria still owns a 35% position in the vape company. Altria is focused on building their own e-vapor products to help with moving smokers away from cigarettes.

The company actually thinks heated tobacco will help transition smokers away from cigarettes. The partnership with JT Group has Altria on the path to a US product in 2025 focused on the Ploom device sold to JT in Japan. Altria will own 75% of the Horizon Innovations JV.

Also, Altria continues to pursue their own heated tobacco products. The HTC platform 1 technology will be finalized by year end with a PMTA submission to the FDA by the end of 2204.

For now, the tobacco segment continues to offer the minimal growth to warrant decent share buybacks, considering the plan to return 80% of profits via a dividend. Altria expects 5% EPS growth this year, and analysts generally expect ~4% EPS growth over the following few years.

The stock only trades at 9x EPS estimates, with the market not factoring in the opportunity for upside from the investments to shift towards a smoke-free future. Specifically, the heated tobacco offering is likely to provide the most upside in the near term, though the cannabis sector could provide a large avenue for growth on any US federal legalization of cannabis.

Takeaway

The key investor takeaway is that Altria offers a surprisingly large NPY of 10.4%. The yield tops the impressive 8.1% dividend yield, but it isn’t even a top 10 NPY.

The impressive part of the Altria story is that the company isn’t increasing debt load to boost the NPY. Investors should use the dip in the stock this year to buy the large yielder.

Be the first to comment