da-kuk

“People never lie so much as after a hunt, during a war or before an election.” – Otto von Bismarck

Looking at the latest print of the US CPI coming in at 7.1%, in effect confirming somewhat some sort of upcoming Fed Pivot in the near future, as well as the continuation of the unravelling of the Crypto Digital Tulips bubble with large players in the industry facing their “Minsky moment”, when it came to selecting our title analogy and in continuation of our post relating to “Deceptology” we decided to go for the “Illusory trust effect”. The illusory truth effect, also known as the illusion of truth, describes how, when we hear the same false information repeated again and again, we often come to believe it is true. This phenomenon was first identified in a 1977 study at Villanova University and Temple University. Repetition makes statements easier to process relative to new, unrepeated statements, leading people to believe that the repeated conclusion is more truthful. In recent years, in many instances, we have seen “familiarity” overpowering “rationality”. For instance, the illusory truth effect’s impact even on participants to crypto, advertising, news media, and political propaganda, knew the correct answer to begin with, but, were persuaded to believe otherwise through the repetition of a falsehood, to “processing fluency”. The following supposed quotation of Joseph Goebbels has been repeated in numerous books and articles and on thousands of web pages, yet none of them has cited a primary source. According to the research and reasoning of Randall Bytwerk, it is an unlikely thing for Goebbels to have said:

“If you tell a lie big enough and keep repeating it, people will eventually come to believe it. The lie can be maintained only for such time as the State can shield the people from the political, economic and/or military consequences of the lie. It thus becomes vitally important for the State to use all of its powers to repress dissent, for the truth is the mortal enemy of the lie, and thus by extension, the truth is the greatest enemy of the State.”

The “Illusory trust effect” is akin to what is called a “big lie (German: große Lüge), being a gross distortion or misrepresentation of the truth, used especially as a propaganda technique. The German expression was coined by Adolf Hitler, when he dictated his book Mein Kampf (1925), to describe the use of a lie so colossal that no one would believe that someone “could have the impudence to distort the truth so infamously.” Psychologists, psychiatrists, and others have explained why the “big lie” technique works. Dr. Ramani Durvasula, a licensed clinical psychologist and professor of psychology who is an expert on narcissistic personality disorder and narcissistic abuse says that:

“Repetition is important, because the Big Lie works through indoctrination. The Big Lie then becomes its own evidence base – if it is repeated enough, people believe it, and the very repetition almost tautologically becomes the support for the Lie. … Hear something enough it becomes truth. People assume there is an evidence base when the lie is big (it’s like a blind spot). … [People also fail to realize] that there are people in our midst that lack empathy, have no care for the common good, are grandiose, arrogant, and willing to exploit and manipulate people for solely their own egocentric needs. … [Instead] a sort of halo effect imbues leaders with presumed expertise and power – when that is not at all the case (most if not all megalomaniacal leaders, despots, tyrants, oligarchs share narcissism/psychopathy as a trait).” – Dr. Ramani Durvasula.

As such, we find of great interest the ongoing disclosures on Twitter’s past behavior following its takeover by Elon Musk because “Social media” plays an important role in such “Illusory trust effect”. Dr. Ramani Durvasula argues that improvement in critical thinking skills is necessary, stating:

“It means ending algorithms that only provide confirmatory news and instead people seeing stories and information that provide other points of view … creating safe spaces to have these conversations … encouraging civil discourse with those who hold different opinions, teaching people to find common ground (e.g., love of family) even when belief systems are not aligned.”

The greatest fear of “big liars” such as the ex-CEO of FTX or career politicians is “accountability”. As per Dr. Matt Blanchard, a clinical psychologist at New York University argued:

“[S]preaders of the Big Lie will only be discredited in the eyes of their supporters if they face their greatest fear – accountability. … They must be seen to lose at the ballot box, they must be arrested when they break the law, they must be sued for every defamation, they must be pursued with every legal tool available in an open society. … Above all else they must be seen as weak. Only then will their lies lose their usefulness for the millions who once saw something to gain – personally, psychologically, politically, financially – in choosing to believe.”

As such, Charles Baudelaire’s ending verse of his poem “Le Joueur Généreux” we repeatedly quoted in our musings continues to resonate with us :

“My God! Lord, my God! Please make the devil keep his word!”

Charles Baudelaire, French poet, “Le Joueur Généreux,” pub. February 7, 1864

One could argue that Baudelaire’s poem’s conclusion means to tell us that the greater the use of “illusory trust effect” or “big lies”, like the ones seen with ex FTX but also with Elizabeth Holmes Theranos scam, the greater the chance of narcissism/psychopathy as a trait in these “colorful” characters that try to seduce us, leading us to pray that the “devil” is going to keep his word, but, we ramble again.

In this conversation, we would like to continue to look at what could continue to be enticing in 2023 as well as our views for next year.

Through our looking glass

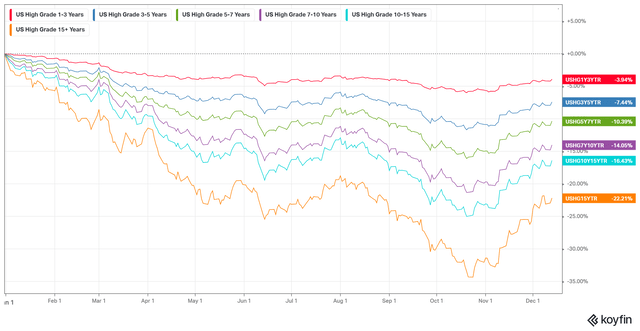

In a previous conversation, we recommended the “Make Duration Great Again” (MDGA) investing on the long end of Investment Grade Credit from a carry and roll down perspective. This trade will continue to be enticing in 2023:

US IG YRD (Macronomics – KOYFIN)

US High Grade (Investment Grade) 15+ years has considerably “rallied” from a low of -33.25% YTD to -22.21% YTD (-25.76% YTD in our previous conversation). As financial conditions continue to worsen, you should look at playing highly rated issuers in defensive sectors such as in consumer staples.

We told you in our conversation from November 23 the following:

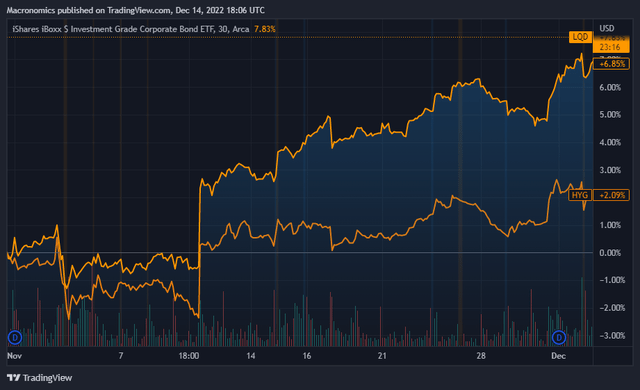

“There is indeed more room for “outperformance” of Investment Grade relative to High Yield when ones look at the two most liquid ETFs LQD for US Investment Grade and HYG for US High Yield” – Macronomics, 23rd of November

We continue to expect an outperformance of US Investment Grade (LQD) relative to US High Yield (HYG) in 2023 as per the below chart from early November:

HYG vs LQD (Macronomics – TradingView)

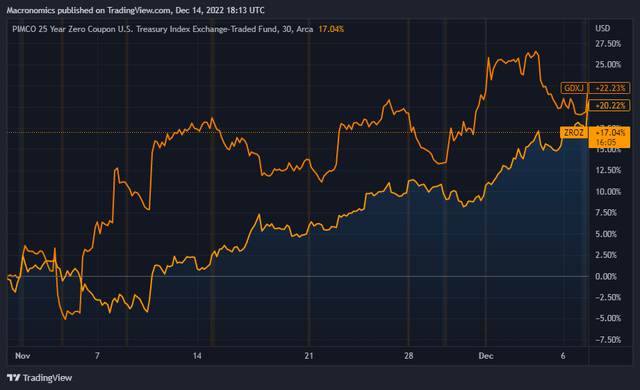

We previously recommended the “Make Duration Great Again” (MDGA) trade via ETF ZROZ (PIMCO 25+ Year Zero Coupon US Treasury Index ETF) which is extremely sensitive to rate moves in conjunction with buying Junior Gold miners through ETF GDXJ. Both trades are highly sensitive and convex (Early November until today chart below):

GDXJ vs ZROZ (Macronomics – TradingView)

This “put-call parity” strategy should continue to play out in 2023 with falling yields with a change in the Fed’s narrative, and rising gold prices.

As we commented in our last musing, the US long end of the yield curve collapsed rapidly in conjunction with Gold breaking the $1800 level, in effect vindicating our “convex” recommendation. We called this “put-call parity” trade “PCP” (not drug-related, just a plain convexity trade to put on).

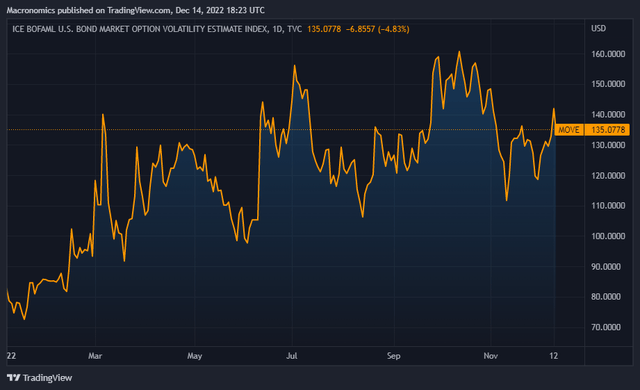

As we indicated in previous conversations the rally in credit markets is depending entirely on bond volatility receding as per the below YTD MOVE index:

MOVE INDEX (Macronomics – TradingView)

The MOVE index matters a lot for Fixed Income related assets in general and credit markets in particular.

There is no doubt that both the US 10-year yield and the USD/JPY have moved in lockstep during the course of 2022:

USTs 10 Year vs USD/JPY (Macronomics – TradingView)

We continue to believe the Japanese Yen will continue to track the US 10-year Treasury Notes yield in 2023. As such, we believe the Japanese yen should continue to strengthen relative to the US Dollar.

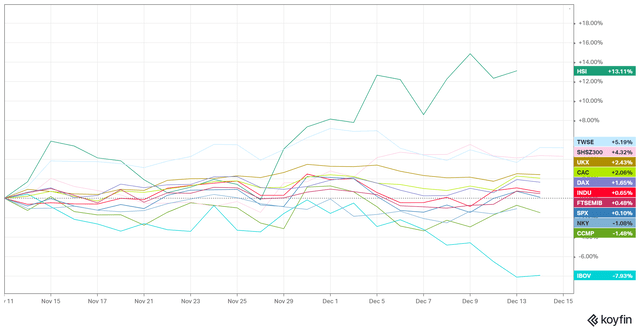

In our conversation “The Scarcity Principle” we argued that a full re-opening of China could bring in more inflationary pressure in the commodities space in that context. As well the “Chinese reopening” theme has led to an outperformance of Asian markets as per the below one-month chart:

World Markets (Macronomics – KOYFIN)

Chinese Tech ETF KWEB’s performance since the start of the month of November:

ETF KWEB (Macronomics – TradingView)

One thing is for sure when it comes to Chinese shares, Chinese TECH is outperforming China large caps (h/t Brian Yates):

KWEB vs FXI (Macronomics – TradingView)

Another pointer of the Chinese “re-opening” play has been in the luxury space as seen in the below chart of LVMH share price vs Hermès in the last three months:

Hermès vs LVMH (Macronomics – TradingView)

China’s zero-Covid policy has weighed heavily on the high-end market in 2022, but we are already seeing a recovery playing out in the last three months. Hermès is still experiencing strong growth in China and relative to LVMH and benefits from higher margins (around 10% more). Hermès has stronger margin than LVMH hence our preference. During the course of 2021, we recommended Hermès over LVMH to our OMH Research clients which was a profitable trade on a relative basis. We continue to believe that French luxury Hermès will outperform LVMH in 2023 thanks to Chinese buyers. Sure, there is a prospect of global recession that could dampen consumer spending. As such we are much more sanguine about European prospects overall as per our conversation “The Fall of Constantinople” from July 12 where we indicated that China was already the second largest art market in the world, accounting to 20% in value. In true “Angus Maddison” fashion there is a shift in “money flows” as we also pointed out in June this year:

“If indeed, “savings” stays more “local” then indeed, the whole “recycling” of flows of money from the East to the West is going to “shift”.” – Macronomics June 2022

According to a recent study by Bain & Company and Altagamma, Chinese shoppers will make up 40 percent of all luxury consumers by 2030.

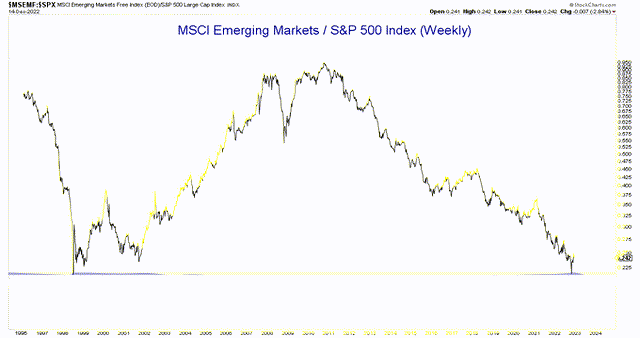

Could 2023 be very bullish for Emerging Markets. We are wondering when looking at the below chart from Brian G (@alphacharts):

MSCI Emerging Markets vs S&P 500 (Brian G – Twitter)

It would be tempting overall to play the emerging markets theme via ETF EEM, but, we do think that commodities players should be over-weighted and as such you should be more selective. For instance, in 2022, Brazil has been a much more defensive play as such in both currency exposure and equities markets. Brazil currently has one of the cheapest equity markets on a P/E basis. If the central bank of Brazil continues with their hawkish attitude, then the currency will continue to be strong, and this could encourage foreign capital such as the Japanese investors we mentioned in our previous conversation. In 2011 Double-decker Japanese funds were massively invested in the real (60% of the segment’s total assets). Could they return to Brazilian shores? We wonder. Japanese retail investors are exposed to funds known as double-deckers, which purchase high-yield debt, then swap the income flows from the bond into a currency with high interest rates. As I mentioned in a previous conversation, you probably want to front-trade Mrs. Watanabe and the Japanese retail crowd as well as the GPIF and Life Insurance friends.

Again, as you already know from our musings and reference to our Peabody Energy coal play recommendation at $5 in December 2020 for our OHM Research readers, we like what is “cheap”. Picking commodities plays will continue to be enticing from a valuation perspective we think (disclosure we are long VALE SA). And no, we are not using the “Illusory trust effect” to try to convince you, we are trying to persuade you to use more “critical thinking” in that context.

A continued shift to the East?

As we posited in our conversation “The Fall of Constantinople” from July 12, in true Angus Maddison f, there is a continued shift from the West to the East. A lot of alliances are being redrawn in the process following the start of the war in Ukraine. With the rise of Asian middle class, on top of global energy woes, we are moving from a phase of “abundance” to an era of “scarcity”. As such, on top of the “deglobalization” theme, there is rising competition for the supply of LNG between Europe and Asia. The world’s top LNG importers remain China, Japan, and South Korea.

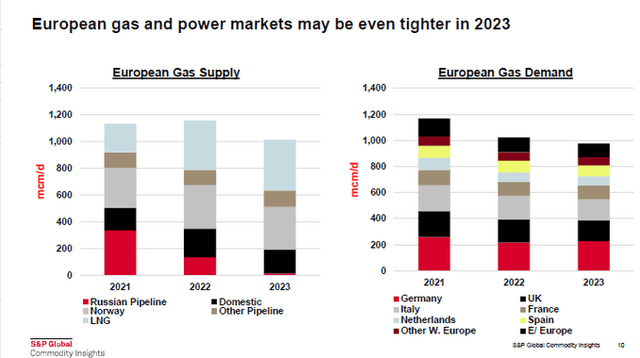

As put it simply by S&P Global Commodity Insights:

“European gas in 2023 must balance on reduced demand vs growth in available supply. Also, a global gas system without any slack, European buyers can’t expect recurrence of weak Asian LNG & mild temperatures.”

European Gas (S&P Global Commodity Insights – Twitter)

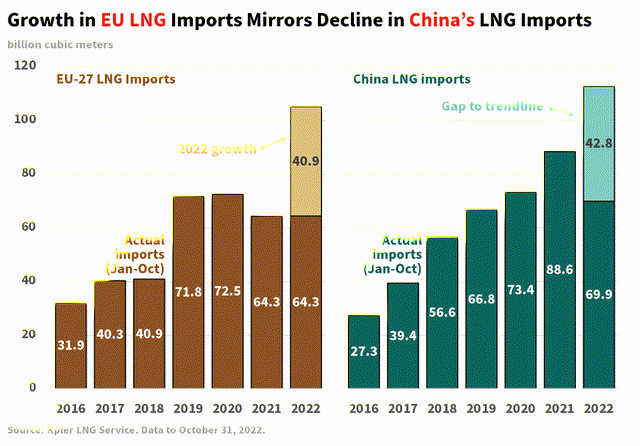

Asian LNG demand was in fact down in the last few months thanks to zero-Covid policies in China as indicated by Nikos Tsafos from our Twitter feed:

Growth in EU LNG (Nikos Tsafos – Twitter)

“It is hard to overstate the significance of China’s zero Covid policies on European energy. The EU imported an additional 41 bcm of LNG through October. China’s LNG imports were down 21 percent. Normally they’re up 27 percent. The delta between +27 and -21 percent? 43 bcm.” – Nikos Tsafos

The end of Russian gas dependency will continue to create tensions on the LNG and gas markets. Effectively Europe needs to tap a significant part of the LNG markets to compensate, in effect directly competing with China. As per Bloomberg reporting, Chinese gas imports are likely to be 7% higher in 2023 than this year, according to Wang Zhen, President of CNOOC’s Energy Economics Institute.

In the LNG space we continue to like GLOP and GNLG as per the below YTD chart particularly with the recent pull-back in the space:

GLOP vs GNLG (Macronomics – TradingView)

As well the Baltic Dry Index has been bouncing recently by 27% in one month, on the back of China re-opening which would as well boost demand for Iron Ore and Coal. The capesize index, which tracks iron ore and coal cargos of 150,000 tonnes, surged 5.4% to its highest level in more than eight weeks at 2,208 points; likely tracking the rise in iron ore prices.

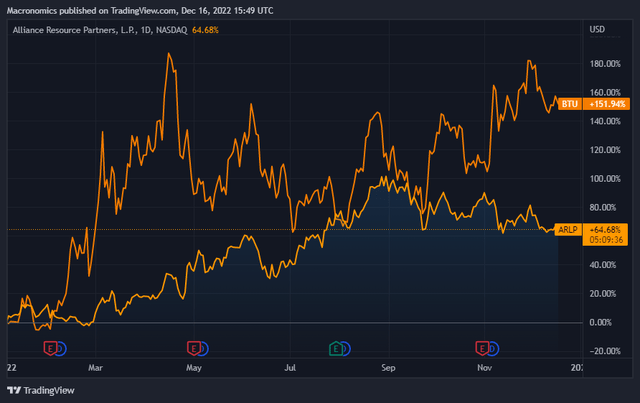

We continue to like the coal sector even after the impressive rally of 2022, we like both BTU and ARLP in that context (YTD chart below):

BTU vs ARLP (Macronomics – TradingView)

Global coal demand has risen to a record high in 2022, surpassing the 8-billion-tonnes level for the first time, according to a new IEA report. According to S&P Global, the demand for seaborne thermal coal will likely rise 3%-4% globally in 2023, but production may not match up to that scale as current unwillingness of banks to fund coal projects. If global gas prices remain elevated throughout 2023, Indian electricity producers will continue to burn more coal than ever to generate baseload power. As such regardless of the “ESG cult”, coal is here to stay.

Regardless of the EV political push from Europe and ESG “narrative”, there is not enough copper, lithium or cobalt around and in our book scarcity is here to stay in 2023. We will see many regions competing to source commodities in already tight markets. As such “money flows” matter and Asia in some instances could “outbid” Europe in some “strategic markets”.

If “deglobalization” is the “trade du jour”, the trade of tomorrow might be more “resource nationalism” meaning potentially more “export bans” going forward. You have been warned.

“History is a vast early warning system.” – Norman Cousins

Be the first to comment