ArtistGNDphotography

Thesis

I view 2023 as a transformational year for the Sunworks, Inc. (NASDAQ:SUNW) business model because of its recent transformational acquisition, the implementation of a direct salesforce over the past year, faster installation times, a better data-driven focus on its pricing during bidding, and the hiring of an internal chief legal officer for local permitting oversight.

Sunworks is well-positioned to benefit from the adoption trend of solar power systems for homeowners and commercial businesses as an alternative to grid-provided electricity. Rising electricity costs, grid power failures, more predictable monthly energy bills from solar systems, eco-friendliness, tax incentives, and a reasonable payback period are the drivers of solar power installations.

The catalysts for upside in SUNW include its direct salesforce expansion, the recent federal tax credit extension, a higher gross margin profile on its $110 million backlog, price hikes to offset cost inflation, cross-selling of products, and a possible acquisition to expand its scale in the commercial market. My $5.00 price target is based on a 0.90x EV/Sales multiple of my 2023 sales estimate of $189 million. This compares to the peer group trading at a median of 1.65x 2023 EV/Sales

Overview

Sunworks provides solar power and battery-based power storage systems to the diversified end markets of residential, commercial, industrial, and public works. Sunworks specializes in high-efficiency photovoltaic (PV) projects for the conversion of sunlight into electricity generation. SUNW’s transformational acquisition of Solcius in April 2021 lessened its reliance on agriculture end markets and vastly increased its sales to more profitable residential customers.

Most of SUNW’s sales are derived from renewable energy residential markets, but SUNW also generates revenue from commercial markets, including office buildings, manufacturing plants, warehouses, agricultural farms, and public works projects (schools, federal buildings, and local municipality buildings). It has installed more than 230 megawatts (MW) of total solar capacity during the past decade and is on track to originate 70 MW of installation orders this year.

Why am I bullish on SUNW?

Early Innings of Solar Adoption for Homes & Businesses

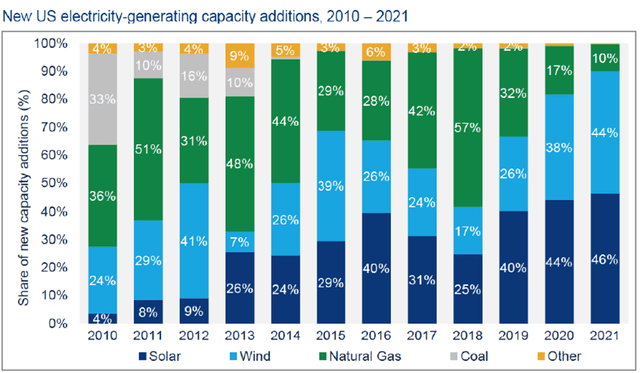

Solar accounted for 46% of all newly added electricity generating capacity in 2021 in the U.S. However, only 5% of U.S. homes had a rooftop solar PV system in early 2022 compared to 30% in Australia with a rooftop PV system or solar water heater. There is a large runway for adoption in the U.S., which should support double-digit annual sales growth for SUNW over the next four years. Furthermore, SUNW’s largest sales exposure state is California, which now has a building code mandating any new single-family constructed home to have a solar PV system. Beginning next month, newly constructed commercial buildings (hotels, offices, retail stores, medical clinics, restaurants) and high-rise multi-family residential buildings in California are mandated to have a solar PV system and battery storage system unless the roof area is too small. A Zillow study found that homes with a solar panel system sold for an average 4% higher than similar homes without one. Homeowners want more choices and control over how they source energy. Annual solar costs are known and fixed compared to the rising retail electricity costs.

New US electricity-generating capacity additions (seia.org)

High Growth Prospects & Attractive Tax Incentives

The U.S. residential solar PV system market is forecast to grow at a 15% CAGR from 2022 through 2030. Also, the recently enacted Inflation Reduction Act (IRA) offers purchase incentives and is expected to enhance the growth of solar panel installations over the next year because of the tax credit incentives and rebates for rooftop solar and battery storage. The IRA has extended the federal solar investment tax credit of 30% through 2032 for newly installed residential and commercial solar systems and battery storage equipment. For example, a $28,000 residential solar photovoltaic system would be eligible for a 30% deduction via a tax credit to reduce the cost to $19,600. These savings lower the average payback period to nine years, depending on the cost of electricity, usage, peak sunlight hours in the area, and if there are any state or city tax incentives. Half of the states offer a personal or corporate tax credit or incentive that is additive to the federal tax credit. Most solar systems can last 25 to 30 years, making solar systems economically attractive and an environmentally friendly choice to reduce greenhouse emissions and mitigate climate change.

Direct Salesforce is the #1 Catalyst for Sales Growth & Margin Expansion

SUNW has improved its go-to-market strategy by adding 600 sales agents in 14 metro areas over the past year. Its direct sales team generated 23% of its residential sales in the September quarter compared to only 5% a year ago. I forecast it could generate 35% of its residential sales by late 2023. Increasing its direct sales mix reduces its customer acquisition cost as the direct channel captures more per watt sold compared to the dealer channel. It can also persuade customers to select an upgraded system or insurance products. Therefore, the gross margin of its direct channel is 5% higher than its dealer channel. SUNW’s enhanced channel mix migration to higher-margin direct selling should be the #1 catalyst for sales growth and margin expansion during 2023.

Home Solar Battery Backup & EV Chargers as Cross-Selling Opportunities

The solar battery energy storage market is forecast to grow at a 20% CAGR over the next few years as homeowners who installed solar power systems over the past decade, and new construction homeowners add a battery storage system. A battery system charges during daylight sunshine and stores that energy for use at night or on cloudy days. This creates energy cost savings for the homeowner or business owner. The installation of solar panels with a battery energy storage backup system helps to power the vital components (heating, cooling, appliances, home office, security system, medical equipment) during a power outage or grid failure. SUNW is a beneficiary of this rising trend for uninterrupted power supply. SUNW now offers the installation of chargers for electric vehicles (EVs) at residential homes.

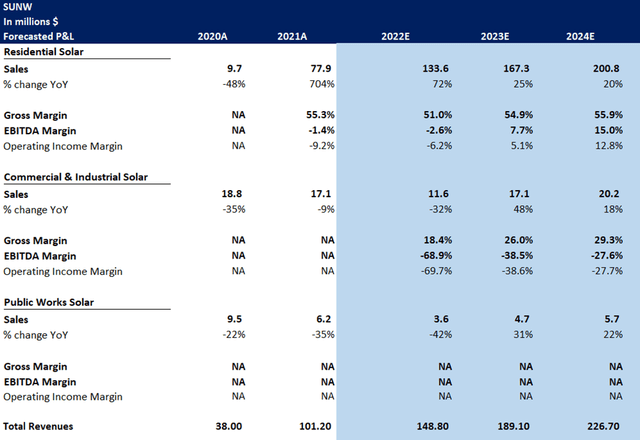

My Outlook Includes a Profitability Inflection Point in 2023

I forecast positive adjusted EBITDA to begin in the September quarter, which could trigger a stock valuation re-rating. I forecast SUNW’s residential solar business to grow sales by 27% over the next 12 months, which should generate strong operating leverage of its fixed cost base and fuel margin expansion. I have modeled its EBITDA margin to expand by 10% (1,000 bps) by September 2023. SUNW’s residential business (90% of sales) achieved a positive EBITDA margin in the September quarter, but its commercial and industrial side will likely be unprofitable for three more years. The company’s net cash position of $15 million provides adequate working capital funding for the next several quarters.

Valuation

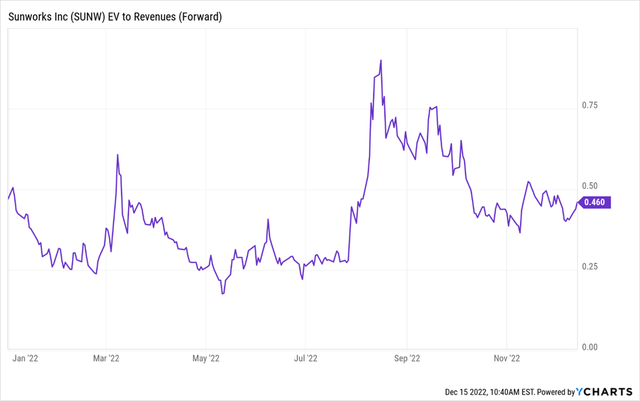

My $5.00 price target is based on a 0.90x EV/Sales multiple of my 2023 sales estimate of $189 million. This compares to the peer group trading at a median of 1.65x 2023 EV/Sales. I assign a discount to SUNW’s valuation because of its near-term lack of profitability. SUNW currently trades at only 0.46x EV/Sales 2023.

SUNW forecasted P&L (my estimates) SUNW EV/Sales (Ycharts)

Investment Risks

The risks to my rating on SUNW include:

- Thin liquidity of the shares (low average daily volume traded).

- Loss-making operations.

- Dilution from potential capital raises.

- Discontinuation of federal or state tax incentives.

- Increased competition in California, prevailing wages bill in California (AB 2143) for public works and commercial renewable energy projects could trigger labor cost inflation.

- Increased tariffs or duties on China solar cells and modules imports.

Final Thoughts

Sunworks has improved its business model and growth opportunities over the past 18 months. This better positions it to benefit from the adoption trend of solar power system installations for homeowners and commercial businesses as an alternative to electricity. Rising electricity costs, grid power failures, more predictable monthly energy bills from solar systems, eco-friendliness, tax incentives, and a reasonable payback period are strong drivers of solar energy system installations. I forecast positive EBITDA to begin in the September quarter of next year. If this occurs, I believe the stock could re-rate to $5.00. The drivers of improved profitability are the higher gross margin of its backlog, achieving optimal residential volume scale, and the improved productivity of its recently hired direct sales team.

Be the first to comment